Australia Centrelink $1900 Payment for Seniors: Australia has a long history of supporting its senior citizens through the Centrelink Age Pension system, which has evolved significantly since its inception over 116 years ago. As of 2025, the pension remains a cornerstone of retirement support, but ongoing discussions about its future and recent changes to rates and eligibility criteria make it crucial for seniors and those nearing retirement to stay informed. Below, you’ll find detailed insights into the pension’s history, recent updates, and what retirees can expect moving forward.

Table of Contents

Australia Centrelink $1900 Payment for Seniors

Australia’s Age Pension has stood the test of time, adapting through more than a century of economic change. While discussions about reforms in 2025 and beyond might cause concern among seniors, staying informed through official sources, preparing financially, and understanding the eligibility criteria will help ensure a secure retirement. Despite ongoing discussions about reforms, the Australian government remains committed to supporting seniors through the Age Pension. Being proactive with your financial planning and staying informed about policy updates will help you navigate any future changes smoothly.

| Topic | Details |

|---|---|

| Payment Amount | No special $1900 lump-sum payment, but regular Age Pension fortnightly payments apply |

| Fortnightly Pension Rate | Approx. A$1,178.70 per fortnight for singles, A$888.50 per fortnight per member of a couple |

| Supplements Included | Pension supplement, energy supplement, and potential rent assistance |

| Cost-of-Living Payment | A separate $750 cost-of-living payment is available for eligible seniors |

| Payment Dates (October 2025) | Fortnightly: October 2, 16, and 30 (deposits usually credited a day early) |

| Eligibility | Age 67+, residency, income/assets test for Age Pension eligibility |

| Source | Services Australia |

A Brief History of the Australian Age Pension

The Australian Age Pension was introduced in 1909 as part of the country’s social welfare system, aimed at providing a safety net for older Australians who could no longer support themselves financially. Over the decades, the system has grown and adapted, reflecting the changing demographic and economic landscape. Key milestones include the introduction of income and assets tests, gradual increases in the qualifying age, and regular indexation to keep pace with inflation.

Historically, the pension has been credited with helping millions of Australians live with dignity and financial independence after retirement. The system has expanded to include various supplements, such as the Pension Supplement, Energy Supplement, and Rent Assistance, which significantly boost the total payments received by qualifying seniors.

Current State of the Age Pension in 2025

In 2025, the Australian government continues to support its aging population, but not without some key updates that retirees need to understand. The latest official figures, updated in September 2025, reveal how the pension rates have adjusted and what seniors can expect on their monthly payments.

