CRA Benefits Payment Dates: If you’ve been waiting for the latest scoop on CRA benefits payments for November 2025, this article has got you covered. The Canada Revenue Agency (CRA) delivers crucial financial support to millions of Canadians through programs like the Canada Child Benefit (CCB), GST/HST credit, Old Age Security (OAS), and Canada Pension Plan (CPP). Knowing when your benefits drop can help you manage expenses, plan bills, and avoid money stress. This guide breaks down the payment dates, eligibility criteria, and benefit amounts in a simple, conversational style anyone can understand—whether you’re new to these benefits or managing finances like a pro.

Table of Contents

CRA Benefits Payment Dates

CRA benefits are vital financial supports for families, seniors, workers, and low-income Canadians. November 2025 promises important deposits including the newly introduced $300 Federal Payment, alongside regular supports like the CCB and pensions. These payments make a tangible difference, helping Canadians meet everyday expenses and plan for the future. Remember, understanding your benefits and knowing when payments land empowers smarter money management so you can focus on living your best life.

| Benefit Name | November 2025 Payment Date | Estimated Average Amount | Eligibility Criteria Summary |

|---|---|---|---|

| Canada Child Benefit (CCB) | November 20, 2025 | ~$620 per child | Resident, filed 2024 taxes, child under 18 |

| GST/HST Credit | October 3, 2025 (Next prior), April 4, 2026 (Next) | ~$496 quarterly | Resident, low/moderate income |

| Old Age Security (OAS) | November 27, 2025 | ~$713 monthly | 65+ years old, legal resident, low income |

| Canada Pension Plan (CPP) | November 27, 2025 | ~$1,307 monthly | Contributors, retired or disabled |

| Canada Workers Benefit (CWB) | November 25, 2025 | Varies, advance $350 | Working low-income individuals and families |

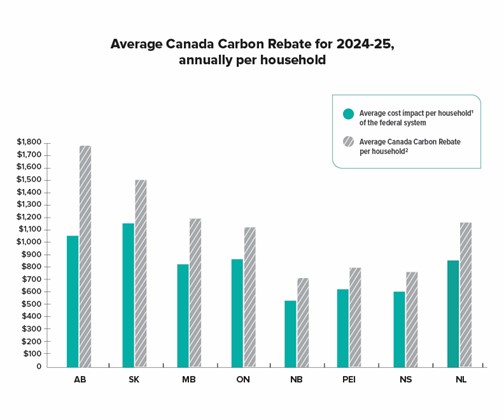

| Climate Action Incentive Payment | January 15 & April 22, 2025 | ~$188 per adult | Living in provinces with carbon pricing |

Why CRA Benefits Payment Dates Matter?

Whether you’re a parent budgeting for kids, a senior counting on pension income, or a hard-working individual balancing bills, the timing of your CRA benefits can make a big difference. These payments ease financial burdens and help families, seniors, workers, and low-income Canadians stay afloat. By knowing the exact schedule, you stay ahead, avoid surprises, and budget confidently.

Understanding these dates helps you avoid unnecessary calls to CRA, reduces anxiety about when payments will hit, and empowers you to plan expenditures like rent, groceries, or saving for emergencies. This is especially important during times of inflation or economic uncertainty when every dollar counts.

Note: Dates and amounts are approximate and may vary by individual circumstances.

What CRA Benefits Payments Are Coming in November 2025?

Here’s the lowdown on the major payments scheduled for November 2025—and why they matter:

1. Canada Child Benefit (CCB) – November 20, 2025

The CCB is a tax-free monthly payment helping families offset costs related to raising children under 18. Besides food and clothing, the money often goes toward school supplies, extracurricular activities, and childcare. The amount you get depends on your family income and number of children. Filing your 2024 tax return on time is critical to ensure you receive the full benefit without delays or interruptions.

For example, a family with two children and an income below $70,000 could receive close to $1,240 in November’s CCB payment alone. This support can be a game changer—helping families overcome tight budgets and invest in their children’s futures.

