$2254 OAS Payment Coming: Listen up, folks! If you’re a Canadian senior or planning for retirement, you’ve probably heard the buzz about a $2254 OAS payment coming in November 2025. Sounds like a stack of cash, right? Well, let’s break down what’s really going on with the Old Age Security (OAS) benefits so you have the real-deal info. Whether you’re new to this or an old hat, this article is your go-to guide packed with simple explanations, practical tips, and legit data to help you score your rightful payments on time.

Table of Contents

$2254 OAS Payment Coming

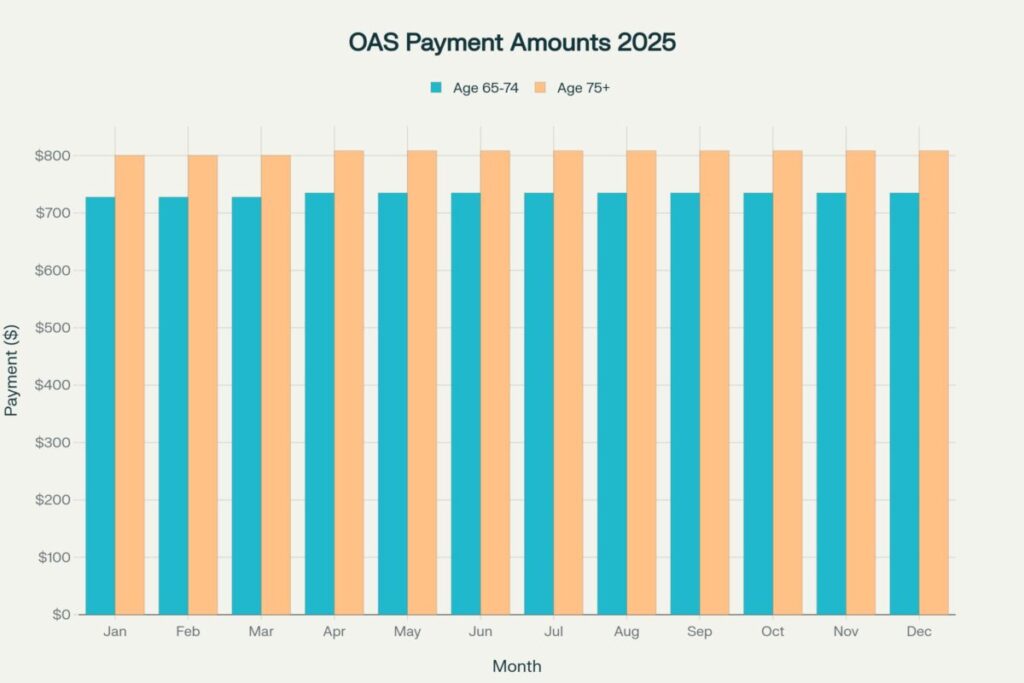

That $2254 OAS payment figure is best understood as a combined or quarterly payout including OAS and other supplements. Regular monthly OAS payments in November 2025 range between $740 and $814, depending on your age. OAS has a rich history of evolving from modest, means-tested pensions in the ’50s to today’s universal and indexed support, with expanded benefits for low-income seniors. Knowing the details helps Canadian seniors get the money they deserve with no hiccups. Plan early, apply on time, monitor your income to avoid clawbacks, and keep your documents and contact info current so your payments arrive hassle-free on November 26, 2025.

| Topic | Details |

|---|---|

| OAS Monthly Payment Range | $740.09 for ages 65-74, $814.10 for 75+ (Oct-Dec 2025) |

| Payment Date (Nov 2025) | November 26, 2025 (direct deposit) |

| Eligibility Age | 65 years or older |

| Residency Requirement | Minimum 10 years in Canada after 18 years old (20 years if living outside Canada) |

| Additional Benefits | Guaranteed Income Supplement (GIS) for low-income seniors |

| Income Clawback Threshold | $90,997 in net world income (2024 figure) |

| How to Claim | Automatic enrollment usually; apply online if no letter received |

| Official OAS Information Website | Government of Canada OAS |

What’s Up With the $2254 OAS Payment Coming?

That $2254 doesn’t mean you’re gonna get $2254 in one single cheque for November 2025. Instead, it’s likely a total number from combined payments—maybe quarterly amounts or includes other linked benefits like the Guaranteed Income Supplement (GIS), which low-income seniors can get on top of their OAS pension. To keep it straight, regular monthly OAS payments for November 2025 fall between $740 and $814, based on age and other factors.

The reason this figure sometimes confuses people is that OAS benefits can be combined with GIS and other allowances, and the total quarterly benefit figure can add up to numbers like $2254 for some seniors with low income.

Understanding this can help you better plan your finances and know what to expect in your statements.

Quick Breakdown: Who Gets OAS?

