Canada $1400 Extra OAS for Seniors: If you’ve been scrolling through Facebook or hearing talk around the community center about a Canada $1,400 Extra OAS for Seniors coming in October 2025, you’re probably wondering whether it’s fact or fiction. Let’s get this straight — as of now, there’s no official government confirmation of a one-time $1,400 Old Age Security (OAS) bonus payment in October 2025. However, there are important updates and policy changes that could affect millions of seniors across Canada — especially those relying on OAS and the Guaranteed Income Supplement (GIS). This article will walk you through everything: what’s real, what’s rumor, and how to make sure you’re getting every dollar you deserve from Canada’s senior benefits.

Table of Contents

Canada $1400 Extra OAS for Seniors

While the “$1,400 Extra OAS for Seniors in October 2025” rumor sounds appealing, it’s simply not true. What is happening is a routine cost-of-living adjustment to OAS, a new GIS eligibility rule affecting sponsored immigrants, and continued provincial supplements supporting low-income seniors. If you’re nearing retirement or already collecting OAS, stay informed and reviewing updates. Start planning and awareness go a long way in keeping your retirement income stable and secure.

| Topic | Details |

|---|---|

| Claim | “$1,400 Extra OAS for Seniors” coming in October 2025 |

| Status | False – No official government confirmation |

| Actual Change | Regular OAS quarterly increase due to inflation |

| New Rule (Oct 2025) | Sponsored immigrants lose GIS eligibility while under sponsorship |

| OAS Payment (Oct–Dec 2025) | $740.09 (ages 65–74), $814.10 (ages 75+) |

| GIS Maximum (Single Senior) | About $1,065/month, income-based |

| Clawback Threshold | Starts near $90,000 annual net income |

| Official Source | Government of Canada – OAS Payments |

| Application Requirement | Automatic for most; apply online if not enrolled |

Understanding the Old Age Security (OAS) Program

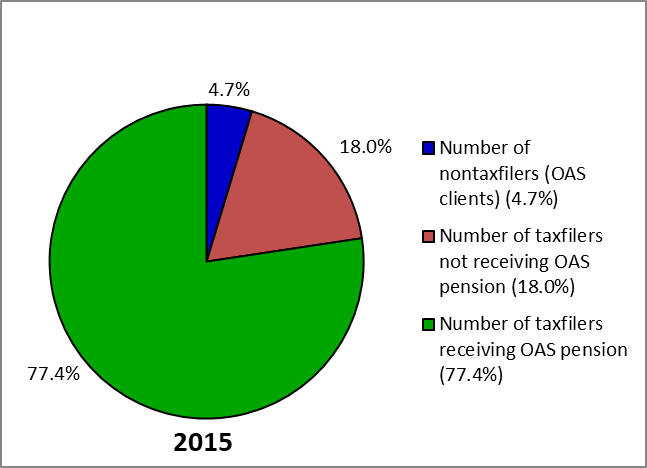

The Old Age Security (OAS) program is one of Canada’s cornerstone retirement benefits. It’s a monthly payment funded directly by the federal government — not from your personal payroll deductions, like the Canada Pension Plan (CPP). That means even if you didn’t work your whole life or paid little into CPP, you can still qualify for OAS as long as you meet the residency and age criteria.

To receive OAS:

- You must be 65 years or older.

- You must have lived in Canada for at least 10 years after turning 18.

- You must be a Canadian citizen or legal resident when your application is approved.

If you’ve lived in Canada for 40 years after age 18, you’ll receive the full OAS amount. Those with fewer years get a partial payment.

