Australia’s $250 and $750 Pension Payment: Australia’s $250 and $750 pension payment rumors have been flying across the internet lately. Some social media posts and small blogs claim that extra cash is on the way for seniors and welfare recipients this October. Sounds great, right? Well — hold up. As of now, there’s no official confirmation from the Australian government, Services Australia, or the Department of Social Services (DSS) that any one-off $250 or $750 bonus will land in pensioners’ bank accounts this October.

What is confirmed, though, is that pension rates were officially increased on 20 September 2025 as part of the regular indexation process. That’s not a special “bonus” — it’s the normal twice-yearly adjustment to keep up with inflation and wages.

Table of Contents

Australia’s $250 and $750 Pension Payment

The chatter about Australia’s $250 and $750 pension payments in October 2025 might sound tempting, but for now it’s just that — chatter. The confirmed news is that pensions have risen modestly through indexation, while deeming rate changes may offset gains for some. Plan conservatively, and never rely on unverified “cash boost” claims. Whether you’re a retiree managing household costs or a financial pro advising clients, the smart move is the same: trust data, not drama.

| Key Point | Latest Facts & Figures | Professional Insight / Why It Matters |

|---|---|---|

| Rumored $250 / $750 pension bonus | No official government confirmation as of Oct 2025 | Treat as unverified speculation; avoid planning around it |

| Confirmed increase (Sept 2025) | Single: $1,178.70 /fortnight, Couple combined: $1,777.00 /fortnight (Services Australia) | Automatic increase due to inflation; not a discretionary bonus |

| Deeming rates | Lower = 0.75%, Higher = 2.75% | Impacts part-pensioners with savings or investments |

| Affected population | ~2.65 million Age Pension recipients (ABS) | Roughly 25% may see smaller net increases due to deeming |

| Policy source | Services Australia, DSS, Treasury | Always verify claims on .gov.au domains only |

| Next review date | 20 March 2026 | Next scheduled indexation cycle |

Why the Australia’s $250 and $750 Pension Payment Rumor Caught Fire?

Let’s be honest — inflation’s been biting. Groceries, energy bills, rent — everything costs more. So when people hear “extra $750 for pensioners,” it spreads like wildfire.

These rumors usually come from non-official blogs or third-party “news” sites. They often recycle information from previous COVID-19 Economic Support Payments (the real one-off $750 payments made in 2020–2021).

But as of October 2025, no new payment legislation or government statement has confirmed such a bonus. The latest federal budget and DSS reports also make no mention of one-off pension supplements.

In other words: if it’s not on a .gov.au site, it’s not confirmed.

What’s Actually Changing: The Real Pension Adjustments

1. Regular Indexation — The Built-In Pay Rise

Twice each year (20 March and 20 September), Services Australia recalculates major welfare payments — including the Age Pension, Carer Payment, and Disability Support Pension. The increase depends on the Consumer Price Index (CPI) and the Pensioner and Beneficiary Living Cost Index (PBLCI).

For the current cycle (20 Sept 2025 – 19 Mar 2026):

- Singles: from $1,149 → $1,178.70 per fortnight

- Couples (combined): from $1,732.20 → $1,777.00 per fortnight

That’s roughly a $770 annual increase for a single pensioner — modest, but meaningful in today’s cost-of-living environment.

Pro tip: These increases are automatic; you don’t need to re-apply or fill out forms. If you’re eligible, the higher rate is deposited straight into your account.

2. Deeming Rate Adjustments — The Quiet Game-Changer

Not as flashy as a “bonus,” but far more impactful for many.

Deeming rates determine how much income the government assumes your financial assets (like savings or shares) earn. The logic? Some retirees hide wealth in low-interest accounts, so the government “deems” a standard return rate.

From September 2025:

- Lower deeming rate: 0.75% (applies to first $60,400 of assets for singles, $100,200 for couples)

- Higher deeming rate: 2.75% (applies above those thresholds)

This means if you’ve got decent savings, the system now assumes you’re earning more — which can reduce your Age Pension.

According to the University of Sydney, about 1 in 4 pensioners will see a smaller net benefit from the indexation increase because of deeming.

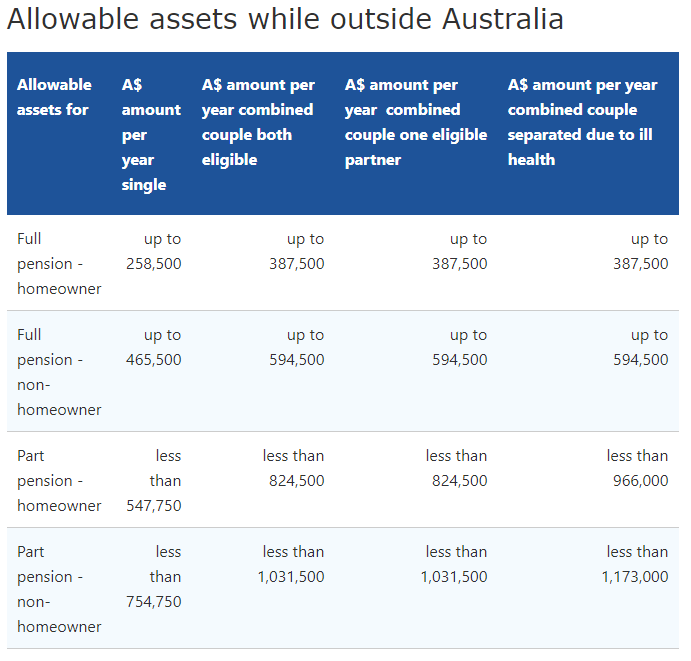

3. Eligibility Rules — The Double Test

To qualify for the Age Pension, you need to pass both the:

- Income Test – based on your earnings, and

- Assets Test – based on the value of your assets (home, investments, etc.)

