COLA Increase Confirmed for 2026: The 2026 COLA Increase has been the talk of the town for months — from retirees chatting at the coffee shop to financial analysts breaking down spreadsheets. Everyone wants to know how much Social Security benefits will rise next year, when the official announcement will hit, and what it really means for wallets across America. Let’s cut through the noise. In this guide, you’ll get all the facts, context, and practical advice — explained simply and clearly, with professional insight and a friendly tone.

Table of Contents

COLA Increase Confirmed for 2026

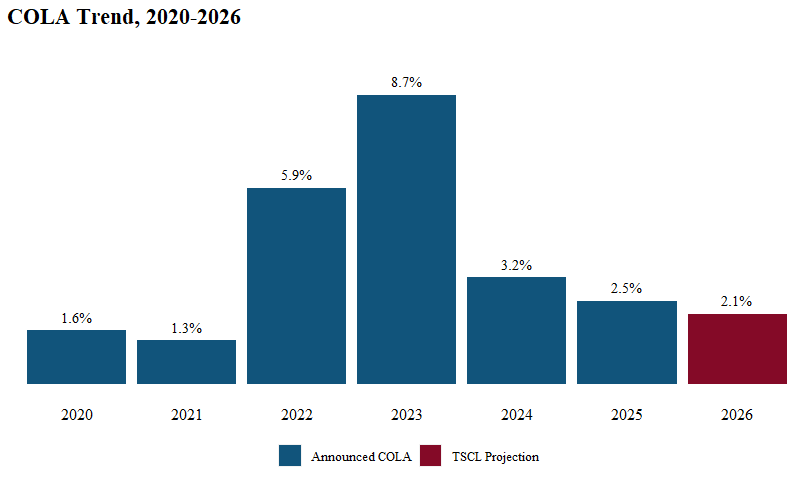

The 2026 COLA Increase may not be huge, but it’s a steady step in the right direction. With an expected rise of about 2.6%–2.7%, most Social Security recipients will see roughly $50–$60 more each month starting January 2026. While the raise helps, rising costs — especially in healthcare and housing — mean careful budgeting and planning remain key. Professionals should update their models, and individuals should treat this adjustment as part of a broader financial strategy, not a windfall. Mark October 24, 2025 on your calendar for the official report, and keep an eye on the SSA and BLS websites for the verified data release.

| Item | Details |

|---|---|

| Projected COLA for 2026 | Around 2.6%–2.7% |

| Official Announcement Date | October 24, 2025 |

| Effective Date of Increase | January 1, 2026 |

| Average Benefit Impact | $2,008 → $2,062 (+$54) for retired workers |

| Calculation Basis | Consumer Price Index for Urban Wage Earners (CPI-W) |

| Main Caveat | Modest bump may not fully offset rising medical and housing costs |

Why COLA Increase Confirmed for 2026 Matters?

Every fall, the Social Security Administration (SSA) releases its Cost-of-Living Adjustment (COLA) — a critical tweak designed to ensure your Social Security benefits keep pace with inflation. Think of it as your paycheck’s way of saying, “Hey, prices went up — here’s a little help.”

Tens of millions of Americans rely on these checks — retirees, disabled workers, survivors, and families. A single percentage point can make a real difference when it comes to covering rent, groceries, or prescription refills.

So yes, when we talk about the 2026 COLA increase, we’re really talking about how far your dollar will stretch next year — and when exactly you’ll get the official word from the SSA.

What’s Going On, Plain and Simple?

Let’s make this straightforward — no finance jargon, no confusion.

Why a COLA Exists?

Inflation means prices climb over time. Without adjustments, people living on fixed incomes — like Social Security recipients — would lose purchasing power. The Cost-of-Living Adjustment fixes that, ensuring your benefits keep up with inflation.

It’s not about “extra money,” really — it’s about preserving your buying power.

How It’s Calculated?

