Apria Healthcare – Data Breach Class Action Settlement: If you’ve heard about the Apria Healthcare data breach class action settlement, you’re not alone. Millions of Americans were impacted when hackers accessed Apria’s systems in 2019 and 2021, leading to the exposure of sensitive personal and medical data.

Now, Apria has agreed to a $6.375 million settlement to compensate victims — and if you received a notice, you might be eligible to claim up to $2,000 plus additional pro-rata payments. This article breaks everything down clearly: what happened, who qualifies, how to file your claim, what professionals can learn, and why this settlement is a big deal in today’s cybersecurity landscape.

Table of Contents

Apria Healthcare – Data Breach Class Action Settlement

The Apria Healthcare data breach settlement represents accountability in the digital age. Nearly 1.9 million Americans now have the chance to receive compensation for the exposure of their personal data — but only if they act before October 22, 2025. If you received a notice, don’t wait. It’s free, straightforward, and could help you recover up to $2,000 or more. And if you’re a professional, let this case serve as a reminder: protecting personal data isn’t just a legal requirement — it’s a moral and business imperative in today’s connected world.

| Item | Detail |

|---|---|

| Settlement Fund | $6.375 million |

| Individuals Affected | Approximately 1.87 million |

| Maximum Claim | Up to $2,000 for documented losses |

| Extra Payment | Pro-rata cash payment for all valid claims |

| Claim Deadline | October 22, 2025 |

| Opt-Out (Exclusion) Deadline | September 22, 2025 |

| Final Fairness Hearing | November 4, 2025 |

| Official Website | ApriaSettlement.com |

What Is Apria Healthcare?

Apria Healthcare LLC is a major U.S. home healthcare provider that offers oxygen therapy, respiratory care, sleep apnea treatment, and other medical services. Founded in 1924 and headquartered in Indianapolis, Indiana, Apria serves millions of patients nationwide through hundreds of service branches.

Because Apria works directly with patients and insurance providers, it stores a huge amount of sensitive personal information — including health records and payment data. That made it a high-value target for cybercriminals.

What Happened: Understanding the Apria Healthcare – Data Breach Class Action Settlement Timeline

The Apria Healthcare data breaches occurred in two separate events:

- First Breach: Between April 5 and May 7, 2019, hackers gained unauthorized access to Apria’s internal systems.

- Second Breach: Between August 27 and October 10, 2021, cybercriminals infiltrated additional systems, exposing even more data.

In total, nearly 1.9 million individuals had their personal information compromised. According to court documents, the stolen data may have included names, dates of birth, Social Security numbers, health insurance details, medical information, and financial account numbers.

Apria first detected suspicious activity in 2021 and hired third-party cybersecurity experts to investigate. However, the company didn’t notify affected individuals until 2023, prompting outrage and multiple lawsuits alleging delayed disclosure and inadequate security practices.

The Class Action Settlement Explained

Apria denies any wrongdoing but agreed to settle the lawsuits to avoid further legal costs and uncertainty. The $6.375 million settlement fund aims to reimburse victims for documented out-of-pocket losses and compensate all valid claimants through pro-rata payments.

This case — officially titled In re Apria Healthcare Data Breach Litigation — was filed in the U.S. District Court for the Southern District of Indiana. The settlement covers anyone who received notice from Apria Healthcare that their data may have been compromised in the 2019 or 2021 incidents.

What Data Was Exposed — And Why It Matters

The hackers potentially accessed:

- Full names

- Addresses and phone numbers

- Social Security numbers

- Driver’s license numbers

- Medical records and insurance details

- Bank account or payment card information

In short, everything needed for identity theft or insurance fraud. According to the FBI, stolen health data can fetch up to 20 times more than credit card data on the dark web because it’s harder to detect and can be misused for years.

This is why the Apria breach drew serious attention from regulators and consumer advocates — medical data theft can ruin a person’s finances, credit, and privacy.

Who Is Eligible to File a Apria Healthcare – Data Breach Class Action Settlement Claim?

You may be eligible to file a claim if:

- You received a notice from Apria Healthcare about the breach (either by mail or email).

- You experienced unreimbursed, documented out-of-pocket expenses resulting from the breach.

- You submit a valid claim form by October 22, 2025 through ApriaSettlement.com.

People who did not receive a notice, judges and their families, Apria employees, and those who opt out of the settlement are not eligible.

Step-by-Step Guide to Filing a Apria Healthcare – Data Breach Class Action Settlement Claim

Step 1 – Check Your Notice:

Confirm that you received a letter or email from Apria stating that your data was affected.

Step 2 – Gather Documentation:

Collect receipts, bank statements, or invoices showing any costs related to the breach. Handwritten notes or unsupported statements are not enough.

Step 3 – Go to the Official Website:

Visit ApriaSettlement.com to file your claim online or download a printable form.

Step 4 – Complete the Claim Form:

Enter your personal information, claim ID (if provided), loss details, and upload supporting documents.

Step 5 – Submit by Deadline:

Your claim must be submitted or postmarked by October 22, 2025.

