Budget 2025 Reveals a Surprising Twist for the CRA: The Budget 2025 has landed with some big news for the Canada Revenue Agency (CRA) that’s set to impact millions of Canadians and tax professionals alike. The most eye-catching change is CRA’s new authority to automatically file tax returns for eligible low-income Canadians—those who typically don’t file tax returns and potentially miss out on critical benefits. But that’s just one twist. The government is also making a heavy investment in artificial intelligence (AI) and automation to speed up service delivery, enhance audit accuracy, and improve taxpayer experience. On top of that, Budget 2025 is slashing some old and inefficient taxes, reforming innovation incentives, and strengthening employer compliance laws. This article digs deep into what these reforms mean, explains the automatic filing system, explores how AI will transform CRA operations, and offers actionable guidance for taxpayers and tax pros navigating this new era.

Table of Contents

Budget 2025 Reveals a Surprising Twist for the CRA

Budget 2025 ushers in a transformative era for the Canada Revenue Agency. Automatic tax filing will help millions of Canadians effortlessly claim benefits, while AI-powered upgrades bring faster, smarter tax administration. Coupled with enhanced digital tools, revamped innovation credits, and tougher worker protections, these changes set the stage for a fairer, more efficient Canadian tax system. Whether you’re an individual or a tax professional, knowing these updates can help you navigate the new tax landscape with confidence.

| Highlights | Details |

|---|---|

| Automatic tax filing | CRA can file tax returns for eligible low-income Canadians who do not file themselves. Opt-out available. Starts 2025 tax year. |

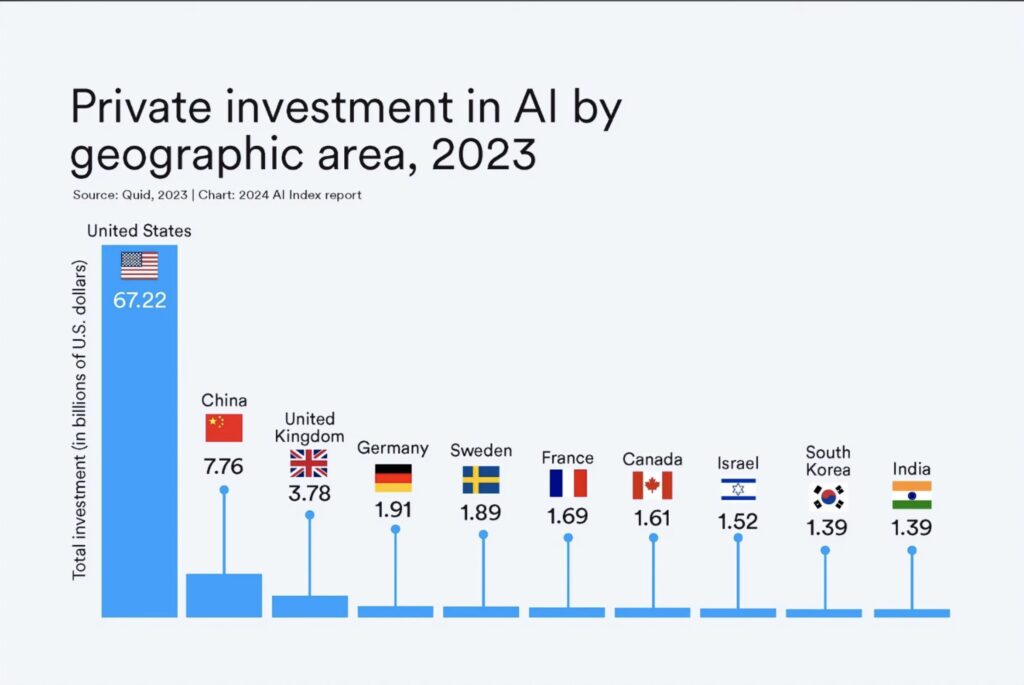

| AI and automation investments | $925.6M over 5 years to boost AI capacity in government; CRA to use AI to speed audits, expedite claims, and improve services. |

| Cutting outdated tax programs | Elimination of digital services tax, luxury tax on aircraft and vessels, federal fuel charge; cost savings reinvested in CRA. |

| SR&ED program reforms | Elective pre-claim approval to speed R&D tax credit claims; AI to reduce low-risk audits and improve processing times. |

| Enhanced tax compliance powers | Expanded audit authority for CRA; improved info-sharing with Employment and Social Development Canada (ESDC). |

| Employer crackdown measures | Restrictions on non-compete agreements; tougher penalties on wage theft and worker misclassification in federally regulated sectors. |

| Enhanced taxpayer digital services | New self-service options, AI chatbots, extended CRA online service hours. |

| Personal Support Worker Tax Credit | A new refundable tax credit recognizes personal support workers’ essential contributions. |

| Corporate tax and business support | Corporate tax rates lowered below US level; simpler investment rules for small business owners. |

The Automatic Tax Filing Revolution: What You Need to Know

The crown jewel of CRA’s Budget 2025 changes is the introduction of automatic tax filing for low-income Canadians, a move designed to help those who struggle or don’t bother filing taxes. This shift aims to make it easier for millions to receive benefits and credits they deserve but often miss due to non-filing.

