Centrelink Age Pension: If you’re keeping an eye on the Centrelink Age Pension for November 2025, you’ve come to the right place. This article breaks down exactly how much money you can expect, who qualifies, and when those payments will hit your bank account. Whether you’re 10 or 70, we’ll keep it simple, clear, and packed with solid info you can trust. Let’s dive in!

Table of Contents

Centrelink Age Pension

Centrelink’s Age Pension payment in November 2025 includes a welcome increase to help seniors manage living expenses. Understanding eligibility, payment structure, application steps, and supplementary supports empowers older Australians to plan their retirement effectively. Along with its rich history and continuous updates, the Age Pension offers reliable financial help tailored to today’s needs.

| Feature | Details |

|---|---|

| Maximum Payment Rates | Single: $1,178.70 per fortnight (~$30,646/year) Couple (each): $888.50 per fortnight (~$23,101/year) |

| Eligibility Age | 67 years old |

| Residency Requirement | Must be an Australian resident for at least 10 years (with some exceptions) |

| Assets Test Limits | Singles: Below $321,500 (home owners) or $579,500 (non-home owners) for full pension |

| Couples: Combined assets below $481,500 (home owners) or $739,500 (non-home owners) for full pension | |

| Income Test | Single: Income ≤ $218 per fortnight for full pension Couple: Income ≤ $380 per fortnight for full pension |

| Payout Dates November | Thursday, Nov 13 and Thursday, Nov 27, 2025 |

| Official Info | Centrelink Age Pension – Services Australia |

What is the Centrelink Age Pension?

The Centrelink Age Pension is a cornerstone of Australia’s social safety net, offering financial assistance to seniors so they can cover essentials like housing, food, and healthcare after they’ve left the workforce. It’s a means-tested payment, which means the amount you get depends on your financial situation — including your income and assets. In November 2025, the pension sees a mid-year boost. This isn’t just regular inflation indexing; it’s an extra lift to help seniors cope with rising living costs, such as grocery prices, electricity bills, and healthcare expenses. It reflects the government’s ongoing commitment to ensuring older Australians can maintain a decent standard of living. This payment, combined with the pension supplement and energy supplement, forms the total fortnightly payout designed to meet pensioners’ ongoing needs.

How Much Is the Age Pension in November 2025?