Step 6 – Wait for the Court’s Approval:

The final approval hearing will be held on November 4, 2025. Payments will be distributed afterward.

Step 7 – Keep Copies of Everything:

Save a copy of your claim confirmation and any correspondence with the settlement administrator.

Why This Settlement Matters?

This settlement is more than just a payout — it’s a powerful message about corporate accountability in healthcare cybersecurity.

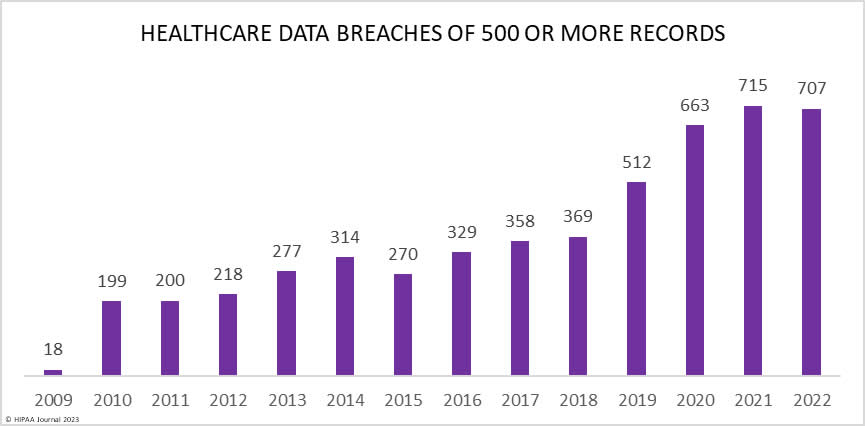

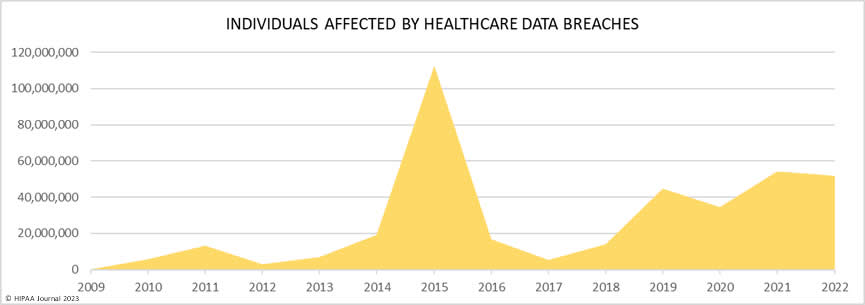

Data breaches have become a recurring threat in the U.S. In 2023, there were over 3,200 data breaches, affecting more than 353 million people, according to the Identity Theft Resource Center. Healthcare remains one of the most targeted industries due to the high value of medical data.

For Apria, this is a reputational and financial hit. But for individuals, it’s a reminder of how vulnerable our information can be and how important it is to act quickly when breaches occur.

Cybersecurity Lessons for Individuals and Professionals

Even if you weren’t part of this breach, you can use it as a wake-up call.

For Individuals:

- Freeze your credit at all three bureaus — Experian, Equifax, and TransUnion.

- Enable two-factor authentication for online accounts.

- Review your credit reports regularly through AnnualCreditReport.com.

- Use strong, unique passwords for every account.

- Report suspected identity theft immediately at IdentityTheft.gov.

For Businesses and Healthcare Professionals:

- Conduct regular security audits and risk assessments.

- Train staff on HIPAA compliance and phishing awareness.

- Implement strong encryption and access controls.

- Establish a clear incident response plan and rehearse it annually.

- Notify affected individuals promptly — delayed disclosures increase liability.

Professionals in risk management, compliance, and healthcare law can view this case as a textbook example of how cybersecurity lapses can escalate into multimillion-dollar liabilities.

Expert Insight: The Bigger Implications

From an industry perspective, the Apria Healthcare data breach settlement is another reminder that cyber risk is not just an IT issue — it’s an enterprise-level responsibility.

Healthcare companies are custodians of the most sensitive data imaginable, yet many still operate with outdated systems or inadequate response protocols. Under HIPAA and state data protection laws, failure to secure personal health information can lead to enormous financial penalties and loss of trust.

This settlement also signals a shift in how U.S. courts handle data breach cases: consumers are increasingly winning settlements even when companies don’t admit fault. The message is clear — prevention is cheaper than litigation.

$1,000 Cash App Settlement Incoming – Check If You Qualify for the Payout!

$5,000 Wells Fargo Settlement Payouts – Who Qualifies and When to Expect Your Money

Professional Takeaways

For those in healthcare, law, or IT, this case offers several lessons:

- Cybersecurity isn’t optional. A single breach can lead to years of litigation and multi-million-dollar settlements.

- Transparency builds trust. Prompt disclosure of breaches can reduce reputational damage and regulatory penalties.

- Documentation is critical. Whether defending a company or filing a claim, clear, traceable evidence matters most.

- Patient trust is priceless. Rebuilding confidence after a data breach requires more than money — it requires stronger systems and clear communication.