GIS Payment Date: If you’re looking to get the lowdown on the Guaranteed Income Supplement (GIS) payment for November 2025—when you’ll get it, how much it’ll be, and whether you qualify—this detailed guide breaks it all down for you. Whether you’re planning retirement finances, helping out a family member, or just curious about Canadian senior benefits, this article covers everything you need to know in a friendly yet authoritative way. GIS is a key piece of Canada’s retirement income system designed to help low-income seniors by supplementing their Old Age Security (OAS) pension. With the cost of living climbing, this support can make a huge difference in keeping life comfortable and secure.

Table of Contents

GIS Payment Date

The Guaranteed Income Supplement is a vital and well-designed program that helps thousands of Canadian seniors keep their financial footing. With payments scheduled for November 26, 2025, knowing your eligibility, payment details, and how to navigate the system can make a big difference in your retirement planning. Filing taxes, updating Service Canada with changes, and using tools like direct deposit and TFSAs can help maximize benefits and secure your financial future. GIS stands as an excellent example of effective social policy helping seniors live with dignity.

| Topic | Details |

|---|---|

| November 2025 GIS Payment Date | November 26, 2025 |

| Maximum Monthly GIS Payment | Up to $1,105.43 for singles; up to $665.41 for couples where the spouse receives OAS or Allowance |

| Eligibility Age | 65 years and older |

| Income Thresholds | Single: less than $22,440 annually; Couples: thresholds range from $29,616 to $53,808 combined |

| Official Info & Applications | Government of Canada – GIS details |

What Is the Guaranteed Income Supplement and Why Is It Important?

The Guaranteed Income Supplement (GIS) is a monthly, non-taxable benefit targeted at seniors with low income who already receive the Old Age Security pension. It acts as a financial top-up, aimed at helping seniors cover basic costs like housing, food, healthcare, and utilities.

The difference between GIS and the Old Age Security pension is crucial: OAS is a universal pension based on age and residency, whereas GIS is income-tested, meaning the less income you have, the more GIS you get. This design is intentional to make sure help goes to those who need it most.

This supplement is especially important because many seniors rely on fixed incomes and may not have sufficient retirement savings or workplace pensions. GIS plays a vital role in reducing senior poverty and supporting financial independence.

A Deeper Dive Into GIS History and Evolution

GIS was created in 1967 as a temporary social assistance program to support low-income seniors during the phased rollout of the Canada and Quebec Pension Plans (CPP/QPP). At the time, many seniors retiring before CPP/QPP existed faced financial hardship.

Initially, policymakers debated whether to expand Old Age Security payments universally or create a supplement. The universal route was rejected due to cost concerns and fairness across generations—young workers would end up funding retirees in a way seen as inequitable.

The Senate Special Committee on Aging recommended an income-tested supplement instead, which led to GIS. Its temporary intent was to act as a bridge during the CPP/QPP buildup period.

However, after the planned 10-year phase-out, it was clear old-age poverty remained high among many retirees, especially those without employer pensions. GIS’s popularity and effectiveness led to its permanency in the mid-1970s. Since then, it has been quarterly-indexed to inflation to keep pace with the cost of living.

Today, around one-third of seniors receiving OAS also receive GIS, reflecting ongoing financial need. GIS’s stability and political support are attributed to its sensitive design—focusing on older adults and using income data from tax filings to avoid traditional burdensome means testing.

In short, what started as a time-limited tweak transformed into a cornerstone of Canada’s retirement security system after proving its social necessity and political viability.

November 2025 GIS Payment Details: When and How Much?

Payment Date

Your GIS payment for November 2025 will land in your bank account on November 26, 2025, if you’re signed up for direct deposit. If you get payments by cheque, give it some extra time for postal delivery.

