Australia Pension Plan Payment: If you’re gearing up for your November 2025 pension check or planning to submit your claim, you’ll want this guide at your fingertips. Covering everything from historic milestones to the latest updates on payment dates, eligibility, and claim procedures, this comprehensive article helps you navigate Australia’s age pension system with confidence and clarity. Whether you’re a seasoned retiree or about to claim for the first time, you’ll benefit from detailed insights and practical advice.

Table of Contents

Australia Pension Plan Payment

The November 2025 Australia Pension payments are designed to be timely, fair, and supportive, with the new increase helping seniors face the rising cost of living. Knowing the eligibility criteria, how to claim, and the upcoming payment schedule empowers retirees to plan confidently. Staying engaged ensures you’re always up-to-date with policy changes, subsidy programs, and additional benefits. Retirement in Australia is built on a foundation of well-structured, adaptable policies that balance government support with personal savings—helping millions of Australians enjoy dignity and security in their later years.

| Topic | Details |

|---|---|

| Pension Payment Dates (Nov 2025) | November 13 and November 27, 2025 — fortnightly payments from Centrelink |

| Annual Pension Increase | $3,600 increase effective November 18, 2025 |

| Age Eligibility | Minimum 67 years old |

| Means Test | Income and asset tests determine how much pension you get |

| Online Claim Portal | Claim through Centrelink linked with myGov for convenience |

| Supporting Documents Needed | ID proof, income statements, asset details, bank info |

| Official Info & Claim Link | Services Australia – Age Pension |

The Evolution of Australia’s Pension System: A 120-Year Journey

Understanding the Australia Pension today requires a glance into its rich history—a journey spanning over a century of social policy innovation. The concept of government support for retirees began with the Invalid and Old-Age Pensions Act of 1908, making Australia one of the earliest countries to implement a nationwide pension scheme.

Initially, the pension was modest, providing minimal support aimed mainly at men aged 65 and women aged 60, reflecting societal norms of the early 20th century. Over the years, reforms gradually expanded coverage, increased amounts, and refined eligibility criteria—tracking socio-economic changes and political priorities. For instance, in 1975, the Whitlam government raised the pension to match 25% of average male weekly earnings, aiming to lift recipients out of poverty.

