Advanced Canada Workers Benefit: If you’re searching for Advanced Canada Workers Benefit (ACWB) October 2025, you’ve found the most comprehensive guide online. This article explains what the benefit is, how to qualify, how much you’ll receive, and what steps to take to make sure you don’t miss your payment. It’s written in an easy-to-understand, friendly American tone — simple enough for a 10-year-old, but detailed enough for professionals who want expert-level clarity.

Advanced Canada Workers Benefit

The Advanced Canada Workers Benefit isn’t just a government program — it’s a smart way to help working Canadians keep more of what they earn throughout the year. Instead of waiting for a refund at tax time, you get advance payments that make budgeting easier. If you want to make sure you receive your October 2025 payment without a hitch, remember three golden rules:

- File your taxes early (before November 1).

- Keep your CRA profile up to date.

- Check your eligibility regularly through the CRA portal.

The ACWB may not solve every financial challenge, but it’s one of those rare government benefits that actually works as intended — giving hard-working Canadians the relief they deserve when they need it most.

| Topic | Key Detail | Source / More Info |

|---|---|---|

| 2025 ACWB Payment Dates | January 10, July 11, October 10, 2025 | Canada.ca |

| Advance Portion | Up to 50% of the full CWB (basic + disability) | CRA – How Much You Can Get |

| 2024 Income Limits | Single: Up to $36,749 · Family: Up to $48,093 | |

| Disability Supplement | Single: Up to $821 extra | |

| How to Apply | No separate application needed; CRA pays automatically if you qualify | |

| Reporting Slip | RC210 — required for tax reconciliation |

Why the Advanced Canada Workers Benefit Matters?

The Canada Workers Benefit (CWB) is a refundable tax credit from the Government of Canada designed to support low- and modest-income workers. Think of it as a financial boost for people who work hard but still face tight budgets. The Advanced Canada Workers Benefit (ACWB) is the “early bird” portion — instead of waiting until tax time, you receive part of your CWB throughout the year.

This matters especially in 2025. Inflation has pushed up the cost of groceries, housing, and transportation, while wages haven’t always kept pace. The ACWB helps smooth out your cash flow by spreading payments across the year, instead of leaving you waiting for a lump sum during tax season. For many families, it’s not just helpful — it’s essential breathing room.

What Exactly Is the Advanced Canada Workers Benefit (ACWB)?

The ACWB is the advance payment system of the Canada Workers Benefit (CWB). Instead of waiting to receive your benefit after filing your income tax return, the CRA divides half of your total benefit into three payments spread across the year.

Here’s how it breaks down:

- CWB eligibility is based on your income, age, and residency.

- The CRA calculates your total entitlement when you file your tax return.

- Up to 50% of that benefit is sent to you early in installments: January, July, and October.

- When you file your next tax return, the CRA reconciles the amount you actually deserved — if you were underpaid, you get more; if you were overpaid, they adjust your credit.

In short, the ACWB puts cash in your hands sooner, when you need it most.

Who Qualifies for the ACWB?

The benefit is aimed at Canadians who are working but still have modest incomes. Here’s what you need to qualify:

Basic Eligibility

- Age: You must be at least 19 years old on December 31 of the tax year.

- Residency: You must be a resident of Canada for tax purposes.

- Income: Your working income (employment or self-employment) must be below certain thresholds:

- Single: up to $36,749 net income

- Family (with spouse or dependents): up to $48,093

- Dependents: You can claim the family portion if you have a spouse or eligible dependent child.

Disability Supplement Eligibility

You may qualify for a disability supplement if you:

- Are approved for the Disability Tax Credit (DTC) (Form T2201 filed with the CRA).

- Have income below the supplement’s phase-out thresholds (about $42,221 for singles, $53,565 for families).

Who Doesn’t Qualify

You may not be eligible if:

- You’re a full-time student for more than 13 weeks during the year (unless you have an eligible dependent).

- You were incarcerated for 90+ days in the year.

- You are a non-resident or a diplomat not subject to Canadian income tax.

How Much Will You Get?

The actual benefit amount depends on your income and family situation. The CRA uses a formula that increases your benefit as your income rises from zero, then decreases it as you pass certain thresholds.

Example Estimates for 2025

- Single (no dependents): Maximum basic benefit of about $1,590.

- Family: Maximum of about $2,739.

- Disability supplement: Adds up to $821.

How the Advance Payments Work?

If you qualify for $1,590 total, you could receive about $795 (half) through ACWB instalments in January, July, and October 2025. That’s roughly $265 each time.

For families eligible for $2,739, you might receive about $1,369 in advance ($456 each instalment). The rest comes at tax time when the CRA reconciles your credit.

If your income changes during the year, CRA will adjust accordingly when you file your next return.

How to Receive the October 2025 Advanced Canada Workers Benefit?

To get your October 10, 2025 payment, here’s what you must do:

- File your 2024 tax return on time (before November 1, 2025).

