Australia Centrelink Age Pension: If you’re an Aussie looking to understand what your Centrelink Age Pension in November 2025 will look like, you’re in the right place. The government has updated the pension rates starting September 20, 2025, giving eligible seniors a welcome bump in their payments through November and beyond. Whether you’re planning your budget, navigating eligibility, or just curious, this guide breaks everything down in a way that’s easy to get—with some extra insights for the pros too.

Table of Contents

Australia Centrelink Age Pension

The Centrelink Age Pension remains the cornerstone of retirement support for Australian seniors in November 2025, with updated rates and thresholds easing the impact of rising living costs. Whether you’re already receiving the pension or planning to apply, understanding the latest policy changes, eligibility criteria, and managing payments online ensures you get the full support you deserve. Stay proactive and informed so your golden years remain financially secure and comfortable.

| Category | Details |

|---|---|

| Maximum Single Payment | $1,178.70 per fortnight (≈ $30,646 per year) |

| Maximum Couple Payment (Each) | $888.50 per fortnight (≈ $23,101 per year) |

| Combined Couple Payment | $1,777 per fortnight (≈ $46,202 per year) |

| Next Payment Dates | November 13 & 27, 2025 |

| Eligibility Age | 67 years and above |

| Full Pension Asset Limit (Single) | $321,500 (homeowner) / $579,500 (non-homeowner) |

| Income Limit (Single) | $218/fortnight for full rate |

| Official Resource | Services Australia – Age Pension |

What’s New This November? The Basics

The Centrelink Age Pension is one of the most important financial supports for seniors, with about 63% of Australians over 67 relying on it fully or partially. The government reviews and adjusts payments twice a year—in March and September—to reflect inflation and living costs.

For November 2025, payments continue at the increased rate set on September 20. Singles receive up to $1,178.70 per fortnight, while couples get $888.50 each per fortnight. This modest hike provides extra cash flow to cover essentials like food, utilities, and healthcare.

Recent changes also include updated deeming rates—the presumed income from financial assets impacting your pension eligibility—after a five-year freeze. This adjustment means some pensioners with savings or investments might see their payments change as investment income is reassessed.

Additionally, in October 2025, a one-off cost-of-living payment of $750 was issued to eligible pensioners to help with rising expenses, demonstrating the government’s ongoing support to seniors facing inflationary pressures.

Who Qualifies for the Australia Centrelink Age Pension?

To get the Age Pension, seniors must meet these key criteria:

- Be aged 67 or over as of July 1, 2025. This is known as the qualifying pension age, aligned with recent legislative changes.

- Have been a permanent Australian resident for at least 10 years, with 5 of those years consecutive. Exceptions exist for those from countries with social security agreements with Australia or refugees.

- Pass the income and assets tests set by Centrelink, designed to ensure support is targeted to those most in need.

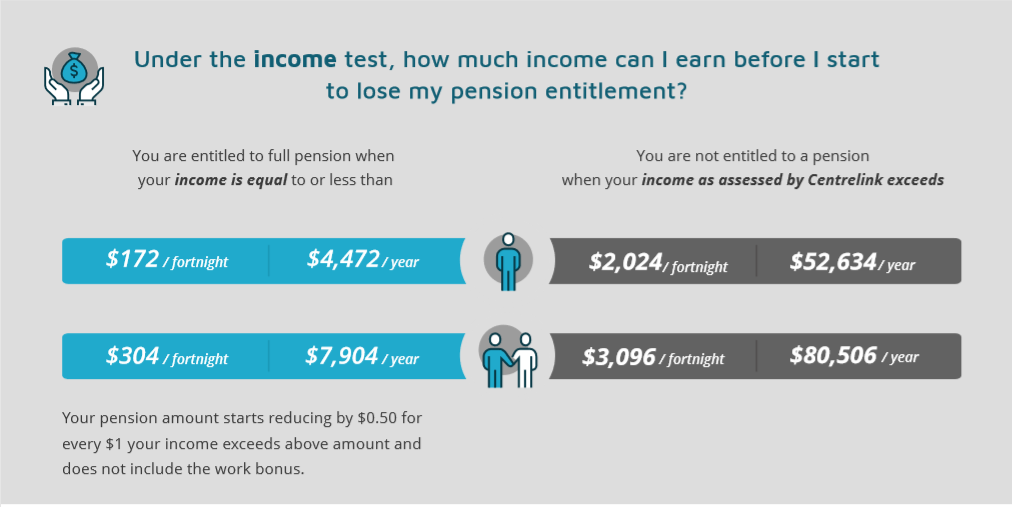

Income Test Details

The income test limits how much you can earn while still receiving the pension:

- Singles can earn up to $218 per fortnight (about $5,668 per year) and qualify for the full pension.

