Australia’s Centrelink payment schedule in October 2025 has become the subject of intense debate after widespread online claims of a $1900 bonus for pensioners. The federal government has now formally denied the existence of any such lump-sum payment, but confirmed Age Pension indexation and a $750 cost-of-living payment for eligible recipients.

Officials and economists say the government’s measures are targeted to offer relief to older Australians most affected by inflation. Misinformation surrounding the alleged $1900 payment, however, has created confusion among vulnerable groups, prompting new public awareness campaigns.

Table of Contents

$1900 Centrelink Payment

| Key Fact | Detail |

|---|---|

| Payment Type | Regular Age Pension + targeted cost-of-living payment |

| Maximum Fortnightly Age Pension | $1,178.70 (single, including supplements) |

| Cost-of-Living Bonus (select groups) | $750 one-off payment |

| Official $1900 Bonus | No official confirmation; widely debunked |

| Official Website | Services Australia |

Government Confirms No $1900 Centrelink Payment

The Department of Social Services (DSS) confirmed this week that claims of a $1900 Centrelink payment are “completely unfounded.” Instead, the government is implementing scheduled pension increases through indexation and a $750 cost-of-living payment for qualifying recipients.

“These rumours are false. They are not supported by any official program or legislation,” a DSS spokesperson said. “Eligible seniors will receive the regular Age Pension and any approved cost-of-living relief, but not an additional $1,900 lump sum.”

The clarification comes as scam activity linked to such rumours has increased, according to the Australian Competition and Consumer Commission (ACCC). Several fraudulent websites have been found imitating Services Australia branding to harvest personal data.

Breakdown of Age Pension and Cost-of-Living Payment

Regular Age Pension Payments

As of 20 September 2025, the maximum fortnightly Age Pension is:

- Single: $1,178.70

- Couples (combined): $1,776.60

This includes both the pension base rate and supplements such as the Energy Supplement. Age Pension eligibility is determined through a combination of age, residency, income, and assets tests. Most pensioners are paid fortnightly, though weekly payments are available in special cases.

One-Off Cost-of-Living Payment

In addition to standard pension payments, the government has approved a $750 cost-of-living payment for seniors and certain welfare recipients. According to the 2025–26 Federal Budget, the payment aims to “cushion low-income Australians from inflationary pressures, particularly in essential spending categories.”

No application is required for this payment. Centrelink will automatically disburse funds to eligible recipients starting 14 October 2025.

Why the Rumour Spread — and Why It Matters

Misinformation about welfare and pension payments has increased in recent years, often spreading rapidly through Facebook, WhatsApp, and blog-style websites. Experts say this creates risks for financially vulnerable Australians.

“This kind of rumour spreads fast because it taps into real financial anxiety,” said Dr. Anya Morales, senior policy analyst at the Grattan Institute. “Many older Australians are struggling with living costs, so the promise of a large payment feels plausible.”

The ACCC’s Scamwatch program recorded a 27 per cent increase in phishing scams referencing Centrelink between January and September 2025. In most cases, victims were asked to provide banking or identity details in exchange for “bonus payments.”

“The best defence is scepticism,” said ACCC Deputy Chair Catriona Lowe. “If it sounds too good to be true, it probably is.”

Eligibility Criteria for $1900 Centrelink Payment

Eligibility for the cost-of-living payment mirrors existing pension requirements. To qualify, a recipient must:

- Receive the Age Pension, Disability Support Pension, or Carer Payment.

- Reside in Australia at the time of payment.

- Pass income and asset tests set by Services Australia.

These thresholds adjust twice yearly, ensuring payments target those in genuine financial need. Home ownership also affects eligibility, with non-home owners permitted higher asset thresholds.

Political and Policy Context

The October payment comes at a politically sensitive time. The Albanese Government faces mounting pressure over inflation, housing affordability, and cost-of-living challenges.

Opposition finance spokesperson Jane Hume said the cost-of-living payment was “a step in the right direction” but argued it “does not go far enough to address systemic issues affecting seniors.”

Treasurer Jim Chalmers defended the package during a budget briefing, stating it “strikes the right balance between targeted support and fiscal responsibility.”

“This is not a windfall; it’s targeted relief for those who need it most,” Chalmers said.

