Australia $1116 Age Pension: If you’ve been scrolling through social media or chatting with friends and heard about the “Australia $1,116 Age Pension coming in October 2025”, you’re not alone. Many Australians are wondering if the government is introducing a new pension payment or bonus later that year. Here’s the truth: there’s no brand-new “$1,116 payment.” What is actually happening is the regular Age Pension increase, which takes effect from 20 September 2025 and continues through March 2026. This adjustment ensures the pension keeps up with inflation and rising living costs. Let’s break this down clearly — who’s eligible, what the rates are, when you’ll be paid, and how to make sure you’re getting the most out of your benefits.

Table of Contents

Australia $1116 Age Pension

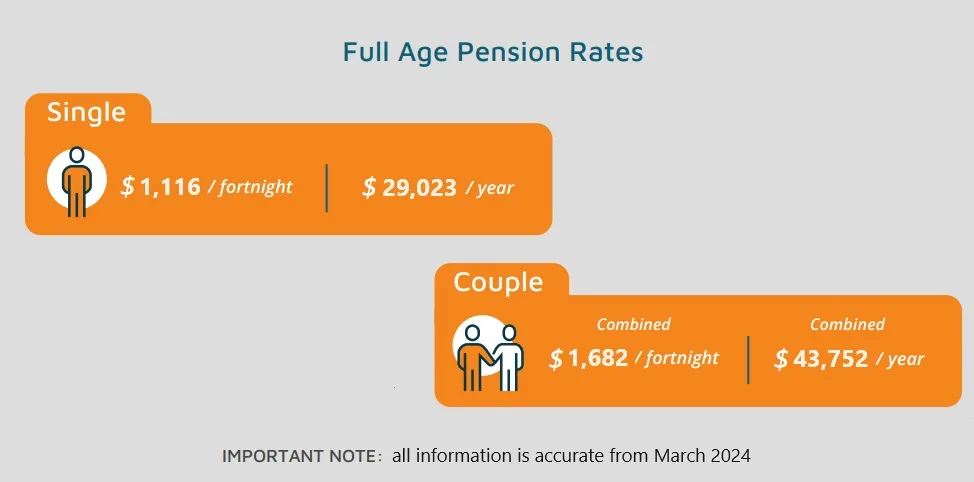

The so-called “Australia $1,116 Age Pension” isn’t a brand-new benefit — it’s the regular September 2025 increase that ensures retirees maintain their purchasing power. From 20 September 2025, single pensioners will receive A$1,178.70 per fortnight, and couples will get A$888.50 each. These changes help millions of Australians cope with rising costs and preserve financial dignity in retirement. Staying informed, planning early, and reviewing your finances regularly can make a huge difference in your retirement lifestyle.

| Aspect | Details |

|---|---|

| Payment Name | Age Pension (Services Australia) |

| Effective Date | 20 September 2025 |

| Single Maximum Rate | A$1,178.70 per fortnight |

| Couple Rate (each) | A$888.50 per fortnight (Combined A$1,777.00) |

| Payment Frequency | Fortnightly (every two weeks) |

| Eligibility Age | 67 years and older |

| Next Scheduled Adjustment | March 2026 |

| Residency Requirement | Minimum 10 years living in Australia (5 continuous) |

| Official Website | servicesaustralia.gov.au |

Background: What the Age Pension Is and Why It Matters

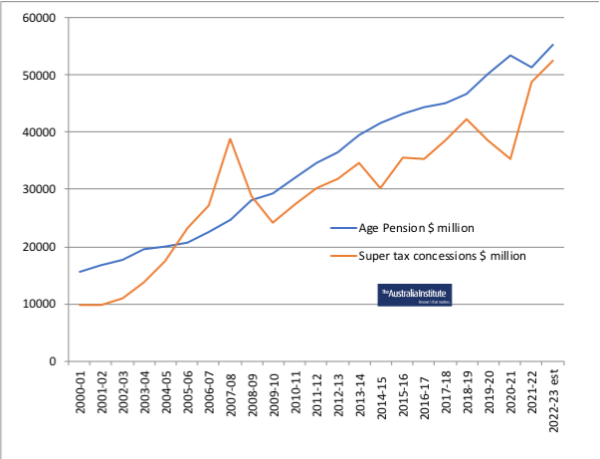

The Age Pension has been a cornerstone of Australia’s social welfare system since 1909. Designed to ensure that older Australians can maintain financial stability in retirement, it is the country’s version of the United States’ Social Security system.