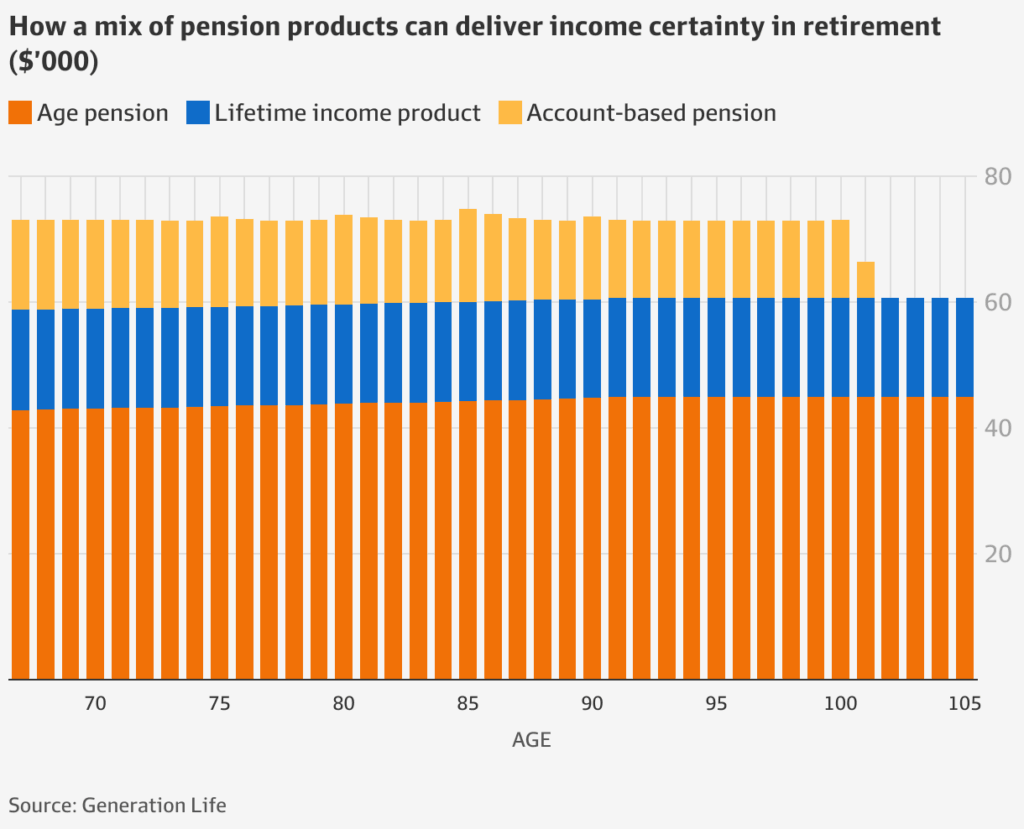

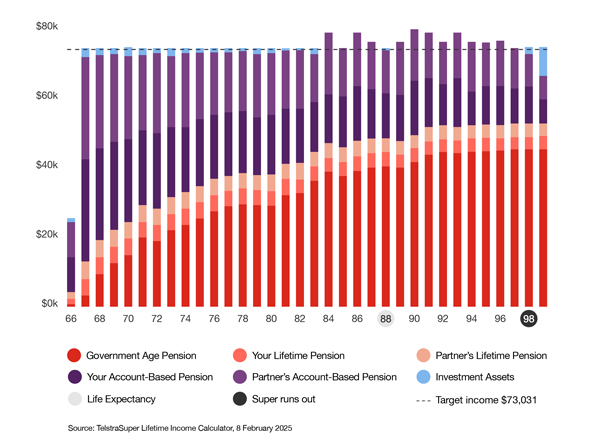

By the late 20th and early 21st centuries, the pension system transformed further, integrating with Australia’s growing superannuation system that began in the 1980s and became mandatory in 1992. These reforms created a three-pillar system—comprising the age pension, mandatory superannuation, and voluntary savings—aimed at ensuring sustainable, adequate retirement income for Australians.

Today, the Age Pension remains a cornerstone of retirement support, targeted at those most in need, with means testing, indexation, and progressive increases designed to adapt to inflation and economic conditions.

When Will Your November 2025 Pension Payment Arrive?

For November 2025, the Australian government continues its diligent schedule of fortnightly payments. The scheduled dates are:

- November 13

- November 27

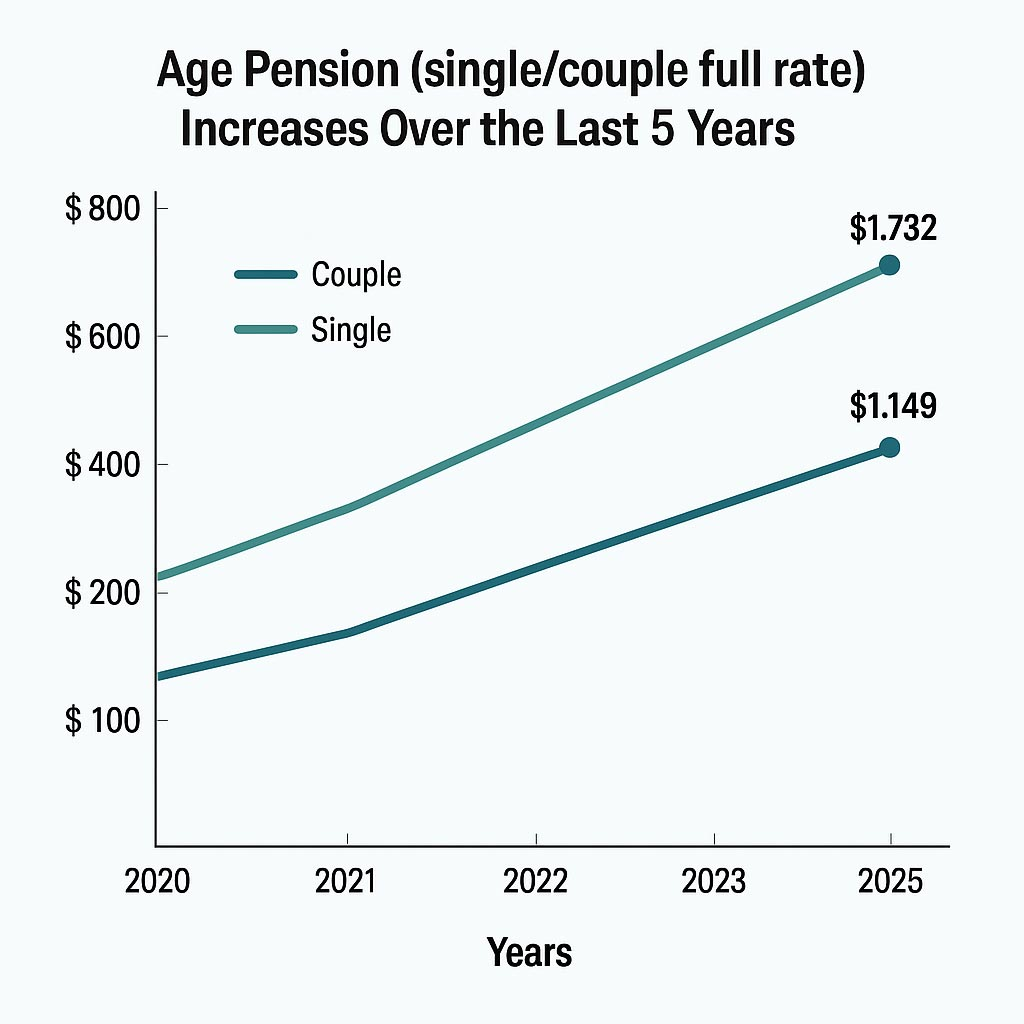

These dates are based on a long-standing biweekly schedule, which provides retirees a steady cash flow. Meanwhile, from November 18, the $3,600 annual pension increase will be reflected in regular fortnightly payments—helping seniors meet increased living costs, healthcare expenses, and everyday needs.