How the Automatic Filing System Works?

- Leveraging data from employers, financial institutions, and government programs (like T4 slips and benefit records), the CRA prepares a pre-filled tax return.

- Eligible individuals receive this pre-filled return via the CRA’s My Account system.

- If the individual does not opt out or make changes within 90 days, the CRA automatically submits it on their behalf.

- It kicks off for the 2025 tax year (filed in 2026), covering roughly 1 million Canadians initially, scaling up to 5.5 million by 2028.

- The system targets those with simple tax profiles: low or moderate income, no owed taxes, and minimal deductions/credits.

Benefits of Automatic Filing

- Reduces barriers for vulnerable Canadians and seniors who find tax filing confusing or inaccessible.

- Ensures timely receipt of critical benefits, including the GST/HST credit, Canada Child Benefit, and Canada Disability Benefit.

- Cuts costs for individuals who might otherwise pay for tax preparation.

- Lessens CRA call volumes by preventing incomplete or unfiled returns.

What About Opting Out?

Individuals can always reject the automated filing and file manually if they want to claim different deductions or have more complex tax situations.

This program highlights the government’s broader goal of shifting to “automated federal benefits” and making tax filing easier, fairer, and less of a burden.

AI and Automation: Turbocharging CRA Efficiency and Accuracy

Budget 2025 commits nearly $1 billion over five years to boost AI adoption in government, particularly the CRA.

Impact of AI on CRA Services:

- Faster Claim Processing: AI will expedite assessment of complex claims like the SR&ED tax credit by automating data verification and risk assessment.

- Targeted Audits: AI algorithms will classify claims by risk, reducing audits for compliant taxpayers and focusing CRA resources on potential non-compliance.

- Debt Management: AI supports tax debt collections by prioritizing cases and streamlining follow-up.

- Digital Customer Service: AI chatbots and automated help lines reduce wait times, provide faster responses, and help taxpayers navigate their accounts online.

- Improved Security: AI-powered systems enhance data security using Canadian-designed tech prioritizing privacy and sovereignty.

Practical Advantages:

- Taxpayers get faster refunds and responses.

- CRA employees free from repetitive workload to focus on complex cases.

- Cost savings reinvested in improved services and compliance efforts.

AI transformation reflects an important modernization of CRA, making tax administration quicker, smarter, and more user-friendly.

Additional Budget 2025 Reveals a Surprising Twist for the CRA Updates

Budget 2025 delivers more than auto-filing and AI by expanding taxpayer support and tightening compliance:

Improved Digital Tools and Support

- CRA extended its online chat support hours to 8 a.m.–8 p.m. ET.

- New self-serve options for account management, including document verifications and unlocking without calling.

- Faster electronic processing for Disability Tax Credits and other adjustments.

- These tech advances make it easier for taxpayers to manage accounts and reduce dependence on phone support.

SR&ED Program Boost

The innovation-driving SR&ED tax credit program receives upgrades to:

- Introduce an elective pre-claim approval process (starting April 2026), allowing businesses to get early technical approvals.

- Cut review times for expenditure claims from 180 days to 90.

- AI will vet claims to reduce unnecessary audits.

- Increase the enhanced expenditure limit from $4.5 million to $6 million to support up to mid-size innovators.

Employer Compliance Crackdown

New steps address wage theft and unfair labor practices in federally regulated sectors:

- Restricting non-compete agreements which limit employee mobility.

- Boosting penalties and enforcement powers for wage theft and misclassification.

- Enhancing data sharing between CRA and Employment and Social Development Canada to catch violations early.

- These protections aim to ensure fair pay and working conditions.

Corporate Taxes and Business Incentives

- Corporate tax rates will fall to an effective marginal rate of 13.2%, below the U.S., to attract investment.

- Simpler rules are introduced around registered plans (RRSP, TFSA), improving financial planning for Canadians.

- Some obsolete or less effective incentives, like the Canadian Entrepreneur’s Incentive, were discontinued to streamline the tax code.

Personal Support Worker Tax Credit

Recognizing the vital role personal support workers play, a new refundable tax credit will help reduce financial strain on this essential workforce, enhancing sustainability in caregiving sectors.

Practical Guide for Taxpayers and Tax Professionals

For Taxpayers:

- Confirm if you qualify for the automatic filing program through CRA’s My Account.

- Understand your right to opt out if you want full control.

- Keep your information updated to maximize benefit access and prevent filing errors.

- Use the expanding digital self-serve options to manage tax records and credits independently.

For Tax Professionals:

- Educate clients about eligibility and benefits of automatic filing for simpler cases.

- Help innovate with the new SR&ED pre-claim approval process to accelerate client claims.

- Prepare for sharper CRA audits enabled by AI and expanded enforcement tools.

- Advise clients on employer-related compliance laws, especially in federal sectors.

- Leverage AI-driven digital services to manage client accounts efficiently.

CRA Benefits Payment Dates in November 2025, Check Eligibility Criteria & Payment Amount

$2600 CRA Payment in November 2025; Who will get it? Check Eligibility