It’s administered by Services Australia under Centrelink and funded through general taxation. The system operates on the principle of fairness — that after decades of working, paying taxes, and contributing to society, every Australian deserves a basic income in retirement.

Unlike a one-off payment, the Age Pension is an ongoing income stream. The rates are reviewed twice a year — in March and September — through a process known as indexation. These adjustments account for inflation and average wage growth, ensuring pensioners aren’t left behind as prices rise.

Understanding the Australian $1116 Age Pension

In September 2025, the government will once again adjust pension rates. The increase will reflect changes in both the Consumer Price Index (CPI) and the Male Total Average Weekly Earnings (MTAWE), ensuring payments align with both inflation and national wage growth.

This is where the confusion about the “$1,116 payment” comes from. That figure likely refers to a part pension amount some retirees receive, depending on their income and assets. The full rate, however, will rise to:

- A$1,178.70 per fortnight for singles

- A$888.50 per fortnight for each member of a couple

So, while the rumored “$1,116” isn’t technically accurate, many part-pensioners may indeed receive a similar amount after the adjustment.

How the Pension Rate Is Calculated?

The government uses several benchmarks to determine Age Pension rates:

- Consumer Price Index (CPI): Tracks inflation by measuring the average price increase of goods and services like groceries, utilities, and fuel.

- Pensioner and Beneficiary Living Cost Index (PBLCI): Focuses on expenses specific to pensioners, giving a more accurate picture of cost-of-living pressures.

- Male Total Average Weekly Earnings (MTAWE): Ensures pensioners’ living standards keep pace with the broader workforce.

Whichever measure provides the highest increase is used to adjust payments. This system ensures that pensioners benefit from both inflation adjustments and national wage growth, not just one or the other.

Who Is Eligible for the Australia $1116 Age Pension?

To qualify for the Age Pension in Australia, you need to meet three key criteria:

1. Age Requirement

You must be 67 years old or older. This threshold was fully implemented in July 2023 and remains in effect in 2025. You can apply for your pension up to 13 weeks before you reach the qualifying age.

2. Residency Rules

Applicants must be Australian residents and have lived in Australia for at least 10 years total, with at least 5 consecutive years.

If you’ve spent part of your life working overseas, Australia has social security agreements with more than 30 countries. These can help you qualify by combining your overseas and Australian work periods.

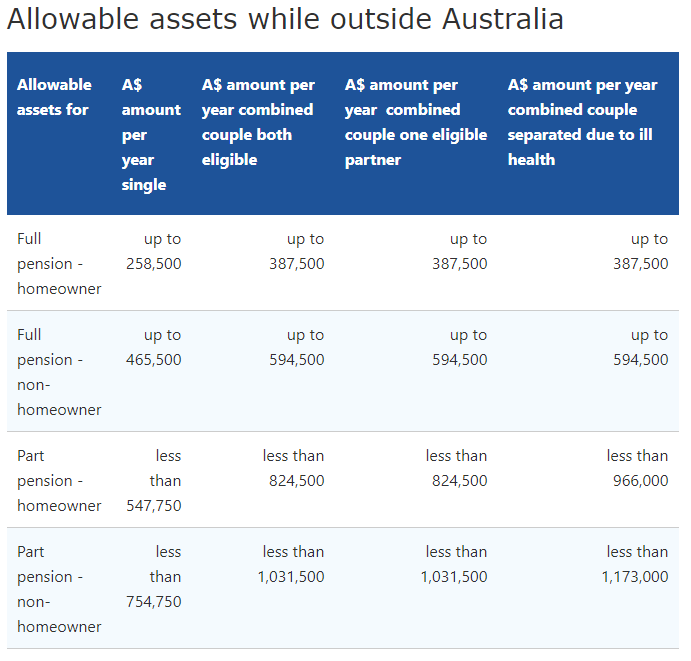

3. Income and Assets Tests

Your payment depends on how much income you earn and what assets you own.