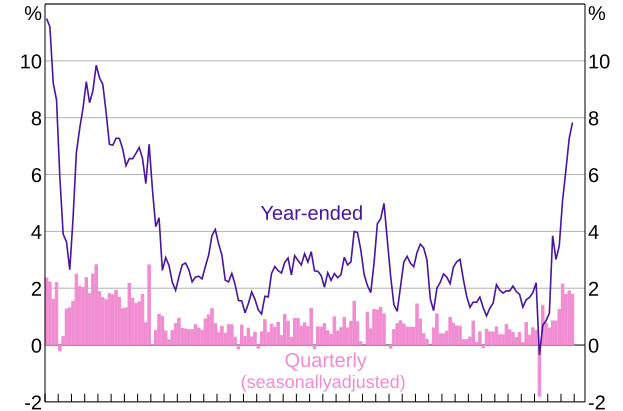

Economists agree that broad, large-scale cash handouts could add pressure to inflation, which remains above the Reserve Bank of Australia’s (RBA) 2–3 per cent target band.

Historical Background: How Centrelink Payments Evolved

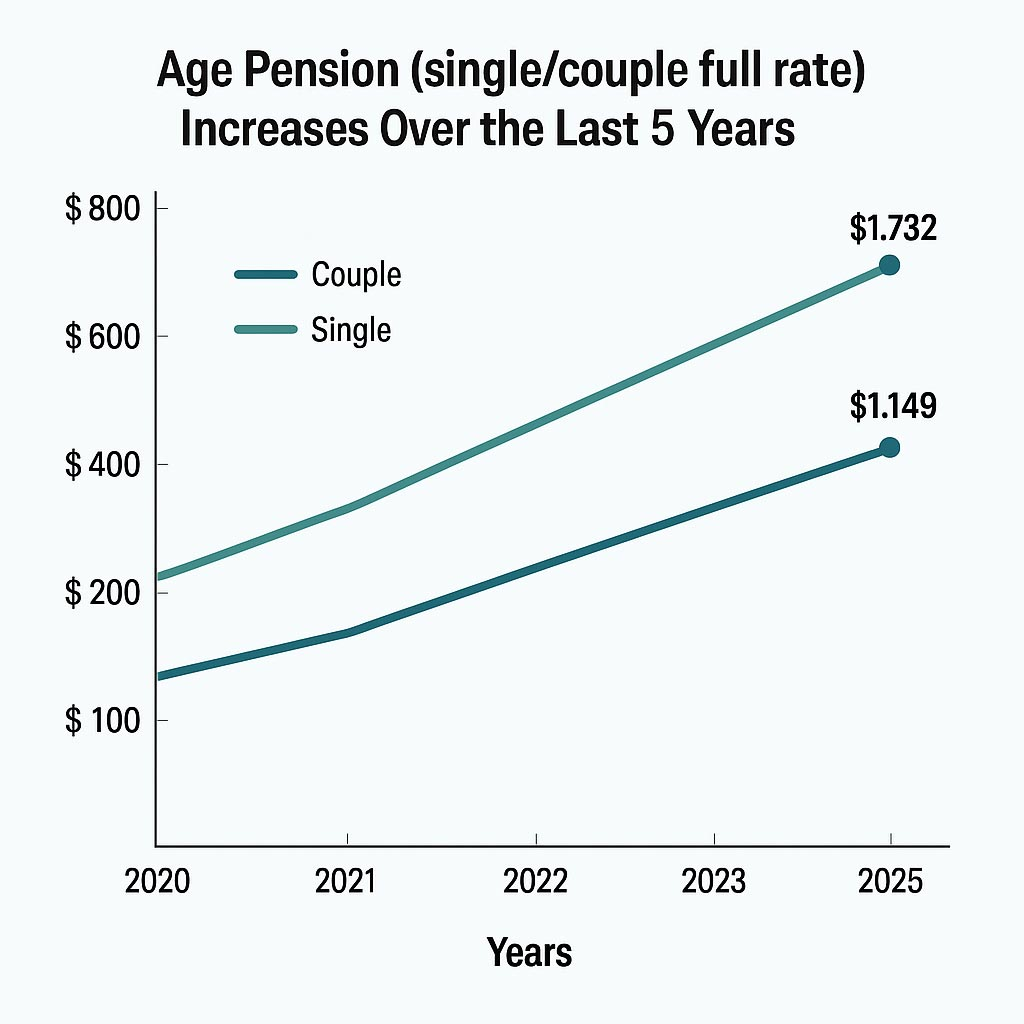

The Age Pension has been a pillar of Australia’s social safety net since 1909. Over the decades, it has undergone multiple reforms, including the introduction of income and asset tests, pension supplements, and indexation mechanisms to adjust for inflation.

A notable precedent for cost-of-living bonuses came during the COVID-19 pandemic, when the government issued several lump-sum economic support payments to pensioners and other welfare recipients. Those payments totalled $750 each and were distributed in multiple rounds between 2020 and 2021.

