Australia Aged Pension Increase: The Australia Aged Pension increase in 2025-26 is capturing the attention of retirees and those nearing retirement, as changes in payment amounts, eligibility, and timing affect planning for a secure retirement. If you’re wondering when the next payment will arrive, how much it will be, and whether you qualify, this comprehensive guide will clear up the confusion with easy-to-understand explanations, real examples, and detailed advice—all backed by the latest facts. Starting September 20, 2025, the Australian government raised the Age Pension payments, recognizing the challenges seniors face with rising inflation and living costs. This increase improves financial security for millions of older Australians. Let’s unpack exactly what this means for you and walk you through eligibility, payment schedules, changes in rules, and practical tips for making the most of your pension.

Table of Contents

Australia Aged Pension Increase

The 2025-26 Australia Aged Pension increase is a significant boost for eligible seniors, reflecting the government’s commitment to supporting retirees in tough economic times. With the next payment scheduled for October 16, 2025, and higher rates ensuring better purchasing power, it’s crucial to understand eligibility, application processes, and additional support options.

| Topic | Details/Stats |

|---|---|

| Effective Date of Increase | September 20, 2025 |

| Full Pension – Single | $1,178.70 per fortnight (Approx. $30,646 per year) |

| Full Pension – Couple | $1,777.00 combined per fortnight (Approx. $46,202 per year) |

| Increase Amount (Sept 2025) | +$29.70 per fortnight for singles, +$44.80 per fortnight combined for couples |

| Age Requirement | 67 years or older (for those born after January 1, 1957) |

| Residency Requirement | Minimum 10 years residency in Australia, with at least 5 years continuous |

| Income Test Threshold | Up to $218/fortnight (singles) and $380/fortnight (couples combined) for full pension |

| Assets Test Threshold | Up to $321,500 for single homeowners and $481,500 for couples |

| Payment Frequency | Fortnightly payments (every two weeks) |

| Official Website | Services Australia – Age Pension |

What Is the Australia Aged Pension Increase in 2025-26?

Starting September 20, 2025, the Australian government increased Age Pension payments to help retirees cope with higher costs. This update reflects inflation and ongoing economic pressures.

- Singles now receive $1,178.70 per fortnight, an increase of $29.70.

- Couples get a combined total of $1,777.00 per fortnight, up $44.80.

These increases ease the burden of expenses like groceries, utilities, and healthcare, helping seniors live more comfortably.

The Next Pension Payment Date

Payments are issued every two weeks (fortnightly). The next payment date is:

- October 16, 2025, covering the payment period from October 18 to November 15.

This regular schedule helps pensioners budget effectively.

Who Qualifies for the Age Pension in 2025-26?

To receive the pension, you must meet these criteria:

Age Requirement

You must be at least 67 years old if born on or after January 1, 1957. You can apply up to 13 weeks before you turn 67.

Residency Requirement

You need at least 10 years of residency in Australia, including a continuous five-year period before applying.

Income and Assets Tests

Australia applies two tests—income and assets—to determine your pension amount, using the lower applicable value:

- Income Test: Singles making less than $218 per fortnight and couples earning less than $380 combined per fortnight can receive the full pension.

- Assets Test: If you own a home, the maximum assets you can have without affecting your pension are $321,500 for singles and $481,500 for couples.

Higher income or assets reduce the pension proportionally.

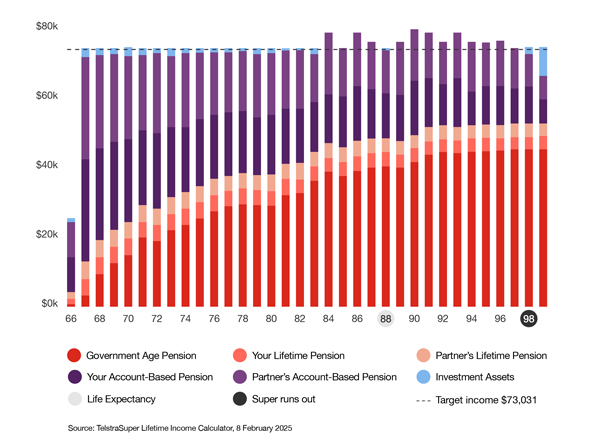

What Are Deeming Rates and Their Impact?

Deeming rates are government-set assumed returns on your financial investments used to calculate pension eligibility and payment.

- They simulate income you might earn from assets, even if your actual returns differ.

- In 2025-26, these rates slightly increased, which can decrease your pension payment if your deemed income surpasses certain limits.

Understanding deeming rates is essential for retirees with investments, as it affects your overall pension amount.

How Inflation Affects the Pension?

The Age Pension is indexed twice a year based on:

- The Consumer Price Index (CPI), reflecting inflation in everyday prices.

- The Average Weekly Earnings (AWE), tracking wage increases.

The higher of these two determines the increase in pension rates, ensuring pensions keep up with real economic changes.

Practical Guide to Applying for the Australia Aged Pension Increase?

Step 1: Check Your Eligibility

Confirm your age and residency meet the criteria.

Step 2: Use the Official Pension Calculator

Estimate payments based on your income and assets at the Services Australia Age Pension Calculator.

Step 3: Gather Necessary Documents

Prepare identification, residency proof, income certificates, and financial statements.

Step 4: Apply Early

Apply online via MyGov or at a Centrelink office up to 13 weeks prior to your 67th birthday.

Step 5: Report Changes Promptly

Notify Services Australia immediately of any changes in income or assets to prevent overpayment issues.