- For a single homeowner, the full pension asset limit is A$321,500.

- For a couple who own their home, the limit is A$481,500 combined.

- For non-homeowners, the limit is higher, reflecting housing costs.

Your pension payment gradually reduces as your income or assets increase. Once your assets or income exceed a certain threshold, you may only receive a part pension or no pension at all.

New Pension Rates from 20 September 2025

Here’s a snapshot of the official rates effective from 20 September 2025:

| Category | Fortnightly Rate | Annual Equivalent |

|---|---|---|

| Single (Full Rate) | A$1,178.70 | A$30,645.00 |

| Couple (Each, Full Rate) | A$888.50 | A$23,101.00 |

| Couple (Combined) | A$1,777.00 | A$46,202.00 |

These amounts include the Pension Supplement and Energy Supplement, which help pensioners cover utilities, fuel, and other essential expenses.

Payment Dates and Frequency

Pension payments are made every two weeks, directly into your nominated bank account.

If you’re already receiving the Age Pension, you don’t need to reapply or fill out new forms — the new rate automatically takes effect on 20 September 2025.

Your first increased payment should appear in early October 2025, depending on your payment cycle.

For Australians living overseas, the schedule may differ slightly, with payments often made every four weeks instead.

Common Mistakes People Make

Navigating Centrelink rules can be tricky, and many retirees miss out on benefits because of small oversights. Here are common mistakes to avoid:

- Not updating financial information: If your income, assets, or living arrangements change, you must notify Services Australia.

- Assuming ineligibility: Many older Australians think they earn too much, but still qualify for a part pension.

- Delaying applications: You can apply up to 13 weeks before reaching 67. Don’t wait until the last minute.

- Ignoring supplements: Check if you qualify for additional payments like Rent Assistance or the Pensioner Concession Card.

What You Can Do Now?

If you’re nearing retirement or already receiving benefits, here are practical steps to prepare for the September 2025 update:

- Check Your Eligibility: Use the Age Pension eligibility tool.

- Estimate Your Rate: Use the Centrelink Payment Estimator to calculate your approximate pension.

- Review Your Finances: Consolidate accounts or reassess assets that might affect your eligibility.

- Plan Ahead: If you’re still working part-time, understand how earnings can reduce your payment under the income test.

- Seek Professional Advice: Financial planners can help you maximize income through superannuation and pension balancing.

Real-Life Example

Consider John and Mary, a retired couple who own their home and have $600,000 in combined assets. They don’t qualify for the full pension but receive about A$1,116 per fortnight combined, which aligns with the number circulating online.

Meanwhile, Margaret, a 68-year-old single homeowner with $40,000 in savings, qualifies for the full pension of A$1,178.70 per fortnight. These examples show how much your financial situation can impact your payments.

Australia Pension Boost Starting 1st October 2025 – Check New Rates and Payment Dates

Australia Age Pension Rules Under Review Will Retirement Age Really Go Up Again?

$950 Pension Bonus Confirmed – Important Details Every Australian Senior Must Check

Common Myths About the Age Pension

Myth 1: Everyone gets $1,116 per fortnight.

False. The payment depends on income, assets, and relationship status.

Myth 2: You must reapply for the increase.

Incorrect. Rate increases are automatic for current pensioners.

Myth 3: Pension payments are taxable.

Mostly false. Age Pension payments are generally tax-free, though other income can affect your overall tax position.

Myth 4: It’s a one-time cost-of-living bonus.

No. The increase is a permanent rate adjustment, not a temporary payment.