IRS $1,390 Direct Deposit Relief: The IRS $1,390 Direct Deposit Relief in 2025 has quickly become one of the most talked-about financial topics across America. From morning coffee shop chatter to workplace breakrooms, folks are asking the same thing: “Am I really getting $1,390 from the IRS?” Here’s the straight talk: as of now, there’s no official $1,390 federal stimulus or relief payment. But the reason this rumor is spreading so fast is that it taps into real financial pain, real history, and real hope. This article will break down everything you need to know — the facts, the background, the real relief programs that do exist, and how to position yourself smartly if new payments are ever approved.

Table of Contents

IRS $1,390 Direct Deposit Relief

The IRS $1,390 Direct Deposit Relief in 2025 may be the talk of the town, but the fact is: no official program has been approved. Rumors thrive in tough economic times, but your smartest move is to stay informed, prepared, and protected. Existing programs — like EITC, Child Tax Credit, and missed stimulus claims — offer real, tangible benefits. If future stimulus payments are approved, being proactive will ensure you’re ready to receive them quickly.

| Key Point | Details |

|---|---|

| Rumored Payment Amount | $1,390 per eligible taxpayer |

| Official Status | No official $1,390 federal stimulus announced as of October 2025 |

| Past Payment Reference | Similar stimulus checks during 2020–2021 ranged between $600–$1,400 |

| Eligibility Rumors | Single filers under $75,000; Married under $150,000 |

| Potential Delivery Methods | Direct deposit, paper check, or EIP card |

| Important Note | Beware of scams asking for personal or banking info for “early access” to payment |

| Source / Link | IRS.gov |

Why the IRS $1,390 Direct Deposit Relief Rumor Took Off?

The talk of a $1,390 relief payment isn’t random. It mirrors the way previous stimulus checks were structured. Americans still remember the direct deposits during the COVID-19 pandemic, which provided crucial lifelines for millions of households.

Those past payments were fast, direct, and for many families — a financial game-changer. So when inflation climbs, wages stagnate, and cost of living keeps rising, people start hoping for a repeat.

Some media outlets and social platforms have exaggerated congressional discussions about potential economic relief, turning them into claims that “the IRS is sending out $1,390.” That is not true, but it explains why the story has gone viral.

How Past Federal Stimulus Programs Worked?

The history of U.S. stimulus checks gives useful context for what could happen in the future:

- March 2020 – CARES Act: $1,200 payments to most adults.

- December 2020 – Second Round: $600 per eligible person.

- March 2021 – American Rescue Plan: $1,400 per taxpayer, including children.

Eligibility was simple:

- Single filer income below $75,000.

- Married couples below $150,000.

- Phase-out rules for higher incomes.

These payments were sent through direct deposit (if banking info was on file), or by paper check and debit cards.

Every payment followed the same federal process: Congress passed a bill, the President signed it, and then the IRS and Treasury handled distribution.

How Federal Relief Programs Are Actually Created?

For any future $1,390 payment to be real, the government must follow these steps:

- Congress introduces and passes a bill — specifying the amount, eligibility, and purpose of the payment.

- The President signs it into law.

- Treasury allocates funds to the IRS.

- IRS issues payments through existing tax and payment infrastructure.

- Americans receive funds automatically if eligible.

Until these steps occur, no direct deposit or check is coming. If there’s no legislation, there’s no stimulus.