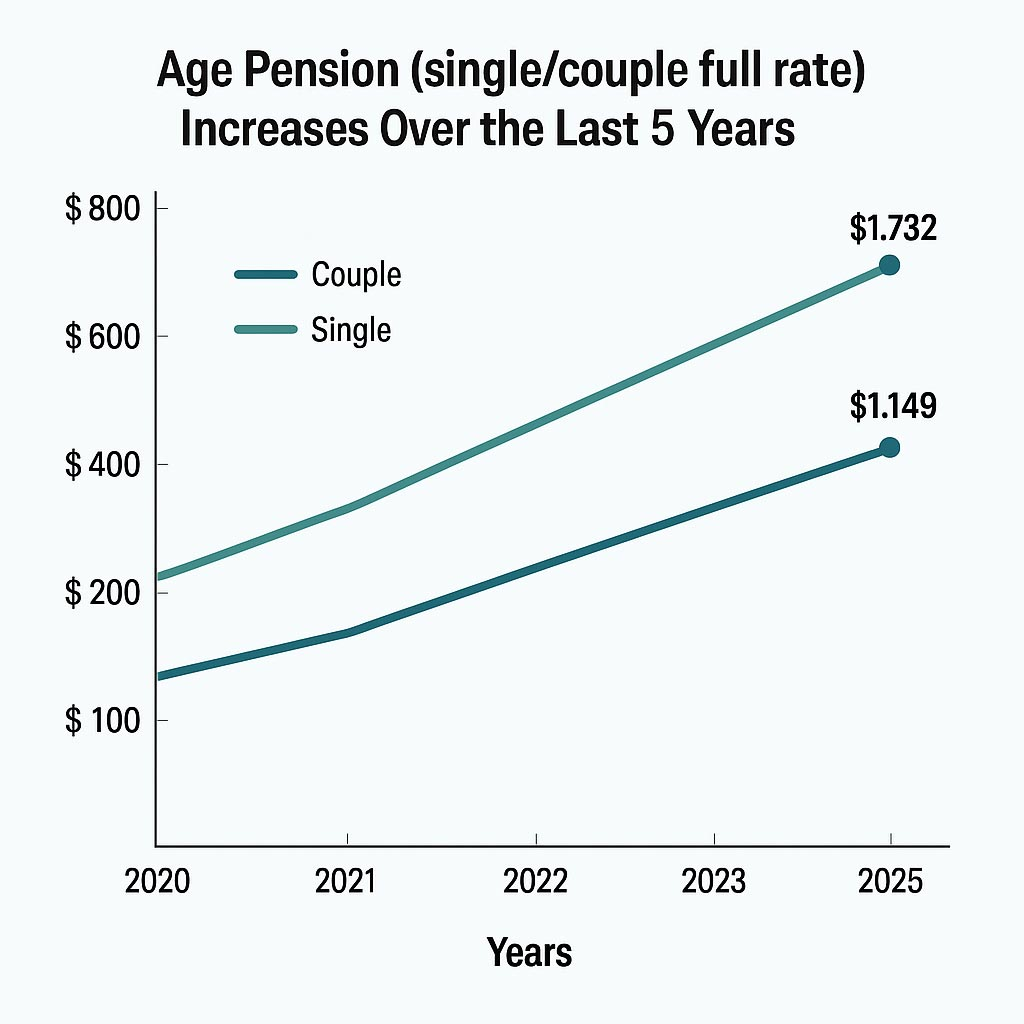

Historical Context and Future Outlook

Australia’s Age Pension has supported seniors since its inception in 1909, evolving through economic challenges and demographic shifts. The 2025 increase is part of this ongoing tradition of maintaining social equity.

While rumors about ending the pension in 2025 have surfaced, the government confirms no plans to cease payments. However, reforms are possible, including potential rises in the qualifying age (possibly 68 by 2026) or tightened means testing, to keep the system financially sustainable as the population ages.

Support Services Beyond Pension Payments

Receiving the Age Pension unlocks additional privileges such as:

- Health Care Card for cheaper medicine and health services.

- Concession Cards providing discounts on utilities, public transport, and rates.

- Access to community services like home care and meals programs to enhance seniors’ quality of life.

Common Mistakes to Avoid When Applying

- Waiting until after your 67th birthday to apply, risking payment delays.

- Missing required documents or submitting incomplete information.

- Failing to update Services Australia about income or asset changes.

- Assuming automatic qualification without confirming eligibility requirements.

Example Scenario

Joan, age 67, a Sydney homeowner with $180 per fortnight income and $300,000 in assets, is eligible for the full pension after the 2025 increase. Her extra $29.70 per fortnight now helps with rising power bills and grocery costs, showcasing the tangible impact of the government’s support.

Importance of Accurate Documentation and Timely Reporting

When claiming the Age Pension, submitting accurate documentation is crucial. You’ll typically need identification such as your passport or birth certificate, proof of Australian residency, and detailed financial statements for income and assets. Remember, if Centrelink requests additional paperwork, you should provide it within 14 days to avoid delays or denial. Additionally, once approved, promptly report any changes in income, living arrangements, or assets, as failing to do so can lead to overpayments and repayment demands. Staying organized and transparent during and after your application helps maintain your pension benefits without interruption or complications.

Australia’s October $400 Centrelink Payment for Pensioners: Eligibility and Payment Date

$750 Australia Cash Relief in October 2025; Check Payout Date, Eligibility Criteria