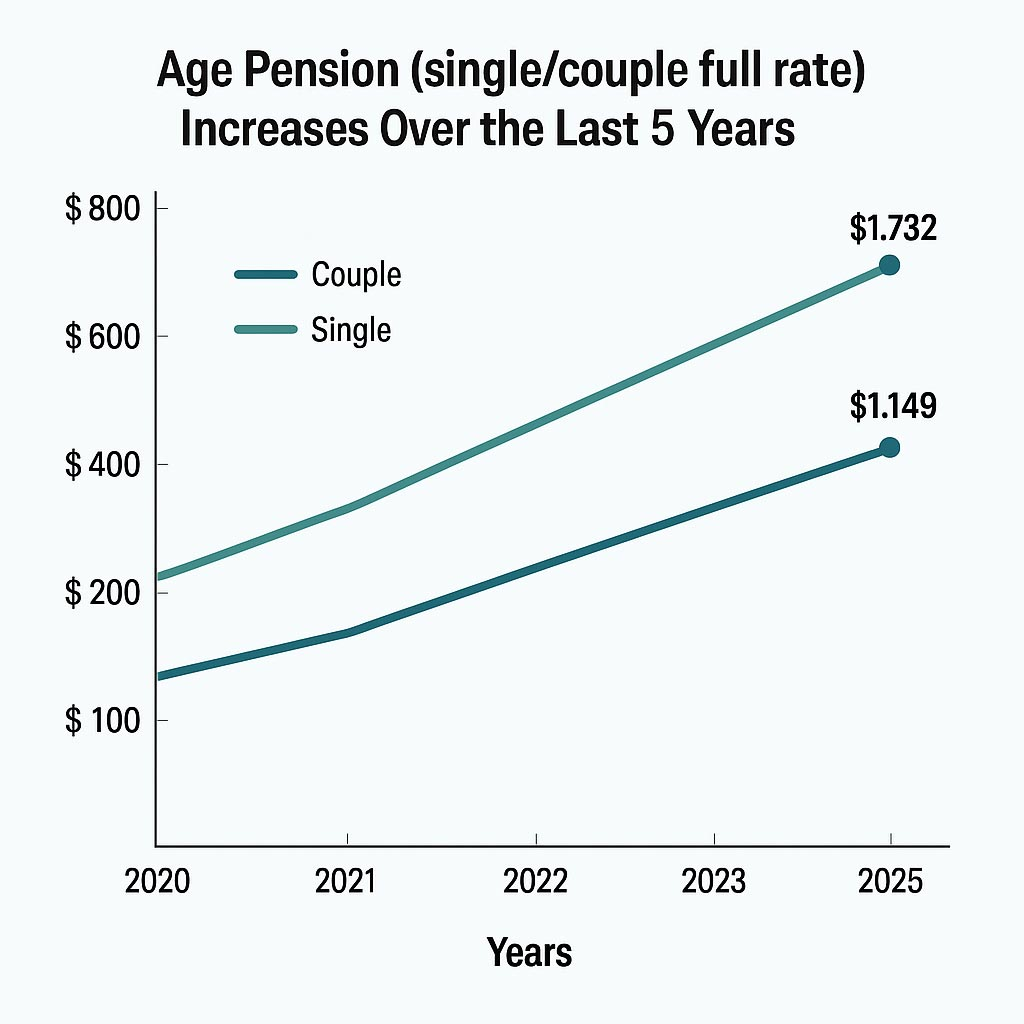

Recent Rate Adjustments

The most recent indexation, effective from September 20, 2025, increased the maximum full Age Pension. For singles, the maximum fortnightly payment rose to A$1,178.70, an increase of approximately A$29.70 from previous levels. For couples, each partner now receives A$888.50 per fortnight, with the combined total reaching A$1,777.

These adjustments are part of Australia’s biannual indexation process, which aims to reflect wage growth and inflation. This ongoing process helps maintain the pension’s purchasing power and ensures that seniors can keep up with rising living costs.

The Dynamics of the Pension System: Indexation and Means Testing

It’s essential to understand how the pension is calculated and what factors influence the amount seniors receive.

Indexation: The pension rates are reviewed twice a year—usually in March and September—to keep pace with inflation and wages. The recent increases are part of this process, which helps prevent the pension’s real value from eroding over time.

Deeming Rates: The government uses deeming rates to determine how much income retirees earn from their financial assets, affecting the pension amount. In 2025, these rates have increased after a five-year freeze, impacting many pensioners whose income from assets has risen. This change aims to better reflect current market conditions and ensure fairness in income testing.

Eligibility Criteria and Who Qualifies

The criteria for qualifying for the Age Pension in 2025 remain similar but could evolve in future reforms. Currently, eligibility depends on:

- Age: 67 years, with a gradual increase to 68 planned for 2026.

- Residency: Must have lived in Australia for at least ten years, with at least five years in the last ten.

- Income and Assets: Must meet strict income and asset limits, which are regularly adjusted for inflation.

For instance, a single homeowner can own assets up to A$301,750 and still qualify for a part pension. Couples have similar thresholds, which are updated during each indexation.

Impact of Policy Changes and Future Outlook

There’s ongoing speculation about further reforms in 2025 and beyond. Governments are examining whether to increase the pension age to 68, tighten income thresholds further, or modify asset limits to ensure sustainability amidst demographic changes and rising costs.

Recent reports suggest that the pension’s future hinges on balancing its affordability with the needs of an aging population. Critics argue that pension rates should be increased to match current living costs, especially for low-income seniors, and that eligibility criteria may tighten for new applicants to curb expenditure.

How the Australia Centrelink $1900 Payment for Seniors Affects Your Financial Planning?

