Canada $1250 Monthly Payment: Starting November 2025, eligible Canadian seniors will receive a $1,250 monthly payment from the federal government. This new supplemental benefit is aimed at helping seniors cope with rising living costs by increasing their monthly income alongside existing retirement programs. Whether you are already receiving benefits like Old Age Security (OAS) or the Canada Pension Plan (CPP), or are planning for retirement, this comprehensive guide will walk you through everything you need to know—from eligibility and application to tax implications, budgeting tips, and protecting yourself from scams. Written in a straightforward, conversational style, this article blends expert knowledge with practical insights.

Table of Contents

Canada $1250 Monthly Payment

The $1,250 monthly payment for Canadian seniors starting November 2025 is a substantial enhancement designed to help older adults meet rising costs without compromising their health or lifestyle. Supplementing foundational programs like OAS and CPP, this payment advances the government’s commitment to senior well-being. Staying informed on eligibility, tax reporting, and the application process ensures this vital financial boost reaches those who need it most. Seniors and caregivers alike should leverage this information and support resources to maximize the benefit’s positive impact.

| Feature | Details |

|---|---|

| Monthly Payment Amount | $1,250 |

| Start Date | November 2025 |

| Eligible Age | 65 years and older |

| Residency Requirement | Canadian citizen or permanent resident, lived in Canada 10+ years after 18 |

| Income Limit | Net income below specified threshold as per recent tax return |

| Other Benefits | Supplemental to OAS and CPP |

| Application | Mostly automatic; manual application available via Service Canada |

| Usage Tips | Can cover essentials, debts, healthcare, and quality-of-life improvements |

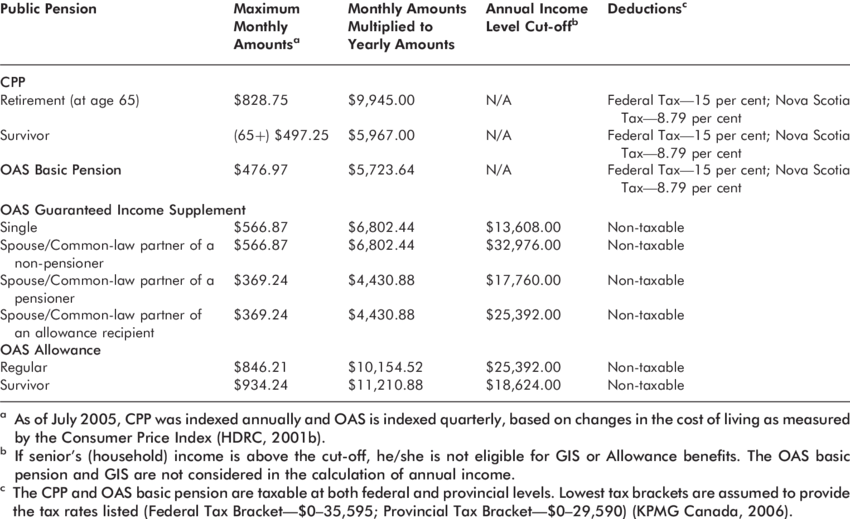

What Are OAS and CPP?

Before diving into the new $1,250 payment, let’s understand the foundations:

- Old Age Security (OAS): A monthly pension for Canadians aged 65 and older based on residency. As of 2025, the average monthly OAS is about $740 for seniors aged 65–74, rising slightly for those 75 and older. OAS provides a stable base income regardless of employment history and is adjusted quarterly for inflation.

- Canada Pension Plan (CPP): A contributory pension tied to your work income and contributions. The average CPP retirement pension paid to new retirees at 65 in 2025 is approximately $848 per month, with a maximum of $1,433 for those with maximum contributions. CPP is indexed annually to inflation.

Together, these benefits form the core retirement income for most Canadian seniors. The new $1,250 monthly payment is a supplemental boost to help deal with the increasing cost of essentials.

Why The Canada $1250 Monthly Payment Matters?

Living costs in Canada keep climbing—food, rent, utilities, and medical expenses squeeze budgets. This payment aims to:

- Ease financial stress: Giving seniors more disposable monthly income helps pay for necessities without scrimping or sacrificing essentials.

- Boost well-being: Studies show financial security reduces anxiety, improves health outcomes, and promotes social engagement among seniors.

- Preserve independence: Additional funds empower seniors to live comfortably in their own homes and communities longer.

Government experts view this payment as a critical step in addressing elder poverty, especially as inflation continues to rise.

Eligibility — Who Qualifies?

To receive this $1,250 monthly top-up, seniors must meet all of the following:

- Be 65 years or older by November 2025.

- Be a Canadian citizen or permanent resident.

- Have lived in Canada for at least 10 years after turning 18 (full OAS eligibility requires 40 years, but partial OAS + this payment can apply with 10+ years).

- Be currently receiving or enrolled to receive OAS or CPP benefits.

- Have a net income below a threshold based on the most recent tax return (specific numbers vary by year and age; typically under $93,000 to $151,000 depending on the clawback bracket).

- Have filed taxes on time, as timely tax filing usually triggers automatic enrollment.

Importantly, the payment is mostly automatic for eligible seniors with up-to-date records. Those unsure about eligibility or who don’t get payments automatically can apply through Service Canada.

How to Apply and Receive the Canada $1250 Monthly Payment?

Navigating how to get this money is straightforward:

- Automatic Enrollment: Most seniors already receiving OAS and filing their taxes on time will be automatically enrolled, meaning no extra action is needed.

- Manual Application: If you believe you’re eligible but did not receive the payment, you can apply through Service Canada’s website or in-person offices.