The OAS program aims to help Canadian seniors maintain a basic standard of living after they turn 65. It’s a universal program, meaning eligibility is not dependent on your job history or contributions but mostly on your age and residency status.

To qualify for OAS, here’s what you should know:

- You must be 65 years or older.

- You should have lived in Canada for at least 10 years after your 18th birthday if you currently reside in Canada.

- If you live outside Canada, you must have lived in Canada for at least 20 years after 18 and been a Canadian citizen or legal resident at the time of leaving.

- You need to be a Canadian citizen or legal resident when you apply.

- You must have an income below the clawback threshold, which is currently about $90,997 (2024 figure), or you risk having to repay part or all of your OAS benefits.

This means that even folks who never worked or contributed directly to Canada’s pension plans can receive OAS benefits as a right, which is a huge help to many seniors.

The OAS Payment Amount and When It Drops

Here’s the down-low on the money side for November 2025:

- For Canadians aged 65 to 74, the OAS payment is about $740.09 per month. This figure is adjusted every quarter to keep up with inflation, ensuring your pension maintains its purchasing power.

- If you are 75 or older, there is an added benefit of around $814.10 per month due to a 10% pension increase introduced in recent years.

- Payments are typically deposited on the last Wednesday of each month, and for November 2025, that date is November 26th.

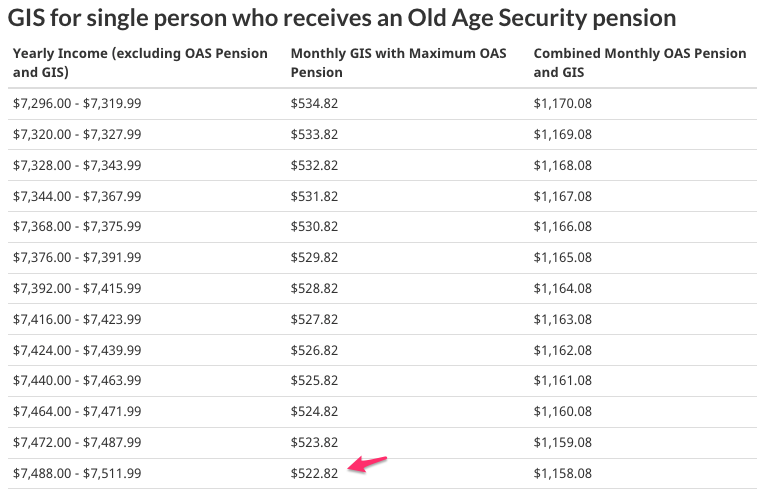

If you qualify for the Guaranteed Income Supplement (GIS), you’ll receive an additional amount on top of your OAS pension each month. This is a tax-free benefit available for low-income seniors and can dramatically boost your monthly income.

How to Claim Your $2254 OAS Payment Coming?

The good news is, most Canadians are automatically enrolled when turning 65, with Service Canada sending out notification letters. However, if you don’t receive this letter, you’re responsible for applying.

Here’s how to make sure those dollars land in your account:

- Sign into your My Service Canada Account online. It’s fast, secure, and lets you track all your government benefits.

- Fill out the application form for OAS online or download and mail it. You will need to provide your Social Insurance Number (SIN), proof of age, and residency.

- Set up or confirm your direct deposit info in Service Canada to avoid payment delays.

- If your income is low, apply separately for the Guaranteed Income Supplement (GIS) to get the extra cash flow.

- Keep all your contact information current with Service Canada to avoid missed payments or documents lost in the mail.

The History of OAS: Why It Matters

The Old Age Security program has a fascinating history dating back over 70 years, showing Canada’s commitment to protecting seniors. Officially launched in 1952, the program initially provided modest pensions only to those aged 70 and older. Back in the day, seniors received around $40 a month—a starting point that was a significant social provision during post-WWII recovery times.

Before OAS, the elderly had limited options and often faced poverty or dependence on family. The program has evolved significantly since then:

- The eligibility age was lowered from 70 to 65.

- Payments are now indexed to inflation, ensuring the pension remains relevant over time.

- In 1967, the Guaranteed Income Supplement (GIS) was introduced to support seniors with low income.

- Other benefits, including allowances for spouses and survivors, were added in later years.

- Most recently, a 10% increase was introduced for those 75 and older to recognize the additional challenges of aging.

This long history underscores the importance of OAS as a bedrock social safety net. It’s not just about money—it’s about dignity and security in the later years.

Understanding Combined Benefits: OAS, GIS, and More

Now, that $2254 figure many hear about? It often refers to combined benefits that might include:

- Old Age Security (OAS) pension — the base amount for most seniors.

- Guaranteed Income Supplement (GIS) — a tax-free benefit supporting lower-income seniors.

- Allowances for spouses aged 60-64 or survivors.

