$750 and $890 CPP Payments: If you’ve been hearing the buzz about $750 and $890 CPP payments hitting bank accounts this November 2025, you’re not alone. Whether you’re retired, thinking about retirement, or helping a loved one manage their pension, it’s key to know the facts straight. The Canada Pension Plan (CPP) payments this year come with a little extra oomph — a boost designed to help with rising costs and inflation. This article breaks it down clearly and casually, making it easy for a 10-year-old to get it, while also giving seasoned pros the in-depth details they need.

Table of Contents

$750 and $890 CPP Payments

November 2025 brings Canadian seniors a welcome one-time boost of $758 added to regular CPP payments, helping to ease financial pressures caused by inflation and rising living costs. Whether you usually get $750, $890, or more monthly, this boost provides significant extra cash that hits your account automatically on November 26, 2025. Understanding how CPP works—the eligibility, contribution rules, and various benefits—allows you to maximize this support and plan confidently for your retirement years.

| Feature | Details |

|---|---|

| Regular November CPP Payment | ~$782 on average |

| One-Time CPP Boost | $758 |

| Total November CPP Payment | Around $1,540 (regular + boost) |

| Eligibility for Boost | Age 60+, income under $85K, receiving CPP by Nov 1, 2025 |

| CPP Payment Date | November 26, 2025 |

| OAS One-Time Relief Payment | $2,350 (paid October 29, 2025) |

| Official Reference | Canada Govt Benefits |

What Is CPP? The Basics

Picture this: CPP is like a government-sponsored piggy bank you and your employer put money into while you work. When you retire, you start pulling money out in monthly payments based on how much you put in and when you decide to take the money.

Here’s the deal:

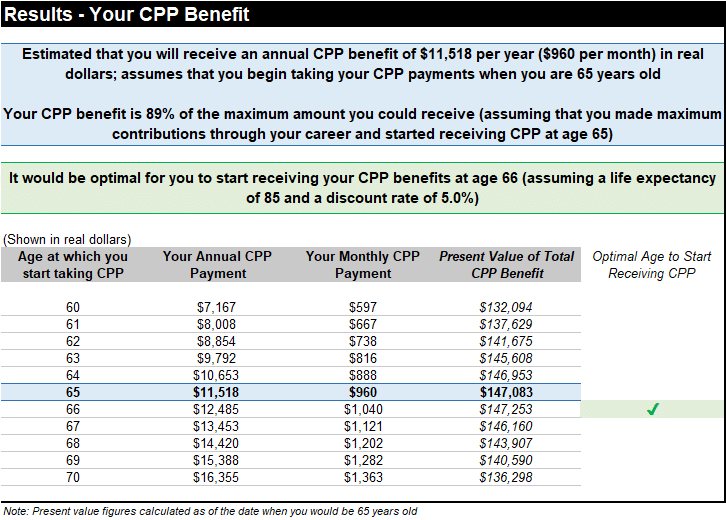

- You can start collecting CPP as early as 60.

- If you start before 65, your monthly payment gets smaller (down by 0.6% per month early).

- If you hold off until 70, your monthly payment grows by 0.7% per month.

In 2025, the top monthly CPP payment for a 65-year-old starting their pension is roughly $1,433, with most receiving somewhere around $848 monthly.

Why $750 and $890 CPP Payments? Where Do These Numbers Come From?

Those figures — $750 and $890 — are common monthly payment amounts for many Canadians receiving CPP. The exact amount depends on how long and how much you paid into CPP. Some folks might get $750, others $890, and some close to the maximum $1,433. So, these numbers are just average ranges, not fixed payments for everyone.

The Game-Changer: November 2025 CPP Payments

What’s Up With the November Boost?

Here’s the big news: November 2025 will see a special one-time CPP boost of about $758. That means seniors getting regular CPP payments will see that amount added on top of their usual monthly check for November. So, if you normally get $750, you might see almost $1,508 total. Pretty sweet, right?

This boost is meant as a financial lifeline to help with inflation and the rising cost of living — a way for the government to help seniors weather the storm without permanently raising monthly payments.

When Does the Payment Drop?

- The usual CPP payment hits accounts on November 26, 2025.

- The one-time boost hits on the same day, all rolled into one deposit.

- No action is needed on your part if you meet the rules — it’s automatic.

Who Gets This Boost?

To qualify, you need to:

- Be 60 or older and already be receiving CPP by November 1, 2025.

- Have an income under $85,000 (based on your 2024 tax filings).

- Seniors eligible for Old Age Security (OAS) also get separate relief payments this year.

How Does Old Age Security Fit In?