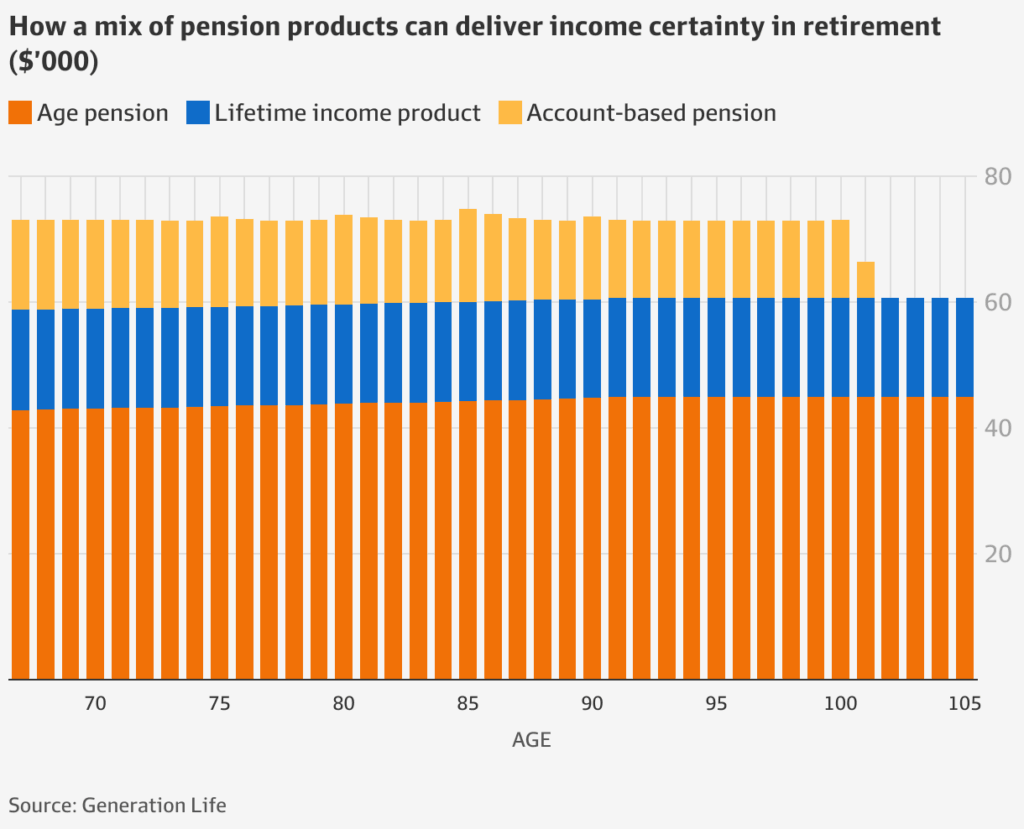

As the pension system evolves, retirees should consider diversifying sources of income. Relying solely on the pension might not be enough if reforms lead to reductions or tighter eligibility. Common strategies include:

- Maximizing superannuation savings.

- Working part-time if possible.

- Investing in private annuities or savings plans.

- Exploring alternative benefits like the Commonwealth Seniors Health Card, which grants discounts on healthcare.

Preparing early and consulting with financial advisors can help secure a comfortable retirement, regardless of policy changes.

Payment Schedules and How to Keep Up

In October 2025, the Age Pension payments are scheduled for:

- October 2

- October 16

- October 30

Bank deposits typically occur a day early, so it’s wise to check your account from October 1 onwards. Keep your details updated with Centrelink to ensure your payments arrive on time and you receive all eligible supplements.

How to Apply for the Australia Centrelink $1900 Payment for Seniors or Update Your Details?

Whether you’re applying for the first time or updating existing information, follow these steps:

- Visit the official Services Australia website.

- Create or log into your myGov account.

- Complete the online application or make an appointment with Centrelink.

- Submit required documents: proof of age, residency, income, and assets.

- Report any changes promptly to avoid overpayment or penalties.

Regularly reviewing your Centrelink account ensures you don’t miss out on benefits or encounter payment delays.

Common Mistakes and How to Avoid Them

Many seniors encounter pitfalls that could affect their benefits:

- Failing to report changes: Any alteration in income or assets must be reported within 14 days.

- Missing documentation: Lack of proof can delay or reduce payments.

- Assuming automatic renewal: Payments aren’t guaranteed; stay proactive in updating details.

- Falling for scams: Only trust official channels like Services Australia and be wary of unsolicited contact asking for personal info.

Tips to Maximize Your Benefits

To get the most out of your pension entitlement:

- Gather all relevant documents early.

- Use the Centrelink online account for updates.

- Stay informed about policy changes through official announcements or financial advisories.

- Consider eligible supplementary benefits like rent assistance or health measures.

Australia’s October $400 Centrelink Payment for Pensioners: Eligibility and Payment Date

$750 Centrelink Pension Payment In Oct 2025: Who Qualifies? Expected Date

$750 Australia Cash Relief in October 2025; Check Payout Date, Eligibility Criteria