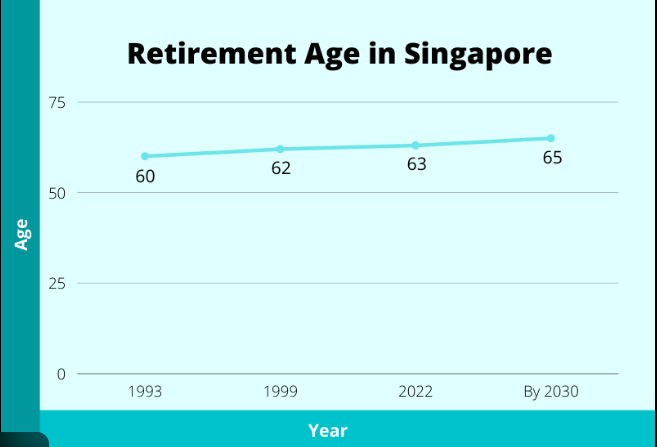

2025 Retirement Age Updates: Singapore is gearing up for a major change in its retirement framework. Starting November 1, 2025, the official retirement age will rise from 63 to 64 years, reflecting the city-state’s commitment to adapting to longer life expectancies, shifting demographics, and evolving workforce needs. But this update is just one part of a broader set of reforms that will affect CPF contributions, re-employment age, and retirement income schemes. This article is your ultimate guide to understanding these 2025 retirement age updates in Singapore. Written in clear, straightforward language, it covers the background, detailed policy changes, economic impact, practical steps for individuals, and a broader global perspective. Whether you’re planning your retirement or managing workforce policy, this guide breaks it down in a friendly but authoritative way.

Table of Contents

2025 Retirement Age Updates

Singapore’s 2025 retirement age updates are a carefully calibrated response to longer life expectancy and economic needs. Raising the retirement age to 64, boosting CPF contributions, and increasing re-employment age create a robust platform for financial security, workforce sustainability, and healthy aging. Whether you’re an employee approaching retirement, an employer planning workforce strategies, or a financial advisor guiding clients, these changes offer new opportunities for planning and growth. Early preparation, savvy saving, and embracing lifelong learning will ensure you make the most of this new retirement landscape.

| Topic | Details |

|---|---|

| Retirement Age | Raises from 63 to 64 years, effective November 1, 2025 |

| Re-Employment Age | Up from 68 to 69 years |

| CPF Contribution Increase | 1% rise in contributions for ages 55-70, bolstering retirement savings |

| CPF LIFE Payouts | Monthly payouts up to S$3,330, with flexible plans suiting different retiree lifestyles |

| Public Sector Implementation | Early adoption starting July 1, 2025 |

| Future Increase Plans | Retirement age to 65 and re-employment age to 70 by 2030 |

Why Is Singapore’s 2025 Retirement Age updated?

Singapore’s decision to increase the retirement age is underpinned by several critical societal and economic realities:

- Longer Life Expectancy: Singaporeans now live well into their 80s, creating a longer retirement phase that demands more savings and planning for financial independence.

- Population Aging: The proportion of citizens aged 65 and above is growing rapidly. With fewer young workers per retiree, the nation must adjust to maintain economic balance and social support systems.

- Sustainability of CPF System: Raising the retirement and re-employment ages ensures more years of contributions from workers, strengthening the Central Provident Fund (CPF) system’s sustainability for future generations.

- Workforce Retention and Economic Growth: Keeping experienced workers active longer benefits businesses through retained skills, reduced recruitment costs, and a more diverse age workforce — essential in a tight labor market.

- Global Norms and Fairness: Singapore’s move aligns with trends in advanced economies like Japan and Germany, signalling fairness to younger generations who face heavier social support burdens.

Officials emphasize this change is not forcing anyone to work beyond their health or will; rather, it gives Singaporeans the flexibility to stay employed longer should they wish. Manpower Minister Dr Tan See Leng highlighted that lifelong learning and engagement in meaningful work are key to “healthy and successful aging”.

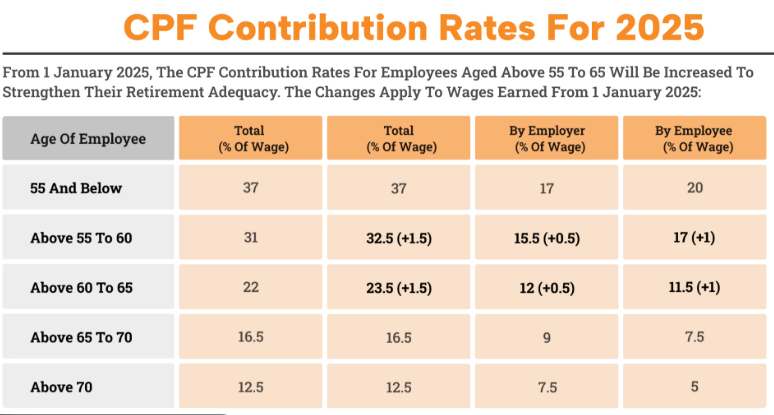

Detailed CPF Changes and Retirement Income Enhancements

Increased CPF Contribution Rates

Effective November 1, 2025, CPF contributions will see an important adjustment:

- Both employee and employer contribution rates rise by 1% for workers aged 55 to 70.

