CPP Under Fire: Four young Canadians have launched a bold lawsuit against the Canada Pension Plan Investment Board (CPP Investments), claiming that the largest pension fund in Canada is failing to protect their retirement savings from the financial risks caused by climate change. This game-changing case, filed in Ontario Superior Court, alleges CPP Investments is ignoring the real dangers of climate change by continuing to invest heavily in fossil fuels and relying on flawed risk assessment models. The lawsuit argues this mismanagement puts millions of future retirees, especially young contributors, at serious risk of financial loss.

So, what’s the deal here? Why are these young folks taking on one of Canada’s biggest financial institutions? And what does it mean for you if you depend on the CPP for a stable retirement? This article breaks down the story and offers expert insights into climate risks in pension investing, the legal stakes, and practical advice to understand the implications for your retirement future.

Table of Contents

CPP Under Fire

The CPP Under Fire lawsuit highlights a pressing reality: climate change is no longer just an environmental battle but a financial one with direct consequences for your retirement future. Young Canadians suing CPP Investments demand transparency, accountability, and stronger climate risk management—a bold push for pension funds worldwide to align financial sustainability with environmental realities. If you rely on a pension fund, now’s the time to learn, engage, and advocate for responsible investment strategies that protect your money and the planet for decades to come.

| Topic | Details |

|---|---|

| Plaintiffs | Four young Canadians, including Aliya Hirji and Travis Olson |

| Lawsuit Filed | Ontario Superior Court, October 2025 |

| Allegation | CPP mismanages climate risks, breaching its duty to protect contributors’ interests |

| Climate Risks Ignored | Continued investments in fossil fuel expansion and reliance on criticized risk models |

| Impact Timeline | Retirements planned post-2050, with 2050 net-zero carbon emissions target abandoned by CPP |

| Consequences | Potential financial loss threatening retirement savings of 22 million Canadians |

| Legal Significance | First Canadian court case suing a pension fund on climate change risk management duties |

| CPP Response | Defends its approach, claims integrating climate risk is part of investment strategy |

| Official Website | Canada Pension Plan Investment Board |

Setting the Scene: Why This Lawsuit Matters

The Canada Pension Plan is a critical financial system that millions of Canadians rely on for retirement. But climate change poses a new and complicated threat—not just to the planet but to financial stability itself. The plaintiffs argue that CPP Investments is underestimating climate change’s financial impact, continuing to pump money into fossil fuels, and using outdated models that don’t capture the true risks. If they’re right, it means your retirement pot is riding on shaky ground.

Aliya Hirji, one of the plaintiffs at just 20 years old, said it best: “I want to retire on a stable pension into a livable future. That’s why I joined this lawsuit.” Their concern is not just personal—it represents a growing unease among young Canadians who see their future financial security threatened by climate-related risks that CPP Investments allegedly fails to adequately address.

This lawsuit is significant because it challenges how large public pension funds adapt—or don’t—to the rapidly evolving realities of climate change, especially when billions are invested in assets vulnerable to climate shocks.

Historical Background and Evolution of CPP Investments

CPP Investments, created by an Act of Parliament in 1997, manages one of the world’s largest pension funds with CAD $731 billion in assets under management as of 2025. Its statutory mandate is clear: invest the fund’s assets to achieve the highest possible return without undue risk of loss, for the long-term retirement security of Canadians.

Over time, CPP Investments has evolved from a focus solely on financial returns to embracing Environmental, Social, and Governance (ESG) factors as critical components of investment decisions. The board began integrating climate risk into its investment strategy during the 2010s, acknowledging global financial risks posed by climate change.

However, the fund’s recent decision to drop its commitment to a 2050 net-zero emissions target surprised many. This retreat has caused concerns about whether CPP can balance its fiduciary duty with the long-term risks climate change poses, especially since many contributors won’t retire until after 2050. For context, CPP’s 2025 Sustainable Investing Policy includes principles for a whole-economy transition, emphasizing engagement with companies to manage decarbonization over time without abrupt divestment. This nuanced approach has supporters and critics alike.

What’s the Lawsuit About? Breaking It Down

The Duty to Manage Risk

CPP Investments has a fiduciary duty to manage the pension fund prudently, carefully assessing and managing risks to protect beneficiaries’ interests. The lawsuit alleges CPP breached this duty by:

- Underestimating the severity and immediacy of climate risks, including physical damage from extreme weather and economic risks from transition policies.

