Bank of Maharashtra posted a 17 percent rise in loans, marking one of the strongest expansions among Indian state-owned lenders. The growth reflects a wider trend: for the first time in more than 14 years, public sector banks (PSBs) have outpaced private lenders in credit growth, reshaping the competitive landscape of Indian banking.

Table of Contents

Bank of Maharashtra’s Strong Performance

The bank’s advances stood at ₹2.54 lakh crore in September 2025, compared with ₹2.17 lakh crore a year earlier, according to official filings. Deposits also increased 12 percent year-on-year to ₹3.09 lakh crore, while the credit–deposit ratio rose to 82 percent from 78 percent in the same period last year.

Its global business — the sum of loans and deposits — expanded to nearly ₹5.64 lakh crore, a 14 percent increase. Analysts say the figures highlight not just strong credit demand but also improved operational performance.

“Bank of Maharashtra has benefitted from improved asset quality, a stable capital base, and a targeted push in retail and SME lending,” said Vivek Agarwal, banking sector lead at consultancy PwC India.

Public Sector Banks Gain Ground

Industry-wide data confirms the momentum. According to the Reserve Bank of India (RBI), PSBs grew their loan books by an average of 13.1 percent in September, compared with 9 percent for private banks. It is the first time since 2010 that government-owned banks have recorded faster growth than their private peers.

The country’s largest lender, the State Bank of India (SBI), reported double-digit credit growth, while Punjab National Bank (PNB) also saw significant expansion. In contrast, private giants such as HDFC Bank and ICICI Bank posted slower growth, reflecting a more cautious approach to lending amid global uncertainty.

“This is a remarkable reversal of trends,” said Rajnish Kumar, former chairman of SBI. “Private banks dominated for more than a decade, but PSBs are regaining market share thanks to government reforms, better risk controls, and improved profitability.”

Why the Shift Happened

Several factors explain the resurgence of public sector banks:

- Government recapitalisation: Over the past five years, the Indian government has injected significant capital into PSBs, strengthening their balance sheets and reducing the burden of bad loans.

