Canada $1050 CRA Pension: If you’re tuning in from the U.S. or living the Canadian dream north of the border, here’s the scoop: the Canada Revenue Agency (CRA) is gearing up to drop the $1050 pension payment this November 2025. Whether you’re a retiree eyeing that sweet monthly check or a financial planner mapping out retirement visions, it’s crucial to get your facts straight about who’s eligible, when the cash hits, and what this pension actually means for your wallet. The Canada Pension Plan (CPP) is Canada’s crown jewel in providing financial security to retirees and disabled Canadians. This November, the expected average pension hits around $1050, making it a critical piece of income for millions. This article breaks down all you need to know—from eligibility, payment schedules, to maximizing benefits—in a clear, conversational style that’s easy to grasp but loaded with expert insight.

Table of Contents

Canada $1050 CRA Pension

The upcoming $1050 CRA pension payment in November 2025 is more than just a check—it’s a foundational element of financial security for millions of Canadian seniors. Knowing who qualifies, when payments arrive, and how to enhance your benefits empowers you to navigate retirement confidently. Plan ahead, stay updated, and make sure you’re getting every dollar you deserve.

| Aspect | Details |

|---|---|

| Payment Type | Canada Pension Plan (CPP) |

| Average Payment Amount | Approximately $1,050 (varies depending on contribution and age) |

| Eligibility | Must be 60 years or older with at least one valid CPP contribution |

| Payment Date | November 27, 2025 |

| Maximum Monthly Pension (2025) | $1,433 (for full CPP recipients retiring at age 65) |

| Payment Method | Direct deposit to bank accounts |

| Apply Through | My Service Canada Account |

What Is the CRA Pension Exactly?

The Canada Revenue Agency pension most people talk about is the Canada Pension Plan (CPP) retirement benefit. When you work in Canada, a portion of your paycheck goes toward the CPP. Over time, this builds the fund that provides you with monthly income during retirement or if you become disabled.

CPP is one of three pillars in Canada’s retirement income system, along with Old Age Security (OAS)—a flat-rate pension based primarily on residency—and the Guaranteed Income Supplement (GIS) that supports low-income seniors. CPP is unique because it’s tied to how much and how long you contributed during your working years, giving it a personal investment feel.

Think of CPP as a pension you earn, almost like a retirement paycheck based on your own work history. It aims to replace a portion of your pre-retirement income, helping you maintain your financial independence and lifestyle after you stop working.

Who’s Eligible for the Canada $1050 CRA Pension?

Here’s the lowdown on eligibility, with added details to paint the full picture:

- Age Requirement: You need to be at least 60 years old to start receiving your CPP retirement pension. You can choose to delay starting until age 65 (which is when you get the standard benefit) or even up to age 70 to increase your monthly payments.

- Contribution History: To qualify, you must have made at least one valid CPP contribution during your working life in Canada. Valid contributions are usually made through payroll deduction from salaries or business income taxes.

- Valid Contributions from Others: If you’re divorced or separated, you may be able to receive credits from your former spouse or common-law partner’s contributions—this can help increase your CPP payout.

- Residency Conditions: Your primary place of residence should be Canada, but CPP payments are often available internationally, especially where Canada has social security agreements (e.g., USA, UK, Australia).

- Québec Residents: Quebec has its own pension plan called the Québec Pension Plan (QPP). If you worked or lived there, your benefits may come from QPP, but these programs coordinate to make sure you’re fully covered.

- Post-Retirement Benefit (PRB): If you keep working while receiving CPP (anytime between ages 60 to 70), you continue making contributions, earning additional retirement income through PRB. It’s like a bonus that adds to your monthly pension each year you contribute post-retirement.

- Death and Estate Rules: If you pass away before receiving CPP and are under 70, no payment goes to anyone else. However, if you are older than 70 and had not applied, your estate might claim up to 12 months of payments retroactively.

When Do You Get Paid? Mark Your Calendar!

The November 27, 2025 date is your go-to—when direct deposits usually hit the bank accounts of millions of Canadians receiving CPP and other CRA benefits.

Why direct deposit? It’s faster, safer, and ensures you don’t have to worry about lost or delayed cheques, especially with holiday seasons and banking holidays around. Not set up yet? Log into your My Service Canada account to link your bank details and avoid payout hiccups.

If you miss a deadline or don’t apply on time, payments may be delayed, so the rule of thumb is to plan ahead and submit your application several months before you want the money—better safe than sorry.

Breaking Down the Canada $1050 CRA Pension: What’s Behind the Number?

