Australia $1725 Disability Support Pension: If you’ve come across talk about a $1725 Disability Support Pension (DSP) payment coming in Australia this November 2025, you’re probably wondering: Is this true? Or is it just another rumor spreading on social media? This article offers a comprehensive and clear explanation to help you understand the reality around DSP, including detailed eligibility requirements, payment schedules, how to apply, and tips to ensure a successful claim. Whether you’re someone living with a disability or a professional working with vulnerable clients, this guide will give you the full picture, with straightforward language and deep insights.

Table of Contents

Australia $1725 Disability Support Pension

The rumor about a $1725 Disability Support Pension payment arriving in November 2025 is not true. DSP payments are steady, carefully indexed support, currently maxing approximately at $1,179 per fortnight for singles after recent increases. This pension remains a critical financial lifeline for Australians with disabilities who face work capacity limitations. If you or someone you know might qualify, it’s vital to understand eligibility criteria, gather detailed medical evidence and apply.

| Topic | Details |

|---|---|

| DSP Max Payment | Approximately $1,179 per fortnight for singles as of the September 2025 indexation |

| Claim Eligibility | Must have a permanent disability reducing ability to work 15+ hours/week for 2+ years, aged 16 to pension age, and meet income/assets tests |

| 2025 Payment Increase | $29.70 per fortnight increase effective from September 2025 |

| Payment Dates in Nov 2025 | Payments expected on November 13 & 27, 2025, fortnightly schedule |

| Official Info Source | Services Australia – Disability Support Pension |

What Is the Disability Support Pension?

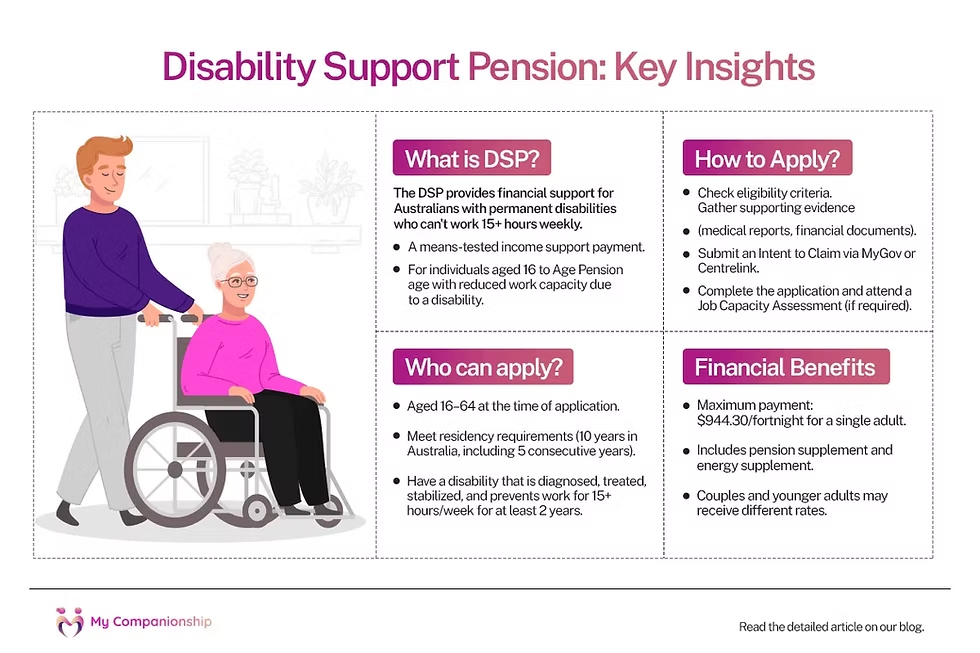

The Disability Support Pension (DSP) is a government financial assistance program in Australia supporting people living with permanent disabilities that substantially affect their capacity to work. People qualify if their disability is expected to last for at least two years and limits their ability to work 15 hours or more per week. The DSP offers essential income support to disabled Australians, ensuring they have funds for basic living expenses while facing health challenges.

DSP functions similarly to Social Security Disability Insurance (SSDI) in the US but comes with Australia’s specific eligibility criteria based on residency, income, and asset limits. The program’s goal is to promote dignity and independence while recognizing real work limitations caused by disability.

Is the Australia $1725 Disability Support Pension Real in November 2025?

There is no official plan or confirmation for a $1725 DSP payment in November 2025. The highest DSP payment for singles currently is around $1,179 per fortnight, following the September 2025 indexation, which increased payments by about $29.70.

The confusion likely comes from misconceptions or mix-ups with other pensions, such as the Age Pension, which can approach or exceed $1,700 per fortnight. DSP payments are strictly regulated and adjusted to reflect cost-of-living increases twice annually, with no large lump sum increases slated for this year.