- For instance, worker contributions will increase from 19% to 20%, and employer shares from 14% to 15% for the 55-60 age bracket.

- The monthly wage ceiling for CPF contributions also increases to S$7,400, enabling higher-income earners to grow their retirement funds faster.

This policy aims to enhance retirement adequacy by encouraging more robust CPF savings during the worker’s final active years. Higher contributions mean a larger accumulation of funds in the Retirement Account, leading to increased monthly payouts after retirement.

Enhanced CPF LIFE Plans

Singapore’s CPF LIFE scheme is also evolving to meet retirees’ needs:

- New maximum monthly payouts can reach S$3,330, providing more financial breathing room.

- Retirees can select from three plans:

- Standard Plan: steady monthly income.

- Escalating Plan: payouts that grow annually to offset inflation.

- Basic Plan: lower starting payouts but dividends guaranteed.

These options provide retirees with flexibility to tailor their incomes to match lifestyle needs, healthcare costs, and longevity considerations, thus enabling a more personalized retirement experience.

Early Adoption in the Public Sector

The public service sector is the first to implement these age changes starting July 1, 2025, ahead of the general workforce. This staggered timeline allows the government to pioneer best practices in managing an older workforce and eases the transition for employers and employees.

Workforce and Economic Impact of 2025 Retirement Age Updates

Raising the retirement and re-employment ages has broad implications:

- Workers will typically work at least one additional year, helping increase their lifetime earnings and retirement savings.

- The extended re-employment age to 69 years encourages older workers who are able and willing to remain employed, contributing to financial and social well-being.

- Employers benefit from retaining institutional knowledge and reducing the costs of recruitment and training.

- The Retirement and Re-employment Act protects eligible seniors against age-related dismissals, promoting fairer employment practices.

Research reveals that previous increments to retirement ages (e.g., in 2022) positively impacted employment rates for older workers, especially those in knowledge-intensive sectors such as manufacturing and wholesale trade. Even though many seniors retire shortly after hitting the new thresholds, the delay extends working lives overall, which softens labour market shortages and supports economic growth.

Additionally, increasing senior workforce participation supports the so-called “silver economy” — industries focused on goods and services for older adults, generating new economic opportunities and innovation.

How to Prepare: Practical Steps for Individuals and Employers

For Individuals

- Review Your Retirement Timeline

Adjust your personal and financial goals knowing retirement now comes a year later. Factor in that you may continue working and contributing to your CPF until 64. - Maximize CPF Contributions

Take advantage of increased CPF contribution rates. Use online CPF calculators to project growth and payout scenarios to make smarter saving and investment decisions. - Select Appropriate CPF LIFE Plans

Assess your health, family needs, and lifestyle preferences to select the right CPF LIFE plan for your payout needs. - Stay Healthy and Skill Up

An extra year or more of work demands good physical and mental health. Lifelong learning and skills upgrading become essential for sustained employment. - Communicate with Employers

Discuss re-employment and retirement options early with your employers to understand opportunities and plan transitions smoothly.

For Employers

- Update HR Policies

Adapt organizational policies to comply with new retirement and re-employment age laws. - Promote Age-Inclusive Workplaces

Foster environments where older workers can thrive with flexible hours, ergonomic setups, and training programs. - Plan for Workforce Longevity

Leverage the expertise of senior workers while planning for succession and training younger employees.

Global Context: How Singapore Compares

Singapore’s approach places it among forerunners in adapting to demographic changes:

- Countries like Japan and Germany have set retirement ages between 65-67, while some nations still maintain 60-62.

- Singapore stands out for linking retirement age adjustments with a comprehensive savings system (CPF) focusing on individual contributions and annuities.

- Its flexible re-employment policies contrast with countries where retirement is more rigid, providing greater choice and workforce participation opportunities.

This comprehensive “whole-of-society” method enables Singapore to balance economic growth with social welfare successfully.

Real-Life Perspectives: Voices from the Ground

Jane, 60, shares: “The extra year to work means I can grow my CPF and delay dipping into my savings. It’s less stressful knowing I’m better prepared.” David, a 67-year-old public servant, notes, “Re-employment lets me keep contributing and stay connected. It’s a win-win for me and my employer.”

Such stories reflect the positive human side of policy, highlighting enhanced dignity, purpose, and financial security for seniors.

Future Outlook: The Road to 2030 and Beyond

By 2030, Singapore aims to increase the retirement age to 65 and re-employment age to 70, completing this phased adaptation to its aging demographic. Complementary policies such as skill upgrading, healthcare programs, and social services are expected to bolster this transformation.

This integrated approach is designed to ensure that Singaporeans are not only protected financially but also empowered to enjoy longer, healthier, and more fulfilling lives.

$1,080 Old Age Payment in November 2025: How Singapore’s Social Security Scheme Operates!

Government Confirms $2,250 AP Cash Payout – Check Your Status Before Payments Begin