CRA Benefits Payment Dates: If you’re looking for the scoop on CRA benefits payment dates in November 2025, this article is your go-to guide. We’ll break down when those important payments arrive, who’s eligible, and what you can expect to receive. Whether you’re a first-time recipient, a financial advisor, or just someone who wants to plan ahead, this piece will take the mystery out of your benefits with clear language, solid facts, and practical tips. Understanding CRA payments can be confusing, but don’t sweat it—this piece is crafted to be straightforward enough for a 10-year-old to get, yet full of the detailed info professionals want. Let’s jump in!

Table of Contents

CRA Benefits Payment Dates

November 2025 is a vital month for Canadians depending on CRA benefits payments. Knowing when payments are disbursed, who qualifies, and how much to expect means fewer surprises and better financial planning. The introduction of new one-time payments adds extra relief during challenging times.

| Benefit Program | Payment Date | Eligibility Summary | Approximate Payment Amount |

|---|---|---|---|

| Canada Child Benefit (CCB) | November 20, 2025 | Caregivers of children under 18, based on income and residency | Varies; average $500-$600/month |

| Old Age Security (OAS) | November 26, 2025 | Canadians aged 65+, minimum residency period | $740 – $814/month approx. |

| Canada Pension Plan (CPP) | November 26, 2025 | Contributors to CPP reaching retirement age or disability beneficiaries | Average $1,433/month (retirement) |

| Guaranteed Income Supplement (GIS) | November 26, 2025 | Low-income seniors receiving OAS | Up to $1,043/month |

| Ontario Trillium Benefit (OTB) | November 10, 2025 | Ontario residents with income and property tax credits | Varies; max about $1,000 annually |

| Alberta Child and Family Benefit (ACFB) | November 27, 2025 | Alberta families with children under 18, income-based | Varies; monthly payments |

| GST/HST Credit | Quarterly, next in early 2026 | Low to moderate income Canadians; quarterly payments | $250-$496/quarter |

Why CRA Benefits Are Essential?

The Canada Revenue Agency (CRA) benefits system is a lifeline for millions across the country. It provides key supports such as the Canada Child Benefit (CCB) for families, Old Age Security (OAS) and Guaranteed Income Supplement (GIS) for seniors, and the Canada Pension Plan (CPP) for retirees and disabled Canadians. These payments help cover everyday costs—from groceries to rent to health care—making life more manageable for many Canadians.

These programs are designed not just to supplement income, but to serve specific needs based on life stage and circumstance. For example, CCB helps nurture young families, while OAS and GIS provide financial peace of mind to seniors, especially those with lower incomes. CPP ensures that Canadians who contributed to the workforce receive retirement or disability support.

When Will Your November 2025 Payments Arrive?

Timing matters — especially when budgeting for bills and essentials. Here’s the lowdown on November CRA payment dates for key programs:

- November 10: Ontario Trillium Benefit (OTB)

This provincial credit helps offset energy bills and property taxes, providing financial relief for Ontario residents who qualify based on income and residency status within the province. - November 20: Canada Child Benefit (CCB)

CCB payments come right around this date to support families with children—vital assistance for food, clothing, or educational expenses. - November 26: Old Age Security (OAS), Canada Pension Plan (CPP), Guaranteed Income Supplement (GIS)

Seniors and retirees receive their key monthly payments on this day, an essential financial lifeline for many older Canadians facing everyday costs. - November 27: Alberta Child and Family Benefit (ACFB)

This payment assists Alberta families with children, cushioning costs related to childcare and other necessities.

Note that some benefits like the GST/HST Credit pay out quarterly, so no November deposit is scheduled for that one.

Breakdown of Eligibility Criteria for CRA Benefits Payment

Knowing if you qualify is crucial to accessing the help offered by CRA. Let’s break down the requirements:

Canada Child Benefit (CCB)

- You must be the primary caregiver living with a child under the age of 18.

- Your family’s net income determines the amount received, with lower income leading to higher benefits.

- You must be a Canadian resident for tax purposes.