Who Is Eligible for the Australia $1725 Disability Support Pension?

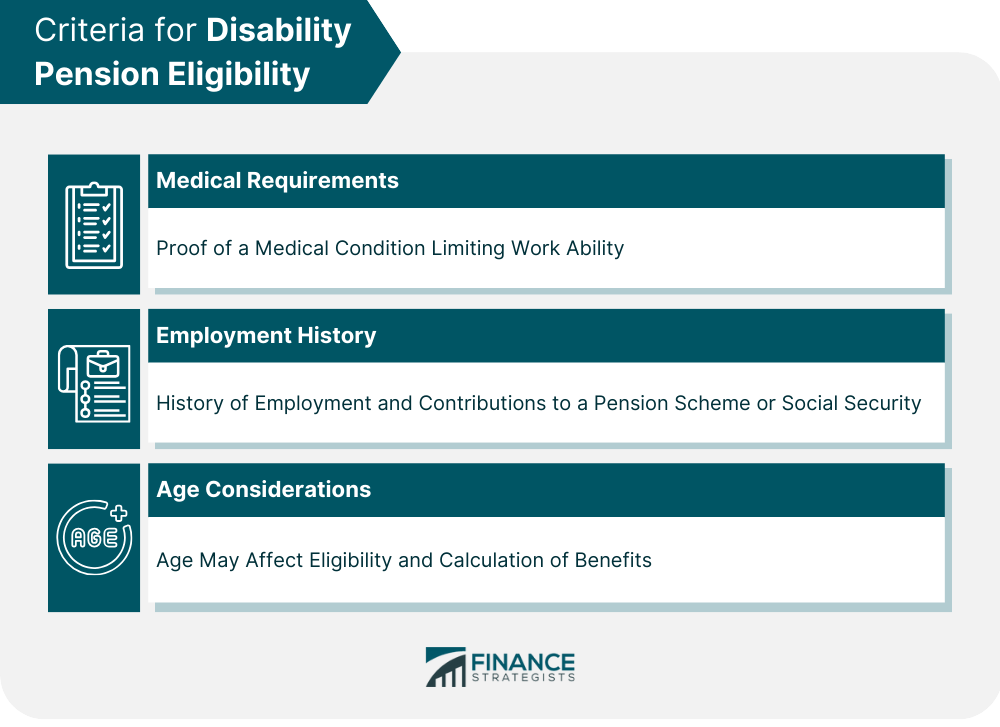

Eligibility requires meeting both medical and non-medical conditions:

Medical Requirements:

- Your disability must be permanent, diagnosed, treated, and stabilized, expected to last two or more years.

- Your condition must score at least 20 points on the government’s impairment rating tables, assessing functional limitations.

- You must be unable to work 15 hours or more per week for at least the next two years due to your disability.

- Evidence from specialists is required, depending on disability type: psychiatrists for mental health, ophthalmologists for vision impairment, audiologists for hearing loss, etc.

- Some conditions qualify for automatic eligibility, such as permanent blindness or terminal illness.

Non-Medical Requirements:

- Be between 16 years old and pension qualifying age (about 67 years as of 2025).

- Hold Australian residency status, generally residing in Australia for 10 years, with at least 5 years continuous.

- Meet the income and assets tests designed to ensure support goes only to those who need it financially.

- Complete or be exempt from a program of support aimed to prepare for, find, or maintain work. Exemptions apply for severe disabilities preventing engagement.

Income and Assets Tests: What You Need to Know

Financial limits play a significant role in DSP eligibility and payment calculation.

Income Test:

- Singles have a $212 fortnightly income free area. Earnings exceeding that reduce your DSP payment by 50 cents per dollar earned.

- The highest income threshold considered is approximately $2,500.80 per fortnight, beyond which payments stop.

- Income includes wages, some government payments, and investments.