- Additional provincial top-ups or supplements available depending on where you live in Canada.

- Retroactive payments or lump sums for missed months or corrections.

Combining these benefits increases the monthly or quarterly total for many recipients, explaining why sometimes the numbers look higher than the basic OAS monthly payment.

Knowing how these work together can help you better plan your retirement income and support options.

Practical Tips to Maximize $2254 OAS Payment

Here’s how to get the most bang for your buck:

1. Consider Deferring Your OAS

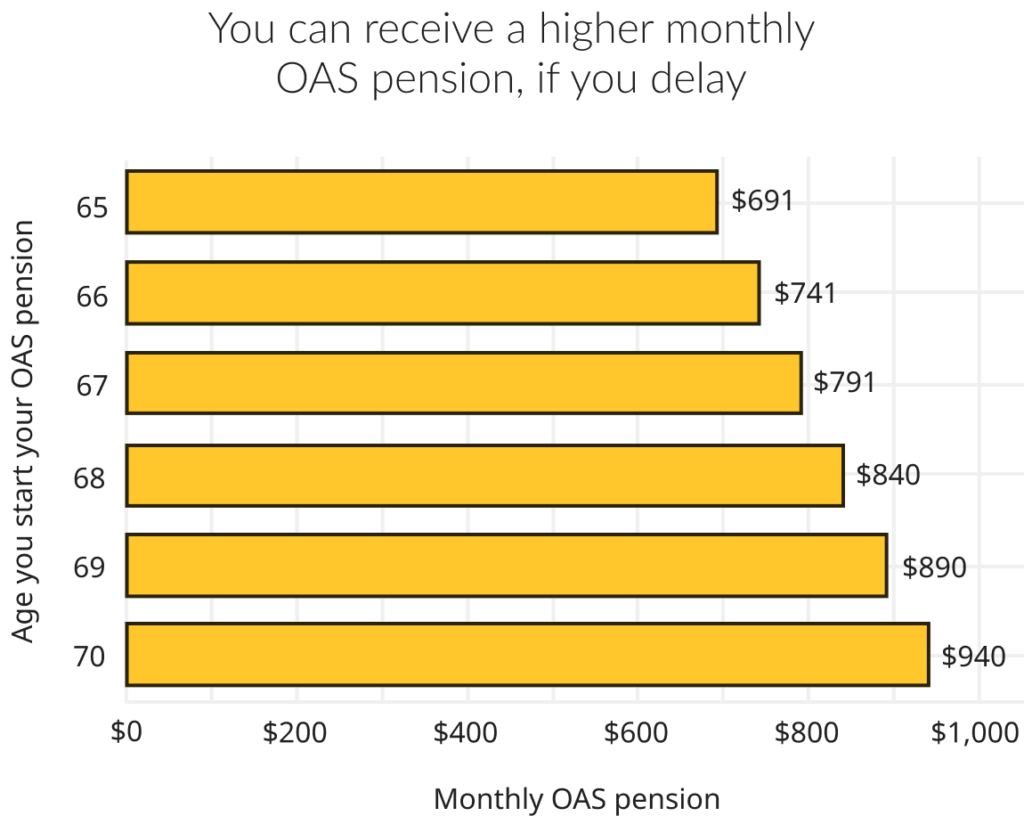

You can choose to delay receiving your OAS pension past age 65, up to age 70. Every month you delay, your pension grows by 0.6%, resulting in a potential 36% higher monthly payment at age 70. This strategy is perfect if you’re still working or have other income sources and want a bigger income later.

2. Audit Your Residency Years

To qualify for full OAS, you need to have lived in Canada for at least 40 years after age 18 (or 10 years if you currently live in Canada). Fewer years mean partial benefits, so gather your documents—tax returns, immigration records—to prove your time in Canada.

3. Manage Income to Avoid Clawbacks

If your net world income exceeds the clawback threshold (around $90,997 for 2024), you might have to repay up to 15% of the excess income through pension recovery tax. Talk to a financial advisor about strategies like income splitting, managing RRSP withdrawals, or deferring OAS to reduce clawback impact.

4. Keep Your Information Up to Date

Update your address, direct deposit info, and contact details with Service Canada to avoid disruptions. Set reminders to check on your payment status regularly via your My Service Canada Account.

5. Look Into Additional Benefits and Programs

Explore other potential income-support programs like:

- Canada Pension Plan (CPP) benefits, including survivor and disability benefits.

- Provincial and territorial top-ups and supplements.

- Allowances for spouses or survivors, if applicable.

Canada Extra GST Payment In November 2025 – Know Amount, Eligibility & Dates

$445 Canada Family Benefit Payment in November 2025, Know Eligibility & Payment Dates

$360 Canada OTB In November 2025 – These people are eligible, Check Eligibility & Payment