“Since the pandemic, there’s been a public expectation that extraordinary circumstances will prompt lump-sum payments,” said Professor Graham Lee, economist at the University of Melbourne. “That expectation fuels misinformation when no such program exists.”

How Australia Compares Internationally

Australia is not alone in providing targeted relief to seniors amid rising living costs. In 2025:

- Canada increased its Guaranteed Income Supplement by CAD $500 for low-income seniors.

- The United Kingdom offered Winter Fuel Payments and a £300 Cost of Living Payment.

- New Zealand expanded its Superannuation top-ups for older residents facing energy price spikes.

However, unlike Canada or the UK, Australia relies primarily on means-tested Age Pension rather than universal retirement benefits. Economists argue this allows more efficient targeting but can create confusion for those unfamiliar with the rules.

Inflation, Cost of Living, and the Pension System

Australia’s inflation rate has declined from 6.7 per cent in mid-2023 to an expected 3.2 per cent by late 2025, according to Treasury forecasts. However, older Australians remain vulnerable to price increases in energy, housing, and healthcare.

“Pensioners often spend a larger share of their income on non-discretionary expenses,” said Dr. Amy Wu, senior research economist at the Australian National University. “Even moderate inflation hits their budgets harder.”

Indexation ensures pension payments keep pace with wage growth and inflation. But the lag between cost increases and payment adjustments often means seniors feel financial strain months before relief arrives.

Scam Awareness: How to Stay Safe

Scammers exploiting Centrelink rumours use fake websites, phishing emails, and text messages. They often:

- Promise large payments like $1,900

- Ask for banking details or identity documents

- Imitate official Services Australia branding

The ACCC urges Australians to avoid clicking on unsolicited links. The safest way to check payment eligibility is through myGov or the official Services Australia website.

Practical Steps: How Seniors Can Maximise Support

To help eligible Australians navigate the system, Services Australia and financial counsellors recommend:

- Checking your myGov account regularly for payment updates.

- Using the Age Pension Calculator to estimate entitlements.

- Registering for direct deposit to avoid mail delays or cheque fraud.

- Contacting Financial Information Service (FIS) officers for free financial guidance.

- Reporting suspicious messages to Scamwatch.

“Understanding the system is as important as receiving the payment itself,” said Helen Crawford, a financial counsellor at the National Seniors Association. “Many people miss out on legitimate support because they don’t know what’s available.”

Regional and Demographic Impact

Regional seniors are expected to benefit significantly from the October cost-of-living payment. According to DSS data, rural and regional pensioners spend up to 25 per cent more on energy and transportation than their metropolitan counterparts, due in part to infrastructure gaps.

Indigenous elders, who have higher rates of economic disadvantage, are also expected to be key beneficiaries. Community services groups have called for additional measures, including increased regional mobility support and health subsidies.

Expert Perspectives on the Road Ahead

Economists and policy experts say the October payment is a short-term measure. Long-term solutions may require structural reforms to housing, healthcare, and energy costs.

Professor Graham Lee emphasised that “cash payments can soften the blow, but they don’t solve underlying cost drivers.”

Meanwhile, advocates for older Australians argue for stronger pension adequacy benchmarks to ensure the payment system keeps pace with real living costs.

National Seniors Australia CEO Chris Grice called on the government to “revisit pension indexation frequency” to provide more responsive support in times of high inflation.

Political Implications and Future Outlook

The October Centrelink payment announcement — and the controversy surrounding the false $1,900 rumour — comes just months before the 2026 federal election. Cost-of-living policy is expected to be a central campaign issue.

Government insiders say further relief measures may be considered in the 2026–27 Federal Budget, depending on economic conditions.

Treasurer Chalmers stated: “We’ll continue to support those who need it most, while ensuring fiscal discipline and long-term economic stability.”

Australia $1116 Age Pension Coming in October 2025: Check Eligibility & Payout Dates

Australia $500 Cost Of Living Payment in October 2025 – Check Eligibility criteria & Pay Dates

FAQ About $1900 Centrelink Payment

Will I receive $1900 in October 2025?

No. There is no confirmed $1900 Centrelink payment. Only standard Age Pension and a $750 one-off payment for eligible recipients are scheduled.

Do I need to apply for the cost-of-living payment?

No. Eligible pensioners will receive the payment automatically if they meet the criteria.

When will I get the payment?

Payments are expected to start from 14 October 2025 and follow the usual Centrelink fortnightly schedule.

How can I avoid scams?

Always check your myGov account or visit servicesaustralia.gov.au. Never click on unsolicited links promising bonus payments.

Where can I get help?

Contact Services Australia, National Seniors Australia, or the Financial Information Service for free support.