Your payment is calculated using whichever test gives a lower pension rate.

Current thresholds (Sept 2025 – Mar 2026)

- Single homeowner: full pension ≤ $321,500 in assets; part pension ≤ $714,500

- Couple homeowners (combined): full pension ≤ $481,500; part pension ≤ $1,074,000

- Income limit (single): up to $218 /fortnight before reduction begins

If you breach either threshold, your pension decreases proportionally — not wiped out instantly.

4. Relationship Status and Residency Rules

- You must generally be 67 years old and have lived in Australia for at least 10 years, with at least 5 years continuous residence.

- Couples are assessed jointly; if one partner earns or holds assets, it affects the other’s entitlement.

- If you separate or your partner passes away, report it immediately — your rate may shift to the single threshold.

Breaking Down the Rumor vs. Reality

| Claim | Reality | Verdict |

|---|---|---|

| “$750 payment in October 2025 for all pensioners” | No government confirmation or legislation | False |

| “$250 cost-of-living boost for seniors” | Not listed in the 2025 Federal Budget or DSS releases | False |

| “Payments increased automatically in September 2025” | Confirmed via Services Australia indexation update | True |

| “Some pensioners may see no net gain” | True due to deeming rate effects | True |

| “Bonus may appear later in 2025” | Unknown — possible only if included in a mid-year fiscal package | Unconfirmed |

How to Verify Official Information?

- Bookmark government sources:

- Services Australia News for Centrelink

- Department of Social Services (DSS) Press Releases

- Australian Treasury Budget Statements

- Check your myGov account:

Any confirmed payment (bonus, supplement, or indexation) appears automatically under your Centrelink payments. - Avoid “claim your bonus now” sites:

Scammers love these rumors. No genuine government payment ever requires you to “apply through a special link.” - Ask your financial adviser or Services Australia directly if you receive conflicting information.

Why Bonuses Sometimes Happen — Historical Context

It’s not crazy to wonder if a $750 bonus could happen again.

During the COVID-19 pandemic (2020–2021), the government issued four separate Economic Support Payments worth $750 each, plus a few smaller top-ups for eligible welfare recipients.

Those payments were meant to stimulate the economy and ease pandemic-era hardship — extraordinary times.

Since then, there have been occasional Cost-of-Living supplements, but none have been confirmed for late 2025.

If economic conditions worsen or a new budget surplus appears, the government could announce targeted support later this year. But until you see it on servicesaustralia.gov.au, it’s pure speculation.

Practical Tips for Pensioners and Advisers

For Everyday Pensioners

- Budget around what’s confirmed. Plan using your current payment rate; treat any rumored “bonus” as icing on the cake if it happens.

- Track your spending. Energy, groceries, and rent rebates may offer more tangible help than speculative bonuses.

- Leverage state-based concessions. Each Australian state and territory offers senior discounts — worth hundreds yearly.

For Financial Advisers and Professionals

- Update retirement models using September 2025 rates and deeming rules.

- Educate clients about verifying payment news from official sources.

- Scenario-test outcomes for part-pensioners with varied savings levels.

- Prepare for legislative updates. If a real bonus is announced, determine its tax treatment and whether it’s “assessable income.”

Australia Pension Boost Starting 1st October 2025 – Check New Rates and Payment Dates

Australia $1116 Age Pension Coming in October 2025: Check Eligibility & Payout Dates

Australia $500 Cost Of Living Payment in October 2025 – Check Eligibility criteria & Pay Dates

Political and Economic Angle

The government has prioritized gradual indexation over one-off cash bonuses. Economists argue this approach is more sustainable and less inflationary.

However, groups like National Seniors Australia and COTA (Council on the Ageing) continue to lobby for one-off relief payments to offset rising living costs, especially energy and food.

Treasury officials hinted in the 2025–26 Budget Review that “targeted cost-of-living support measures” could be revisited if inflation remains above 3%. That leaves the door open — but doesn’t guarantee anything.

So, could the rumored $750 still happen? Possibly — but not yet.

Bottom Line: Stay Smart, Stay Skeptical

In summary, as of October 2025:

- There’s no confirmed $250 or $750 one-off pension bonus.

- Regular indexation has already increased payments since 20 September 2025.

- Deeming rates have risen, reducing benefits for some part-pensioners.

- Official info only comes from gov.au sites.

If a genuine cash boost ever appears, it will make national headlines and show up in your myGov account — not on some random blog or Facebook post.

Keep your expectations grounded, your information official, and your finances steady.