- Couples can earn a combined income of up to $380 per fortnight for the full pension.

- The pension reduces by 50 cents per dollar for income over these thresholds.

- Importantly, the Work Bonus allows pensioners to earn $300 per fortnight from work without affecting their pension, encouraging part-time employment and active engagement in the workforce.

The recent increase in deeming rates affects how income from financial assets is calculated. The two-tier deeming rates, applied to different portions of your assets, assess a notional income to factor into your income test. This change may result in adjustments for people with significant investments.

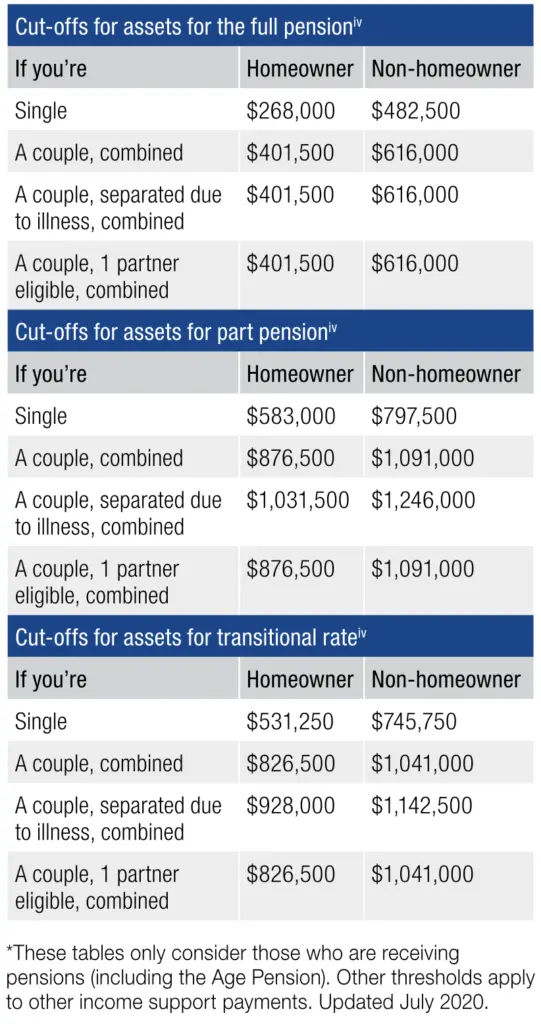

Assets Test Explained

The assets test evaluates the value of what you own (excluding your principal home if you live in it) to determine your pension eligibility and payment rate. This includes:

- Savings and investments

- Real estate (other than your main home)

- Vehicles, caravans, and boats

- Business assets and superannuation balances

Here are the updated asset thresholds as of July 2025:

| Homeownership | Full Pension Limit | Part Pension Limit |

|---|---|---|

| Single homeowner | $321,500 | $704,500 |

| Single non-homeowner | $579,500 | $962,500 |

| Couple homeowner (combined) | $481,500 | $1,059,000 |

| Couple non-homeowner (combined) | $739,500 | $1,317,000 |

The asset thresholds were increased this year to align better with inflation and housing market changes, potentially enabling more seniors to qualify for part or full pensions.

Fortnightly Payments and When You’ll See Cash

Centrelink disperses Age Pension payments every two weeks, typically on Thursdays. In November 2025, payments will arrive on:

- Thursday, November 13

- Thursday, November 27

Payment processing is usually seamless when your banking details are current. Centrelink encourages pensioners to keep their contact and bank information updated through the myGov platform to avoid payment delays, especially important around holidays and weekends when payments may be advanced.

What’s Included in Your Payment?

Your fortnightly payment has components designed to cover basic living costs and essential services:

| Component | Single | Couple (each) |

|---|---|---|

| Base Rate | $1,079.70 | $813.90 |

| Pension Supplement | $84.90 | $64.00 |

| Energy Supplement | $14.10 | $10.60 |

| Total per fortnight | $1,178.70 | $888.50 |

The energy supplement helps pensioners meet utility costs, and the pension supplement helps with general cost-of-living expenses.

Couples separated due to illness receive the single rate, ensuring fair treatment. Taxes may still apply, but Centrelink does not automatically withhold tax unless requested by the pensioner.

How to Apply and Manage Your Australia Centrelink Age Pension Online?

Applying for the Age Pension is streamlined through digital platforms or direct assistance:

- Use myGov to register or log in, sign up for Centrelink services, and complete your Age Pension application online. This platform also lets you upload documents, update circumstances, and access payment history.

