Canada $1400 Extra OAS Payment: When talking about retirement income, Canada’s Old Age Security (OAS) program is a lifeline for millions of seniors to cover essential living costs and maintain a comfortable lifestyle. Recently, rumors about a $1400 extra OAS payment for October 2025 have caught many off guard. So, what’s really going on? Is this extra payment really happening? This article breaks it down in simple terms—giving clear facts, guidance, and expert tips from an experienced perspective, so you get the real picture and know how to prepare.

Table of Contents

Canada $1400 Extra OAS Payment

While many hoped for a direct $1400 extra payment in October 2025, the reality is a modest but meaningful 0.7% increase in regular OAS payments. This helps seniors keep up with inflation and maintain financial stability. By understanding how OAS and GIS work, eligibility rules, and payment schedules, Canadian seniors can better plan their retirement incomes with confidence. Including knowledge about the broader retirement system and additional supports allows for smart decision-making to ensure comfort and dignity in later years.

| Feature | Details |

|---|---|

| Official OAS Increase (Oct–Dec 2025) | 0.7% increase |

| Maximum Monthly OAS Payment (65-74) | $740.09 |

| Maximum Monthly OAS Payment (75+) | $814.10 |

| Typical Combined OAS + GIS Support | Up to approximately $1,450/month for low-income seniors |

| Next OAS Payment Date (Oct 2025) | October 29, 2025 |

| Source | Canada.ca |

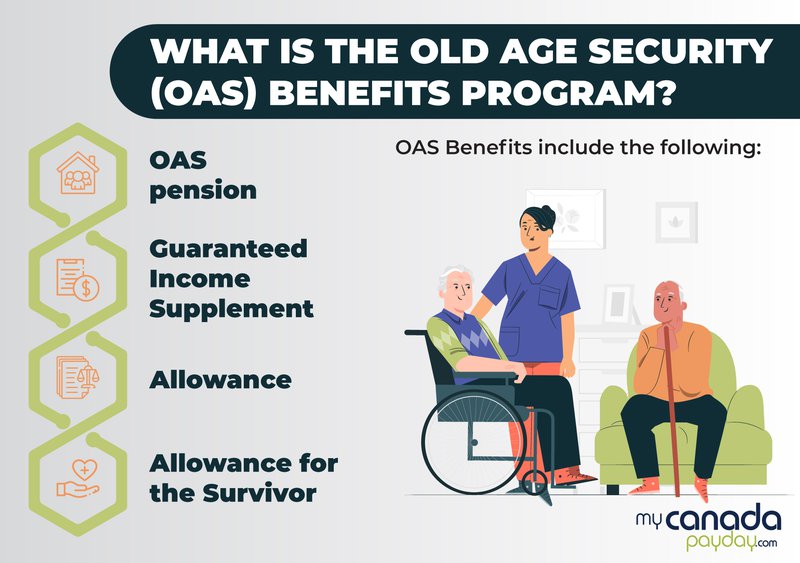

What is Old Age Security (OAS)?

The OAS program is Canada’s largest public pension, aimed at helping seniors earn a steady retirement income even if they didn’t contribute directly through employment. This pension is funded by general tax revenues and paid monthly to those who meet specific age and residency rules, providing a financial cushion in retirement.

The program was officially established in 1952 to provide a universal flat-rate pension to Canadians 70 years and older. It was designed as a fundamental right, free of stigmatizing means-testing, to recognize the contributions of seniors to society and reduce poverty among older adults. Over time, the eligibility age was lowered to 65, and additional supplements were added to support those with low incomes.

The Canada $1400 Extra OAS Payment: Fact vs. Fiction

There’s no official announcement of a $1400 lump sum OAS payment for this October 2025. What seniors will actually get is a standard 0.7% cost-of-living increase to their quarterly payments, designed to help keep pace with inflation.

- For those aged 65 to 74, the maximum monthly payment is roughly $740.09.

- For those 75 and older, it increases slightly to $814.10.

Low-income seniors receiving the Guaranteed Income Supplement (GIS) may see combined monthly amounts near $1,450 or higher, depending on their financial circumstances.

Why OAS Matters for Seniors?

Most seniors live on fixed incomes, meaning their expenses don’t go down, but inflation makes everything cost more. OAS payments help bridge the gap between costs and income. Though the 0.7% bump is modest, it ensures the program keeps up with economic realities. For many Canadians, OAS combined with the Canada Pension Plan (CPP) is their main financial foundation in retirement.

