Canada $4100 CRA Direct Payment: As Canadian seniors prepare for the final stretch of 2025, a significant financial announcement is capturing attention: the Canada Revenue Agency (CRA) will distribute a one-time benefit of $3,900 to eligible seniors — expected to arrive in November 2025. This initiative aims to provide vital financial support amid ongoing inflation, rising healthcare costs, and everyday expenses that demand careful planning and budgeting. If you’re a senior, caregiver, or financial advisor, understanding the ins and outs of this benefit is crucial to ensuring you receive what you’re entitled to without unnecessary delays. This comprehensive guide will take you through eligibility requirements, application procedures, payment schedules, and tips for making the most of this support — all written in clear, straightforward language.

Table of Contents

Canada $4100 CRA Direct Payment

Canadian seniors will receive a $3,900 one-time payment in November 2025, a necessary boost in an inflationary environment that aims to help the elderly meet rising costs. The approval process is straightforward, with most seniors automatically qualifying. The best advice: stay updated via CRA online portals, verify your account details, file your taxes, and prepare to utilize this support efficiently.

| Feature | Details |

|---|---|

| Payment Amount | $3,900 (One-time direct payment) |

| Eligible Age | Seniors aged 65+ |

| Payment Date | Approximate: November 27, 2025 |

| Payment Method | Direct deposit or mailed cheque |

| Eligibility Requirements | Canadian residents, age 65+, tax filing up-to-date |

| Purpose | Financial relief to combat rising living costs |

| Claim Process | Automatic for most; CRA My Account update recommended |

| Official CRA Website | Canada Revenue Agency |

Why Is the Canada $4100 CRA Direct Payment Being Issued?

The Canadian government recognizes that many seniors are facing unprecedented economic challenges. Inflation has pushed up prices for groceries, medicine, heating, and housing—sometimes faster than benefit increases. In response, CRA has announced a special financial assist: a one-time, non-taxable payment of $3,900 designed to help seniors meet their daily needs during this difficult period.

This support isn’t a replacement for regular pensions like the Old Age Security (OAS) or Canada Pension Plan (CPP); rather, it’s an additional infusion to supplement existing income and ensure seniors stay financially stable.

The Broader Context

The problem is broad and complex—rising inflation impacting every facet of daily life, especially for seniors on fixed incomes. Historically, Canada’s social safety net includes programs like OAS, GIS, and CPP, which have served as anchors for retirement income. However, with inflation constantly eroding purchasing power, governments often introduce supplementary payments during extraordinary economic conditions — this is one such measure.

Officially announced and confirmed, this $3,900 payment aligns with similar previous initiatives like the $500 or $1,500 one-time payments during earlier pandemic relief efforts, but with increased scope reflecting current economic pressures.

Who Qualifies for the Canada $4100 CRA Direct Payment?

This is where clarity and precision are important. The supporters of the government’s effort must meet specific eligibility criteria to ensure the benefit reaches those who need it most.

Key Eligibility Factors

- Age: You must be 65 or older at the time of payment. The government prioritizes seniors in this age group, recognizing their heightened vulnerability to inflation.

- Residency: You need to be a Canadian citizen or a permanent resident living in Canada for the duration of the eligibility period.

- Tax Filing Status: You should have filed tax returns for recent years. The CRA relies on tax records to determine eligibility for this benefit.

- Account Details: An updated CRA My Account with current banking info ensures faster, direct deposit payments.

- Income Details: While the payment is designed as a broad support mechanism, certain income thresholds and benefit histories might influence qualification, especially for those already receiving specific government assistance programs.

Additional Notes on Eligibility

The government emphasizes that the payment is not targeted only at low-income seniors but is accessible to all seniors who meet age and residency criteria, ensuring broad support during tough economic times. Therefore, even seniors with moderate incomes are encouraged to check their eligibility.

How to Know if You Are Eligible?

Most seniors automatically qualify if they meet the basic criteria, and the CRA will issue the payment based on existing records, particularly those with updated banking details. However, verifying eligibility via the CRA’s online platform or by consulting with their helpdesk can clarify doubts and prevent delays.

