OAS Increase in November 2025: The Old Age Security (OAS) increase in November 2025 is an important update for Canadian seniors, ensuring that their pension benefits stay in line with inflation and rising living costs. Whether you’re a seasoned retiree, planning ahead, or working with clients on retirement strategies, understanding this update’s details can significantly impact your financial security. This comprehensive guide covers everything from the inflation-adjusted increase, historical context, comparison with other benefits, practical planning tips, and official resources to help you navigate your retirement journey confidently.

Table of Contents

OAS Increase in November 2025

The November 2025 OAS increase underscores Canada’s dedication to safeguarding seniors’ income against inflation. While the 0.7% boost appears modest, it plays a vital role in preserving the buying power of millions of Canadians who rely on this foundational pension. Whether you’re already receiving OAS or planning for the future, understanding these updates helps you make smarter, more informed financial choices. Remember, regularly reviewing your eligibility, income, and benefits options is crucial to maximizing your retirement income.

| Topic | Detail |

|---|---|

| OAS Payment Increase | 0.7% increase for October to December 2025 quarter; 1.7% compared to last year |

| Max OAS Amount (65-74 years) | Up to $740.09 per month |

| Max OAS Amount (75+ years) | Up to $814.10 per month, reflecting the 10% increase since 2022 |

| Payment Date in November | November 26, 2025, for most recipients |

| Income Threshold for Clawback | Over $90,997 in net income triggers a partial recovery of benefits |

| Eligibility Requirement | At least 10 years of residence for partial benefits; 40+ years for full OAS |

| Source | Canada.ca OAS Benefits |

What Is the OAS Increase in November 2025?

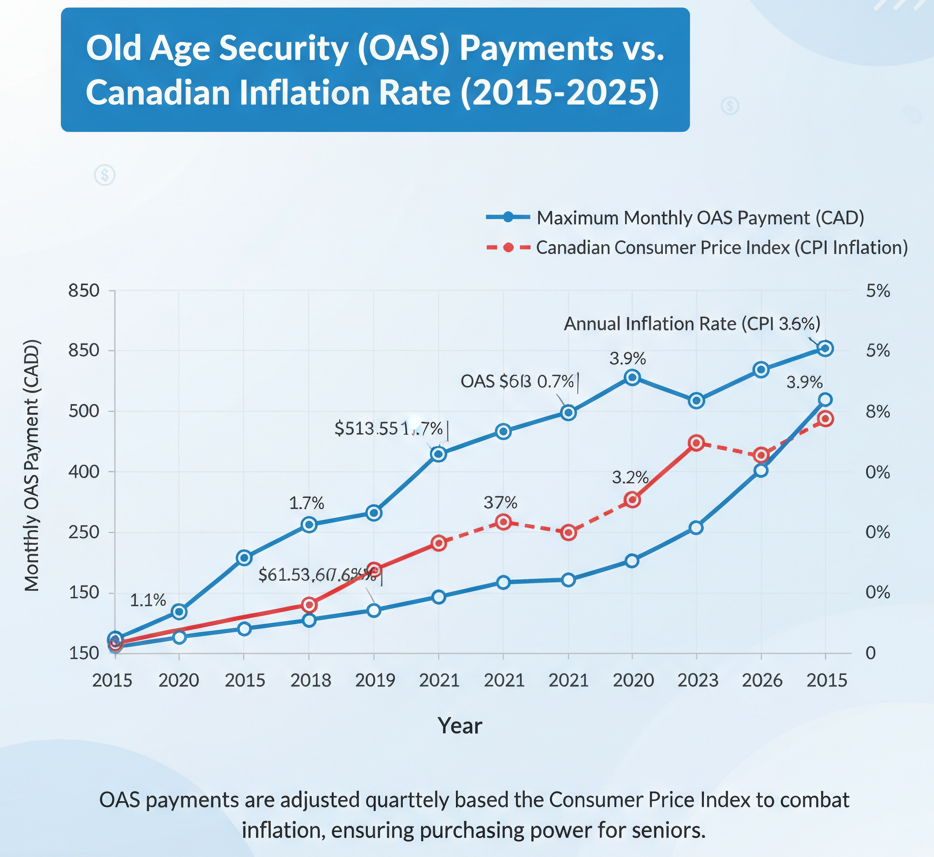

The OAS increase scheduled for November 2025 aligns with Canada’s ongoing commitment to index benefits to inflation. For this quarter, benefits will grow by 0.7%, a modest movement reflecting the current inflation rate. Since October 2024, the benefits have risen 1.7% year-over-year, helping seniors combat rising costs of groceries, housing, healthcare, and other essentials.

