$2350 Relief for Canadian Seniors: Hey there, seniors! If you’re living the Canadian dream and wondering about that much-talked-about $2350 relief payment coming around in 2025, you’ve hit the jackpot with this guide. This article is your go-to source for all the info you need about snagging that sweet one-time payment—from who qualifies to when and how you’ll get paid, plus a deep dive into other benefits that could boost your retirement cash flow. Let’s break it down easy-peasy so you can keep your money game tight.

Table of Contents

$2350 Relief for Canadian Seniors

Navigating benefits for seniors can be a maze, but the $2350 relief payment in 2025 is a straightforward, generous lifeline to help handle rising costs. If you’re 65+, have lived in Canada long enough, and filed your taxes, you should be on track to receive it—automatically and hassle-free. Keep your accounts current, avoid scams, and plan your finances wisely with this extra support. Combined with your regular OAS, GIS, and CPP, you’ve got a solid setup to keep your golden years shining bright and comfortable.

| Topic | Details |

|---|---|

| Payment Amount | Up to $2350 one-time relief payment |

| Eligibility Age | 65 years or older |

| Residency | Minimum 10 years in Canada after age 18 |

| Income Limits | Income-based thresholds apply |

| Payment Date | November 27, 2025 (regular OAS payment date); $2350 mostly disbursed earlier in 2025 |

| How to Claim | Automatic, no separate application |

| Other Benefits | Old Age Security, Guaranteed Income Supplement, Canada Pension Plan |

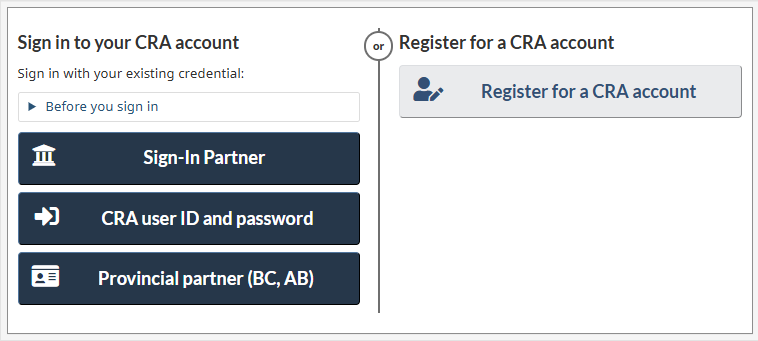

| Resources | Canada Revenue Agency |

Why This $2350 Relief for Canadian Seniors is a Big Deal?

Rising costs got you stressed? You’re not alone. Between higher grocery bills, medical expenses, and utility hikes, many seniors on fixed incomes are feeling the pinch. That’s why the Canadian government stepped up with the $2350 relief payment in 2025—a one-time cash injection meant to ease the financial squeeze.

Make no mistake: this isn’t an ongoing pension bump; it’s a special boost to help cover those surprise expenses or give you a little breathing room. Consider it extra cash to get through tough months, pay down bills, or even treat yourself to something nice.

The timing couldn’t be better, with inflation creeping up and fixed incomes struggling to keep pace. This payment shows the government recognizes these challenges and wants to support seniors who’ve earned their rest.

Who Qualifies? Breaking Down Eligibility

You might be thinking, “Am I even gonna get this?” Here’s what you need to qualify:

Age and Residency

To qualify, you gotta be aged 65 or older on the date of payment. Plus, you need to have been a resident in Canada for at least 10 years after turning 18. These residency requirements ensure the relief payment goes to folks who’ve built their life here.

Income Limits

Income is a big factor. The CRA sets income thresholds based on your latest tax return (for 2024) to target seniors on low or moderate incomes. If your income’s too high, you might not qualify for the full amount.

Tax Filing Status

Filing your tax return on time is crucial. The CRA uses your 2024 taxes to determine eligibility, so seniors who don’t file may miss out. Even if you don’t owe taxes, filing is essential to get benefits.

Receiving Other Benefits

If you already receive the Old Age Security (OAS) pension or the Guaranteed Income Supplement (GIS), you’re likely in the mix for this relief. These programs work together to support senior finances.

