Additional One-Time $2385 CPP Payment: If you or someone you know is a senior in Canada, you’ve probably heard talk about an additional one-time $2385 CPP payment coming in November 2025. But what’s the truth behind this number? Will seniors actually see an extra $2,385 in their bank accounts this fall? This article will break down the facts simply and clearly—easy enough for a 10-year-old to understand, yet detailed and authoritative to offer valuable insights for professionals.

You will get the lowdown on what the Canada Pension Plan (CPP) is, what the upcoming November 2025 payment includes, who’s eligible, how the whole program works, and practical tips to make sure you get all the benefits you’re entitled to.

Table of Contents

Additional One-Time $2385 CPP Payment

While the $2385 figure floating around is more noise than fact, the Canadian government is indeed giving seniors a meaningful one-time CPP boost of about $758 in November 2025 to help with inflation and costs of living. This extra cash joins your regular pension payment automatically—no hoops, no hassle. Stay sharp: Make sure your CPP enrollment is current, update banking and tax info, and budget smartly to make the most of this financial lift. The CPP remains a cornerstone of Canada’s retirement system, helping millions maintain dignity and financial independence in their golden years.

| Topic | Details |

|---|---|

| One-time CPP Boost | About $758 extra added on top of the regular November 2025 CPP payment |

| Regular November CPP Payment Date | November 26, 2025 (direct deposit) |

| Eligibility Age | 60 years and older, receiving CPP by Nov 1, 2025 |

| Income Limit | Under $85,000 based on 2024 tax filing |

| No Action Required | Payment is automatic for eligible seniors |

| CPP Maximum Monthly Payment 2025 | $1,433 |

| Average Monthly Payment Mid-2025 | Around $844 |

| Official Info Link | Canada.ca – CPP Payment Amounts |

What Is the CPP and Why Does It Matter?

The Canada Pension Plan (CPP) is a federal program that helps Canadian workers save for retirement. When you work and make CPP contributions through payroll deductions, you earn credits that translate to monthly payments when you retire. CPP also covers disability benefits and survivor pensions, helping families in tough times.

Established in 1966, CPP has grown into one of Canada’s most important social safety nets, providing monthly, taxable pensions to millions. For 2025, the maximum CPP retirement payment is $1,433 per month, but most recipients get less, averaging around $844 monthly.

The Real Scoop on the November 2025 Additional One-Time $2385 CPP Payment

Is It Really $2385? Not Exactly

A lot of buzz exists online and in social circles about a whopping $2,385 supplementary payment in November 2025, but official government announcements don’t support this figure. Instead, seniors should expect a one-time CPP boost of approximately $758 during their regular November payment. This bump reflects efforts to offset inflationary pressures and rising costs of living.

So, if you usually get $750 in CPP, your November payment could be around $1,508 once the boost is applied.

When Will the Payment Arrive?

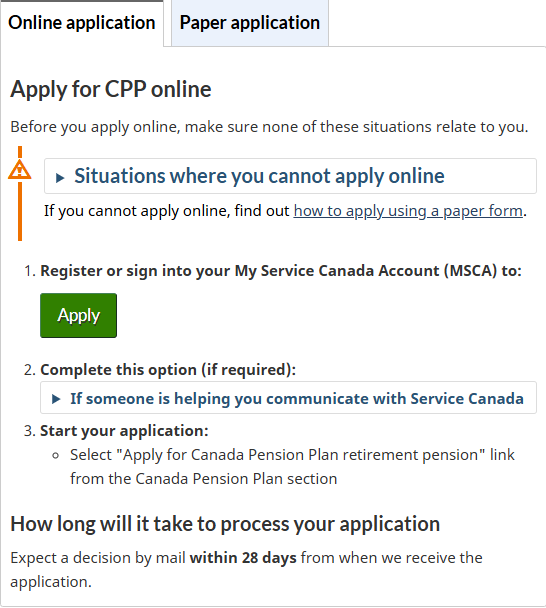

- Regular CPP payments for November 2025 are scheduled for November 26, 2025 via direct deposit.

- The one-time extra boost will be included in this deposit, so you don’t need to wait or apply separately.

- Those who receive mailed checks can expect their payment a few days following the direct deposit date.

Who Qualifies for This Extra Boost?

Not everyone gets this extra cash, so here’s who’s in:

- You must be 60 years or older as of November 1, 2025.

- You should already be receiving CPP retirement benefits by that date.

- Your income in 2024 must be below $85,000 to qualify.

- The boost only applies to CPP recipients; if you don’t get CPP payments, you won’t see this extra.

A Little History: CPP’s Role in Canadian Society

The CPP was created in 1966 to provide Canadian workers with a reliable source of retirement income. Before CPP, pensions were patchy, tied to specific jobs, or non-existent for many. The plan was designed as a portable, contributory program that ensures workers carry retirement savings with them regardless of the job.