This adjustment ensures that OAS payments retain their purchasing power, minimizing the impact of inflation on retirees’ incomes. Every quarter, the Government reviews economic data and adjusts benefits accordingly, providing a crucial layer of financial stability for millions of Canadians.

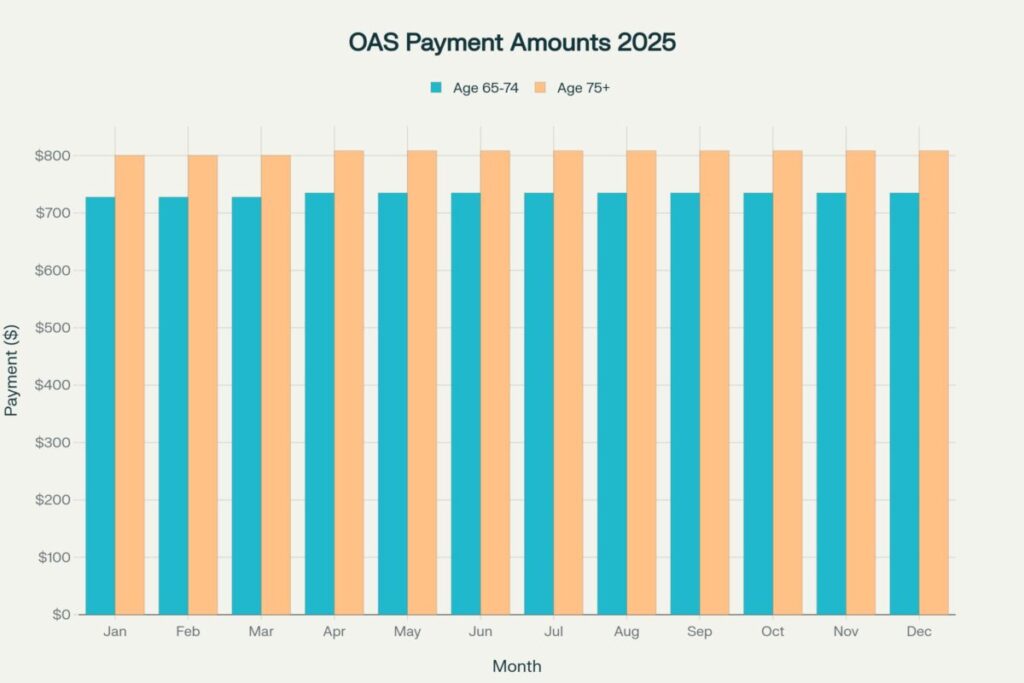

How Much Will You Receive?

The amount you receive depends primarily on your age and your residency history:

- Seniors aged 65 to 74 can expect to receive a maximum of $740.09 monthly.

- Those 75 and older benefit from an additional 10% increase, which translates to $814.10 monthly.

It’s important to note that the full OAS pension requires 40 years of residence in Canada after age 18. Partial benefits are available if you’ve lived in Canada between 10 and 40 years, with the benefit calculated proportionally.

Additionally, income levels influence your benefits. If your income exceeds the set threshold (about $148,451 for 2024), a recovery tax kicks in, and you may have to repay part or all of your OAS benefits.

When Will the November 2025 Payment Arrive?

Most Canadians can expect their OAS payment on November 26, 2025. The government processes payments through direct deposit, making it fast and secure. If you haven’t enrolled in direct deposit, payments might come via cheque, which could take a few extra days.

Ensuring your banking details are up-to-date in your My Service Canada Account will help guarantee you receive your benefits promptly.

Why Does the OAS Increase Matter?