- Filing your taxes annually is mandatory—this ensures payments are calculated based on the most recent family income.

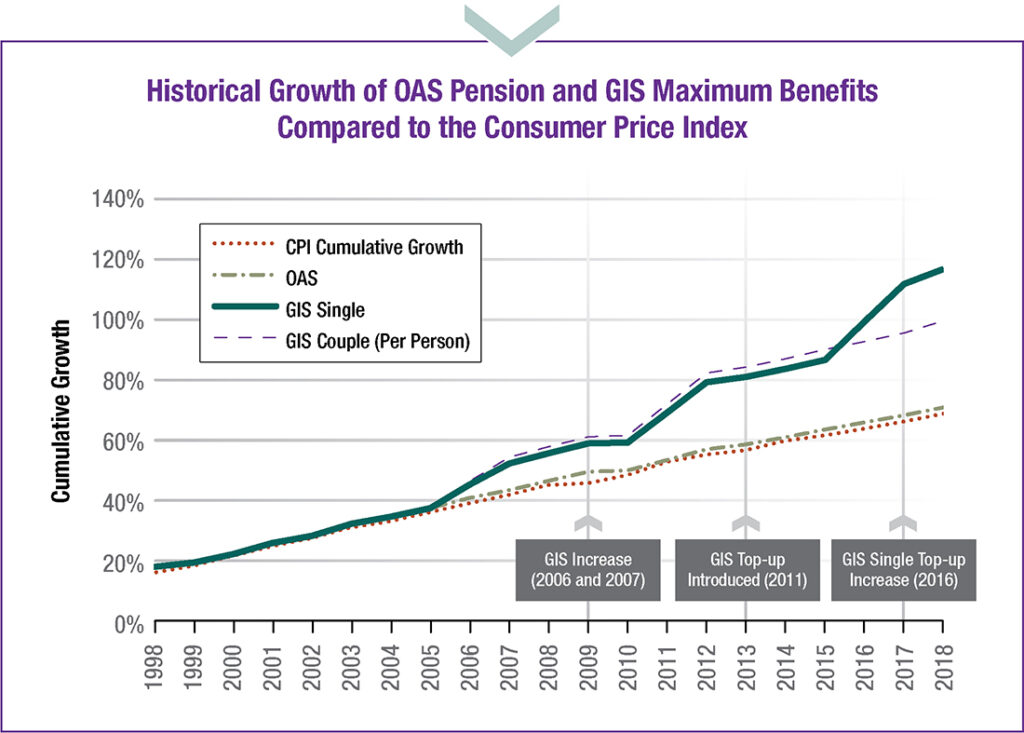

Old Age Security (OAS) and Guaranteed Income Supplement (GIS)

- Eligibility kicks in at age 65 or older.

- To qualify for the full OAS pension, you need at least 40 years of residency in Canada after age 18 (minimum 10 years for partial OAS).

- GIS is designed for low-income seniors who are already receiving the OAS pension, providing extra income support.

- As with other benefits, regular tax filing is required.

Canada Pension Plan (CPP)

- CPP benefits depend on your contributions over your working lifetime.

- Retirement pensions can start as early as age 60, with monthly amounts increasing the longer you wait (up to 70).

- Disability and survivor benefits have separate eligibility conditions based on your contributions and qualifications.

Provincial Benefits (OTB, ACFB)

- Residency in the respective province is required.

- Income thresholds apply and these benefits typically offset costs like energy bills or childcare expenses.

- Amounts vary per household income and size, making it important to understand your province’s specific rules.

How Much Can You Expect? Payment Amounts Explained

Payment amounts vary widely based on individual circumstances such as income level, family size, and province.

- Canada Child Benefit (CCB): Can range from several hundred dollars to over $1,000 per month depending on income and number of children. The average tends to hover around $500-$600 monthly for many families.

- Old Age Security (OAS): Payments typically range from approximately $740 to $814 per month. Eligibility period influences amount.

- Canada Pension Plan (CPP): The average monthly retirement pension payment is around $1,433, but amounts vary considerably based on lifetime contributions and age at retirement.