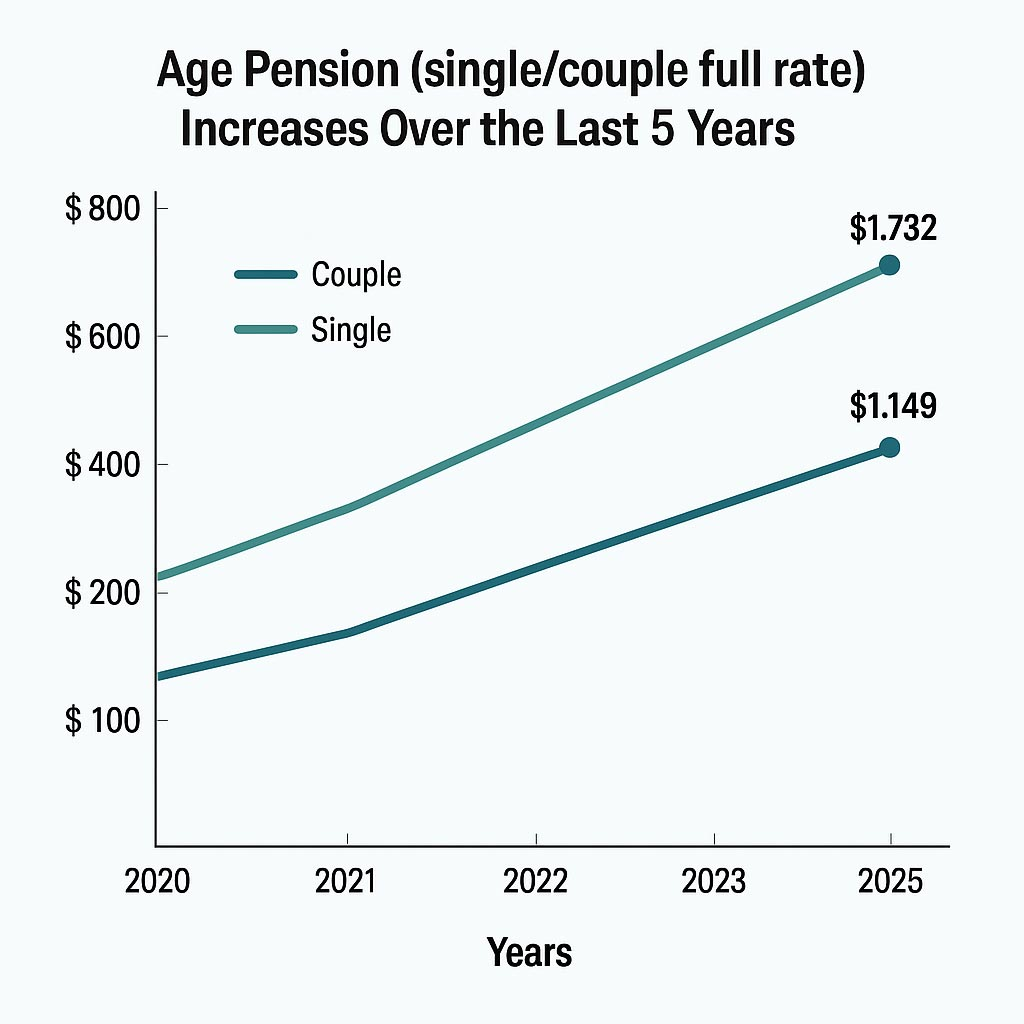

As of November 2025, the max Age Pension rates have gone up due to adjustments in the cost of living:

- A single individual is eligible for up to $1,178.70 every two weeks. That’s roughly $30,646 a year.

- For couples, each partner can claim $888.50 per fortnight, equating to $23,101 annually per person.

The pension is made up of several components:

- The base rate, which forms the bulk of your payment.

- The pension supplement, designed to help cover day-to-day expenses like food and clothing.

- The energy supplement, which specifically assists in managing electricity and gas bills.

These payments aim to support you through retirement, helping with everything from doctor visits to grocery shopping. The rise in payments reflects the growing costs many seniors are facing and represents a government effort to ease some of that pressure.

Who Qualifies for the Centrelink Age Pension?

Understanding eligibility ensures you know whether you can claim and how much you might get. Here’s a breakdown of who can qualify as of 2025:

Age 67 and Over

You generally must have hit the 67-year mark (this depends on your birthdate, as pension ages increased gradually over past years).

Residency Requirements

You must be an Australian resident and physically in Australia when claiming, and meet the residency rule of living in Australia for at least 10 years in total. Of those 10 years, at least 5 years must be continuous. There are exceptions, such as for refugees or those who arrived under certain social security agreements with other countries.

Income and Assets Tests

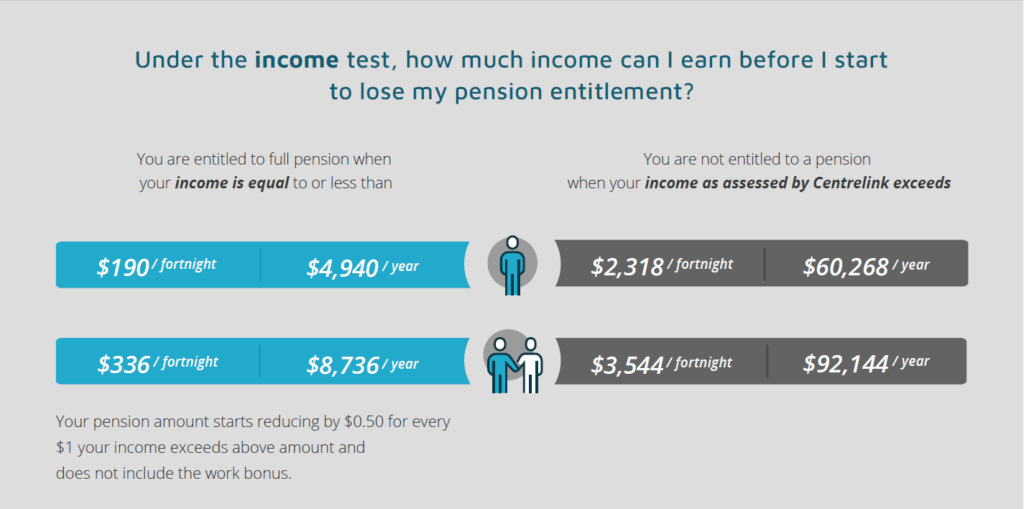

Centrelink uses two different tests — the income test and the assets test — to figure out how much pension you’re eligible for. The test that results in the lower payment is the one that applies.