- Documents Needed: Keep your Social Insurance Number (SIN), recent tax information, and government-issued ID handy.

- Payment Methods: Payments are issued via direct deposit to your bank account or paper checks if you haven’t set up direct deposit.

- Keep Information Updated: Notify Service Canada of address or marital status changes to prevent payment delays.

For added help, family members, community organizations, and local Service Canada centers offer assistance with applications and digital literacy.

Tax Implications of the Payment

This $1,250 monthly payment is taxable income, so you need to report it on your tax return. However, many seniors have low or moderate incomes, meaning the additional tax burden may be minimal or offset by credits.

Financial advisors recommend:

- Consulting a tax professional or using CRA tools to plan for any tax owed.

- Filing taxes accurately and on time to avoid payment delays or penalties.

- Keeping records of all government payments for tax filing and verification purposes.

Reporting ensures ongoing eligibility and smooth payment processing.

Comparing Senior Benefits: OAS, CPP & $1,250 Payment

| Benefit | Approximate Monthly Amount | Eligibility Criteria | Notes |

|---|---|---|---|

| Old Age Security (OAS) | $740 (65–74), $814 (75+) | 65+, Canadian residency, income-tested | Base government pension |

| Canada Pension Plan (CPP) | $848 average new retiree | Work contributions, age 60-70 | Earnings-based retirement income |

| New $1,250 Payment | $1,250 | 65+, low income, OAS/CPP recipient | Supplemental cost-of-living relief |

Together, these payments can sum to over $2,500 monthly for many seniors, providing an important financial cushion.

Practical Suggestions for Using This Payment

Here are recommended ways to stretch this income:

- Cover immediate necessities: Rent, utilities, food, transportation.

- Reduce debt: Prioritize paying off high-interest credit card balances or payday loans.

- Healthcare expenses: Prescription drugs, hearing aids, dental care, or private therapy.

- Comfort and social well-being: Minor home repairs, adaptive devices, social activities, and hobbies to enhance quality of life.

- Build an emergency fund: Buffer against unexpected expenses like sudden medical bills or appliance repairs.

Creating or updating a monthly budget with this supplemental income in mind can maximize benefits and reduce stress.

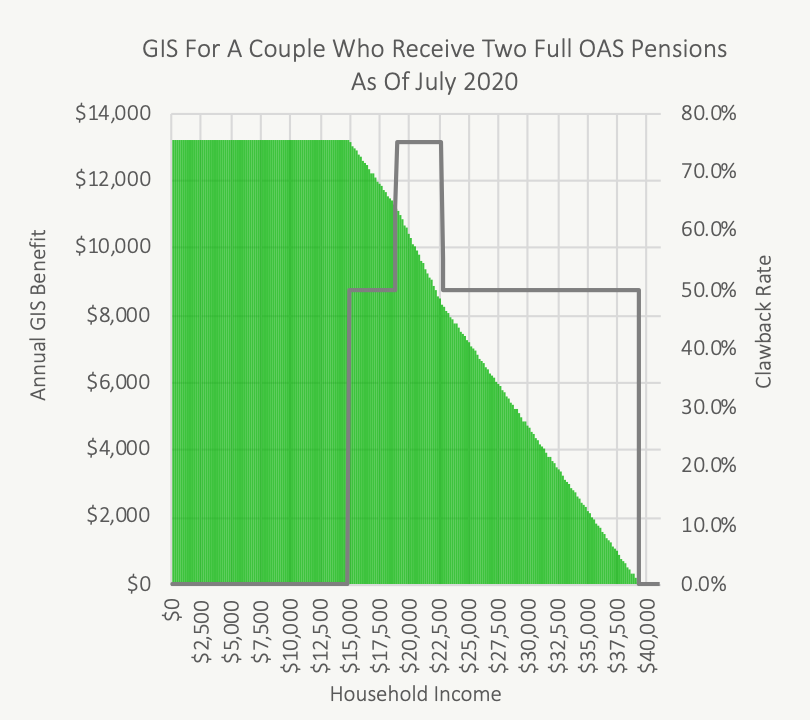

The Guaranteed Income Supplement (GIS) and Other Supports

The GIS program provides extra income to low-income seniors, sometimes totaling over $1,000 monthly. Since 2025, GIS eligibility has expanded to include some pre-retirement seniors aged 60-64, creating a smoother income bridge.

Combined with CPP, OAS, GIS, and this new $1,250 payment, many seniors approach or exceed $2,500 monthly income, helping reduce poverty rates.

Protecting Yourself From Scams

Unfortunately, fraud targeting seniors is all too common. Follow these safety tips:

- Only trust official government websites and contacts for benefit communications.

- Never give out personal or banking information via phone or email unless you initiated the contact.

- Be skeptical of urgent demands or pressure tactics.

- Verify any offers or notifications independently by visiting canada.ca or calling Service Canada.

If you suspect scam attempts, report them immediately to authorities and inform close contacts.

Canada Extra GST Payment In November 2025 – Know Amount, Eligibility & Dates

Pension Boost Canada in November 2025: Check Expected CPP and OAS Pension Increase in 2025

$445 Canada Family Benefit Payment in November 2025, Know Eligibility & Payment Dates

Broader Impact on Seniors and Communities

This payment and the overall income support system aim to:

- Reduce elder poverty in Canada, which affects over 15% of seniors in low-income brackets.

- Improve seniors’ health and mental well-being by alleviating financial stress.

- Increase seniors’ ability to remain independent in their homes, reducing institutional care costs.

- Stimulate local economies through increased spending on goods and services.5

Supporting senior financial security contributes widely to economic and social welfare.