- Guaranteed Income Supplement (GIS): This can add up to approximately $1,043 per month to qualified low-income seniors.

- Ontario Trillium Benefit (OTB) and Alberta Child and Family Benefit (ACFB): Payments vary by income level and family size but offer crucial support totalling up to $1,000 annually or more, spread across multiple monthly payments.

Remember, these amounts are personalized and are recalculated every year based on the tax information filed for the prior year.

New Updates and One-Time Payments in 2025

Amidst economic challenges and rising living costs, the Canadian government has introduced several one-time payments to provide extra relief in 2025:

- A $680 one-time payment will be automatically disbursed to low- and modest-income Canadians who qualify for certain benefits like GST/HST Credit or Canada Workers Benefit. This payment supports people grappling with inflation and increased household expenses. You do not need to apply separately; the CRA determines eligibility based on your 2024 tax filing.

- Additionally, a $250 one-time payment targets seniors receiving OAS and GIS, families receiving the Canada Child Benefit, and eligible GST credit recipients. This non-taxable payment will be issued automatically between November 15 and 28, 2025. This additional support is designed to offset increasing costs during the fall season.

Both one-time payments aim to help Canadians maintain household stability without complicating application processes.

Managing Your CRA Benefits Payment Like a Pro

Navigating CRA benefits smoothly ensures you receive timely support without bureaucratic hiccups. Here’s how to manage your benefits effectively:

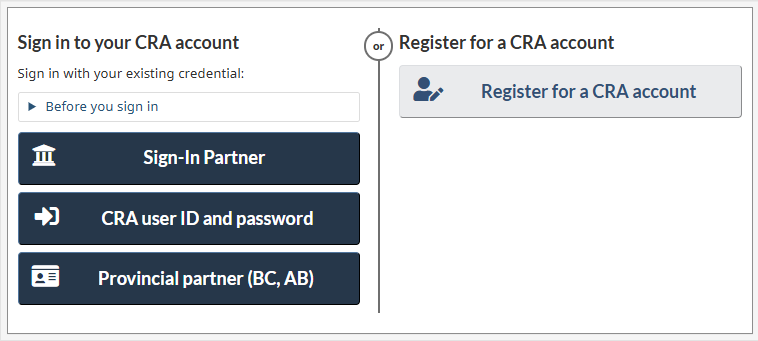

- Choose Direct Deposit: This is the fastest and most secure way to receive payments, avoiding postal delays or lost cheques. Register or update your banking details via CRA’s My Account online portal.

- Keep Your Information Updated: Life changes like marriage, new children, income fluctuations, or moving homes impact your benefit amounts. Report these changes promptly to avoid overpayments or payment interruptions.

- File Your Taxes Annually: CRA calculates benefit amounts based on your latest tax returns. Missing your filings could mean missed payments.

- Be Alert for Scams: CRA will never ask for personal info via email or phone.

- Plan Ahead for Payment Schedules: Knowing exact payment dates helps with budgeting, especially in months with multiple deposits like November.

Special Groups Who Can Benefit More

Newcomers to Canada

New residents are considered newcomers for tax purposes in their first year living in Canada. They can apply for benefits as soon as they meet residency criteria, often requiring filing taxes for the year of arrival. The CRA provides online tools and support to simplify the application process and determine eligibility promptly. Important documents include immigration papers, proof of residence, and tax filing.

Persons with Disabilities

The Disability Tax Credit (DTC) and related benefits offer substantial support for Canadians living with serious and prolonged disabilities. These programs require medical approval and can include monthly supplements or larger tax credits. The CRA also provides a Canada Disability Benefit, which disburses monthly support to eligible recipients automatically based on recent filings.

$2600 CRA Payment in November 2025; Who will get it? Check Eligibility

CRA Benefits Payment Dates in November 2025 – OAS, CPP & CWB Benefits Date

Canada CRA $496 GST/HST Credit for November 2025: Check Payment Dates & Eligibility Criteria