- Income Test: This includes income from wages, business, investments, and deemed income from financial assets like superannuation and savings. You can earn up to $218 per fortnight as a single person without affecting your pension, or $380 combined for couples receiving the full payment. There is also a “work bonus” exemption allowing up to $300 per fortnight per person from employment without affecting the pension calculation.

- Assets Test: This looks at what you own, such as properties (other than your primary home), vehicles, savings, and investments. The limits for full pension depend on whether you own your home:

| Status | Asset Limit Owning Home | Asset Limit No Home |

|---|---|---|

| Single | Below $321,500 | Below $579,500 |

| Couple (combined) | Below $481,500 | Below $739,500 |

Assets above these values mean a reduced pension or none at all.

Example: If you’re a single homeowner with assets valued at $300,000 and income under the limit, you may qualify for a full pension. But if your assets or income are higher, your pension amount tapers down.

Special Eligibility Notes

- If you’re legally blind, you might be eligible without income or asset tests.

- If you currently receive certain disability or veteran payments, this could affect Age Pension eligibility.

- People who live overseas can claim, but different rules and payment rates apply.

When Will You Get Your Pension in November 2025?

Payments are made fortnightly on Thursdays. In November 2025, expect your payment on:

- Thursday, November 13, 2025

- Thursday, November 27, 2025

It’s best to watch your bank account or log into your myGov Centrelink portal to see the exact deposit date. Booking payments regularly helps with budgeting and planning.

How to Apply for the Centrelink Age Pension?

Applying for the pension is straightforward and can be done well in advance.

Start Early

You can lodge your claim starting 13 weeks before your 67th birthday, ensuring no delay once you hit eligibility.

Claim Online

- Sign in to your myGov account connected to Centrelink.

- Select Make a claim and choose the Age Pension service.

- Provide documents proving your identity, residency, income, and assets.

In-Person or Phone Help

If online isn’t your thing, you can visit a local Centrelink office or call their older Australians line for assistance. Translation services are also available for those who need help in languages other than English.my

Extra Benefits for Age Pensioners

Getting the Age Pension can open doors to other valuable supports:

- Rent Assistance: If you rent privately and meet criteria, you may get help with rental costs.

- Health Care Card: This card provides cheaper medicines under the Pharmaceutical Benefits Scheme and discounts on medical services.

- Energy Supplement: Additional support to offset winter and summer energy bills.

- Carer Payment: If you care for someone with a disability, this benefit may be relevant.

These extras can make a big difference, sometimes easing hefty living costs that aren’t fully covered by your pension.

A Brief History of the Australian Age Pension

It might surprise you, but Australia’s Age Pension has over a century of history. Established in 1909 with the Invalid and Old-Age Pensions Act 1908, it was one of the first countries to develop such a system, designed to protect elderly citizens from poverty. Initially, the pension was quite limited and had strict eligibility based on residency, race, and gender—men qualified at 65, women at 60. Property ownership and income heavily influenced eligibility, setting the groundwork for means testing still used today.

Over the decades, as Australia’s population aged and economic conditions changed, the pension was reformed multiple times to increase accessibility and fairness. Recent decades have seen adjustments to pension age, means tests, and the introduction of supplements to respond to modern cost-of-living challenges. This historical context shows how Australia has continuously worked to balance sustainable welfare with dignity for its aging population.

Tips to Maximize Your Pension Benefits

- Stay Current with all changes posted on the official Services Australia website.

- Report Any Changes in your income or asset status promptly to avoid issues.

- Use Online Tools: Pension calculators can help estimate benefits and prepare for the future.

- Seek Financial Advice to structure superannuation and assets optimally.

- Explore Additional Supports like concessions, rebates, or health care cards.

Australia Pension Plan Payment November 2025: Check Payment Dates & Claim Process

$1000 Centrelink Advance Payment in November 2025 – Check Deposit Date & Eligibility

Why Knowing Your Age Pension Matters?

With steady inflation impacting food, fuel, and healthcare costs, understanding the Age Pension isn’t just wise — it’s essential. Knowing your eligibility, how the payment is calculated, and additional benefits allows you to plan confidently. It helps protect your financial independence and can open doors to supports you might not realize exist. The Age Pension is a vital part of Australia’s retirement income system, working hand-in-hand with superannuation and personal savings. Staying informed helps you get the most out of it.