$1546 OAS Payment Alert: If you’ve scrolled through Facebook or gotten a text saying you’re getting a $1,546 OAS payment in November 2025, you probably perked up — who wouldn’t want that kind of deposit? But hold up — before you start celebrating or checking your bank account, let’s clear up what’s real and what’s just clickbait. The Old Age Security (OAS) program is one of Canada’s most important retirement benefits. It’s been around since 1952, helping millions of Canadians age 65 and older maintain financial stability. But misinformation spreads fast, and many posts claiming “extra OAS payments” or “bonus cheques” often twist real facts into half-truths.

This article will give you the real numbers, explain how OAS works, who qualifies, and why that $1,546 payment alert might not be what you think. We’ll also show you how to verify your benefits directly from the government, avoid scams, and maximize your retirement income safely.

Table of Contents

$1546 OAS Payment Alert

The $1,546 OAS Payment Alert for November 2025 may sound exciting, but it’s not an official one-time payment. The real OAS maximum for November 2025 sits around $740–$814 CAD, depending on your age and income. The official direct deposit date is November 26, 2025. While no special “bonus” is coming, seniors can still increase monthly income through GIS, CPP, and smart tax planning. Financial security in retirement starts with facts, not Facebook posts — and your best defense is staying informed.

| Detail | Information (as of 2025) |

|---|---|

| Program Name | Old Age Security (OAS) |

| Rumored Amount ($1,546) | Not an official OAS figure — may combine OAS + GIS benefits |

| Official OAS Amount (Ages 65–74) | $740.09/month (max) |

| Official OAS Amount (Ages 75+) | $814.10/month (max) |

| Payment Date for November 2025 | November 26, 2025 |

| Eligibility | 65+ years, Canadian citizen or legal resident, 10+ years living in Canada after age 18 |

| Clawback Threshold (2025) | Starts around $142,609 net income |

| Official Website | Canada.ca – Old Age Security (OAS) |

Where Did the $1546 OAS Payment Alert Come From?

That $1,546 number has made the rounds on social media and email newsletters, often described as a “November 2025 bonus.” Unfortunately, it’s not an official government amount.

The most likely explanation? It’s a combination of OAS and GIS (Guaranteed Income Supplement) payments. Seniors with low income can receive both, and when combined, those benefits may indeed total around $1,546 or more per month.

But OAS alone — the main benefit — caps out at around $740 to $814 per month, depending on your age group. The GIS is a separate, income-tested benefit designed to help lower-income seniors, sometimes adding another $1,065 monthly for single individuals in 2025.

So, yes, a total payment could hit that number — but it’s not a new OAS bonus, and there’s no separate “$1,546 direct deposit” scheduled by the Government of Canada.

How the OAS Program Really Works?

The Old Age Security pension is funded through general tax revenues, not your personal work contributions. That’s a big difference from CPP (Canada Pension Plan), which is funded by paycheck deductions.

You’re generally eligible if:

- You’re 65 years or older.

- You’re a Canadian citizen or legal resident.

- You’ve lived in Canada for at least 10 years after turning 18.

If you’ve lived in Canada for 40 years or more, you qualify for the full pension amount. If less than that, you’ll get a partial pension, proportional to your years of residence.

For instance:

- 20 years in Canada = about half the full OAS amount.

- 40 years = full OAS pension.

OAS Payment Dates for 2025

The government sticks to a consistent monthly schedule for OAS payments. If you’re using direct deposit, your payment lands automatically in your account.

| Month | OAS Payment Date (2025) |

|---|---|

| January | January 29 |

| February | February 26 |

| March | March 26 |

| April | April 28 |

| May | May 28 |

| June | June 25 |

| July | July 29 |

| August | August 27 |

| September | September 24 |

| October | October 29 |

| November | November 26 |

| December | December 22 |

Understanding the OAS Clawback (Repayment Threshold)

