November $3100 Centrelink Payment: If you’ve been hearing buzz about a $3100 Centrelink payment for seniors in November 2025, you’re not alone in wondering when that cash hits your bank. The truth? There’s no official lump sum payment of $3100 slated for November. What is official, though, is a solid system of fortnightly Age Pension payments that keep thousands of Aussie seniors afloat every month. Whether you’re new to Centrelink or a seasoned pensioner, this guide breaks down everything from eligibility and payment dates to practical tips — all in plain English. So let’s get to the nitty-gritty of what you really need to know about your 2025 Centrelink payments.

Table of Contents

November $3100 Centrelink Payment

Here’s the lowdown: the $3100 lump sum is a myth, but Australian seniors can count on dependable Age Pension payments every two weeks in November 2025, which collectively provide essential financial support. Payment dates, eligibility rules, and amounts are transparent and backed by a century of welfare history in Australia. Reporting changes, and accessing available supplements ensures you maximize benefits and stay safe from scams. This pension system is a cornerstone of Australian social support, giving seniors peace of mind.

| Feature | Details |

|---|---|

| Fortnightly Age Pension for Singles | Up to $1,178.70 per fortnight (~$30,646 annually) |

| Fortnightly Age Pension for Couples (per partner) | Up to $888.50 per fortnight (~$23,101 annually) |

| Expected Payment Dates in November 2025 | November 13 and November 27, 2025 |

| Eligibility Age | 67 years or older |

| Income Limit for Full Pension (Single) | $218 or less per fortnight |

| Assets Limit for Full Pension (Single, homeowner) | Approximately $321,500 |

| Official Resource | Services Australia – Age Pension |

What Is the November $3100 Centrelink Payment?

Straight talk first: there is no single $3100 lump sum payment from Centrelink for seniors in November 2025. What you get instead is your Age Pension in regular chunks — usually every two weeks (fortnightly). Think of it as your monthly paycheck from the government that totals up over the year to provide financial security.

The monthly income might feel smaller in one slice but adds up to a crucial safety net for many older Australians. It’s easy to see how some folks might hear about a “$3100 payment” when considering the combined total of several fortnightly pension payments received in a couple of months—it’s just not a single deposit.

Breakdown of Centrelink Age Pension Payments in November 2025

What Seniors Actually Receive?