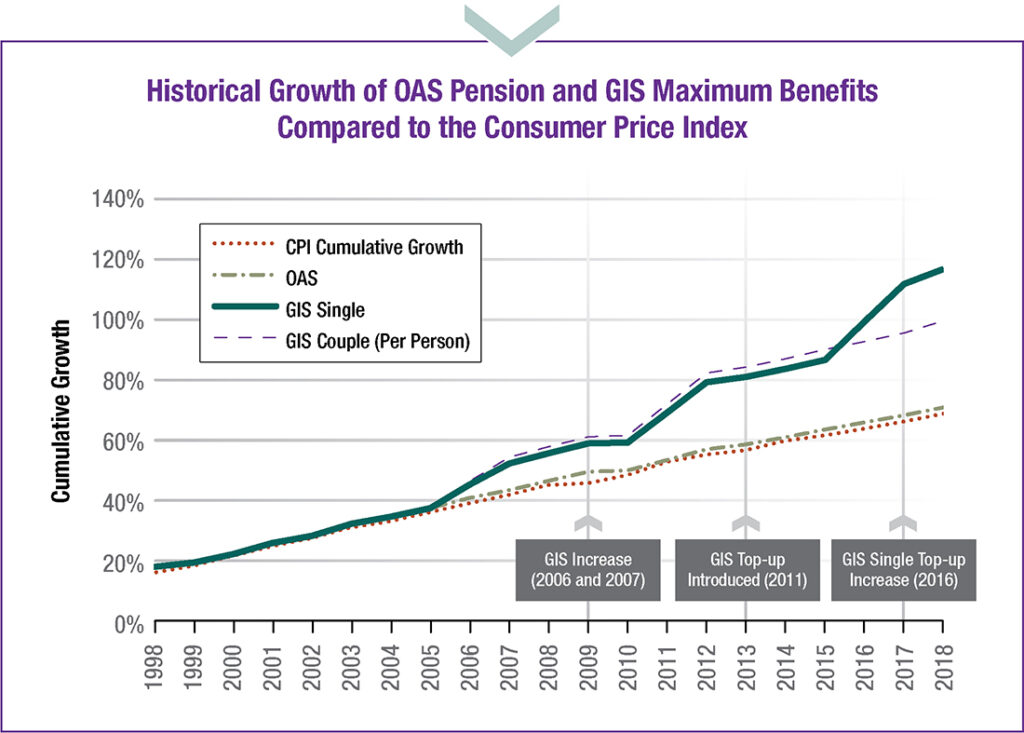

OAS is reviewed and adjusted every three months — January, April, July, and October — based on the Consumer Price Index (CPI) to keep up with the rising cost of living. That means your payment automatically goes up when inflation rises.

Where the “Canada $1400 Extra OAS for Seniors” Claim Came From?

The viral claim about a $1,400 OAS bonus didn’t come out of thin air, but it’s not accurate. Here’s why the rumor took off:

- Stacked Benefits Misunderstanding

Some media outlets added together the OAS, GIS, and provincial top-ups (like Ontario’s GAINS or British Columbia’s Senior Supplement) and called it a “$1,400 bonus.” In reality, that total represents combined monthly benefits, not a new one-time payment. - Confusion About Inflation Adjustments

When the OAS increases each quarter due to inflation, some people mistake it for a new program. These adjustments are typically small increases — a few dollars a month — not a $1,400 lump sum. - Clickbait and Misinformation

Certain blogs and YouTube videos exaggerate benefit changes to get attention, even without verifying government data.

What’s Actually Changing in October 2025?

1. Regular OAS Payment Increase

OAS payments rise quarterly with the cost of living. For October to December 2025, the maximum OAS amounts are:

- Ages 65–74: $740.09 per month

- Ages 75 and older: $814.10 per month

These payments are taxable and may vary depending on your years of residence and income.

2. GIS Eligibility Changes for Sponsored Immigrants

A significant policy shift begins October 1, 2025. Sponsored immigrants — those who arrived in Canada through family sponsorships and are still under a sponsorship agreement — will no longer qualify for:

- Guaranteed Income Supplement (GIS)

- Allowance

- Allowance for the Survivor

This change means thousands of sponsored seniors could lose part of their income support. It’s essential for affected individuals to contact Service Canada or community organizations to explore other available supports.

3. OAS Clawback (Recovery Tax)

The OAS Recovery Tax — commonly known as the clawback — reduces or eliminates OAS benefits for higher-income seniors. It starts when your net annual income exceeds around $90,000 and phases out completely at roughly $150,000.

To manage this, retirees can use income-splitting strategies with their spouse or contribute to RRSPs and TFSAs to lower taxable income.

OAS vs. CPP vs. GIS: How They Work Together

| Program | Who Qualifies | Funding Source | Max Monthly Payment (2025) | Key Details |

|---|---|---|---|---|

| OAS | Canadians 65+ with 10+ years of residency | Government | $740.09–$814.10 | Indexed for inflation |

| CPP | Workers who contributed to CPP | Employee & employer contributions | About $1,365 | Based on lifetime earnings |

| GIS | Low-income OAS recipients | Government | Up to ~$1,065 | Non-taxable supplement |

Most retirees receive a mix of these programs. Knowing how they interact can help you plan a stable retirement income.

