Say Goodbye to the Penny: If you’ve been scooting through Kroger, Kwik Trip, or Sheetz recently, you might’ve noticed a shakeup in how you pay your tabs — especially if you’re still holding on to those shiny pennies. That’s right, folks: the era of the penny is winding down, and these major retailers are making moves that could change how you cough up your cash forever. This article digs deep into what’s going down, what it means for everyday shoppers and pros, and how you can roll with the punches in this new penny-less world.

Table of Contents

Say Goodbye to the Penny

The penny is slowly but surely fading out of American wallets, and retailers like Kroger, Kwik Trip, and Sheetz are at the forefront of adapting to this new reality. From requesting exact change to rounding cash payments and embracing digital and crypto payment options, these changes mark a pivotal shift toward faster, more efficient, and tech-forward shopping experiences. For consumers, staying flexible is the name of the game. Carry some change when necessary, lean on digital payments when possible, and don’t shy away from exploring innovative payment options. These small habits will smooth your shopping experience and help you navigate the transition gracefully in a world saying goodbye to the penny.

| Retailer | Payment Change | Important Stats & Info |

|---|---|---|

| Kroger | Requests customers pay with exact change for cash | Signs posted in 2700+ stores; U.S. Mint lost $85.3M in 2024 minting pennies |

| Kwik Trip | Rounds cash transactions down to nearest nickel | Applies across 850+ stores; estimated $3M loss due to rounding |

| Sheetz | Encourages cashless payments and rounding up purchases | Offers 50% off for crypto payments and charity rounding options |

Why Say Goodbye to the Penny?