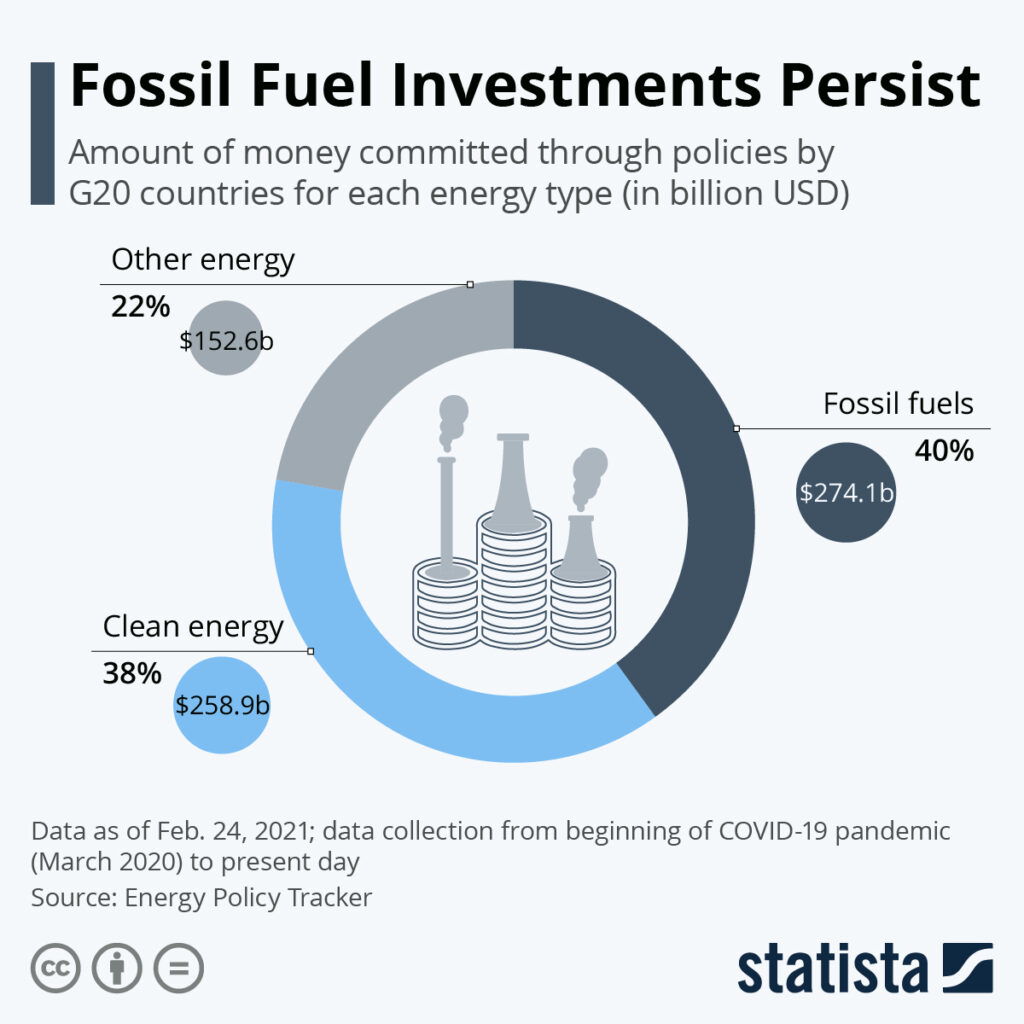

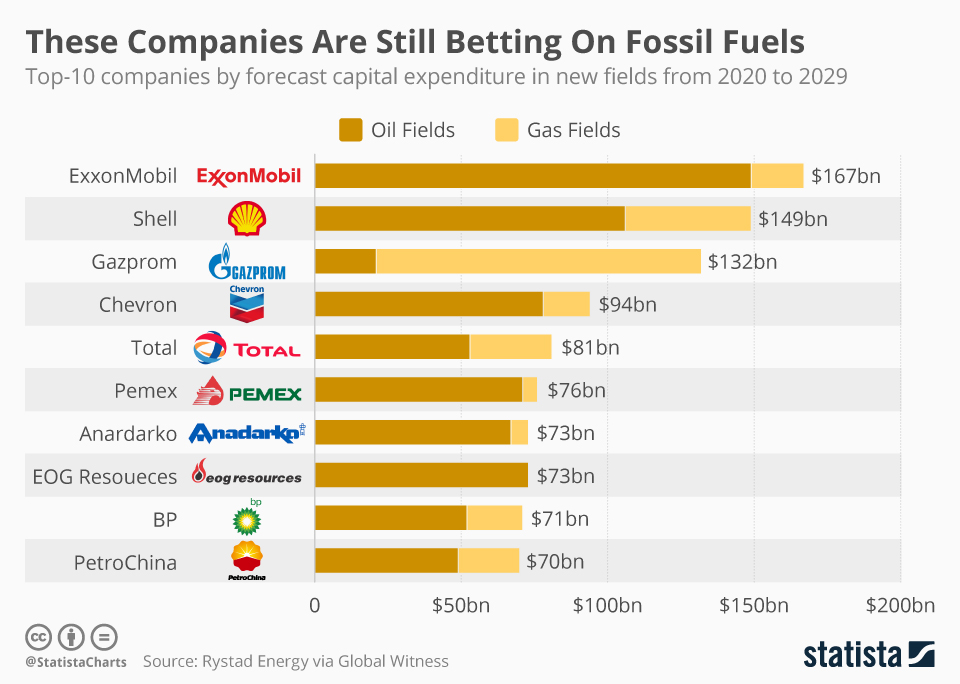

- Continuing large-scale investments in fossil fuel companies, many of which are expanding production despite global climate commitments.