2. GST/HST Credit – October 3, 2025 (Next prior), April 4, 2026 (Next)

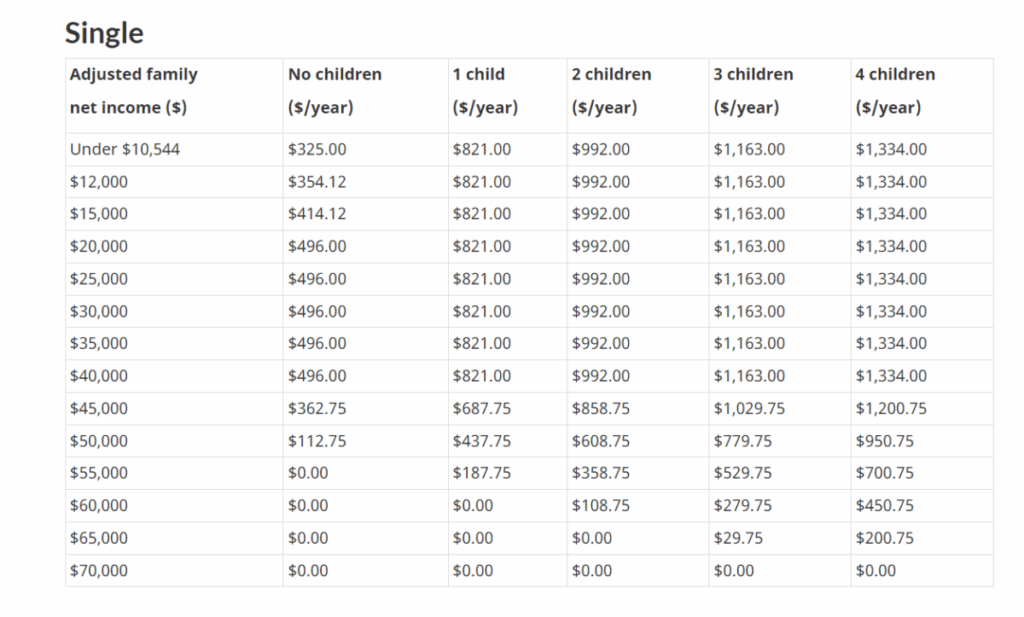

Paid quarterly, this credit helps offset the federal and provincial sales taxes paid when buying goods and services. The average quarterly payment is about $496, though this varies based on family size and income. This credit is especially helpful for individuals and families with moderate to low incomes by easing the impact of regressive consumption taxes.

You don’t need to apply separately; eligibility is automatically determined based on your latest tax filing. This is why timely and accurate tax returns matter.

3. Old Age Security (OAS) and Canada Pension Plan (CPP) – November 27, 2025

OAS and CPP form the backbone of retirement income for seniors. OAS is a universal payment for Canadians 65 and older who meet residency requirements, averaging about $713 per month. CPP benefits depend on your contribution history and retirement age, averaging roughly $1,307 monthly. Both amounts are adjusted annually to keep pace with inflation.

These payments provide stable, predictable income for retirees, helping with everyday costs from housing to healthcare. Seniors are advised to keep their contact and banking info up to date to prevent payment delays.

4. Canada Workers Benefit (CWB) – November 25, 2025

The CWB offers financial relief to low-income workers through a refundable tax credit. An advance payment of approximately $350 is issued in November to eligible workers, with the total benefit depending on income and family configuration. This program incentivizes employment by supplementing low wages and reducing poverty.

Single workers without children typically qualify if their income is below about $33,000, while families can earn more and still be eligible.

5. CRA $300 Federal Payment – November 20-30, 2025

New for this year, the $300 Federal Payment aims to assist low- and middle-income Canadians with inflationary pressures and rising living costs. Eligible recipients are automatically identified based on their 2024 tax returns and income thresholds. Payments will be made via direct deposit or mailed cheque.