The modest 0.7% adjustment might seem small, but it plays a critical role in maintaining seniors’ quality of life. As the cost of living increases, especially for essentials like food and housing, this adjustment acts as a buffer, preventing seniors from falling behind financially.

Since the pension is indexed quarterly, seniors benefit from annual updates that keep pace with inflation. This prevents erosion of purchasing power and safeguards the financial well-being of Canada’s aging population.

The Historical Context of OAS

The Old Age Security program was launched in 1952, marking a major milestone in Canadian social policy, aiming to create a safety net for aging Canadians. Initially, it was a flat-rate pension for seniors aged 70 and over, regardless of income (with a maximum of $40/month). Over the decades, the program has evolved significantly with key reforms:

- The age of eligibility was lowered from 70 to 65 in 1966.

- A corresponding Guaranteed Income Supplement (GIS) was introduced to assist low-income seniors.

- The benefit amounts have increased periodically, especially with inflation adjustments.

- Numerous amendments have expanded eligibility, especially for residents with years of residence but limited contribution histories.

The program’s expansion was driven by the recognition that many seniors live below the poverty line, especially during and after the Great Depression, and the economic pressures of the 1930s and 40s emphasized the need for a comprehensive federal approach.

This evolution reflects Canada’s commitment to social justice and economic stability for seniors, ensuring that older Canadians can retire with dignity and financial security.

Comparing OAS with Other Retirement Benefits

While OAS is the foundation of Canada’s pension system, it’s complemented by other benefits:

| Pension Plan | Source | Who Benefits | Max Monthly Payment (2025 est.) |

|---|---|---|---|

| Old Age Security (OAS) | Federal Government | All seniors post-65 | $740.09 to $814.10 |

| Canada Pension Plan (CPP) | Employment-based contributions | Working Canadians pre-retirement | About $1,200 – $1,400 on average |

| Guaranteed Income Supplement (GIS) | Federal Government | Low-income OAS beneficiaries | Up to $1,000+ in addition |

| Employer Pensions | Private or public sector | Employed Canadians | Varies depending on plan |

These sources together provide a more comprehensive income during retirement, with OAS serving as the baseline for most Canadians.

Practical Planning Tips for Retirees and Future Retirees

Whether you’re already retired or still working, strategic planning around OAS can maximize your financial security:

1. Consider Delaying OAS Benefits

You can defer claiming OAS up to age 70, increasing the payment by 0.6% monthly, which totals a 36% boost if delayed five years. This is especially advantageous if you have other income streams in early retirement and want to maximize future benefits.

2. Manage Income to Prevent Clawbacks

If your net income exceeds the threshold of $90,997 (2024), you will need to repay part of your OAS benefits through a recovery tax. Employ tax planning strategies, such as RRSP withdrawals or splitting income, to stay below the threshold.

3. Enroll in Direct Deposit

Avoid delays and risks associated with cheques by setting up direct deposit. It guarantees your money arrives safely and on time.

4. Leverage Online Tools

Use the Government of Canada’s OAS Benefits Estimator to project your benefits based on different scenarios.

Step-by-Step Guide: Applying for and Managing Your OAS Increase in November 2025

Step 1: Verify Eligibility

Ensure you meet age and residency requirements. Usually, you qualify if you are 65 or older, have lived in Canada for at least 10 years for partial benefits, and 40 years for full benefits.

Step 2: Apply Appropriately

Apply online six months before your 65th birthday via the Service Canada Account portal or by mail. Early application ensures smooth processing.

Step 3: Choose Your Payments Method

Opt for direct deposit to receive your benefits promptly each month, or select cheque delivery if preferred.

Step 4: Stay Informed & Renew

Review your income annually, and update your information with Service Canada to ensure your benefits remain accurate. Keep an eye on inflation updates and policy changes.

Step 5: Explore Additional Supports

Apply for the Guaranteed Income Supplement (GIS) or provincial supplements if your income falls below qualifying thresholds.

CRA Sending Double Payments in November 2025: $1,700 OAS + $650, Are You Eligible?

Canada Extra GST Payment In November 2025 – Know Amount, Eligibility & Dates

Canada CRA Benefits Payment Dates For November 2025: Check Payment Amount, Eligibility