- Dependence on climate risk models like MSCI’s Climate Value-at-Risk, which experts argue overlook critical vulnerabilities such as cascading climate impacts and tipping points.

The Flaws of Current Climate Risk Models

Many pension funds use statistical models based on historical data and projected emissions scenarios to assess risk. However, climate change represents an unprecedented systemic risk—a “black swan” event if not addressed properly.

Critics argue CPP’s models fail to simulate worst-case scenarios or abrupt economic shifts that might devalue major fossil fuel and related investments. This is equivalent to forecasting using yesterday’s weather in a climate crisis—highly unreliable.

The plaintiffs argue for more conservative, precautionary scenario planning to protect assets over the long term and safeguard intergenerational fairness.

The Bigger Picture: Intergenerational Equity

A key pillar of the lawsuit is intergenerational equity—the principle that the pension fund must act impartially, protecting both current and future contributors equally.

The young plaintiffs contend CPP’s decisions disproportionately jeopardize Millennials, Gen Z, and future Canadians. As climate change consequences intensify, financial risks increase for those who will retire far in the future, shifting losses unfairly onto them.

This argument challenges pension managers to balance immediate financial returns with the long-term ecological and economic risks, ensuring fairness across generations.

Global Comparison: How Are Other Funds Doing?

CPP Investments is not alone in grappling with climate risk, but comparisons to international peers reveal differing approaches. For example:

- Norway’s Government Pension Fund Global: Has committed to net-zero by 2050, divested from coal and companies not meeting strict climate targets, and uses rigorous scenario planning.

- CalPERS (California Public Employees’ Retirement System): Actively invests in green infrastructure, employs climate stress testing, and has committed to measurable interim emissions reductions.

- Canada’s CDPQ (Caisse de Dépôt et Placement du Québec): Recently exited investments in oil production, demonstrating a more aggressive shift to sustainable portfolios.

CPP’s lawsuit intensifies pressure to close the gap and adopt clearer, science-based climate actions consistent with evolving global best practices.

CPP Under Fire: Practical Implications for You

If You’re a Young Contributor

- Your payment today fuels investments that need to weather climate risks decades from now.

- If risks aren’t managed, those investments might depreciate in value, threatening future payouts.

- It’s crucial to engage with your pension fund, asking how climate risks are integrated into strategy and whether credible net-zero targets are in place.

If You’re Closer to Retirement

- Climate risks may have less impact on your timeline but are still relevant.

- A well-managed fund balances risk exposures to protect returns for current retirees.

- Monitor fund updates, especially if the lawsuit prompts shifts in investment policies.

Tips for Individual Investors

- Consider adding ESG funds or climate-aligned investments to personal portfolios.

- Demand transparency and clear communication from your pension plans.

- Support shareholder activism that pushes for responsible corporate climate actions.

The Economic Ripple Effect

Mismanaging climate risk is not just a pension issue—it threatens the broader economy. Pension funds control trillions in assets; if major investments suffer heavy losses from climate disasters or policy shocks, repercussions could ripple through stock markets, job markets, and government budgets.

This lawsuit underscores the need for financial systems worldwide to treat climate risk as seriously as any traditional financial risk, pushing pension managers to integrate climate data into fiduciary decision-making holistically.

Expert Voices

Dr. Emily Larson, a climate finance expert, explains:

“This lawsuit is a landmark moment. Climate change isn’t just an environmental issue; it’s a fiduciary issue. Pension funds must anticipate and mitigate those risks to protect long-term savings.”

John Hayes, retired pension fund manager, adds:

“The risks are real and looming. Pension managers need to evolve beyond historic returns and embrace climate data aggressively. CPP’s challenge is a wake-up call for all.”

How CPP Investments Responds?

CPP Investments asserts it:

- Sees climate change as a material risk and opportunity.

- Incorporates climate considerations into investment and risk management processes.

- Engages companies to improve their climate strategies rather than divesting outright.

- Aims to protect 22 million Canadians’ retirement security through diversified global investments.

Nonetheless, this position faces criticism for lacking transparency on fossil fuel investments and for retreating from publicly stated net-zero commitments.

Steps to Protect Your Retirement from Climate Risk

- Understand your pension fund’s climate policies: Review official reports and sustainability disclosures.

- Request transparency: Contact fund managers for clearer climate risk communication.

- Diversify: Consider adding ESG or green funds in personal portfolios.

- Stay informed: Follow climate finance news, legal developments, and pension reforms.

- Advocate: Encourage pension funds to adopt science-based climate targets and improve reporting.

Canada Extra GST Payment In November 2025 – Know Amount, Eligibility & Dates

$445 Canada Family Benefit Payment in November 2025, Know Eligibility & Payment Dates

Canada $300 Federal Payment in November 2025; Who will get it? Check Eligibility