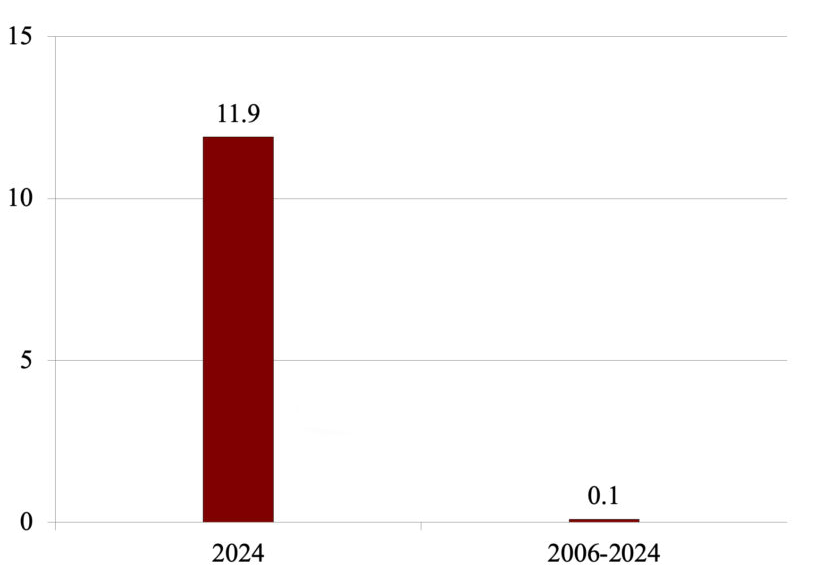

That $1050 figure is an average prediction that falls right in the middle for many retirees, but actual payouts vary based on your circumstances:

- The average CPP retirement pension is about $848 per month for those starting at the standard age of 65.

- The maximum monthly pension for 2025 is pegged at $1,433, which is for contributors who worked max hours and earnings for 40 years.

- Starting early at age 60 means a 0.6% reduction per month before 65, which can cut your monthly payment significantly but gives you a paycheck longer.

- Conversely, delaying CPP until age 70 gets you up to 42% more per month in benefits.

- CPP payouts rise annually with inflation adjustments based on the Consumer Price Index (CPI) to ensure purchasing power isn’t lost, a critical feature for seniors navigating rising living costs.

Additional Benefits Under CPP

The CPP is more than just a retirement check. It provides critical support through various other benefits:

- CPP Disability Benefit: If you’re under 65 and severely disabled, and you’ve made sufficient contributions, you may qualify for ongoing monthly support.

- CPP Survivor’s Pension: Upon the contributor’s death, their surviving spouse or common-law partner can receive monthly benefits, the amount depending on contribution history and survivor’s age.

- CPP Children’s Benefits: To help families, dependent children of disabled or deceased contributors get monthly payments until 18, or 25 if they’re full-time students.

- Post-Retirement Disability Benefit: Those aged 60-65 who become disabled after starting their CPP can qualify for disability coverage despite no longer being eligible for standard disability benefits.

More Than Just a Check: How to Maximize Your CPP Benefits

Planning your retirement finances means squeezing every dollar out of your entitlements:

- Wait Longer for Bigger Benefits: Hold off on CPP payments until age 70 if you can afford it. The monthly payout increases by 0.6% every month past 65—an increase of up to 36% more income.

- Work After Starting CPP: Keep contributing between ages 60 and 70. The post-retirement benefit adds dollars to your monthly payment automatically.

- Apply Early: Applying at least six months before your desired start date smooths out any kinks, so you don’t miss payments.

- Keep Your Information Updated: Regularly audit your CPP contribution record through your Service Canada account to catch any gaps.

- Explore Pension Sharing: Couples can split CPP benefits to reduce taxable income and optimize retirement returns.

Step-by-Step Guide: Applying For Your Canada $1050 CRA Pension

Here’s your no-jargon roadmap to applying:

Step 1: Verify Eligibility

Use the Service Canada CPP eligibility tool to check your status and contribution history.

Step 2: Prepare Documentation

You’ll need your Social Insurance Number (SIN), proof of age (birth certificate or passport), banking info, and residency documentation (especially if living abroad).

Step 3: Complete Application

Apply online via the My Service Canada Account, or opt for mail/in-person submission.

Step 4: Set Up Payment Method

Link your bank account for direct deposit for timely payments.

Step 5: Monitor Application status

Keep tabs on your My Service Canada profile for confirmation and estimated payment dates.

Step 6: Adjust When Necessary

If you return to work, relocate, or face changes, report to Service Canada to keep your CPP records up to date.

Real Talk: How CPP Fits With Other Benefits

Understanding CPP’s place in broader retirement income is key:

- Old Age Security (OAS): A universal pension based on residence time in Canada. It does not affect CPP amounts but adds to your total retirement income.

- Guaranteed Income Supplement (GIS): For low-income seniors, GIS supplements OAS and CPP to reduce poverty risk.

- Work and CPP: CPP payments do not reduce even if you earn income while drawing it, and post-retirement benefits can build your pension while working.

The Big Picture: CPP Reform and Future Predictions

Canada’s government continually works to enhance CPP to keep pace with evolving economic realities:

- Gradual enhancements that raise contribution rates started in 2019 and are set to end by 2025, increasing expected pension incomes.

- Discussions around changing the eligibility age from 65 to 67 over coming decades reflect changing life expectancy and workforce participation.

- The CPP system is evolving to reduce dependency on other social assistance while guaranteeing a more adequate retirement income.

- Regular inflation adjustments and multi-year reforms make CPP a sustainable source of retirement income for generations.

CRA Benefits Payment Dates in November 2025 – OAS, CPP & CWB Benefits Date

CPP $782 + $758 Extra Deposit For November 2025, Check Who Is Eligible?

CPP Payment Dates for October & November 2025: Everything Canadian Retirees Should know