$2,400 Christmas Bonus: If you’ve seen headlines or Facebook posts about a “$2,400 Christmas Bonus for Canadian Seniors”, you’re probably wondering: Is this real? It’s a question thousands of Canadians are asking as the holiday season approaches — especially with living costs, groceries, and heating bills still climbing in 2025.

Here’s the truth: as of October 2025, there’s no federal announcement of a one-time, nationwide $2,400 Christmas bonus for all Canadian seniors.

However, there are a number of legitimate benefit programs, provincial top-ups, and annual adjustments that may lead some seniors to receive extra money around the holidays, depending on where they live and their income level. Let’s break down what’s real, what’s rumor, and how you can check if you might qualify for any of these legitimate payments.

Table of Contents

$2,400 Christmas Bonus

Let’s keep it simple: despite what social media might say, there’s no confirmed $2,400 Christmas bonus for Canadian seniors in 2025. The good news? Federal and provincial programs already deliver thousands of dollars in yearly support — from OAS and GIS to tax credits and housing subsidies. If you want to make sure you’re getting every dollar you’re entitled to, start by checking your eligibility, filing your taxes, and monitoring your My Service Canada Account. Real help is out there — just make sure it’s the real deal.

| Program / Topic | Details (2025) |

|---|---|

| OAS Pension | Up to $713.34/month (ages 65–74); $784.67/month (ages 75+) |

| GIS Supplement | Up to $1,065.47/month for single low-income seniors |

| CPP Retirement Payment (Avg 2025) | About $811/month |

| Provincial Top-Ups | Ontario GAINS: up to $90/month; Alberta Seniors Benefit: up to ~$3,000/year |

| “$2,400 Christmas Bonus” | No federal confirmation — possibly confusion with other benefits |

| Official Source | Canada.ca |

What Is the $2,400 Christmas Bonus Everyone Is Talking About?

The rumor started spreading across social media platforms — especially TikTok, Facebook, and YouTube — where short clips claimed that “Canadian seniors are finally getting a $2,400 Christmas payment.”

In reality, the number $2,400 appears to come from other government programs, such as the Canada Disability Benefit (CDB) that offers up to $200 per month ($2,400 annually) for working-age Canadians with disabilities. Some online content creators likely misunderstood or repurposed this information as a “senior bonus.”

The Government of Canada has not issued an official press release or policy statement promising a $2,400 holiday payment for seniors. But that doesn’t mean help isn’t available — it just comes through existing, ongoing programs like Old Age Security (OAS), Guaranteed Income Supplement (GIS), and various provincial benefits.