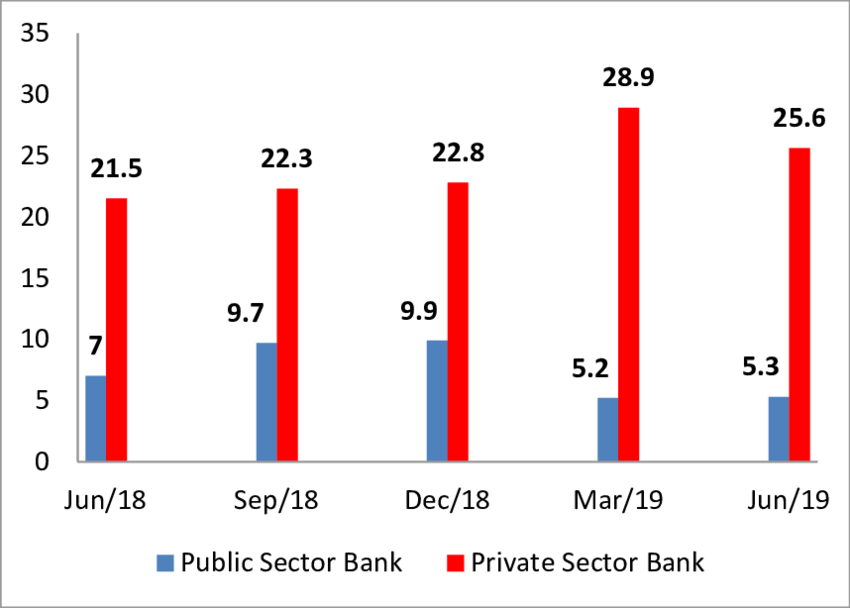

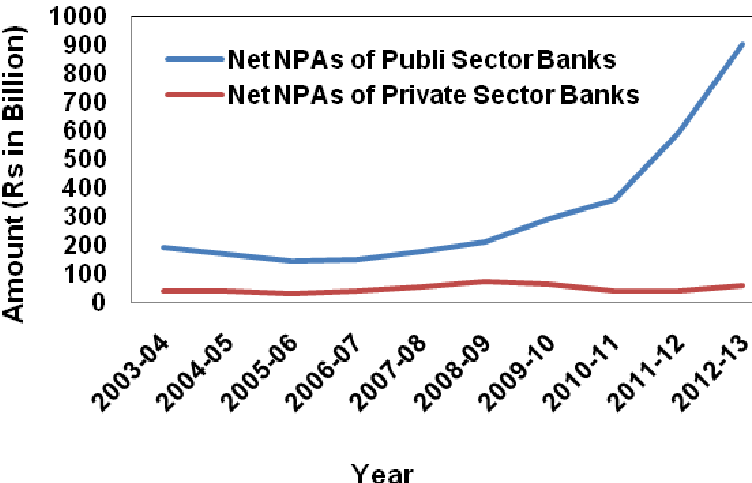

- Asset quality improvement: Non-performing assets (NPAs) at PSBs have fallen sharply, narrowing the gap with private banks. According to RBI data, gross NPAs at state-run banks declined to 4.9 percent in 2025, down from nearly 12 percent in 2018.

- Policy support: Regulatory measures such as mergers of weaker PSBs and technology-driven initiatives have improved efficiency and scale.

- Credit demand: Infrastructure, housing, and small business sectors have seen strong credit demand, areas where PSBs traditionally dominate.

Sectoral Trends in Lending

The credit surge has been most pronounced in:

- Retail loans: Housing, auto, and personal loans continue to drive demand, with PSBs expanding aggressively in semi-urban and rural areas.

- MSMEs (Micro, Small and Medium Enterprises): State banks have increased lending under government-backed schemes designed to boost entrepreneurship and job creation.

- Agriculture: Seasonal credit demand for crops and agri-infrastructure has contributed to lending growth.

- Infrastructure: Large state-run projects in energy, transport, and logistics are being financed mainly by PSBs.

Private banks, in contrast, have focused more on prime retail borrowers and avoided higher-risk corporate or agricultural loans.

Capital Strength and International Recognition

Ratings agency S&P Global assigned Bank of Maharashtra a “BBB” rating with a stable outlook, citing its robust capital, liquidity, and funding profile. This follows a trend of improved ratings for several state-owned banks, a sign of greater confidence in their stability.

“India’s public sector banks have emerged stronger after years of restructuring,” S&P said in its report. “They now have adequate capital buffers to support sustained credit growth.”

Risks of Overheating

Despite the positive momentum, experts caution against overextension. Rapid loan growth can increase risks if underwriting standards weaken. With global interest rates elevated and commodity prices volatile, borrowers could face repayment pressures.

“Banks must avoid the mistakes of the past,” said Dr. Meera Subramanian, professor of finance at Jawaharlal Nehru University. “The last credit boom ended with a surge in bad loans. Sustainable growth requires strong risk management and careful monitoring of asset quality.”

The RBI has already advised banks to maintain prudent provisioning and capital adequacy ratios, even as lending expands.

Global and Economic Context

India’s banking trend mirrors developments in other emerging markets, where state-owned lenders are stepping in to support government-led growth strategies. In China, state banks continue to dominate lending, particularly in infrastructure and manufacturing.

For India, the surge in credit is part of a wider strategy to maintain high GDP growth, projected at 6.5 percent for 2025–26 by the International Monetary Fund (IMF). Credit expansion is expected to fuel investment in energy transition, infrastructure, and digital industries.

However, stronger credit growth may also add inflationary pressures if not matched by productivity gains. The RBI will need to balance supporting growth with containing price stability.

Looking Ahead

Bank of Maharashtra’s performance underscores how far public sector banks have come since their crisis years in the mid-2010s. With improved profitability, stronger capital bases, and reduced NPAs, they are once again central to India’s economic story.

Yet challenges remain. Private banks still lead in profitability, technology adoption, and customer service. Foreign investors often prefer private lenders due to governance concerns at state banks. Sustaining the resurgence will require reforms in management autonomy, digital transformation, and continued vigilance against credit risks.

“Public sector banks have won back ground, but the real test will be maintaining momentum in a volatile global economy,” said Sonal Verma, chief India economist at Nomura.

Conclusion

The 17 percent loan growth at Bank of Maharashtra reflects more than one bank’s success. It signals a turning point in India’s financial sector, with state-owned lenders regaining strength and expanding their role in driving the economy. Whether this marks a permanent shift or a temporary resurgence will depend on how banks balance ambition with prudence in the years ahead.