$1,647.34 Canada Survivor Allowance Payment: Losing your spouse or common-law partner is among life’s toughest challenges—not just emotionally but financially as well. If you’re aged between 60 and 64 and facing financial difficulties after such a loss, the Canada Survivor Allowance could serve as a crucial financial lifeline. As of November 2025, eligible survivors can receive up to $1,647.34 monthly, bridging the income gap before qualifying for Old Age Security (OAS) at age 65. This in-depth article covers everything you need to know—from eligibility and application to payment schedules and practical advice—helping both individuals and professionals navigate this important benefit.

Table of Contents

$1,647.34 Canada Survivor Allowance Payment

The Canada Survivor Allowance represents vital financial support for Canadian survivors aged 60 to 64, providing up to $1,647.34 in November 2025. This benefit bridges the challenging income gap faced after the death of a spouse before retirement benefits begin. Timely application, meeting eligibility requirements, and informed management of the benefit ensures you maximize your support during this difficult transition in life. This guide’s detailed steps, comparisons, and real-life insights aim to empower survivors and advisors alike with the knowledge to navigate the Survivor Allowance smoothly.

| Aspect | Details |

|---|---|

| Program Name | Canada Survivor Allowance |

| Maximum Monthly Payment | Up to $1,647.34 |

| Eligibility Age | Between 60 and 64 years old |

| Residency Requirement | Must have lived in Canada for at least 10 years since age 18 |

| Income Limit | Annual income must be below approximately $29,712 |

| Payment Date | Around November 26-27, 2025 |

| How to Apply | Online via Service Canada or by mail |

| Purpose | Financial support for low-income survivors aged 60-64 until OAS eligibility at 65 |

What Is the Canada Survivor Allowance? History and Purpose

The Canada Survivor Allowance was created in the 1970s to fill a notable gap in Canada’s retirement income system. Before its introduction, many widowed spouses faced severe financial hardships during the years between the loss of their partner and becoming eligible for old age benefits like OAS. The allowance acts as a temporary income bridge, helping widowed individuals aged 60 to 64 maintain financial stability.

This program fits within Canada’s broader retirement income framework, which includes the Canada Pension Plan (CPP), Old Age Security, and the Guaranteed Income Supplement (GIS). Its importance lies in providing tailored support to a vulnerable demographic before they can qualify for full retirement benefits.

Historically, survivor benefits like those under CPP have evolved to respond to societal changes such as increased workforce participation by women and changing family structures. Over time, policy amendments expanded survivor benefits and refined eligibility rules, underscoring the government’s commitment to equitable support.

Who Can Qualify for the $1,647.34 Canada Survivor Allowance Payment in 2025?

To qualify, the applicant must meet all the following:

- Ages 60 to 64: Eligibility is capped at age 64. Once you turn 65, this allowance ends and OAS benefits begin.

- Surviving Spouse or Common-law Partner: You must be the widow or widower—or a common-law partner legally recognized—of a deceased OAS or GIS recipient.

- Canadian Residency: Must have lived in Canada for at least 10 years after age 18 to establish sufficient ties and residency.

- Income Limits: Your annual income must be below approximately $29,712 for 2025. This ensures the allowance reaches those in genuine financial need.

- Citizenship or Permanent Resident Status: You must legally reside in Canada.

- Not Remarried or in New Common-law Union: Entering a new relationship stops eligibility for this benefit.

- Not Receiving OAS: Once old-age pension begins, the allowance ceases.

These requirements help target support to those who need it most and ensure the benefit acts as intended.

How Much Will You Receive in November 2025?

The maximum monthly allowance payment is $1,647.34 for November 2025, but the actual amount depends on your income. Since the program is income-tested, higher earnings reduce the payment proportionally.

The payment amount is adjusted quarterly to reflect inflation and cost of living. This ensures the allowance keeps pace with economic conditions, preserving its purchasing power for recipients.

When Will Payments Arrive?

Payments for the Canada Survivor Allowance are deposited monthly near the end of the month. For November 2025, you should expect the payment around November 26 or 27 directly into your bank account via direct deposit, which is fast, safe, and reliable.

Prompt payment timing is important for recipients to plan their monthly budgets efficiently without cash flow surprises.

Step-by-Step Guide to Applying for the $1,647.34 Canada Survivor Allowance Payment

Applying need not be a daunting process. Follow these detailed steps for a smooth experience:

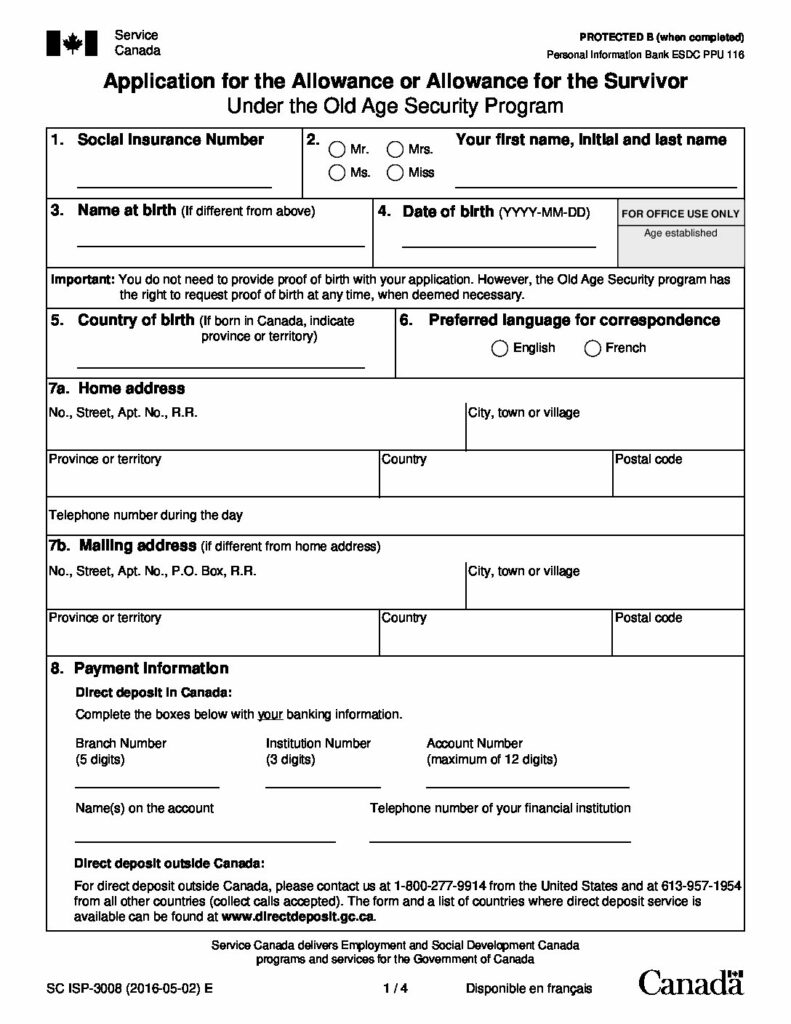

Step 1: Gather Essential Documents

Prepare these for submission:

- Death certificate of your deceased spouse or common-law partner.

- Social Insurance Numbers (SIN) for both yourself and the deceased.

- Proof of Canadian residency (such as utility bills, lease agreements).

- Income tax returns or Notice of Assessment for the previous year.

- Direct deposit information (bank institution number, transit number, and account number).

Step 2: Submit Your Application

You can apply:

- Online via the secure My Service Canada Account (MSCA) portal, which is the recommended and fastest method.

- By mailing a printed application form available at Service Canada centres or on their website.

- In-person assistance is also available at Service Canada offices if needed.

Step 3: Await Processing

Service Canada typically takes a few weeks to process applications. To avoid delays:

- Respond promptly to correspondence requesting further information.

- Ensure all forms are correctly filled out and documents are clear.

Step 4: Start Receiving Payments and Manage Your Benefit

After approval:

- Payments are direct-deposited monthly.

- Keep Service Canada informed of any income changes, address updates, or relationship status changes.

- Use the MSCA portal to track payment status and manage your account details.

Common Mistakes and Challenges to Avoid

Understanding common pitfalls helps protect your benefit and avoid complications:

- Delaying your application: Many survivors wait too long to apply, losing out on payments.

- Not reporting income accurately or timely: This can cause overpayments, which you’ll be required to repay.

- Failing to update marital status: Remarrying or entering a new common-law relationship terminates your eligibility.

- Misunderstanding income thresholds: It’s crucial to know how your other sources of income impact the allowance.

- Ignoring changes in residency: Extended stays outside Canada can affect eligibility.

Staying informed and proactive is key to avoiding these issues.

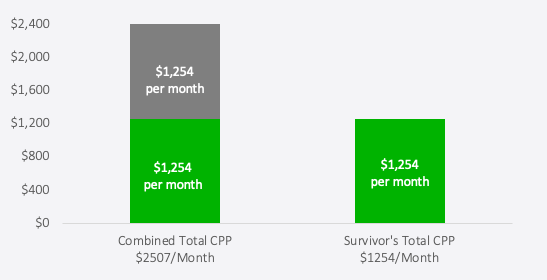

Comparing the Survivor Allowance With Related Benefits

| Benefit | Eligibility Age | Max Monthly Payment (2025) | Description |

|---|---|---|---|

| Canada Survivor Allowance | 60-64 | $1,647.34 | Bridge for survivors before OAS eligibility |

| Old Age Security (OAS) | 65+ | ~$615 | Basic federal retirement benefit |

| Guaranteed Income Supplement (GIS) | 65+ | Up to ~$1,000+ | Extra support for low-income seniors |

| Canada Pension Plan Survivor Benefit | Any age | Varies | Benefits based on deceased contributor’s record |

Unlike the OAS or GIS, the Survivor Allowance is specifically for widowed individuals under 65 who need temporary financial support. CPP survivor benefits are different, providing pensions or lump-sum death benefits based on contribution history.

Real-Life Impact: A Survivor’s Story

“After my husband’s sudden passing, I was left worried about how I would manage financially before I turned 65. Thanks to the Canada Survivor Allowance, I had steady monthly support that covered rent and groceries. Applying online was straightforward, and payments arrived promptly each month. It truly helped me regain some peace of mind during a difficult time.” — Susan M., Alberta

Tax Implications of the Survivor Allowance

A big plus: the Survivor Allowance is non-taxable income. You do not need to report it on your income tax return, simplifying your tax filing and ensuring you keep every dollar of the benefit without tax deductions.

Financial Planning Tips for Survivors

- Prioritize essential living expenses like housing, utilities, and groceries.

- Avoid making large financial commitments or risky investments during this period.

- Consider consulting a financial advisor to plan long-term retirement income.

- Monitor your income carefully to stay within program limits and avoid overpayments.

- Plan ahead for transitioning to OAS and GIS benefits at 65.

Canada Carbon Tax Rebate in November 2025? – Check Eligibility, Payment Amount & Date

Canada Grocery Rebate Amount for November 2025 – Check Eligibility & Payment Dates

Canada $300 Federal Payment in November 2025 – Who will get it? Check Eligibility

Contact Information and Resources

For assistance or to learn more:

- Service Canada Toll-Free: 1-800-277-9914

- TTY (Hearing Impaired): 1-800-255-4786

- Official survivor allowance page: Service Canada