Here’s the behind-the-scenes math:

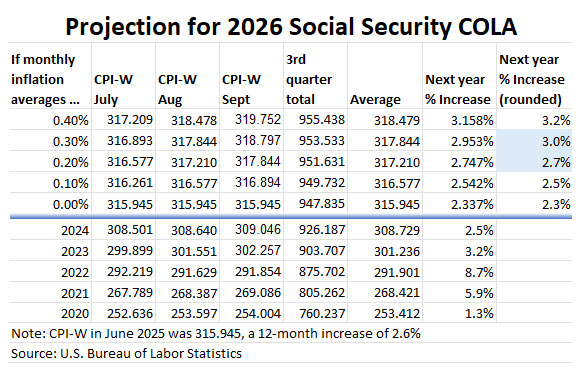

- The Bureau of Labor Statistics (BLS) measures price changes using the CPI-W index (Consumer Price Index for Urban Wage Earners and Clerical Workers).

- They take the average of July, August, and September data for the current year.

- They compare it to the same months from the previous year.

- The percentage difference becomes the COLA.

Example:

If the CPI-W average increases by 2.7%, then Social Security benefits rise 2.7% starting the next January.

What’s Different in 2026?

Normally, the COLA announcement drops in early-to-mid October. But 2025 hasn’t been a “normal” year.

- Government Shutdown Delay: Due to a temporary federal shutdown, the September 2025 CPI data — the last piece needed to calculate COLA — got pushed back.

- New Date Confirmed: The Bureau of Labor Statistics (BLS) will now release September’s CPI data on October 24, 2025. The SSA will announce the COLA that same day.

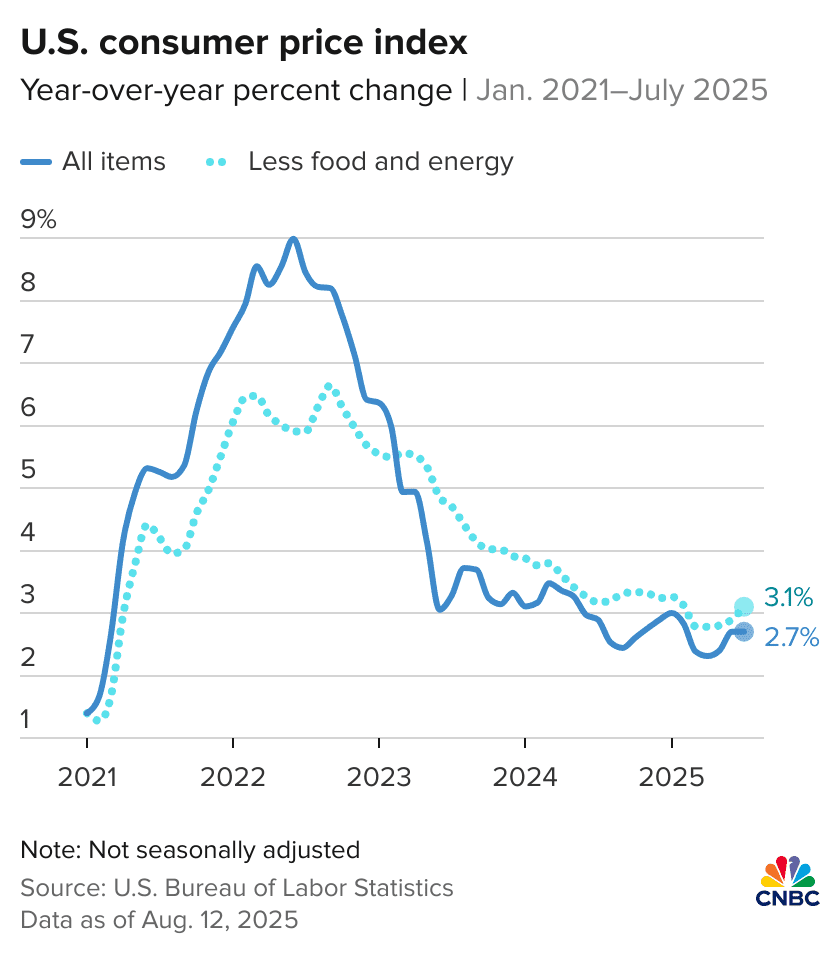

- Expected Increase: Current projections hover around 2.6%–2.7%, signaling steady inflation but not the sky-high jumps seen in 2022–2023.