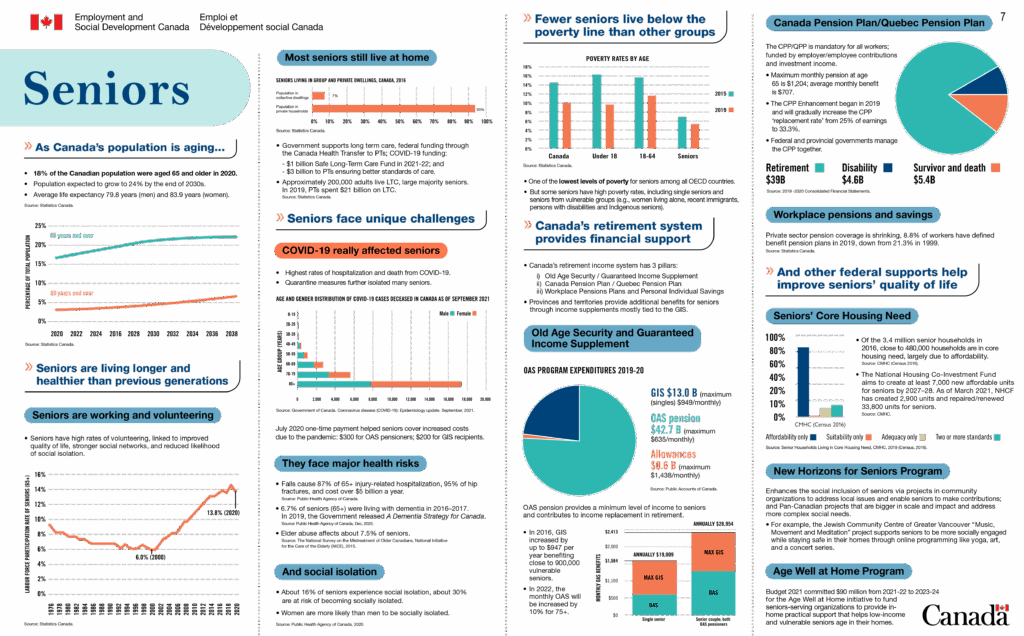

Understanding the Real Programs Supporting Canadian Seniors

1. Old Age Security (OAS)

The Old Age Security pension is the backbone of senior support in Canada. It’s available to most Canadians aged 65 or older who have lived in the country for at least 10 years after age 18.

OAS is indexed quarterly to match inflation — meaning if prices rise, payments increase.

For 2025:

- Ages 65–74 → $713.34/month

- Ages 75+ → $784.67/month

That’s roughly $8,560–$9,416 per year — and it’s taxable income.

Payments typically arrive monthly, with upcoming pay dates listed on Canada.ca.

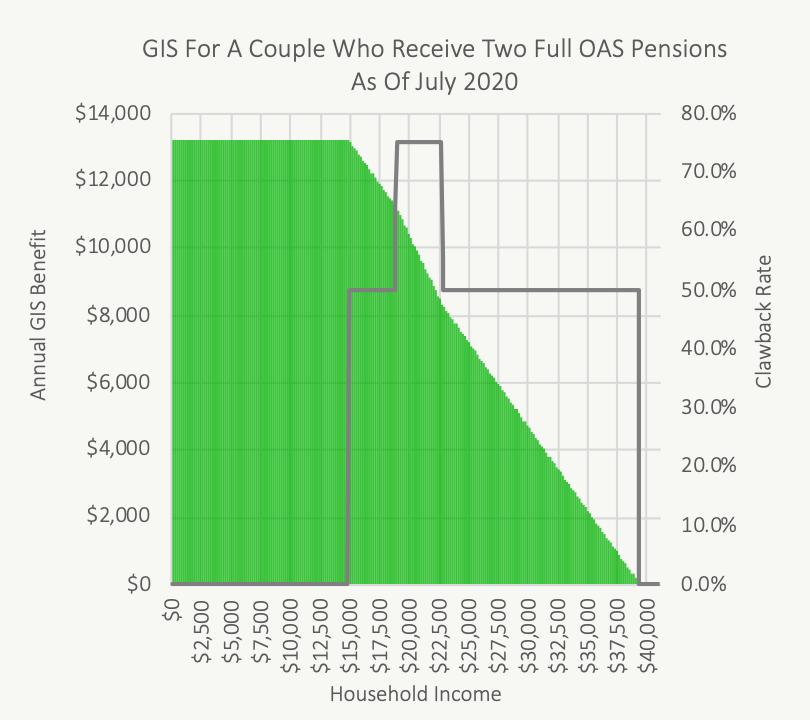

2. Guaranteed Income Supplement (GIS)

GIS is a non-taxable supplement for low-income seniors already receiving OAS. You don’t have to apply separately — as long as you file taxes annually, Service Canada recalculates your GIS automatically.

In 2025:

- A single senior with no other income can receive up to $1,065.47/month.

- Couples can receive up to $1,725.19/month combined, depending on income.

GIS payments can increase or decrease each year, based on the previous year’s income tax return. So, timely filing is crucial.

3. Canada Pension Plan (CPP)

The CPP is a contributory program based on your work history and contributions. While not a “bonus,” it forms a major part of seniors’ income.