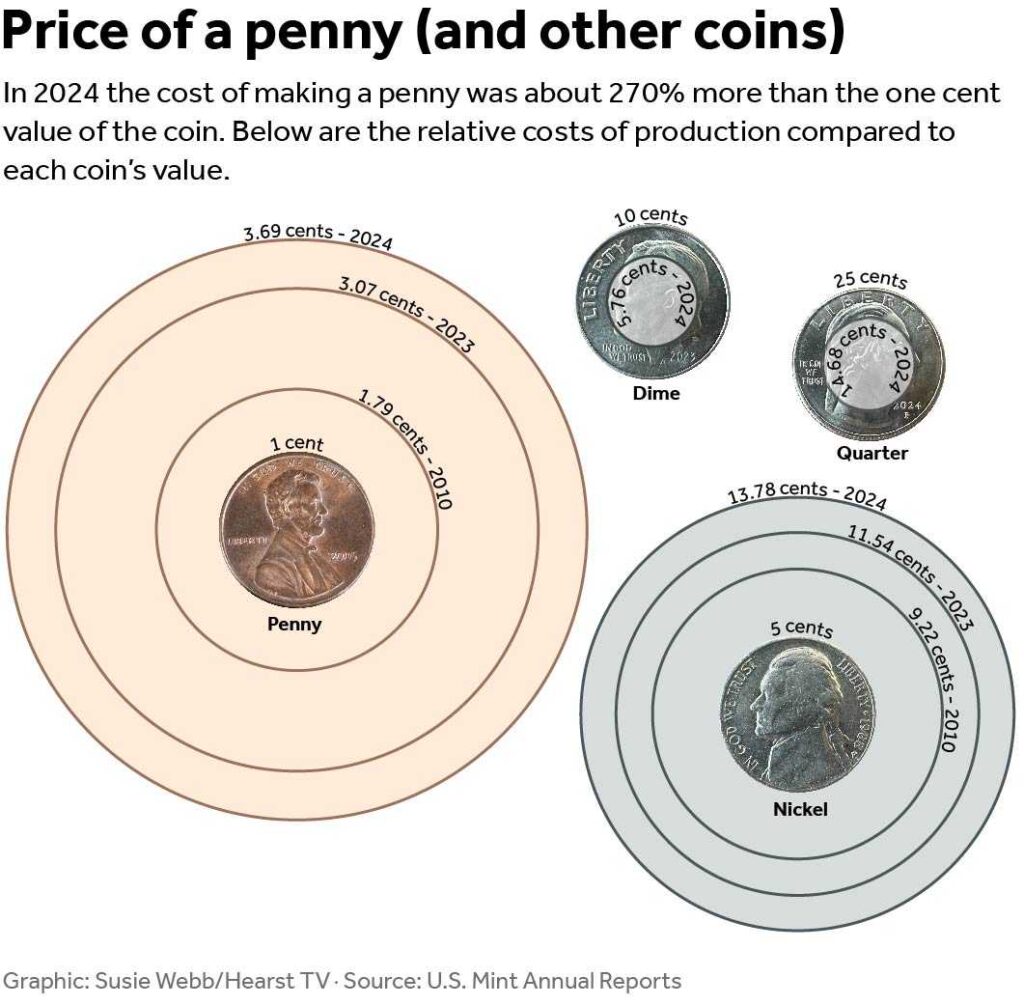

Let’s get straight to the point. The U.S. Treasury officially stopped producing pennies in 2025 to save money and resources. Believe it or not, it costs more than one cent to make a single penny—about 3.7 cents per coin when accounting for raw materials, labor, manufacturing, and distribution. That’s nearly four times its face value, making the penny a costly relic in today’s economy.

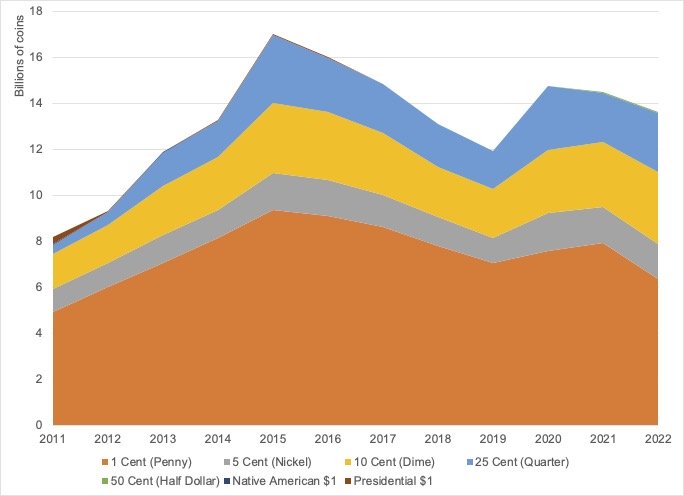

The decision to halt penny production followed a directive from former President Donald Trump in early 2025. Despite there being over 100 billion pennies still in circulation, the stop created an immediate shortage at points of sale nationwide. Without fresh pennies entering the system, retailers are scrambling to adjust how they handle cash payments.

This shortage is not just inconvenient; it’s triggering chains of challenges:

- Coin supply issues: Fewer pennies mean cashiers struggle to make exact change, leading to longer lines and frustrated customers.

- Pricing and transaction rules: Stores must adopt new ways to handle transactions without pennies, often resulting in rounding policies or requests for exact change.

- Government program complications: Retailers accepting SNAP (Supplemental Nutrition Assistance Program) benefits face compliance issues when rounding prices, as equal treatment for low-income customers is legally required.

With challenges cascading, huge retailers are setting the tone for how the economy will function in this penny-less future.

Kroger’s Call for Exact Change: Here’s What You Need to Know

Kroger’s approach is straightforward and customer-friendly: if you plan to pay with cash, bring exact change or near enough to avoid transaction delays. The store continues to accept pennies but stresses that the supply shortage makes it important for shoppers to come prepared.

This move follows the Treasury’s penny production halt and reflects Kroger’s efforts to ease checkout headaches caused by missing pennies. Notably, Kroger has placed notices in over 2,700 stores nationwide, urging customers to provide exact cash amounts, especially in their Cincinnati and Northern Kentucky divisions where the policy first rolled out.

Kroger’s spokesperson stated, “While we continue to accept pennies, the ongoing shortage means we strongly encourage our customers to use exact change when paying with cash to help keep the lines moving and the checkout experience smooth.”

Why Such a Big Emphasis on Exact Change?

With pennies scarce, cashiers without exact coins must offer rounding or store credit. However, not all customers are savvy or happy with this. Exact change reduces transaction friction, minimizes complaints, and helps comply with government food assistance program requirements that mandate equal pricing treatment.