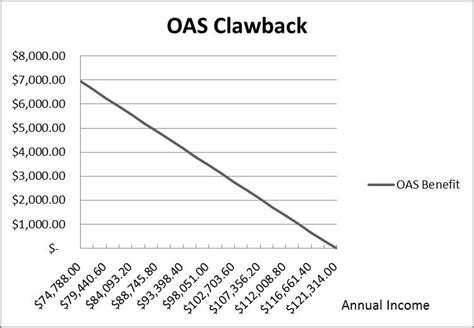

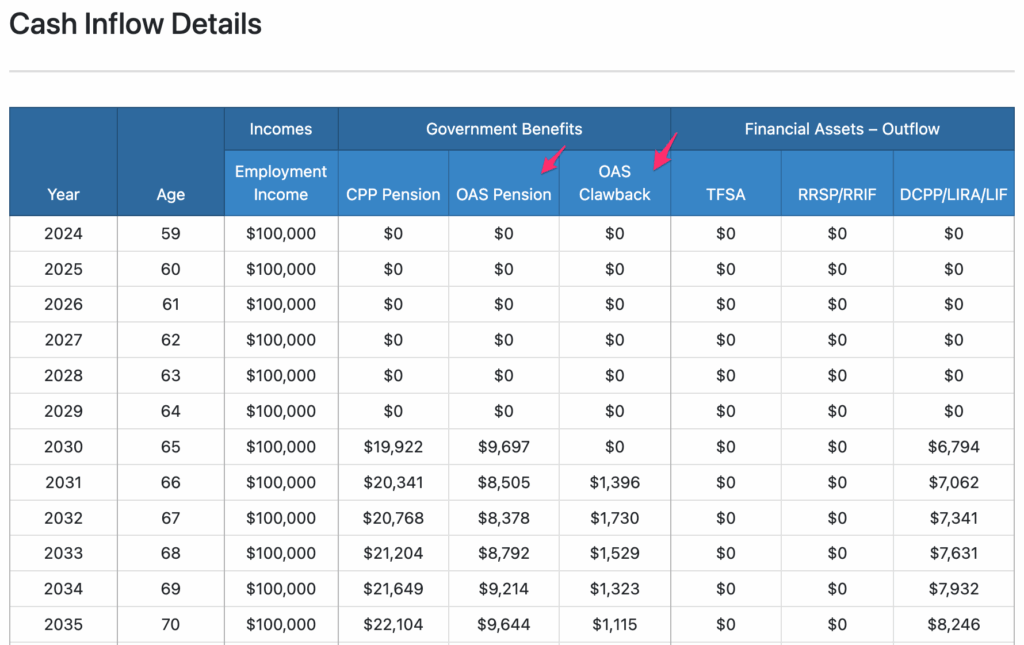

Here’s something many people overlook: the OAS Clawback (also called the OAS Recovery Tax).

If your net world income goes over $142,609 in 2025, the government starts reducing your OAS payments at a rate of 15 cents per dollar above that threshold. Once your income hits about $150,000, your OAS might be fully clawed back.

That means high-income retirees — especially those with investment or pension income — may not see the full benefit.

Pro Tip: You can reduce taxable income (and keep your OAS intact) by using RRSP withdrawals, TFSA investments, or income splitting with your spouse.

Quarterly Indexing and Inflation Adjustments

OAS payments aren’t static — they rise with inflation. The government adjusts them every January, April, July, and October based on the Consumer Price Index (CPI).

For example:

- In early 2024, OAS went up by 1.3%.

- In 2025, adjustments are expected to stay around 1.2% to 1.6% quarterly, depending on inflation trends.

So, while you won’t get a surprise “bonus,” your OAS will gradually increase to keep up with living costs.

Step-by-Step: How to Check Your Eligibility For $1546 OAS Payment Alert

Step 1: Verify Your Age and Citizenship

You must be 65+ and either a Canadian citizen or a legal resident at the time your application is approved.