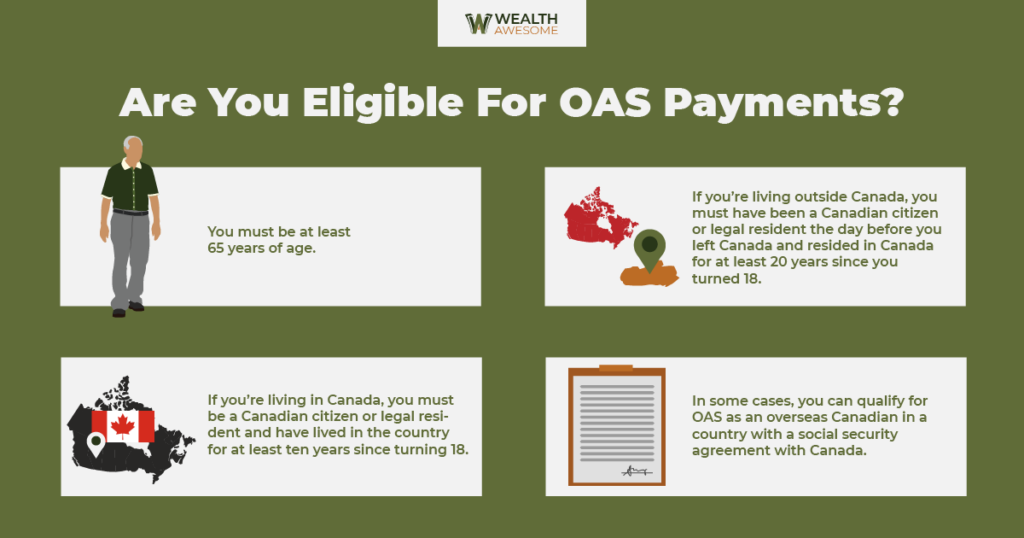

Breaking Down Canada $1400 Extra OAS Payment Eligibility

Here’s an easy guide on qualifying for OAS:

- Be 65 or older.

- Be a Canadian citizen or legal resident.

- Live in Canada for minimum 10 years after age 18 (if applying within Canada).

- Live in Canada for 20 years after age 18 if applying from abroad.

- The number of years you lived in Canada determines if you get the full or partial pension. Forty years or more equals the full pension.

Even if you don’t qualify for a full pension, you might be eligible for a partial one.

Understanding the Guaranteed Income Supplement (GIS)

The GIS is a non-taxable monthly payment on top of OAS for seniors with lower income. To qualify, seniors must receive OAS and meet income criteria.

- Single low-income seniors can get up to $1,105.43 per month from GIS.

- This payment varies depending on your income and marital status.

Getting GIS can make a huge difference in poverty reduction among seniors. In fact, GIS constitutes about one-third of all OAS-related benefits paid to seniors, providing a critical income floor for those in financial need.

How and When Will You Get Paid?

Mark these 2025 OAS payment dates in your calendar:

- September 25

- October 29

- November 27

- December 20

Payments are usually direct deposits, helping seniors get their money quickly and securely. Cheques are mailed if you haven’t set up direct deposit.

The Impact of Inflation and Cost-of-Living Adjustments

Inflation affects the cost of essentials like food, medical supplies, and housing. To protect seniors from the negative impact of rising costs, OAS payments are adjusted quarterly based on the Consumer Price Index (CPI). The recent 0.7% increase is part of this routine adjustment.

While it may seem small month-to-month, over time these adjustments can help preserve the purchasing power of retirement income, allowing seniors to maintain a better standard of living.

How OAS Fits in the Bigger Picture of Canadian Retirement Income?

Canada’s retirement income system consists primarily of three pillars:

- Old Age Security (OAS) – Universal pension based on residency.

- Canada Pension Plan (CPP)/Quebec Pension Plan (QPP) – Earnings-based pension funded through employment contributions.

- Personal savings and employer pensions – Includes RRSPs, TFSAs, pension plans.

OAS is the only pillar that is completely funded through general taxation, providing a baseline for all seniors regardless of work history.

Planning Your Retirement with OAS

Here are practical steps to get the most out of your OAS benefits:

Step 1: Confirm Your Eligibility Early

You don’t have to apply for OAS if you are eligible and have been filing Canadian taxes regularly—many people are automatically enrolled. Still, checking your status on the official Government of Canada website or through the My Service Canada Account portal is a smart move.

Step 2: Decide on Your OAS Start Date

You can start receiving OAS at age 65, but you can delay payments up to age 70. Delaying results in a 0.6% increase per month (7.2% per year) in your OAS amount, which can add up to an additional 36% if you wait until 70. This is a useful strategy if you expect to work or have other income sources before starting OAS.

Step 3: Understand the Clawback

If your annual income exceeds around $81,761 (2025 figure), a portion of your OAS payments will be recovered through the OAS recovery tax or “clawback.” Seniors with high incomes may receive reduced or no OAS payments.

Step 4: Maximize Your GIS

If you have low income, apply for GIS early to get the financial support you deserve. This supplement helps prevent poverty among seniors, enhancing your overall income security.

Additional Benefits and Supports for Seniors

Besides OAS and GIS, seniors in Canada can access other supports, such as:

- Allowance for the Survivor and Allowance (for low-income spouses aged 60-64).

- Provincial supplements and benefits tailored to specific provinces, such as Ontario’s Guaranteed Annual Income System (GAINS).

- Pharmacare programs to help cover medicine costs.

- Property tax rebates or relief programs.

Check local government websites to learn what additional resources you might qualify for.

Canada Carbon Tax Rebate Payment Schedule in 2026: Check Eligibility, Payment Amount & Date

OAS Increase in October 2025 – Will OAS Amount be increased in October? Check Payment Date

CPP & OAS Benefit Payment Coming In October 2025 – Check Revised Amount & Eligibility