U.S. taxpayers are poised for larger refunds in 2026, thanks to key extensions of the Trump-era tax law. Economists predict the changes will deliver significant relief to millions of Americans when they file their 2025 returns. These adjustments, part of the “One Big Beautiful Bill Act” (OBBBA) signed into law in 2025, are expected to increase both tax refunds and overall savings.

Table of Contents

Tax Refunds in 2026

| Key Change | Details |

|---|---|

| Higher Standard Deductions | Increased deductions for married couples ($32,200) and singles ($16,100). |

| Expanded Child Tax Credit | Increase to $2,200 per qualifying child. |

| New Senior Deductions | Additional $6,000 deduction for seniors 65+. |

| Inflation-adjusted Refunds | Refunds are expected to grow by 18%, totaling $50 billion. |

The anticipated increase in tax refunds in 2026 represents a significant moment of relief for millions of Americans. The continuation and expansion of the Trump-era tax provisions are set to provide greater financial security for many, particularly those with children or seniors aged 65 and older. However, the potential economic consequences, especially with regard to inflation and national debt, remain a point of concern for policymakers and economists alike.

As the situation evolves, it will be crucial to monitor the broader effects of these tax changes, including their impact on consumer spending, inflation, and overall economic growth.

Understanding the Tax Cuts: A Historical Overview

The Tax Cuts and Jobs Act (TCJA), signed into law by President Donald Trump in December 2017, was the largest overhaul of the U.S. tax code in decades. It introduced major tax cuts for businesses and individuals, lowering corporate tax rates and slashing tax rates for most American households. While the TCJA was designed to stimulate economic growth, its temporary provisions for individuals were set to expire after 2025.

In response to growing concerns about middle-class tax burdens and economic recovery post-pandemic, the One Big Beautiful Bill Act (OBBBA) was signed into law in 2025, extending and expanding several key elements of the TCJA. As a result, taxpayers are now looking forward to significantly larger refunds when they file their taxes in 2026, due to the continued tax cuts and newly added benefits.

