Canada $3500 Old Age Security Payment: Heard the buzz about a $3500 Old Age Security (OAS) payment heading to every senior’s bank account this November 2025 in Canada? This kind of claim catches attention, especially on social media and in cross-border conversations with neighbors in the United States. So here’s the straight talk: Is Canada really dropping a $3500 lump sum to all its seniors? Spoiler alert: No. But let’s break down what’s really happening with Canada’s OAS benefits, why misinformation spreads, and what seniors can actually expect. Canada’s Old Age Security program is a cornerstone of its public pension system. Designed to help seniors maintain financial security, it delivers a steady monthly pension to qualified Canadians aged 65 and older. However, claims about a sudden big payout like $3500 don’t match the official facts and can lead to confusion among seniors and their families.

Table of Contents

Canada $3500 Old Age Security Payment

To sum it up, the $3500 Old Age Security lump-sum payment for all Canadian seniors in November 2025 is false news. Reliable government data confirm seniors will receive their regular monthly OAS payment near $808.45 CAD, modestly adjusted for inflation. Understanding the OAS legacy, eligibility, supplementary benefits, and future trends arms seniors, families, and advisors with the knowledge to confidently navigate retirement finances. Confirm latest benefit information and avoid falling for misleading rumors.

| Topic | Details |

|---|---|

| Program Name | Old Age Security (OAS) |

| Eligible Group | Canadian seniors aged 65 and older |

| Typical Monthly Payment Amount (Nov 2025) | Approximately $808.45 CAD |

| Payment Date | Around third week/month, next on Nov 27, 2025 |

| Basic Eligibility | Age 65+, 10+ years residency in Canada after age 18 |

| Full Payment Requirement | 40 years residency for full payment |

| Payment Adjustments | Indexed quarterly based on inflation (0.7% increase from Oct-Dec 2025) |

| Official Info Source | Government of Canada – OAS Page |

What Is the Old Age Security (OAS) Program?

The Old Age Security program was launched in 1952 as Canada’s pioneering universal pension system aiming to ease the financial strains faced by aging citizens. Unlike many pension systems worldwide, OAS does not depend on your employment history or contributions over your working years. Eligibility hinges primarily on age and residency status.

To qualify, you must be 65 or older and have lived in Canada for at least 10 years after your 18th birthday. For the full pension, a residency of 40 years or more after age 18 is required. Payments are set monthly, with deposits typically made by the Canada Revenue Agency (CRA) around the third week of each month. For November 2025, payments are scheduled for November 27.

This program serves as a bedrock of financial security for seniors who might not have substantial private retirement savings or workplace pensions. It helps ensure a dignified standard of living for millions of Canadians in their golden years.

Is the Canada $3500 Old Age Security Payment Real?

The short and direct answer is no. There is no official confirmation or government announcement about a $3500 lump sum being paid to all Canadian seniors in November 2025.

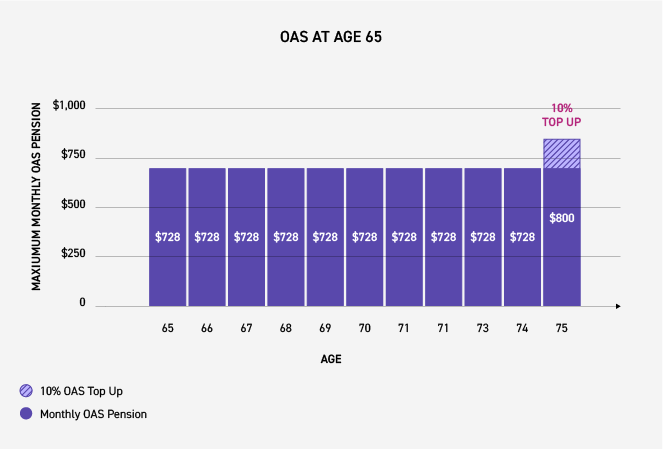

What seniors will receive is their regular monthly OAS payment, which for November 2025 will be approximately $808.45 Canadian dollars, thanks to a small inflation adjustment. Seniors aged 75 and older receive an automatic 10% increase, slightly boosting their payment amount.

Rumors of large one-time OAS payouts often arise from misunderstandings or misleading posts circulated on social media and websites. These claims lack official backing, and relying on them can lead to misplaced expectations or even scams targeting seniors.

What to Expect for OAS Payments in November 2025?

Here’s the detailed scoop on what payments will look like:

- The maximum monthly OAS payment for seniors aged 65 to 74 is about $740.09 CAD before adjustment.

- Seniors 75 and older receive a 10% boost, bringing the payment to nearly $814.10 CAD.

- Payments are adjusted quarterly based on inflation. For October to December 2025, an increase of 0.7% was applied, resulting in the updated November payment amounts.

- Those with less than 40 years of residency receive a prorated amount based on years spent in Canada after age 18.

So, while seniors receive an important monthly income boost from OAS, it is not a one-shot, massive payment like $3500.

How Did Canada’s Old Age Security Get Started?

Understanding the history of OAS sheds light on its significance and scope today. The struggle to create a federal pension system began in the early 20th century. Canada’s first pension program, the Old Age Pensions Act of 1927, was means-tested and limited in scope; only poorer British subjects aged 70 or over with low income qualified, and the maximum pension was just $20 per month.