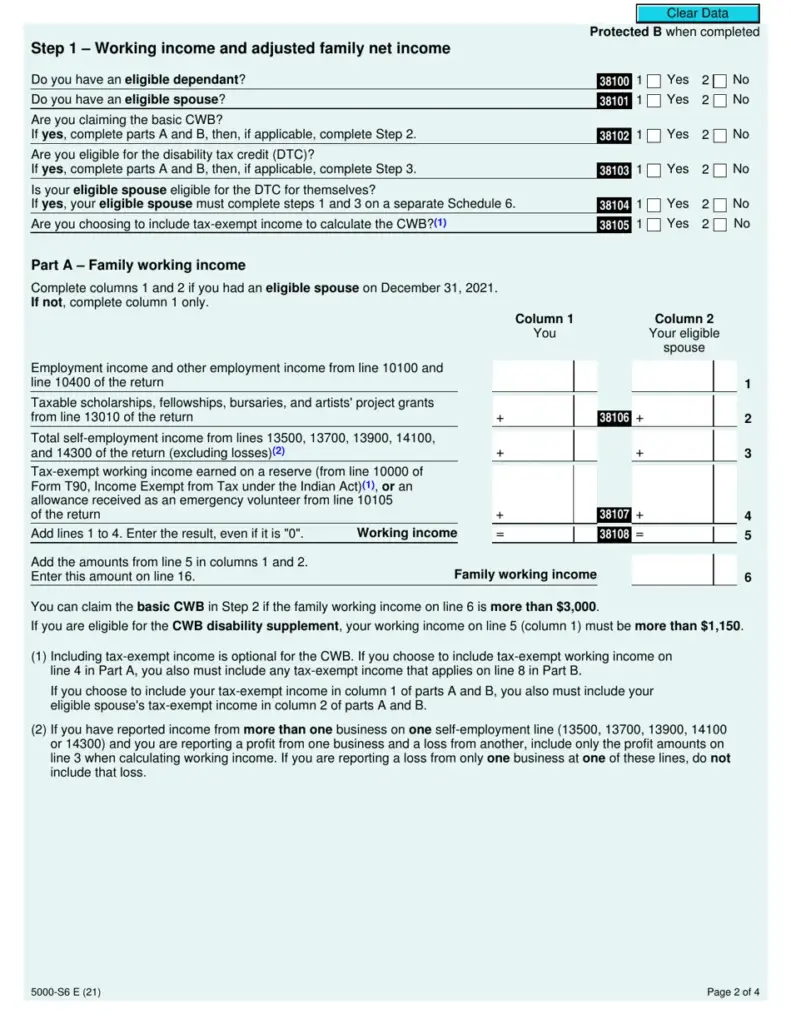

- Include Schedule 6 (Canada Workers Benefit form).

- Ensure your direct deposit information is correct in your CRA My Account.

- Keep your information up-to-date — address, marital status, dependents, and disability status.

- Check your CRA account regularly to confirm your eligibility and payment schedule.

If you file late or miss a detail on your return, your October advance might not be issued.

Step-by-Step Guide to Securing the Advanced Canada Workers Benefit

- File Early: The earlier you file, the sooner CRA can process your eligibility.

- Use Direct Deposit: Paper cheques can be delayed or lost; direct deposit is safer and faster.

- Check Your CRA Notices: CRA sometimes sends letters requesting additional information. Respond promptly.

- Track Your RC210 Slip: Keep this for tax filing—it reports the total ACWB payments you received during the year.

- Reconcile at Tax Time: On your next tax return, include the amounts reported on your RC210 slip to ensure proper adjustment.

Common Mistakes to Avoid

- Late Filing: Missing the November 1 cutoff means no advance payments for that cycle.

- Incorrect Direct Deposit Info: Update your bank details as soon as they change.

- Unreported Income: CRA uses your declared income to calculate your CWB and ACWB — undeclared side income can affect eligibility.

- Skipping Schedule 6: Without it, CRA cannot confirm your benefit calculation.

- Ignoring CRA Notices: If CRA asks for clarification and you don’t respond, your payments may stop.

Province-by-Province Differences

Although the benefit is federal, the CWB amounts vary slightly by province or territory because cost-of-living and income profiles differ. For instance:

- Quebec administers its own similar program under a provincial structure.

- Alberta and Nunavut have adjusted thresholds for working income due to higher living costs.

- Ontario, Manitoba, and Nova Scotia follow the standard federal formula.

Inflation and Indexation Updates

The Canada Workers Benefit is indexed annually to inflation. This means the income thresholds and benefit amounts increase slightly each year to keep up with rising prices. For example, between 2023 and 2025, the CWB amounts rose by about 3–5% in most provinces.

While these adjustments seem small, they ensure that more Canadians remain eligible even as wages and costs climb.

Real-Life Example

Case Study: Alex from Winnipeg

Alex works full-time in retail earning $29,000 per year. He files his 2024 tax return on time and qualifies for the basic CWB. CRA calculates his total benefit at $1,400.

- CRA pays $700 in advance (50%) through the ACWB in three payments: January, July, and October 2025.

- Each payment equals roughly $233.

- When Alex files his 2025 tax return in spring 2026, CRA confirms his actual income and sends the remaining $700 balance.

For Alex, these periodic payments help him manage expenses without dipping into credit cards during slow months.

Tools and Resources to Check Eligibility

Here are reliable places to confirm or estimate your benefit:

- CRA’s CWB Calculator: Use the official calculator to estimate your potential benefit.

- CRA My Account: Check your eligibility, payment history, and advance schedule.

- Tax Software (like TurboTax or Wealthsimple Tax): Automatically fills out Schedule 6 for you.

- CRA Helpline: Call 1-800-387-1193 for personalized help if your case is complex.

CRA $680 One-Time Payment Coming for these People – Check Eligibility, Payment Dates

Canada Carbon Tax Rebate Payment Schedule in 2026: Check Eligibility, Payment Amount & Date

Canada CRA $2,600 Direct Deposit in October 2025, Eligibility & Payment Schedule