How the 2025 Tax Law Expansions Will Impact Refunds in 2026

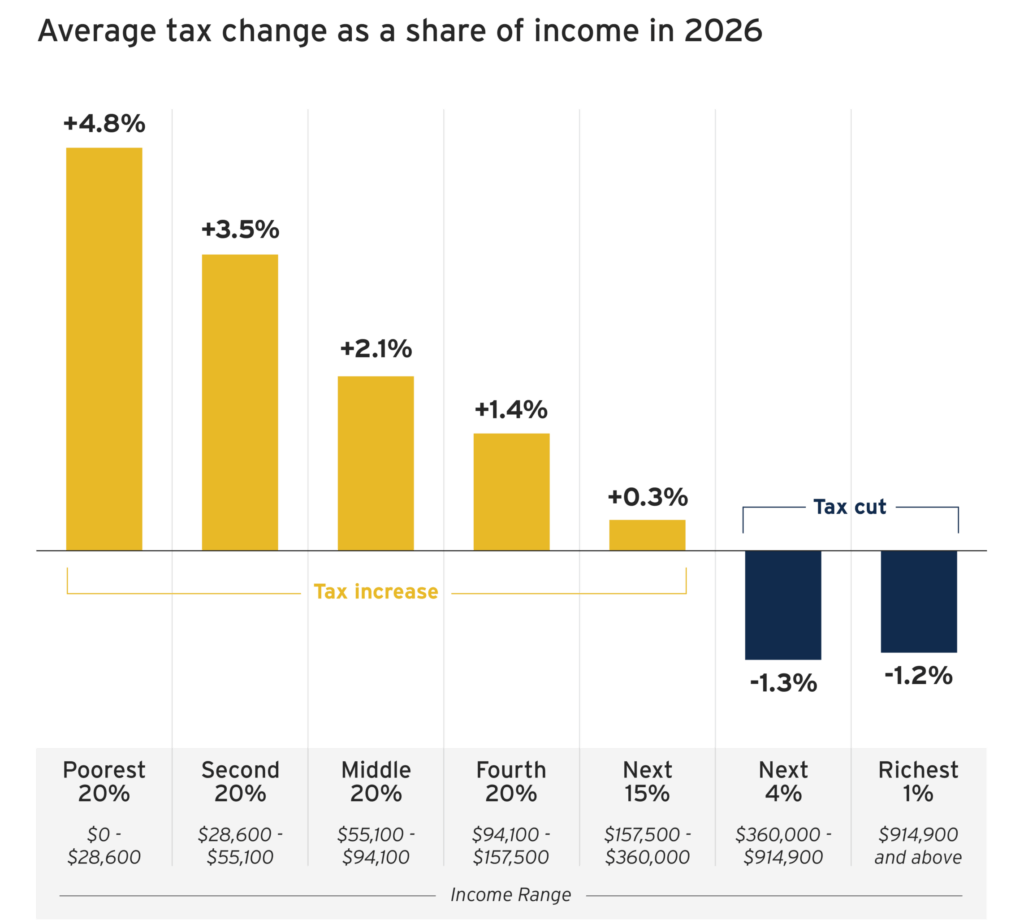

The 2025 tax law will lead to substantial changes for taxpayers in 2026, with most of these changes designed to benefit middle- and lower-income earners. Let’s examine some of the most significant provisions of the OBBBA and how they directly impact tax refunds:

Higher Standard Deductions: A Key Boost for All Filers

The increase in standard deductions will directly reduce the amount of income subject to tax. In 2026, married couples filing jointly will benefit from a $32,200 deduction, while single filers will receive $16,100. These figures represent a notable increase from 2025 levels, which were $31,000 for married couples and $15,000 for singles. As a result, more taxpayers will be able to reduce their taxable income, leading to larger refunds.

Moreover, these deductions are adjusted for inflation, ensuring that the benefits of these changes are sustained in the coming years.

Expanded Tax Credits: More Relief for Families

The Child Tax Credit (CTC) will increase to $2,200 per qualifying child. This credit has been a significant factor in increasing refunds for families, and its expansion will allow households with children to claim even larger refunds. For low-income families, the credit is fully refundable, meaning that even if the credit exceeds their tax liability, they will still receive the full benefit in the form of a refund.

The Earned Income Tax Credit (EITC) will also increase for taxpayers with multiple children, offering a maximum of $8,231. These credits are a direct source of income for working families, especially those in lower tax brackets. With these expanded credits, families are expected to receive significant refunds, particularly those with young children or multiple dependents.

New Deductions for Seniors: Financial Relief for the Elderly

One of the more targeted provisions of the OBBBA is the additional $6,000 deduction available to seniors aged 65 and older. This change is aimed at providing financial relief to retired individuals or those nearing retirement, many of whom may be living on fixed incomes or facing rising medical costs. The deduction is expected to lower their taxable income and increase their refunds, providing them with greater financial security in retirement.

The Broader Economic Landscape: Effects Beyond the Taxpayer

While these changes will certainly benefit U.S. taxpayers, economists and analysts have raised concerns about the broader economic implications. The expected surge in tax refunds could act as a hidden stimulus, boosting consumer spending, particularly in the early months of 2026.

Inflationary Risks and Consumer Spending

The increased refunds are expected to lead to higher consumer spending, especially among households that typically use their refunds to purchase large-ticket items, pay off debt, or make necessary home repairs. However, David Kelly, Chief Global Strategist at JPMorgan Asset Management, warns that this surge in consumer demand could exacerbate inflationary pressures, especially given the current high levels of inflation.

With the Federal Reserve already tightening monetary policy to curb inflation, Kelly notes that the influx of additional funds from tax refunds could complicate the Fed’s efforts to stabilize prices. The ripple effects of these changes may also impact interest rates, housing markets, and retail sectors.

Concerns About Deficits and Debt

Another long-term concern revolves around the growing federal deficit. Tax cuts, especially those benefiting high earners and corporations, have often been criticized for reducing government revenue without a clear plan for offsetting the loss. Critics argue that, while the tax changes may benefit taxpayers in the short term, they could contribute to an increasing federal deficit in the long run, potentially leading to higher national debt.

Some economists worry that such fiscal policies could limit the government’s ability to respond to future economic crises, such as a downturn or a natural disaster.