Over the years, CPP has helped drastically reduce senior poverty in Canada—a drop from nearly 37% poverty rate in 1976 to about 12% by 2010 is largely thanks to CPP and the related Quebec Pension Plan (QPP) [source: Conference Board of Canada].

The CPP Fund is managed professionally by CPP Investments (CPPIB), one of the world’s largest pension funds, ensuring the plan stays strong and sustainable for future generations.

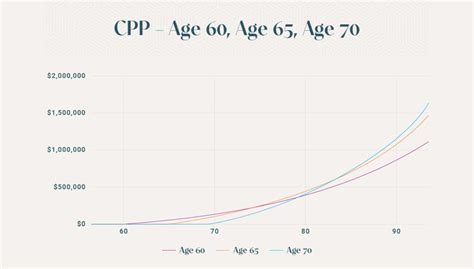

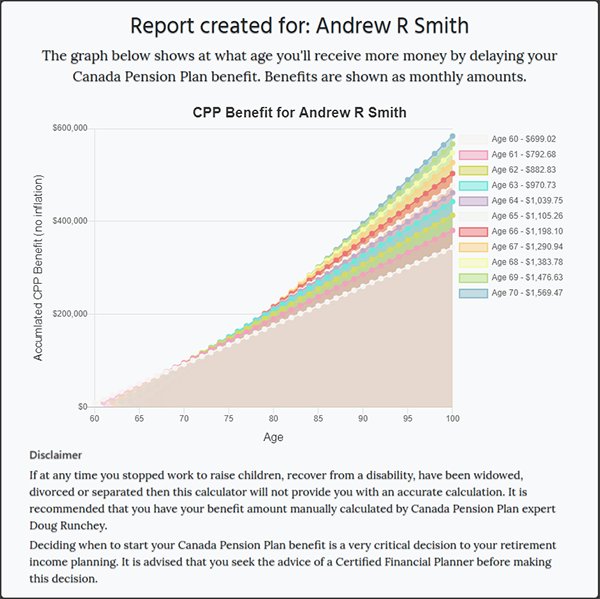

How Does CPP Work Throughout the Year?

Monthly CPP payments arrive like clockwork. Here’s what you should know:

- CPP pays benefits once per month, usually in the last week.

- Payments come via direct deposit or mailed check.

- The amount depends on your contributions—you get what you put in, plus adjustments for inflation and cost of living.

- CPP is taxable income, so keep track when filing your tax returns.

Financial Planning Tips for Seniors Receiving CPP

Getting that extra $758 this November is great—but it should be part of a bigger plan to keep your finances healthy.

- Budget smartly: Use the boost to cover essential expenses or catch up on bills rather than splurging.

- Set aside some savings: If you can, stash some for emergencies. Inflation might not let up anytime soon.

- Review your tax situation: Since CPP is taxable, make sure you’re aware of tax obligations.

- Check other benefits: Seniors may qualify for Old Age Security (OAS) or Guaranteed Income Supplement (GIS) as well. Combining your income sources can improve financial comfort.

- Consult a financial advisor: Especially if you have investments or private pensions, coordinating them with your CPP income is wise.

Real-Life Example: How the Boost Helps

Take Mary, 67 years old, regularly receiving $850 a month from CPP. In November 2025, she gets her usual payment plus the $758 boost, totaling $1,608. With her usual expenses of $1,500 monthly, that extra cash helps her cover unexpected medical bills and grocery price hikes without stress.

For John, 62, who started CPP early with a lower monthly amount, this boost adds a significant slice to his retirement income—giving him peace of mind amid inflation.

Comparison: CPP Boost vs. Similar International Pension Programs

Canada’s approach to supplementing senior income through one-time boosts or adjustments mirrors trends in countries like the US, UK, and Australia:

| Country | Pension Program | Recent One-Time/Increased Payments | Purpose |

|---|---|---|---|

| Canada | Canada Pension Plan | $758 one-time boost in Nov 2025 | Inflation relief |

| USA | Social Security | Occasional Cost-Of-Living Adjustments (COLA) | Offset rising costs |

| UK | State Pension | Winter Fuel Payment & occasional bonus | Help with heating and inflation |

| Australia | Age Pension | Supplementary payments in certain years | Support vulnerable seniors |

Canada’s lump-sum boost has similarities to these but tends to be larger relative to the regular monthly benefit.

CRA Benefits Payment Dates in November 2025 – OAS, CPP & CWB Benefits Date

CPP $782 + $758 Extra Deposit For November 2025, Check Who Is Eligible?

New CPP/OAS and GIS Payment for Canadian Seniors in November 2025: Check Payment Amount