How and When Will the Payment Be Disbursed?

Timely and efficient distribution is vital. Based on official schedules and recent government confirmations, seniors should expect the $3,900 payment to be deposited around November 27, 2025.

Payment Methods

- Direct Deposit: The fastest, safest way. Seniors should ensure their bank details are linked and verified through the CRA My Account.

- Mailed Cheques: Those not enrolled in direct deposit will receive physical cheques by postal mail, though this method may take longer.

Payment Schedule

The CRA updates the payment timelines regularly, but for 2025, the scheduled date is approximately November 27, aligning with regular pension disbursement dates. Other benefits like CPP are also scheduled around late November or late December, which makes this a logical annual adjustment.

What Should Seniors Do Now?

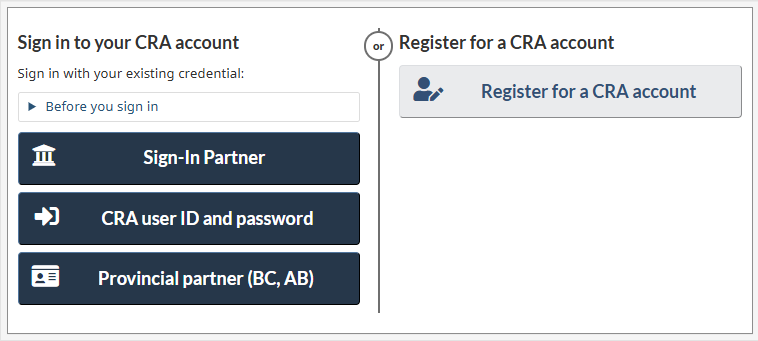

- If you haven’t set up your CRA My Account, do so today at CRA My Account.

- Verify your banking details for direct deposit.

- Keep your contact info updated and ensure you’ve filed your last tax return.

Step-by-Step: How Seniors Can Ensure They Get Canada $4100 CRA Direct Payment

Even though most will automatically receive this benefit, taking these steps can ensure a seamless process:

- Verify Your Eligibility: Confirm you are 65 years or older, a Canadian resident, and have recent tax filed.

- Create or Log Into Your CRA My Account: This allows you to view the payment status and update banking details.

- Update Your Banking Details: Link your bank account for faster, direct deposit payment.

- Stay Alert for Official Notices: CRA will send notifications—either by mail or online—announcing the deposit.

- Plan for Your Payment: Once received, use the funds wisely to cover essential needs.

Canada CRA Benefits Payment Dates For November 2025: Check Payment Amount, Eligibility

Canada $1700+$650 CRA Double Payment in November 2025: Check Payment Date & Eligibility Criteria

CPP $782 + $758 Extra Deposit For November 2025, Check Who Is Eligible?

Why Is This Payment Such a Game-Changer?

The $3,900 payment serves as vital support, especially as inflation continues to inflate costs. For seniors, it can mean the difference between affording medication, keeping the roof over their heads, or simply having peace of mind in uncertain economic times.

Comparing with Other Benefits

| Benefit | Description | Typical Amount/Support |

|---|---|---|

| Old Age Security (OAS) | Monthly pension for seniors 65+ | Starting at about $600/month, adjusted quarterly |

| Canada Pension Plan (CPP) | Pension based on employment contributions | Varies, but average around $700/month |

| Guaranteed Income Supplement | For low-income seniors | Up to approximately $950/month |

| $3,900 one-time payment | Special relief in 2025 | Single payment, covers many essentials for weeks/months |

This new benefit fills a critical gap, offering immediate relief that can be used to buy groceries, pay bills, or cover unforeseen expenses.

Final Tips for Seniors

- Keep all your documents handy—birth certificate, tax records, CRA notices.

- Update your CRA account for speed and security.

- Be wary of scams—CRA will never ask for money or personal encryption codes by phone or email.

- Share accurate info with your family or caregivers to help manage the funds efficiently.

- Stay informed through the official CRA website Canada Revenue Agency.