Payment Amounts Explained

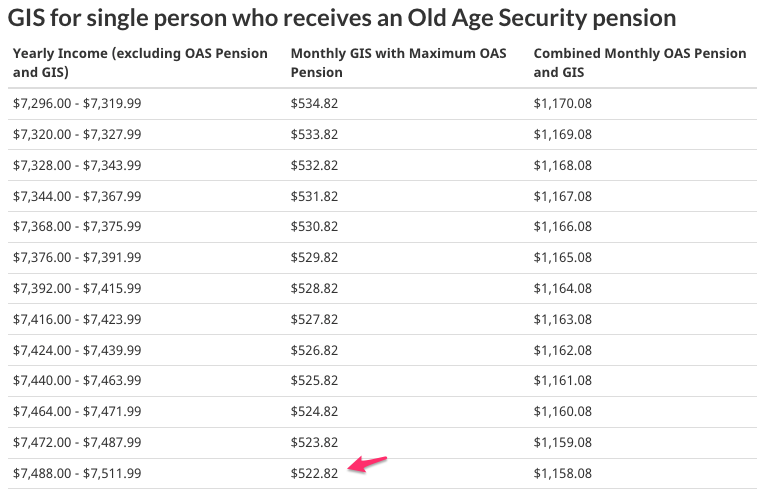

GIS payments are based on your or your combined household income from the previous tax year. Here is a detailed view:

| Status | Income Threshold (Annual) | Max Monthly Payment Amount |

|---|---|---|

| Single, divorced, or widowed | Less than $22,440 | Up to $1,105.43 |

| Spouse/common-law partner receiving OAS | Combined income under $29,616 | Up to $665.41 |

| Spouse/common-law partner receiving Allowance | Combined income under $41,472 | Up to $665.41 |

| Spouse/common-law partner not receiving OAS or Allowance | Combined income under $53,808 | Up to $1,105.43 |

You’ll notice payments gradually reduce as income approaches the threshold. The idea is to provide maximum support for those with the least income while tapering off benefits as financial need decreases.

Who Qualifies for GIS?

To be eligible for GIS, you must:

- Be at least 65 years old.

- Receive the Old Age Security pension.

- Be a Canadian resident at the time of application and while receiving benefits.

- Have income below the set thresholds (individual or combined if married).

- File income tax returns annually with the Canada Revenue Agency (CRA).

There’s no separate GIS application; eligibility is mostly automatic based on your tax returns and OAS receipt. Filing your taxes promptly and accurately is critical to maintaining GIS payments.

What Income Counts for GIS?

GIS eligibility and amount calculations consider income from:

- Employment earnings

- Canada Pension Plan (CPP) or Québec Pension Plan (QPP)

- Old Age Security (OAS)

- Private pensions and foreign pension income

- Investment income, including dividends and interest from taxable accounts

- Rental income or business profits

- Other sources like workers’ compensation or alimony

An important note: Income sheltered inside Tax-Free Savings Accounts (TFSA) doesn’t get counted, so TFSAs are a useful tool to protect your GIS eligibility.

How to Make the Most of Your GIS Benefits: Practical Advice

- File Taxes on Time: Timely tax filing triggers automatic eligibility assessments.

- Keep Service Canada Informed: Report life changes such as marital status, address, or income modifications.

- Opt for Direct Deposit: It’s the fastest, safest way to receive your money.

- Plan Investment Income Wisely: Use TFSAs to shelter investment gains from GIS income calculations.

- Request Income Recalculation: If your financial situation changes mid-year (for example, retirement or job loss), ask Service Canada for a reassessment.

- Be Aware of Provincial Supplements: Some provinces offer extra benefits for GIS recipients—check your local programs.

GIS in the Larger Context of Income Security Programs

GIS represents one of the most effective income-tested social programs worldwide, designed to fight poverty in old age with a minimal administrative burden. Its success is mirrored by growing interest in income support policies globally, such as Universal Basic Income (UBI) pilots in several U.S. cities.

Understanding GIS offers insight into how thoughtful policy design can create sustainable social safety nets that protect vulnerable populations while fostering dignity and independence.

Canada Extra GST Payment In November 2025 – Know Amount, Eligibility & Dates

$445 Canada Family Benefit Payment in November 2025, Know Eligibility & Payment Dates

Pension Boost Canada in November 2025: Check Expected CPP and OAS Pension Increase in 2025

Glossary of Important Terms

- Old Age Security (OAS): A universal pension for Canadians aged 65+.

- Guaranteed Income Supplement (GIS): Additional support for low-income OAS recipients.

- Canada Pension Plan (CPP) / Québec Pension Plan (QPP): Earnings-related pensions.

- Tax-Free Savings Account (TFSA): An investment vehicle that doesn’t affect GIS income.

- Recalculation: Updated GIS amount based on income changes post-tax filing.