How Different Demographics Will Benefit

The changes to tax law are likely to have different impacts depending on the taxpayer’s situation. Let’s break down the expected benefits for various groups:

Low- to Middle-Income Households

For households earning under $100,000 per year, the OBBBA will provide the most significant relief. Families with children, in particular, will see their refunds increase due to the expansion of the Child Tax Credit and the Earned Income Tax Credit. The increased standard deduction will also benefit these households by lowering their overall tax burden.

Seniors and Retirees

The $6,000 senior deduction will provide substantial relief to older Americans, especially those with limited income. Seniors living on pensions or Social Security will see a reduction in their taxable income, resulting in higher refunds, which could make a big difference in their budgets.

Small Business Owners

Small business owners could also benefit from the tax changes, particularly due to the continuation of reduced corporate tax rates. Though the tax cuts primarily benefit larger corporations, small business owners who file under pass-through taxation models will see a reduction in their effective tax rates, leading to larger refunds or reduced tax liabilities.

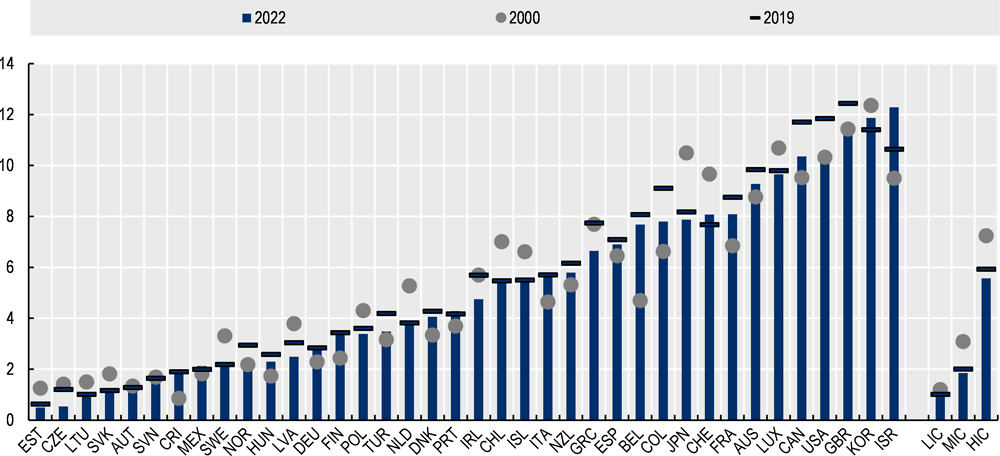

Comparative Global Context: How U.S. Tax Relief Stacks Up

It’s useful to understand the U.S. tax changes in the context of global tax relief measures. Other countries, particularly in Europe, have introduced similar tax reforms to stimulate economic recovery after the COVID-19 pandemic. For instance, the United Kingdom has expanded its child benefits and offered larger tax refunds to lower-income households. However, unlike the U.S., many European nations have also introduced universal basic income programs to further cushion the economic impact of the pandemic.

Countries such as Germany and Canada have continued to offer robust welfare programs alongside tax cuts, reflecting a different approach to balancing fiscal responsibility with social support. The U.S., by contrast, has focused more heavily on tax cuts, with mixed results in terms of long-term economic stability.

Retirement at 69? The Controversial Plan That Could Slash Benefits for Millions of Americans

$2000 Economic Relief Payment in November 2025: Check Direct Deposit Dates, Eligibility

Social Security Shift: Millions to Receive SSI Payments Early — Here’s the Real Reason Why

FAQ About Tax Refunds in 2026

Q1: How much can I expect my tax refund to increase in 2026?

The average tax refund for 2026 is expected to rise to approximately $3,500, up from $2,939 in 2025, largely due to higher deductions and expanded tax credits.

Q2: Who will benefit most from these tax changes?

Families with children, seniors over 65, and low- to middle-income earners are expected to see the greatest benefits from these changes, especially through expanded credits and increased standard deductions.

Q3: Will these tax changes have long-term economic effects?

Economists have expressed concerns that increased consumer spending from higher refunds could contribute to inflationary pressures, potentially influencing the Federal Reserve’s policies in 2026.