- Alternatively, phone Centrelink or visit a local Service Centre for in-person help.

Applications require essential documentation such as proof of identity, residency status, income, and assets. The government allows you to begin the process up to 13 weeks before your qualifying age.

Managing your pension online lets you report changes instantly, request advance payments if emergencies arise, and track your benefit status—reducing paperwork and speeding up service.

Changes in Circumstances: What You Need to Know

Centrelink relies on accurate, up-to-date information to calculate correct payments. If your situation changes, report it within 14 days to avoid overpayments or debts. Key changes include:

- New or lost income streams (e.g., starting/stopping work, superannuation changes)

- Buying or selling assets

- Changes in living arrangements, such as moving to supported accommodation

- Marital status updates, including separation or marriage

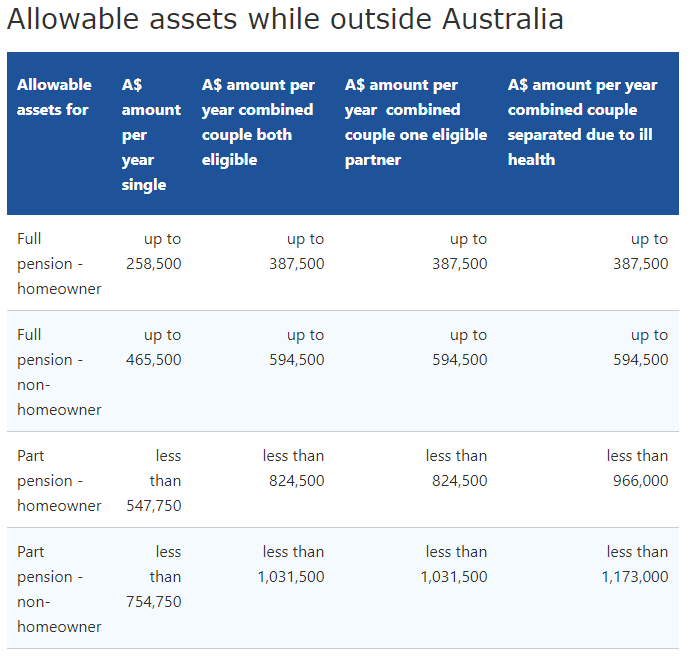

- Absence from Australia exceeding allowed periods

Failure to report changes promptly can lead to financial penalties or payment suspensions.

Extra Help for Renters: Rent Assistance

For pensioners who rent their homes, the government offers Rent Assistance to ease housing costs:

| Category | Minimum Rent to Qualify | Maximum Assistance (per fortnight) |

|---|---|---|

| Single | $152.00 | $215.40 |

| Couple (combined) | $246.20 | $203.00 |

If you pay private rent above these thresholds, you could receive supplementary payments. This benefit supports pensioners facing rising rental markets, helping maintain housing affordability.

Taxation and the Pension

The Centrelink Age Pension is considered income for Australian tax purposes, though many pensioners may pay little to no tax due to offsets such as the Seniors and Pensioners Tax Offset (SAPTO).

You can request tax withholding on your pension payments to avoid a large tax bill during assessment. It’s wise to consult the Australian Taxation Office (ATO) or a tax professional for personalized tax planning.

Financial Planning Tips for Pensioners

Managing your pension effectively enables a better lifestyle and financial security:

- Budget carefully: Prioritize essentials and plan for variable expenses.

- Consider part-time work: Use Centrelink’s Work Bonus to increase income without pension impact.

- Seek financial advice: Many community groups offer free pension counseling.

- Plan healthcare expenses: Leverage government subsidies for medications and services.

- Stay informed: Pension rules, rates, and thresholds can change; regular updates help avoid surprises.

History and Context of Pension Changes in 2025

The Age Pension has evolved over the years in response to demographic trends and economic factors. Key 2025 changes include:

- Pension rate increases effective from September 2025.

- Asset test threshold adjustments aligning with housing market values.

- Ending the five-year freeze on deeming rates, affecting how investment income is counted.

- One-off cost-of-living payments announced in October to address inflation pressures.

These adjustments highlight governmental efforts to protect the purchasing power of elderly Australians and adapt the pension system to changing economic conditions.

Australia Pension Boost Starting 1st October 2025 – Check New Rates and Payment Dates

$1000 Centrelink Advance Payment in November 2025 – Check Deposit Date & Eligibility

Australia $500 Cost Of Living Payment in October 2025 – Check Eligibility criteria & Pay Dates