The introduction of this payment reflects the federal government’s commitment to providing targeted relief during economic challenges and is a welcome support for Canadians budgeting tighter in 2025.

6. Climate Action Incentive Payment (CAIP)

While paid separately in January and April, this benefit deserves mention as it offsets carbon pricing costs in some provinces. Recipients receive around $188 per adult yearly, which helps reduce energy costs related to carbon taxes.

Who Qualifies for CRA Benefits Payment?

Understanding eligibility is key to accessing these benefits:

- Residency: Must be a Canadian resident for tax purposes.

- Tax Filing: Filing an income tax return annually is mandatory—even with zero income—to maintain eligibility.

- Income Thresholds: Many benefits phase out at higher income levels; exact limits vary by program.

- Age & Family Status: Seniors qualify for OAS and CPP at 65+, while families with children qualify for CCB based on child age.

- Updated Personal Info: Changes in marital status, address, income, or family size should be reported immediately to avoid payment delays or incorrect amounts.

For example, newcomers to Canada are considered residents for tax purposes from the date they start living in Canada and need to file taxes to claim benefits. Some programs like the Canada Disability Benefit also require additional criteria like approved disability status and age between 18 and 64.

Sponsorship during immigration can affect eligibility, particularly for benefits like the Guaranteed Income Supplement for seniors.

The Canada Workers Benefit is aimed at those with earned income meeting specific thresholds depending on marital and family status. Filing taxes correctly and on time activates these benefits automatically.

Tips for Smoother CRA Benefits and Faster Payments

Navigating government benefits is easier when you use these strategies:

- File Early and Accurately: Early filing avoids backlogs and ensures eligibility is confirmed promptly.

- Sign Up for Direct Deposit: It’s the safest, fastest way to receive your benefits—no postal delays or cheque loss.

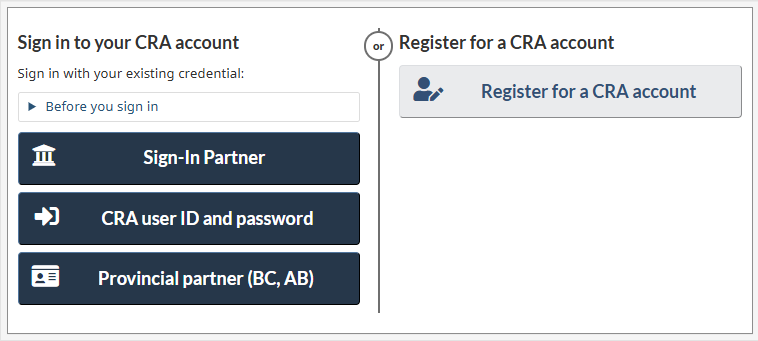

- CRA My Account: This online portal lets you check payment status, update your info, and set up alerts.

- Report Life Changes Immediately: Failing to update marital status, income, or addresses can cause payments to stop or be miscalculated.

- Beware of Scams: CRA will never call or email demanding personal info—always check official CRA communications.

Using CRA’s online tools can save you time and reduce stress. For example, enable email or SMS alerts to get instant notification when payments are made or if action is needed.

CRA Benefits Payment November month Dates 2025: Check Provincial, Territorial Benefit Schedule

Canada $1700+$650 CRA Double Payment in November 2025: Check Payment Date & Eligibility Criteria

CPP, OAS, CWB, CAIP, GST & HST By CRA Payment Dates in November 2025 – Know Amount

What to Do If You Miss a Payment?

Missed payments happen for various reasons, but timely follow-up is crucial:

- Log into CRA My Account to verify if payment was issued.

- Double-check that your personal info and banking details are current.

- Contact CRA if payment is delayed more than 10 business days past the scheduled date.

- Overpayments may require repayment; keep track to avoid surprises.

- Consider using CRA’s automated phone line for quick inquiries.

Understanding these steps can help you resolve issues quickly without waiting too long or missing out on entitled funds.