Step 2: Residency Check

To qualify for full benefits, you must have lived in Canada for 40 years after age 18. If you have less, you’ll receive a partial benefit.

Step 3: Income Check

If you earn less than the GIS threshold (roughly $21,624/year for singles), you may also qualify for GIS on top of OAS.

Step 4: Apply (if not auto-enrolled)

Most Canadians are automatically enrolled around age 64½. If you don’t get a letter from Service Canada, apply manually through your My Service Canada Account or by mail.

Step 5: Set Up Direct Deposit

To ensure on-time payment, sign up for direct deposit via your Service Canada account. November’s official date is Wednesday, November 26, 2025.

OAS vs. CPP vs. GIS — What’s the Difference?

| Program | Eligibility Basis | Average 2025 Payment | Max 2025 Payment | Taxable? |

|---|---|---|---|---|

| OAS | Residency | $640 | $814.10 | Yes |

| CPP | Work contributions | $811 | $1,364 | Yes |

| GIS | Low income + OAS | $600 | $1,065 | No |

Note: Actual amounts depend on income, age, and contribution history.

In short, OAS is the baseline pension, CPP depends on your working years, and GIS supports those with smaller incomes. Combined, these can indeed exceed $1,500 per month, which is likely where the “$1,546” figure originated.

OAS and Living Abroad

If you’ve lived in Canada for at least 20 years after age 18, you can still receive OAS payments while living abroad.

However, if you’ve lived in Canada for less than 20 years, your OAS stops after being outside Canada for six months.

Canada also has social security agreements with more than 50 countries (including the U.S.), allowing you to combine residence periods to qualify for OAS.

How to Avoid OAS Scams and False Alerts?

Sadly, fake “OAS payment alerts” are everywhere — often shared on Facebook, TikTok, or via email. Here’s how to stay safe:

- Never share your Social Insurance Number (SIN) via email or text.

- Only trust messages from @canada.ca or Service Canada.

- Ignore any site that asks for a “processing fee” or “bonus claim.”

- Bookmark official pages like canada.ca/oas for updates.

If you suspect fraud, report it to the Canadian Anti-Fraud Centre (1-888-495-8501).

Tips to Maximize Your Retirement Income

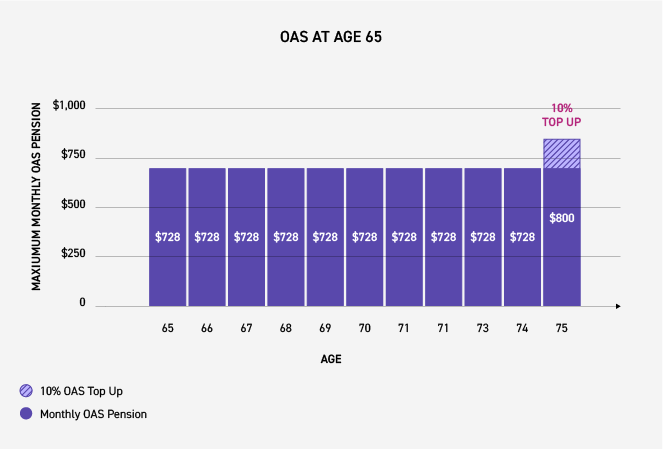

- Delay OAS to age 70 – Your payment grows by 0.6% per month (up to 36% higher).

- Use a TFSA – Income earned in a Tax-Free Savings Account doesn’t affect OAS eligibility or clawback.

- Split income with your spouse – Reduces taxable income and protects full OAS.

- Plan RRSP withdrawals – Timing withdrawals strategically can help you stay under the clawback threshold.

- Apply for GIS – If your annual income is low, GIS can significantly increase your total monthly benefits.

Canada Extra GST Payment In November 2025 – Know Amount, Eligibility & Dates

Canada CRA Benefits Payment Dates For November 2025: Check Payment Amount, Eligibility

Canada $1700+$650 CRA Double Payment in November 2025: Check Payment Date & Eligibility Criteria