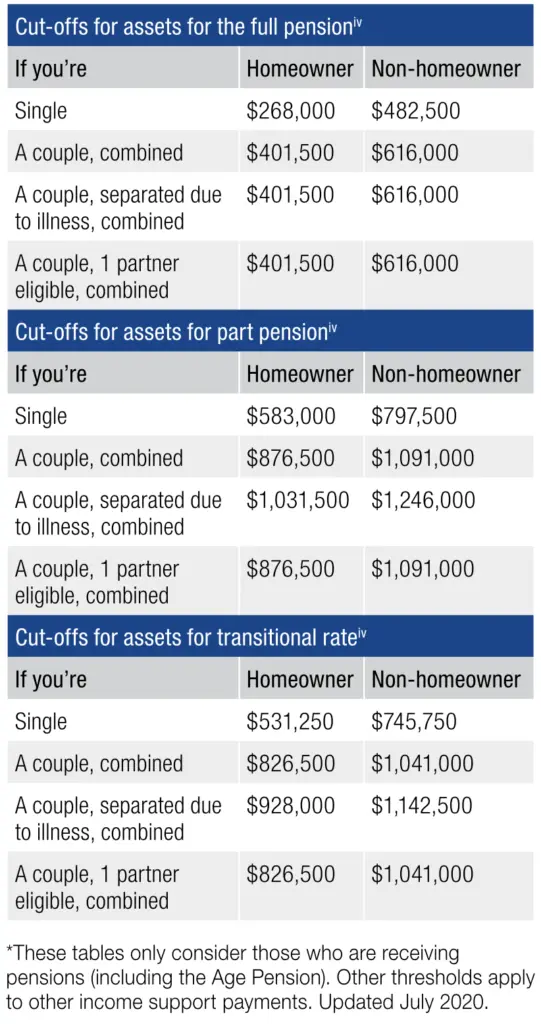

Assets Test:

- If you own a home, your asset limit to receive full DSP is roughly $714,500. Non-homeowners have a higher limit near $972,500.

- Couples combining assets must be below about $1,074,000 (homeowners) or $1,332,000 (non-homeowners).

- Assets assessed include savings, properties (besides the family home), and investments.

- Exceeding asset limits results in reduced or no payments.

How to Apply for Australia $1725 Disability Support Pension: A Comprehensive Guide

Applying for DSP involves careful preparation and adherence to steps:

Step 1: Assess Your Eligibility

Use Services Australia’s online pre-claim eligibility tool to understand if you qualify based on initial medical and non-medical criteria.

Step 2: Gather Thorough Medical Documentation

Collect detailed reports from doctors and specialists that outline your diagnosis, treatments, stability of your condition, and how it limits your work capacity. This documentation is your most crucial evidence.

Step 3: Create a MyGov Account

Since DSP claims are processed through Centrelink via MyGov, establishing this account is essential for submitting and tracking your application.

Step 4: Submit Your Application Online

Complete the application with all necessary medical and personal information through the MyGov portal. Be honest and thorough in describing your condition’s impact.

Step 5: Respond to Follow-Ups

Centrelink may request additional information or interviews. Staying prompt and cooperative speeds up decision-making.

Step 6: Await Outcome and Payment

It can take weeks or months for the application to be assessed. Once approved, payments begin on the scheduled fortnightly dates.

Step 7: Keep Centrelink Updated

Inform Centrelink when your health, income, or living situation changes. Regular reviews maintain your eligibility and the accuracy of your payments.

How Much Will You Receive & When?

Current Payment Rates:

| Status | Payment per Fortnight (2025) |

|---|---|

| Single Adult | Up to $1,179 |

| Couples (each) | Approximately $889 |

| Couples Combined | Around $1,777 |

| Youth (under 21) | $569 to $822 depending on circumstances |

Payment Schedule

Disability Support Pension is paid fortnightly, commonly on dates such as November 13 and 27 in 2025. Payments encompass:

- The base pension rate

- Pension supplement for everyday living costs

- Energy supplement to offset utility expenses

These are designed to support recipients with consistent, manageable income.

Comparing DSP With Other Australian Benefits

| Payment Type | Who Qualifies | Typical Fortnightly Payment |

|---|---|---|

| Disability Support Pension | Persons with permanent disability limiting work | Up to approx. $1,179 (single) |

| Age Pension | Australians over pension age | Up to about $1,700–$1,725 (single max) |

| JobSeeker Payment | Unemployed job seekers temporarily out of work | Around $700 |

The $1725 payment figure often linked to DSP actually corresponds closer to Age Pension amounts, which apply mainly to older Australians after reaching pension age—not DSP recipients

Pro Tips for a Successful DSP Claim

- Start early gathering all medical evidence; delayed reports slow the process.

- Provide detailed explanations about how disability affects your everyday tasks and ability to work.

- Organize documents and keep copies to avoid missing paperwork.

- Get professional support from social workers or advocacy groups experienced in DSP claims.

- Stay proactive by frequently checking for Centrelink communication and responding promptly.

Australia Pension Plan Payment November 2025: Check Payment Dates & Claim Process

Australia $500 Cost Of Living Payment in October 2025 – Check Eligibility criteria & Pay Dates

Common Pitfalls To Avoid

- Missing critical deadlines and failing to respond to Centrelink.

- Underreporting income or assets, risking penalties or disqualification.

- Assuming you won’t qualify without trying.

- Neglecting to update Centrelink about changes to your condition or finances.

- Missing required involvement in programs of support without seeking exemptions.