Old Age Security is another pension for seniors, and it works alongside CPP. In October 2025, eligible seniors received a one-time OAS relief payment of around $2,350—which complements the CPP boost and provides bigger support during inflation-heavy times.

How CPP Payments Are Calculated?

Understanding your CPP payments starts with two main things:

- How Much You Paid In: This is based on your employment history and contributions to CPP throughout your working years.

- When You Take It: Starting earlier means smaller monthly checks, while delaying until 70 means bigger monthly payments.

Also, if you keep working while receiving CPP, you might get a Post-Retirement Benefit (PRB). It’s like a bonus that adds cash to your monthly payments for working seniors.

Simple Example

- Sam worked steadily, paid max contributions, so their monthly CPP is near the max ($1,433).

- Alex had gaps/part-time jobs and paid less, so their monthly CPP is closer to $750 or $890.

Come November, both Sam and Alex will receive their usual payment plus the $758 boost, which is a nice bump.

Step-by-Step November 2025 CPP Payment Guide

Step 1: Confirm Eligibility

Ensure you:

- Are 60 or older and collecting CPP by November 1.

- Have reported income under $85,000 on the 2024 tax year.

Step 2: Mark Your Calendar

Watch for payments on November 26, 2025.

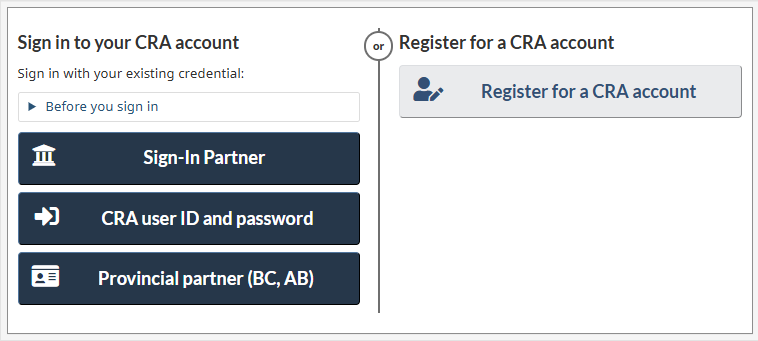

Step 3: Keep Your Info Updated

Update your banking info and address with Service Canada to avoid payment delays.

Step 4: Plan Your Finances

Use the boost for paying bills, medical expenses, or saving for future needs.

CPP Eligibility and Contribution Details

To qualify for CPP, you must meet these basic conditions:

- Be at least 60 years old.

- Have made at least one valid contribution to CPP during your working life.

Contributions can be from work in Canada or, in some cases, credits transferred from a former spouse or common-law partner after separation or divorce.

Who Has to Contribute?

Virtually all Canadian workers between 18 and 64 years who earn above $3,500 annually must contribute. Employees contribute 5.95% of their earnings, matched dollar-for-dollar by employers. Self-employed workers pay both portions (11.9%). The maximum pensionable earnings for 2025 are $71,300, capping how much you pay and how much you can receive.

Post-Retirement Benefit

If you choose to work after starting your CPP pension (between ages 60 and 70), you can continue contributing and earn the Post-Retirement Benefit (PRB), which adds to your monthly CPP payments. Contributions stop at 70, but benefits last for life.

Beyond Retirement: Other CPP Benefits

While retirement payments get the spotlight, CPP also offers important benefits for Canadians facing challenges or family changes:

- Disability Benefit: Financial support for contributors under 65 who can’t work due to disability.

- Post-Retirement Disability Benefit: For those disabled between ages 60-65 after starting CPP.

- Survivor’s Pension: Monthly payments to surviving spouses or common-law partners.

- Children’s Benefits: Support for children of disabled or deceased contributors.

These features make CPP a vital lifeline for many Canadian families beyond retirement.

Taxes and CPP: What You Should Know

All CPP income, including the November 2025 one-time boost, is taxable and must be reported on your tax return. Plan accordingly to avoid surprises. However, CPP payments do not affect eligibility for other supports like the Guaranteed Income Supplement or provincial benefits.

Living in the U.S. or Abroad?

If you’re a Canadian receiving CPP while living outside Canada (including the U.S.), the payments continue. Currency fluctuations and local taxes may affect your net amount, but the government continues CPP payments no matter where you reside.

$750 + $890 Double CPP Payment in November 2025 – Fact Check Here, Eligibility & Payment Date

Canada Extra GST Payment In November 2025 – Know Amount, Eligibility & Dates

$628 Canada Grocery Rebate in November 2025: Is it true? How to Check Status