Canada Extra GST Payment: If you’re living in Canada and looking for some extra financial relief this fall, chances are you’ve heard about the Extra GST Payment from the Canada Revenue Agency (CRA). Designed to help low- and modest-income Canadians manage the goods and services tax (GST) and harmonized sales tax (HST) they pay throughout the year, this payment plays a vital role in easing financial burdens. So, what’s the scoop on the Canada Extra GST Payment in November 2025? This article provides a detailed, expert, yet easy-to-understand breakdown—perfect for anyone managing a household or advising clients professionally. The GST/HST credit is a non-taxable, quarterly payment aimed at helping Canadians offset some of the taxes paid on essentials like food, clothing, and household items. Based on your 2024 tax return, this credit helps you get some money back each year. Many folks expect an “extra payment” in November, but payments actually follow a consistent quarterly schedule throughout the year.

Table of Contents

Canada Extra GST Payment

The Canada Extra GST Payment in November 2025 is part of the larger GST/HST credit program, a vital financial support system helping low- and modest-income Canadians offset tax costs on essentials. While no specific GST payment happens in November, other benefits often coincide, providing additional relief. Accurate tax filings, timely updates to CRA, and knowing related benefits ensure you receive your full entitlements. Whether budgeting personally or advising financially, this credit is a reliable quarterly boost in Canada’s social safety net.

| Topic | Details |

|---|---|

| Payment Amount | Up to $533 for singles, $698 for couples, plus $184 per child (under 19) |

| Number of Payments | 4 quarterly payments: January, April, July, October; next due January 2026 |

| November 2025 Payment | No separate GST payment in November; regular benefits like Canada Child Benefit may occur |

| Eligibility | Canadian resident, filed 2024 tax return, income below CRA limits, 19+ years old |

| Related Benefits | Includes Canada Child Benefit, Canada Workers Benefit, GST/HST credit |

| Official Resource | Canada Revenue Agency – GST/HST Credit |

What Is the GST/HST Credit?

The GST/HST credit is a government financial boost paid quarterly to ease the burden of sales tax for Canadians with low or modest incomes. This payment acts like a quarterly tax rebate on essentials such as groceries, clothing, and services — things that add up and affect your wallet monthly.

How the Payments Work in Detail?

The credit amount depends heavily on your family income and composition, and it’s recalculated every year based on your tax returns. For 2025, based on 2024 tax returns:

- Single individuals can receive up to $533 annually.

- Couples or common-law partners can receive up to $698 annually.

- Families receive an additional $184 for each child under 19.

These amounts are divided into four quarterly payments, which means you get a predictable boost every few months to help with your budget. For example, a single parent with two kids could receive around $225 each quarter, totaling about $900 annually.

Why There Is No Canada Extra GST Payment?

The common misconception is that November comes with a special GST top-up or additional payment. In reality, GST/HST credits are distributed quarterly in January, April, July, and October. The last payment in 2025 was on October 3rd. There’s no separate payment scheduled for November.

However, November might feature other federal payments like:

- The Canada Child Benefit (CCB), which supports families with children.

- The Canada Workers Benefit (CWB)

- Potential one-time payments or emergency relief, such as the confirmed $2300 one-time payment announced for November 2025 to support Canadians facing inflationary pressures.

These additional payments can make November seem like an “extra” GST month, but they come from separate programs within Canadian social support.