The Great Depression exposed the inadequacy of these limited pensions, sparking increasing calls for universal social security. In 1951, the Liberal government passed the Old Age Security Act, establishing the first universal pension in Canada, effective 1952. Unlike previous programs, this one offered flat-rate monthly payments available to all seniors with sufficient residency, regardless of employment history.

Over time, the program expanded with the introduction of the Guaranteed Income Supplement (GIS) in 1967, offering additional support for low-income seniors. Inflation indexing began in 1973 to preserve benefit value. More recently, eligibility age changes and new supplements have been introduced in response to demographic shifts.

This evolutionary journey highlights Canada’s commitment to fighting senior poverty and ensuring dignity in retirement.

Supplementary Benefits for Canadian Seniors

The OAS pension is just part of the support system for seniors:

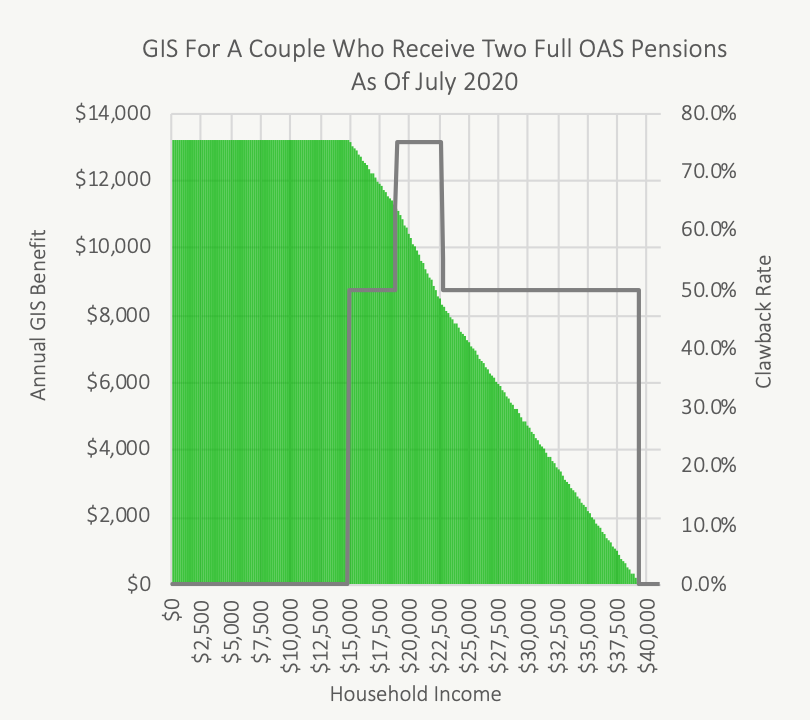

- Guaranteed Income Supplement (GIS): This monthly, non-taxable benefit helps low-income seniors bridge the income gap. Payments can range from a few hundred to over a thousand dollars monthly depending on income levels.

- Allowance and Allowance for the Survivor: These help low-income Canadians aged 60-64, including spouses of GIS recipients.

For example, in the 2022-2023 fiscal year, GIS expenditures exceeded $16 billion, helping over 2.3 million seniors receive additional income support. Seniors with modest income levels (under approximately $21,000 annually for singles) rely heavily on GIS to maintain financial stability.

Comparing Canadian OAS and U.S. Social Security Payments

For those in the United States or considering retirement planning across borders, here’s a clear look at how the two systems compare:

| Feature | Canadian OAS | U.S. Social Security |

|---|---|---|

| Eligibility | 65+ years old, 10+ years residency | Age 62+ with work credits |

| Payment Type | Flat-rate monthly pension (based on residency) | Earnings-based monthly benefit |

| Max Monthly Payment (2025) | About $808 CAD (~$600 USD) | Average $1,800 – $2,000 USD |

| Extra Supplements | GIS, Allowance | Supplemental Security Income (SSI) |

| Payment Adjustments | Quarterly, based on Consumer Price Index | Annual Cost of Living Adjustments (COLA) |

Canada’s OAS provides a universal floor of income security, while the U.S. Social Security benefits are earnings-related and tend to be higher on average. Both include additional supplements and government programs targeting low-income seniors.

Tips to Maximize Your Retirement Income from OAS

Here are some practical retirement tips:

- Apply on Time: OAS benefits don’t begin automatically at 65. Filing your application early ensures payments start promptly.

- Keep Documents Updated: Annual income declarations are necessary for continued GIS benefits and avoid cuts due to outdated data.

- Investigate Provincial Programs: Provinces offer seniors’ benefits, tax credits, or health subsidies that can stack on top of OAS.

- Plan for Taxes: OAS income is taxable; proper planning can reduce year-end surprises.

- Consider Deferral: Deferring OAS payments past age 65 increases monthly benefits by 0.6% each month up to age 70—potentially boosting your income significantly.

Future of Old Age Security: What to Watch For

Canada’s population is aging rapidly, prompting ongoing discussion about OAS sustainability. The government has already started gradually raising the eligibility age from 65 to 67, a transition running through 2029.

Other potential reforms may include:

- Tweaking benefit formulas to balance finance and fairness.

- Increasing benefits for vulnerable seniors.

- Expanding supplementary programs to reduce poverty.

Keeping up-to-date with official announcements is key to planning effectively.

Canada Extra GST Payment In November 2025 – Know Amount, Eligibility & Dates

Canada CRA Benefits Payment Dates For November 2025: Check Payment Amount, Eligibility

Canada Cost of Living Increase in November 2025 – Check How much? Payment Date