When Will You See the Money?

The official OAS payment for November 2025 is scheduled for November 27. This is when many seniors get their regular monthly pension deposits. The $2350 relief payment itself was mainly disbursed as a lump sum earlier in 2025.

If you are set up for direct deposit, the money goes straight into your bank account, usually the fastest, safest way to get benefits. If not, a cheque will be mailed, but setting up direct deposit is highly recommended to avoid delays or lost mail.

How to Secure $2350 Relief for Canadian Seniors: A Step-by-Step Guide

Let’s keep your money flowing smoothly. Follow these steps:

Step 1: Check Your Eligibility

Go to CRA’s or Government of Canada’s official websites to confirm you meet the age, residency, and income rules. This step helps avoid surprises down the road.

Step 2: File Your 2024 Taxes ASAP

Don’t drag your feet. The CRA relies on your 2024 tax return to verify income. If you haven’t filed, get on it immediately.

Step 3: Get or Confirm Direct Deposit

Update your banking info in CRA’s My Account and Service Canada Account portals to ensure your payments hit your account fast and safe.

Step 4: Monitor Your Payments

Check online regularly to track your benefit status and upcoming payments. Don’t wait until payday to find out there’s a problem.

Step 5: Beware of Scams

CRA never asks for passwords or financial info via phone or email. Watch out for phishing scams and only trust official channels for your info.

Other Senior Benefits to Know in 2025

Your financial toolbox isn’t just the $2350 relief—here’s what else you should keep on your radar:

Old Age Security (OAS)

This monthly pension is the backbone of senior income. In late 2025, max payments hover around $740 to over $1100 depending on your income and marital status. It’s inflation-adjusted, so it grows with the cost of living.

Guaranteed Income Supplement (GIS)

GIS kicks in if your income is low. It’s a monthly add-on to your OAS that helps cover essentials.

Canada Pension Plan (CPP)

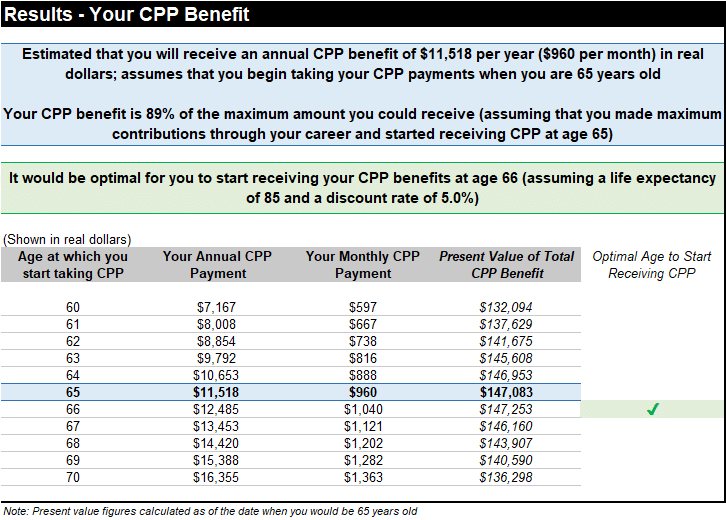

Your employer and you have contributed for years, and now it pays out retirement income based on how much you put in.

Provincial Benefits

Many provinces top up federal programs with extra perks or financial help, so check your local resources too.

How to Use This Extra Cash Wisely?

Money in hand is good, but how you use that $2350 relief can make the difference between stress and peace of mind:

- Cover urgent bills: Catch up on utilities or rent.

- Pay for medical costs: Prescription meds, dental, or vision not covered.

- Emergency fund: Set some aside if you can.

- Treat yourself: Because you earned it!

Smart planning is key—don’t rush to spend it all at once.

Canada Extra GST Payment In November 2025 – Know Amount, Eligibility & Dates

Canada CRA Benefits Payment Dates For November 2025: Check Payment Amount, Eligibility

Canada Cost of Living Increase in November 2025 – Check How much? Payment Date