As of mid-2025, the average CPP retirement benefit is around $811/month, though some receive up to $1,364.60/month (the maximum for those who contributed at or above the earnings ceiling for 39 years).

4. Provincial Supplements and Top-Ups

Canada’s provinces and territories provide extra benefits beyond federal payments:

- Ontario: Guaranteed Annual Income System (GAINS) adds up to $90/month for low-income seniors, totaling about $1,080 annually.

- Alberta: Alberta Seniors Benefit provides up to $3,000 per year for low-income individuals or $4,800 for couples.

- British Columbia: Offers rent supplements and home-owner grants for seniors.

- Quebec: Provides the Senior Assistance Amount, a refundable tax credit up to $2,000 for those 70 and older.

- Saskatchewan & Manitoba: Offer property-tax credits, home-repair grants, and heating subsidies for low-income seniors.

Depending on your mix of programs, it’s easy to see how total annual assistance could approach — or even exceed — $2,400. That’s likely where the confusion comes from.

Why So Many Canadians Believe the $2,400 Christmas Bonus Rumor?

Several factors feed the viral “$2,400 Christmas Bonus” story:

- Misinterpreted headlines. News about the Canada Disability Benefit (worth up to $2,400 per year) spread quickly, with “for seniors” accidentally attached.

- Cumulative math. When you add federal, provincial, and local benefits, the yearly increase might total roughly $2,400 — which some people mistake as a single cheque.

- Timing. Many programs issue cost-of-living adjustments in December or January, so payment bumps appear near Christmas.

- Social-media amplification. Posts promising “free money” get shared fast — even without citations.

Step-by-Step Guide: How to Verify and Maximize Your $2,400 Christmas Bonus

Step 1: Confirm Your Eligibility

To qualify for OAS:

- You must be 65 years or older

- Be a Canadian citizen or legal resident

- Have lived in Canada for at least 10 years after age 18

For GIS, you must:

- Receive OAS

- Have income below the annual threshold

- File taxes each year

Step 2: Check Official Sources

Always rely on credible sites:

- Canada.ca – Federal programs and announcements

- Service Canada – Payment details, contact info

- Benefits Finder Tool – Personalized benefit list by location and income

Avoid unofficial blogs or social-media posts that don’t link back to government websites.

Step 3: Keep Your Tax Records Updated

Your income tax return determines GIS and other need-based benefits. Even if you have zero income, file your return every year. Missing a filing can delay or cancel your supplement payments.

Step 4: Track Payment Dates

Most OAS and GIS payments arrive on the same day each month.

Step 5: Beware of Scams

Whenever money news spreads, scammers act fast. Be cautious of:

- Emails or texts asking for bank information or “activation fees”

- Messages from addresses not ending in “@canada.ca”

- Calls urging you to act “immediately” to receive your bonus

Report suspicious activity to the Canadian Anti-Fraud Centre or call 1-888-495-8501.

Common Scenarios (Examples)

Example 1:

Mary, age 70, lives in Ontario with a modest pension. She gets OAS and GIS plus $90/month from GAINS. Over the year, that’s an extra $1,080. Not a lump sum, but it adds up.

Example 2:

Robert, age 76, in Alberta, has low income. He receives OAS and the Alberta Seniors Benefit, totaling nearly $2,900 yearly in provincial support — sometimes arriving near year-end. This could easily be mistaken for a “Christmas bonus.”

Example 3:

Linda, age 68, saw a viral video promising $2,400.

Financial Expert Insight

Financial planners across Canada stress that accurate information is key for seniors. Many clients assume they’ll automatically get every benefit, but most programs rely on up-to-date tax filings and proper applications.

Tip from professionals:

Review your benefit situation every spring after tax season. Verify all payments and thresholds through My Service Canada Account.

Keeping an updated budget spreadsheet with your OAS, GIS, CPP, and provincial amounts helps ensure you’re not missing out.