How the Australia Pension Plan Payment Works?

The legislative adjustments approved in 2025 mean the pensioners receive a boost of approximately $69.20 per fortnight for singles, and a proportionate increase for couples, effective from mid-November. This is part of ongoing efforts to support Australians and their economic resilience, especially amid rising inflation rates and energy prices.

Updated Rates for 2025: How Much Will You Get?

The 2025 pension rates, reflecting recent revaluations, are:

| Type of Pension | Fortnightly Payment | Annual Total | Notes |

|---|---|---|---|

| Single pensioner | $1,178.70 | Approximately $30,646 | Including supplements |

| Each partner in a couple | $888.50 | Approximately $23,101 | For each individual |

| Full couple rate | $1,777 | Approx. $46,202 | Combined |

These rates are index-linked and subject to adjusting based on inflation and the means test criteria.

Who Is Eligible for Australia Pension Plan Payment?

Basic Eligibility Requirements in 2025:

- Age: At least 67 years old.

- Residency: Must be an Australian citizen or permanent resident, with a set period of residence.

- Income & Assets: Must pass the means test, which considers income from employment, investments, and savings, as well as assets like property, vehicles, and financial holdings.

Income & Assets Limits

For 2025, the income and asset thresholds are calibrated to ensure targeted support:

- Single homeowners with assets below about $321,500 qualify for the full pension.

- Couples who own their home can have combined assets up to roughly $481,500 and still receive at least a partial pension.

Special Considerations

Your primary residence is generally exempt from the assets test, which benefits homeowners significantly. Additionally, some seniors may qualify for partial pensions depending on their combined income and assets, making the system flexible and accessible.

How to Claim Your Australia Pension Plan Payment?

Step 1: Collect Your Documentation

Prior to starting your claim, gather essential documents:

- Proof of age, e.g., birth certificate or passport.

- Australian citizenship or residency proof.

- Financial details, like bank statements, superannuation statements, and investment portfolios.

- Income documentation: payslips, pension statements, rental income.

- Assets proof: property deeds, vehicle registration, investment certificates.

Step 2: Create a myGov Account and Link to Centrelink

- Sign up or log into myGov.

- Link your account with Centrelink.

- Complete identity verification steps to securely connect your profile.

Step 3: Submit the Claim Online

- Log into myGov and select Centrelink.

- Choose Make a New Claim under Older Australians.

- Follow the prompts: answer questions about your income, assets, and residency.

- If applicable, include your partner’s information for joint claims.

Step 4: Track & Confirm the Claim

Once submitted, you can:

- Track the progress online.

- Upload any additional documents if requested.

- Ensure your bank details are correct to receive your payments promptly.

Tips for a Smooth Claim

- Apply early: To avoid delays, file your claim several weeks before the scheduled payment date.

- Double-check your info: Discrepancies can cause rejection or payment delays.

- Notify changes immediately: Income, assets, or relationship status changes impact your eligibility.

- Stay updated: Regularly check Services Australia for updates on policy changes.

Recent Policy Changes and Future Outlook in 2025

This year, the government introduced several updates:

- The $3,600 annual pension increase aligns with inflationary trends, meaning increased benefits for most retirees.

- The pension eligibility thresholds have been adjusted upward, reducing the number of partial pensioners and increasing full pension eligibility.

- Digital claims and online verification processes have been expanded to reduce processing times and improve accessibility.

- Ongoing reforms aim to address gender gaps in superannuation and explore ways to support low-income and Indigenous seniors more effectively.

The Future

Australia’s retirement income system continues to be a model of balance—blending government support with private savings. The focus remains on sustainable growth, targeted support, and adaptable policies to meet demographic shifts and economic realities.

Real-Life Examples

Barbara, 68, owns her home outright—her assets are below the threshold, so she qualifies for the full pension. The additional $69.20 per fortnight makes a real difference, helping cover her health services and grocery bills.

David and Emily, a couple aged 70 and 69, have combined superannuation savings and pension entitlements. They use their income to enjoy travel, hobbies, and securing healthcare.

Mohammad, 67, recently claimed online, navigating the process with ease thanks to the clear guidelines and document checklist provided by Centrelink.

Additional Benefits & Support Programs

Aside from the pension bimonthly payments, seniors can access:

- Concession cards for utilities, transport, and health services.

- Discounts on prescriptions via the PBS.

- Support for housing, community care, and emergency relief programs.

These benefits help maintain quality of life without stretching limited budgets.

How Australia’s System Compares Internationally?

Compared to systems like the US Social Security, Australia’s means-tested pension provides targeted support whereas the US system offers flat benefits based primarily on work history. The UK’s State Pension is more universal but less targeted. Australia’s blend of public pension and mandatory superannuation is often hailed as a sustainable, efficient model for addressing aging populations.

Australia’s October $400 Centrelink Payment for Pensioners: Eligibility and Payment Date

$1000 Centrelink Advance Payment in November 2025 – Check Deposit Date & Eligibility