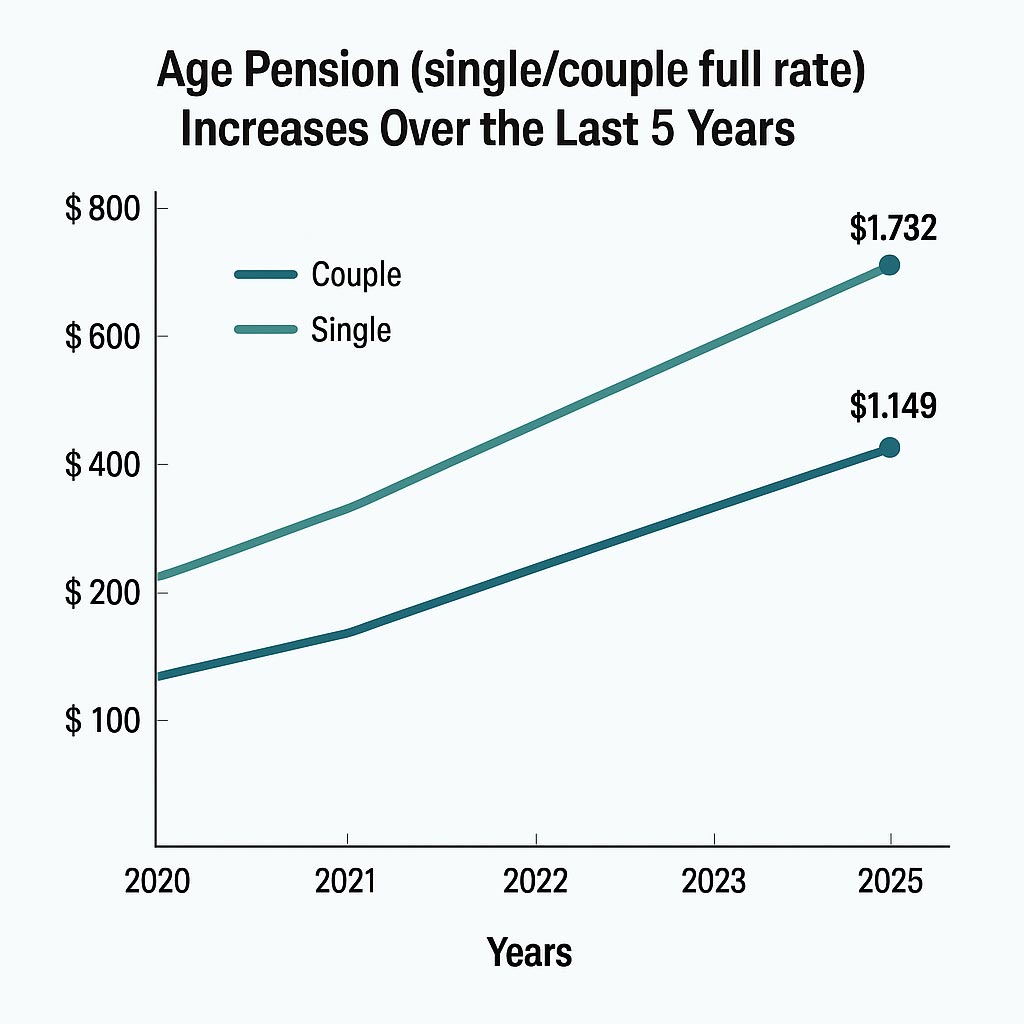

- Singles can expect to receive up to $1,178.70 every two weeks, roughly adding to $30,646 annually.

- Couples each receive around $888.50 every two weeks, or about $23,101 per year individually.

For couples, that means a combined pension of roughly $1,777 per fortnight, or nearly $46,202 yearly. This level of payment was recently boosted to catch up with inflation and living costs, thanks to government indexation measures.

The fortnightly payments break down into the base rate, a pension supplement, and an energy supplement designed to help with rising utility costs. For instance, singles get a base pension rate of around $1,079.70 plus additional supplements that push the total to $1,178.70 per fortnight.

When Are Payments Made?

In November 2025, the Age Pension payments arrive on:

- Thursday, November 13

- Thursday, November 27

These bi-weekly deposits ensure pensioners have a steady stream of income through the month. Centrelink payments are usually processed early in the morning on payment day, and banking processing times mean money often appears in accounts a few hours later. If payment day falls on a public holiday or weekend, payments are usually processed earlier.

Knowing these dates helps seniors manage their budgets effectively and avoid financial strain.

Who Qualifies for the Centrelink Age Pension?

Here’s the skinny on eligibility:

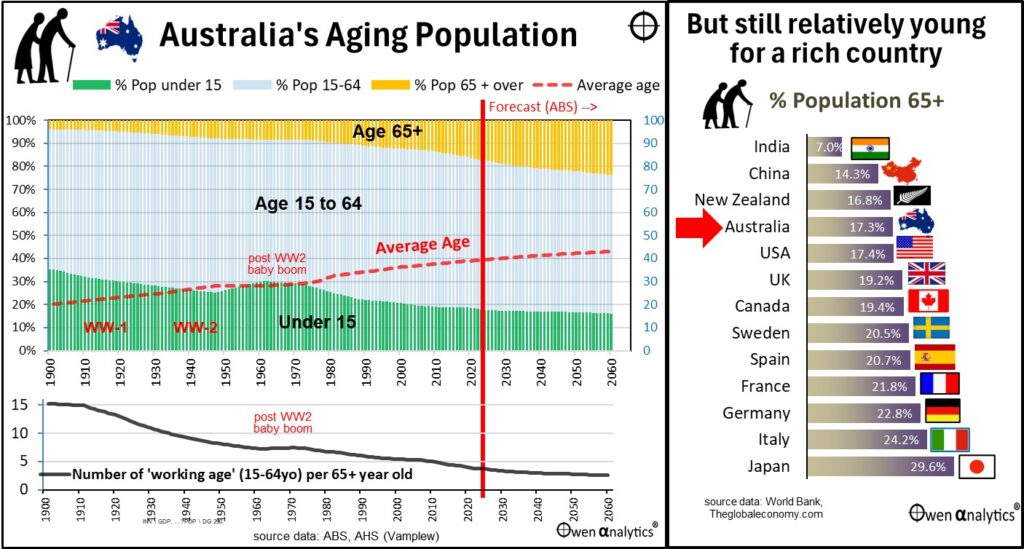

- Age: You must be at least 67 years old as of November 2025 (the qualifying age was gradually increased from 65 to 67 over recent years).

- Residency: You need to have been an Australian resident for at least 10 years, with some additional requirements around continuous residence in the past 5 years.