The 2025 Economy: Why This Matters Now

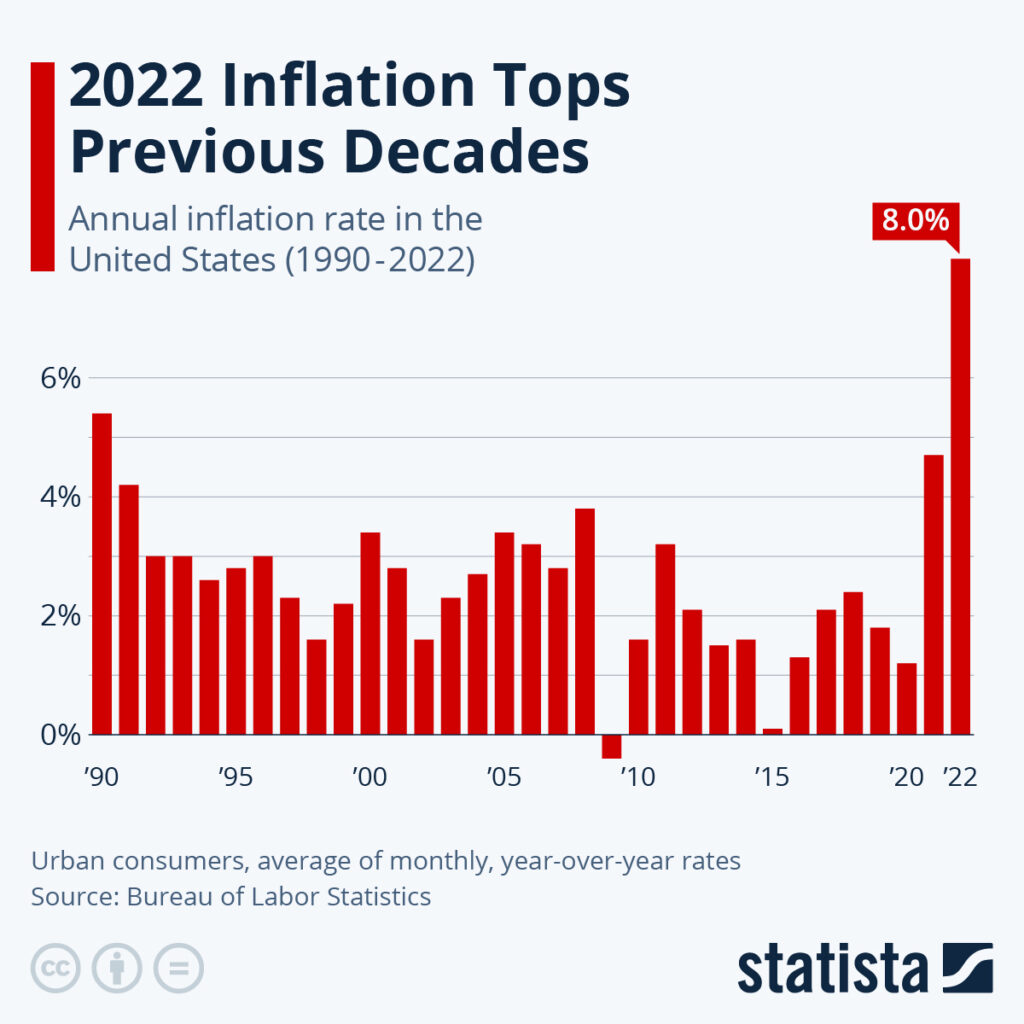

The rumor didn’t grow in a vacuum. Many Americans are facing real economic pressure:

- U.S. inflation is averaging 3.5% in 2025 (Bureau of Labor Statistics).

- Gas prices are up 15% since January 2025.

- Food and rent costs have increased sharply, putting pressure on middle- and lower-income households.

- Interest rates have remained elevated, making credit card and mortgage payments more expensive.

Economists warn that while the U.S. isn’t in a recession, the financial squeeze is very real for millions of working families. That’s why a rumor about $1,390 sounds believable — because the need is real.

Real Relief Programs You Can Access Now

Even though there is no new $1,390 payment, several legitimate programs can help eligible individuals and families.

Recovery Rebate Credit (Missed Stimulus Payments)

If you missed your 2020 or 2021 stimulus payments, you can still claim them by filing your 2021 return.

Example: A single filer who never received their $1,400 in 2021 can still get it through this credit.

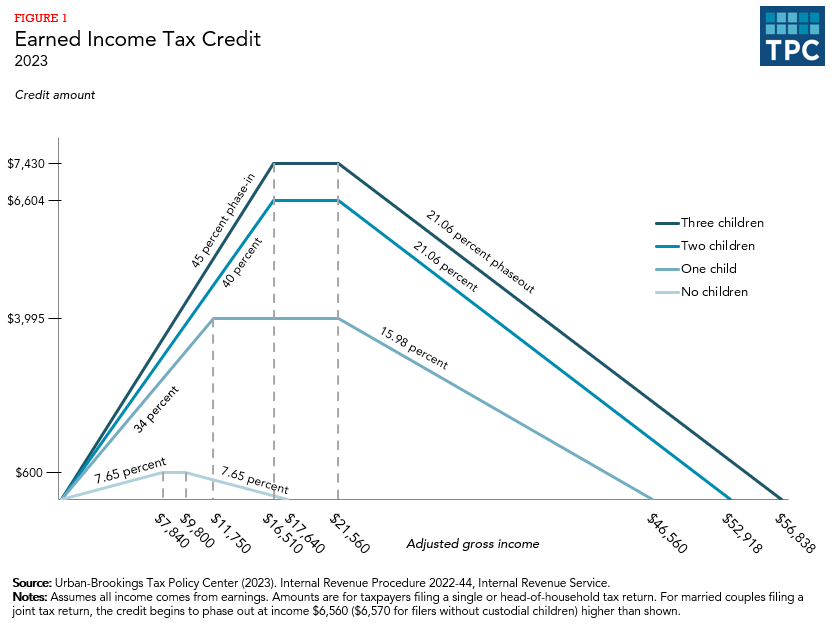

Earned Income Tax Credit (EITC)

The EITC is a powerful credit for working families:

- Maximum credit of $7,430 in 2025.

- Available to eligible taxpayers depending on income and number of dependents.

- Refundable, meaning you can get the money even if you owe no tax.