So, if you were hoping for another 8% bump — not this time. But this steady rise still adds meaningful dollars to millions of households.

Who’s Affected and What to Watch?

Who Benefits?

- Retired Workers: The biggest group impacted — over 52 million Americans.

- Survivors and Disabled Beneficiaries: Their benefits are tied to the same adjustment.

- SSI Recipients: Supplemental Security Income benefits adjust alongside COLA.

- Professionals: Financial planners, HR specialists, and accountants need to update payroll systems and models based on the new COLA.

Key Things to Track

- The official SSA announcement (Oct 24).

- The CPI-W data release from BLS.

- Possible changes in Medicare Part B premiums, which could offset some of your gain.

- Tax implications for higher-income retirees.

Step-by-Step Guide: What You Should Do

1. Mark the Date

Circle October 24, 2025 on your calendar. That’s when the official COLA is expected to be announced.

2. Review Your Current Benefits

Find your latest benefit statement or sign in to mySocialSecurity.gov to see your current monthly payment.

3. Estimate Your Raise

If your current benefit is $2,000/month:

- 2.6% increase: +$52

- 2.7% increase: +$54

That’s an extra $624 per year — before taxes or Medicare deductions.

4. Revisit Your Budget

Inflation may slow, but costs haven’t dropped.

- Expect higher utility and grocery prices to persist.

- Check out your healthcare plans for premium adjustments.

- Consider updating emergency savings to match new monthly needs.

5. For Professionals and HR Managers

- Update salary models and benefits estimates.

- Communicate clearly to employees and retirees about the changes.

- Adjust retirement planning projections accordingly.

Practical Example

Let’s put this into a real-world story.

Mary, age 68, gets $1,900 a month in Social Security. A 2.7% COLA means she’ll see about a $52 bump — $1,952 a month.

But her rent’s going up $45, and her Medicare Part B premium might rise by $9. That means her net gain could be closer to $0.

That’s why it’s crucial to look beyond the percentage — COLA helps, but it’s not a cure-all.

Financial pros often recommend creating a “COLA buffer” — using part of the annual increase to pay down debt or increase savings instead of treating it as free spending money.

Why the COLA Might Still Feel Small?

You’re not imagining it — even with a bump, many retirees still feel squeezed.

- CPI-W doesn’t reflect senior spending: Retirees often spend more on healthcare and housing — categories that rise faster than the general inflation rate.

- Premiums offset gains: Rising Medicare and insurance premiums can eat into the raise.

- Regional differences: A 2.7% increase feels very different in Phoenix than in rural Iowa, thanks to different living costs.

Experts from The Senior Citizens League note that the average retiree has lost about 36% of buying power since 2000, despite annual COLAs.

Additional 2026 Social Security Changes

The COLA isn’t the only update you’ll see next year. According to Kiplinger, here are other adjustments to expect:

- Taxable Wage Base Increase: The earnings cap subject to Social Security taxes will rise (likely above $175,000).

- Earnings Test Threshold: For those under full retirement age, you can earn more before benefits are withheld.

- Trust Fund Solvency: While no immediate crisis looms, professionals are closely monitoring Congress for long-term fixes.

Financial Planning Advice

- For Retirees: Use your COLA raise strategically — pay down debt, offset inflation, or boost savings.

- For Pre-Retirees: Run “what-if” scenarios assuming smaller COLAs in the future.

- For Professionals: Integrate updated COLA assumptions into your clients’ models and emphasize diversification of retirement income streams.

Social Security COLA Hike 2026 – Experts Predict Major Boost Amid Rising Inflation

Social Security Payment Changes for Thanksgiving 2025 – Check Payment Amount, Date & Eligibility

October Social Security Payments: Why You Might Get Two SSI Checks This Month