- Income and Assets Test: To qualify for the full pension, singles need to earn less than $218 per fortnight from all sources while having assets below certain limits. The asset threshold for a homeowner single is about $321,500, and slightly more for non-homeowners.

- Partial Pension: If your income or assets exceed these limits, you might still get a reduced pension.

- Other Criteria: You must not be imprisoned or in a psychiatric hospital for more than two weeks, as pensions are typically suspended during such stays.

If your circumstances are complex, Centrelink will assess your entire financial situation to determine the exact pension amount.

How to Apply or Manage Your November $3100 Centrelink Payment?

Applying or managing payments is straightforward:

- Visit the myGov website and link your Centrelink account if you haven’t already.

- Fill in the Age Pension application online or contact Centrelink for assistance with paper forms or phone applications.

- Provide documentation, including proof of identity, income, assets, and residency history.

- Use your myGov account or the Centrelink app to check payment status, report changes, manage details, and access support services.

Tips for a smooth application:

- Start your claim a few months before you turn 67 to avoid payment delays.

- Gather all supporting documents, such as bank statements, property details, and residency papers.

- Keep your contact information updated to receive timely notifications from Centrelink.

The online system is user-friendly, but you can always get help at Centrelink offices or via phone if you prefer.

Maximizing Your Benefits: Tips for Seniors

Pensions are more than just a fortnightly payment. Here’s how to get the most from the system:

- Supplemental Benefits: Many pensioners are entitled to other benefits like the Pension Supplement (extra cash added to fortnightly payments), Rent Assistance if you’re renting privately, and a Health Care Card which gives discounts on medicines, doctors, and public transport.

- Energy Supplement: Added to your fortnightly pension, this helps offset the cost of electricity and gas bills.

- State Concessions: Across Australia, many states offer pensioners discounted or free access to public transport, council rates rebates, and utility discounts.

- Report All Income: Be honest about income and changes; failing to do so could lead to debts or penalties, but reporting can also open doors to additional help.

- Financial Counseling: Many community organizations and councils offer free advice on budgeting and managing your pension and benefits.

How Did We Get Here?

The Age Pension is one of Australia’s oldest and most important social welfare programs. Here’s a quick history to give perspective:

- In 1908, the Commonwealth Parliament passed the Invalid and Old-Age Pensions Act, setting up the first national pension for men over 65 and women over 60.

- The scheme was revolutionary—a groundbreaking way to support elderly Australians living in poverty at a time when elderly care was primarily handled by families or charities.

- Early pensions had strict residency and means tests and were very modest.

- Over the decades, the pension system evolved with changes like:

- Automatic increases linked to the cost of living, introduced in the 1930s and refined over the years.

- Gradual alignment of pension age to 67 years today.

- Expansion into a more comprehensive social security system covering widows, unemployed, and disabled Australians.

- The pension has remained a modest but vital safety net, with amounts slowly increasing over time to keep pace with inflation and living costs, reflecting Australia’s commitment to social welfare.

This history reflects a society that values dignity and security for seniors.

One-Off Payments and Cost of Living Supports in 2025

While there’s no scheduled $3100 lump sum payment, the Australian government has provided occasional one-time payments to cushion rising costs or emergencies:

- Earlier in 2025, some pensioners received a $750 Cost of Living payment to help with inflationary pressures.

- There are also Crisis or Advance Payments that can be applied for if you hit unexpected hardship.

- These payments are separate from your regular pension and require specific eligibility or application.

Keep an eye on official announcements because one-off supports like these can arise in response to economic conditions.

Common Mistakes to Avoid

Avoid these pitfalls so you don’t risk delays, penalties, or overpayments:

- Failing to update your income or assets promptly if they change.

- Not reporting moves in living arrangements, like moving to a care facility or changing address.

- Waiting too long to apply, which can delay payments.

- Falling for scams: Don’t share personal or banking information from unsolicited contacts.

- Misunderstanding means tests: Know how income and assets affect your pension to avoid nasty surprises.

Scam Alert: Protect Yourself

Scams targeting seniors around Centrelink payments are unfortunately common. Here’s what to watch for:

- Centrelink will never call or email asking for payment or private account details unexpectedly.

- Never pay a fee or share passwords or PINs to get a payment.

- Use the official Services Australia website to confirm or apply for benefits.

- If in doubt, contact Centrelink directly using verified contact numbers.

- Report suspected scams to the Australian Cyber Security Centre.

Australia Pension Plan Payment November 2025: Check Payment Dates & Claim Process

Centrelink Age Pension in November 2025 – Check How much Amount coming?, Eligibility & Payout Dates