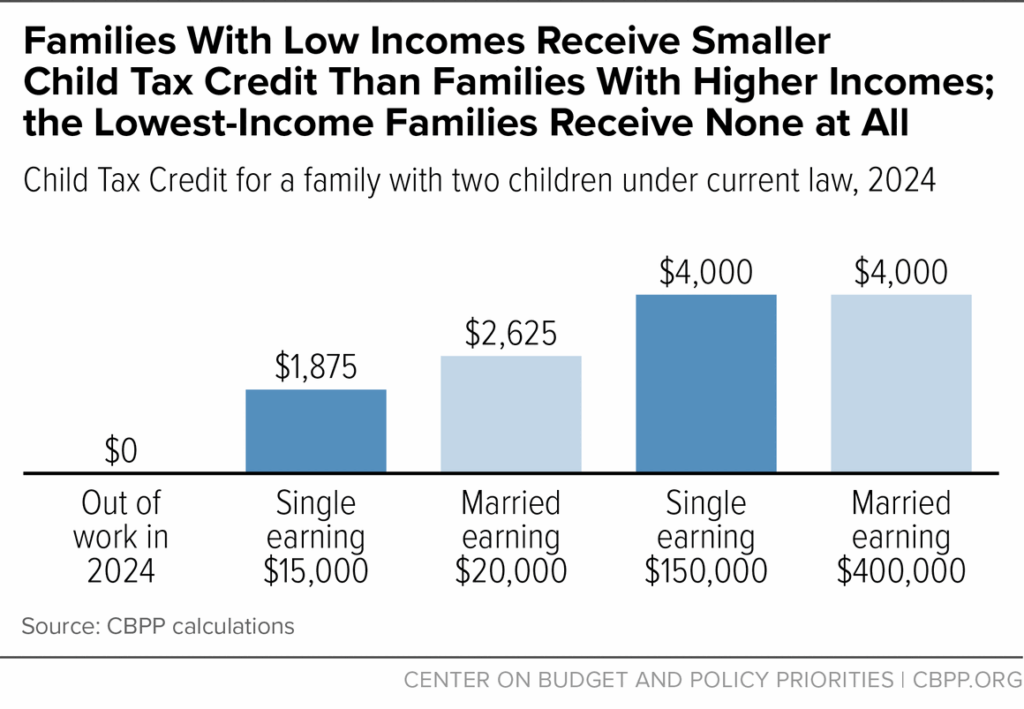

Child Tax Credit

The Child Tax Credit can be worth up to $2,000 per child, with partial refundability. This credit has been a major relief tool for families nationwide.

State-Level Stimulus or Rebate Programs

Many states have implemented their own relief programs:

- California – Middle-Class Tax Refund up to $1,050.

- New Mexico – Inflation relief payments.

- Minnesota – State rebates for lower- and middle-income workers.

These programs are independent of the IRS. You should check your state’s Department of Revenue or Taxation website for the latest updates.

How to Get Ready If IRS $1,390 Direct Deposit Relief Is Approved?

Preparation is key. If a $1,390 stimulus or any future payment becomes real, here’s how to make sure you’re ready to receive it fast.

- File your taxes annually — Even if your income is low.

- Update your direct deposit information with the IRS.

- Create an IRS Online Account to monitor your tax records and payments.

- Update your address promptly if you move.

- Keep official documents safe and avoid sharing personal info.

Tax Tips to Maximize Your Benefits

- Don’t overlook refundable credits like EITC and CTC. Many people miss out simply because they don’t file.

- File as early as possible. When relief checks are issued, people with recent tax returns on file usually get them first.

- Use IRS Free File or trusted tax professionals.

- Avoid paid “stimulus filing services” — many are scams.

Real-Life Example: Sarah’s Smart Move

Sarah, a single mother of two in Oklahoma, heard the $1,390 rumor online. Instead of waiting for something that might never happen, she took action:

- She filed her taxes early.

- Claimed EITC and Child Tax Credit.

- Received a $4,800 refund within weeks.

- Used part of it to pay rent and save for emergencies.

Her story is a reminder that real relief often comes through existing programs, not viral headlines.

How to Spot and Avoid Stimulus Scams?

Scammers use fake IRS emails, texts, and calls to trick people into giving personal or banking information. Common warning signs include:

- Messages claiming to be from the “IRS Relief Department” (no such department exists).

- Requests for Social Security numbers, bank account details, or card info.

- Promises to “fast-track” or “unlock” your payment for a fee.

- Fake websites mimicking IRS pages.

If you receive a suspicious message:

- Don’t click links or give personal info.

- Report it to FTC.gov.

- Visit IRS.gov directly to verify.

Timeline: What Could Happen Next

While no new federal stimulus has been approved, here’s a realistic timeline of what might unfold:

- Late 2025 – Economic relief discussions in Congress intensify due to inflation pressure.

- Early 2026 – If a relief bill passes, IRS and Treasury begin payment rollout.

- Throughout 2025–2026 – State-level relief programs continue to launch.

Keeping your tax records updated ensures you’ll be among the first to receive any legitimate future payments.

$1800 Automatic Stimulus Payment in October 2025: SSI, SSDI & VA Benefit Eligibility, Pay Date

$1,390 Stimulus Payment For these People in October 2025 – Check Eligibility & Payment Date

Social Security Boost: How a Simple Strategy Can Increase Your Monthly Payments by $100s