Detailed Eligibility Criteria

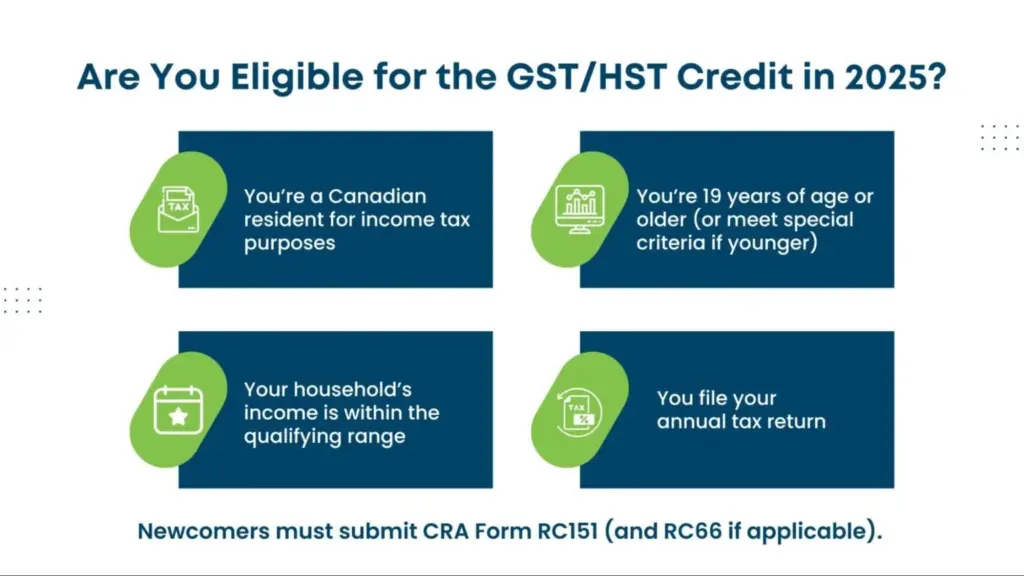

To receive the GST/HST credit in 2025, Canadians must satisfy several criteria based on CRA guidelines:

- Residency: You must be a resident of Canada for income tax purposes at the beginning of the month when payments are made.

- Age: Generally, you must be at least 19 years old. However, individuals under 19 qualify if they have a spouse/common-law partner or are parents living with a child.

- Tax Filing: You need to have filed your 2024 income tax return, even if your reported income was zero.

- Income Thresholds: The credit is income tested. For example:

- Single individuals with income above $52,255 annually don’t qualify.

- Couples with four children have a threshold of about $69,015.

- Family Situation: Your marital status, number of children, and other personal details must be accurately reported on your tax return.

CRA determines eligibility automatically from your tax filing data—no additional application is typically required.

How the Canada Extra GST Payment Helps Canadians?

Rising inflation and living costs hit low- and middle-income Canadians hard. The GST/HST credit offers:

- Financial relief: Covers part of the tax paid on everyday purchases like groceries, public transportation, and utilities.

- Budget predictability: Quarterly payments provide regular cash flow support.

- Support for families: Additional credits for children enable families to better afford essentials like food and clothing.

- Incentive to file taxes: Filing taxes ensures that eligible people receive this relief, even if they earn little or no income.

For financial advisors, the GST/HST credit is a key point when helping clients with effective budgeting and planning.

How to Monitor and Maximize Your GST/HST Credit?

- File taxes on time: Early and accurate filing guarantees no delays in receiving your payments.

- Enroll in Direct Deposit: This is faster and safer than receiving paper cheques.

- Update CRA with life changes: Changes in address, marital status, or dependents must be reported promptly to avoid miscalculations.

- Access CRA My Account: Online access lets you track payment dates, amounts, and eligibility easily.

- Keep documentation handy: Proof of residency, birth certificates for children, and income records help if CRA requests verification.

Related Programs: Beyond GST/HST Credit

Understanding related benefits can help you optimize all available financial support:

- Canada Child Benefit (CCB): Tax-free monthly payments to families helping cover child-rearing costs.

- Canada Workers Benefit (CWB): Designed to support low-income workers with employment-related earnings supplements.

- One-Time Relief Payments: For example, the $2300 CRA payment in November 2025 aimed at alleviating inflation cost pressures.

- Provincial Benefits: Some provinces offer additional top-ups to the federal GST credit, so check local programs.

Keeping abreast of these overlapping credits helps ensure you don’t miss payments.

Budgeting Tips to Stretch Your GST/HST Credit

Making the most of your GST/HST credit helps ease tight finances:

- Separate your credits: Save quarterly payments in a dedicated emergency or household fund.

- Focus on essentials: Allocate money toward groceries, utility bills, and transportation first.

- Tackle debt: Use funds to pay off high-interest debts, reducing monthly financial pressure.

- Plan for seasonal expenses: Use credit to cover back-to-school supplies or holiday necessities.

- Invest in tools: Budget for efficiency tools like energy-saving appliances for long-term savings.

This credit can be a financial lifeline if managed thoughtfully.

Newcomers: Accessing GST/HST Credit in Canada

For those new to Canada:

- File your first Canadian tax return promptly, even if your income is low or zero.

- Submit forms like RC151 (GST/HST Credit Application) if you arrived mid-year.

- Bring documents proving residency and family details to support eligibility.

- Set up Direct Deposit for faster payments.

- Use community resources like Settlement.org and CRA newcomer services for guidance.

Getting these basics right ensures quicker access to all available government credits.

Canada Next Extra GST Payment 2026: Check Eligibility to Get Extra GST in 2026? Extra Amount, Dates

$445 Canada Family Benefit Payment in November 2025, Know Eligibility & Payment Dates

Canada Cost of Living Increase in November 2025 – Check How much? Payment Date