Pro Tip: Avoid the hassle at Kroger by using your debit or credit card, or bring coins and bills that match your purchase.

Kwik Trip’s Clever Nickeling Policy

Kwik Trip has taken a unique and bold stance: rather than asking for exact change, it simply rounds down cash transactions to the nearest nickel. That means if your total is $23.82, you’ll pay $23.80; if it’s $15.83, you still pay $15.80 with cash.

This policy applies only to cash sales. Digital payments remain exact, giving customers who pay electronically the benefit of precise charges. Kwik Trip has rolled this policy out across 850 stores in the Midwest and parts of the South, accepting the financial hit as a cost of customer convenience and operational efficiency.

The company projects it will lose about $3 million this year from rounding down cash purchases but welcomes the move as necessary to maintain smooth operations amid the penny drought.

Kwik Trip CEO Mike Van Newkirk commented, “We believe rounding down is the right choice to ease customer burden and reduce delays, and we’re proud to take one for the team financially to make it happen.”

Why does Kwik Trip round down and not up?

Rounding down builds goodwill, making sure customers don’t feel shortchanged while navigating the penny shortage. It also speeds up transactions and gives cash-paying shoppers a small bonus which can keep them coming back.

Sheetz Goes Digital and Crypto-Friendly

Sheetz is embracing innovation by pushing customers towards cashless and digital payment methods. They encourage shoppers to use credit/debit cards, mobile wallets, and even cryptocurrencies like Bitcoin and Ethereum.

To sweeten the deal, Sheetz offers an eye-popping 50% discount to customers who pay using supported cryptocurrencies—a major incentive for both veteran crypto users and those curious about dipping their toes into digital payments.

For customers still using cash, Sheetz promotes rounding up your total purchase. The extra change goes directly to charity, supporting community programs like food banks and youth initiatives. Some Sheetz stores even run penny donation drives where contributors get perks like free coffee or soda.

Sheetz’s forward-looking approach signals a broader retail trend moving towards digital payments, reducing reliance on coins and paper currency, and embracing emerging financial technologies.

Impact on Other Retailers and Small Businesses

The coin shortage isn’t contained to these three chains. McDonald’s, Love’s Travel Stops, and convenience stores across the nation are adopting rounding policies or push cashless payments for similar reasons.

For smaller retailers, the transition is complicated:

- Many registers and POS systems aren’t programmed to round transactions, forcing costly hardware or software upgrades.

- Staff need detailed training to explain changes to customers calmly and clearly, avoiding frustration.

- Communication with consumers is essential since unexpected rounding or payment policies risk alienating shoppers.

In states like California and New York, consumer laws still mandate exact change, creating tension with operational realities. This regulatory patchwork is motivating Congress to debate the Common Cents Act, which would legalize rounding nationwide and ease enforcement worries for retailers.

The Economic and Environmental Angle

Pennies are more than pesky pocket weights—they’re a costly government expense. The U.S. Mint reported losing $85.3 million in 2024 producing nearly 3.2 billion pennies at a cost of 3.7 cents each.

Phasing out pennies saves taxpayers millions and also reduces the demand for metals used in coin making—copper and zinc—lowering mining impacts and carbon emissions.

Countries that ditched their smallest coins years ago, like Canada and Australia, saw no disruption. Their experiences suggest Americans can adapt just fine, with smoother transactions and less waste.

How to Adapt: Practical Tips for the Penny-less Era

Here’s how to keep your wallet and sanity intact:

- Carry Exact Change When Possible: Especially nickels and dimes, useful at Kroger and similar stores.

- Go Digital: Credit/debit cards, Apple Pay, Google Wallet, and PayPal make payments exact and quick.

- Try Crypto Payments: Take advantage of retailer discounts like the 50% off at Sheetz for crypto users.

- Watch for In-Store Announcements: Policies evolve—stay informed by checking official sites or store signage.

- Be Generous: If rounding up your purchase, know your spare change can support worthy causes.

1976 Bicentennial Quarter Worth $2.5 Billion—How to Spot This Rare Coin in Circulation

eBay Madness Over a 50p Coin; Why It Sold for £211 and Could Yours Be Next?