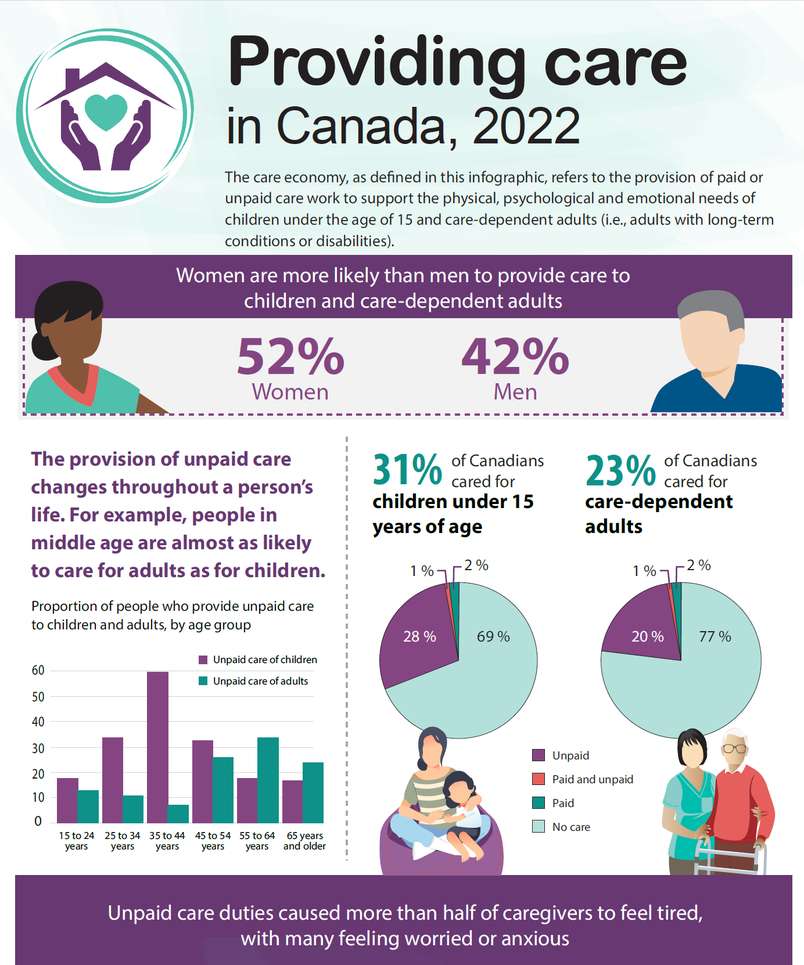

Broader Context: How Canada Supports Seniors in 2025

As of 2025, there are about 7.5 million Canadians aged 65 and older, projected to reach 9.5 million by 2030. That’s roughly 1 in 5 Canadians. With the population aging fast, the government regularly adjusts benefit levels to offset inflation and maintain purchasing power.

Recent trends:

- Average household expenses for seniors increased 11 % since 2022 (StatsCan 2024).

- Average grocery costs rose 6 % year-over-year in 2025.

- OAS and GIS were indexed twice in 2025, adding about $20–30/month for most recipients.

These incremental raises can easily total $240–$360 per year, further explaining how a $2,400 cumulative increase rumor could sound believable — even though no single bonus cheque exists.

$445 Canada Family Benefit Payment in November 2025, Know Eligibility & Payment Dates

Canada Cost of Living Increase in November 2025 – Check How much? Payment Date

$360 Canada OTB In November 2025 – These people are eligible, Check Eligibility & Payment

Practical Tips for Seniors and Families

- Sign up for Direct Deposit: Faster and safer than paper cheques.

- Use My Service Canada Account: Track OAS, GIS, and CPP in one place.

- Seek local help: Community centres, libraries, and Service Canada offices often assist with applications.

- Consult a financial planner: They can help you layer programs to maximize income.

- Avoid misinformation: If it’s not on Canada.ca, it’s probably not real.