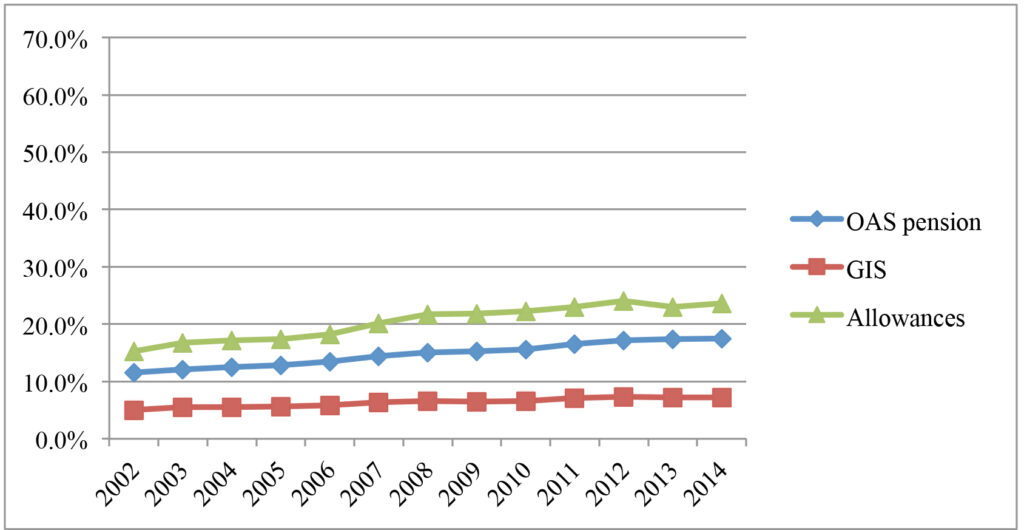

Historical Context: OAS Growth Over the Years

The OAS program has been around since 1952, when the maximum monthly payment was just $40. Since then, the program has expanded several times:

- 1970s: Introduction of the Guaranteed Income Supplement (GIS) for low-income seniors.

- 2011: Age eligibility changes proposed, later reversed.

- 2022: 10% permanent increase for seniors aged 75 and older.

- 2025: GIS eligibility change for sponsored immigrants.

This long history shows Canada’s ongoing effort to adapt OAS to economic conditions and demographic shifts. Today, more than 7 million seniors receive OAS, making it one of the country’s most critical social programs.

Example: How a Typical Senior’s Benefits Add Up

Let’s say John, age 72, lives in Alberta. He’s been in Canada for 45 years, earns $18,000 annually from part-time work, and gets full OAS.

Here’s how his monthly income breaks down (Oct–Dec 2025):

| Benefit Type | Monthly Amount |

|---|---|

| OAS (age 65–74 rate) | $740.09 |

| GIS (based on income) | $510.00 |

| Alberta Seniors Benefit | $100.00 |

| Total Monthly Income | $1,350.09 |

This is close to the $1,400 figure circulating online — but again, that total reflects existing programs combined, not a new bonus.

How to Apply for the Canada $1400 Extra OAS for Seniors?

Step 1: Check Automatic Enrollment

If you’re eligible, Service Canada might automatically enroll you. You’ll receive a letter before your 65th birthday explaining your enrollment status.

Step 2: Apply If You Haven’t Been Enrolled

If you didn’t get the letter, apply manually through My Service Canada Account or by mailing in an application form.

Step 3: Apply for GIS

When you apply for OAS, you can also apply for the Guaranteed Income Supplement if your income is low. GIS payments depend on your household income and marital status.

Step 4: Keep Information Updated

Changes in address, marital status, or direct deposit details can affect your payments. Always update these promptly to avoid delays or overpayments.

Provincial and Territorial Supplements

Each province adds its own flavor of senior assistance. Here’s a quick snapshot:

- Ontario: The Guaranteed Annual Income System (GAINS) gives up to $83/month. (Ontario.ca)

- British Columbia: BC Senior’s Supplement provides extra money for OAS/GIS recipients. (BC Gov)

- Alberta: Alberta Seniors Benefit adds monthly cash depending on income. (Alberta.ca)

- Quebec: Residents may qualify for Soutien aux aînés and provincial tax credits.

These add-ons are automatic in some provinces but require applications in others, so always double-check with your local seniors’ service office.

Canada $1400 Extra OAS Payment for Seniors Coming in October 2025: Check Payment Dates & Eligibility

$742 OAS Boost Confirmed by CRA for October 2025: Check Eligibility & Payment Schedule

$1,790 and $943 Monthly OAS Increase in 2025: Check Payment Date & Claim Process

Smart Tax and Income Planning Tips

- Split Pension Income

Married or common-law couples can share eligible pension income to lower total taxes and protect OAS from clawback. - Use RRSPs and TFSAs Wisely

Withdraw from TFSAs instead of taxable RRSPs when possible. TFSA withdrawals don’t count as income for OAS or GIS calculations. - Report Medical Expenses

Large medical or caregiving expenses can reduce taxable income — helping preserve full OAS eligibility. - Delay OAS for Higher Payments

You can delay OAS up to age 70 for a higher monthly amount — about 7.2% more for every year you defer past 65.