The Canada Child Benefit (CCB) is one of Canada’s key social safety nets, designed to provide financial support to families raising children. For October 2025, the benefit payments are set to increase, with some families eligible for up to $666.41 per child under six years of age. This article will explore how to apply for the CCB, tips on maximizing payments, and how it affects Canadian families and the national economy.

Table of Contents

Canada Child Benefit October 2025

| Key Fact | Detail/Statistic |

|---|---|

| Maximum Payment for Children Under 6 | $666.41 per child per month |

| Maximum Payment for Children Aged 6-17 | $562.33 per child per month |

| Payment Date for October 2025 | October 20, 2025 |

| Eligibility Criteria | Based on adjusted family net income (AFNI); higher income reduces payments |

| Official Website | Canada.ca |

The Canada Child Benefit is a vital source of financial support for Canadian families, and the October 2025 payment offers a timely boost for many households. By understanding the application process, staying up to date with eligibility requirements, and actively managing their financial information, families can maximize the amount they receive from the CCB.

With this benefit playing a key role in reducing child poverty and enhancing the well-being of families across the country, it remains a cornerstone of Canada’s social safety net. As we look ahead to the October payment, families are encouraged to take the necessary steps to ensure they receive the full benefit available to them.

The Importance of the Canada Child Benefit

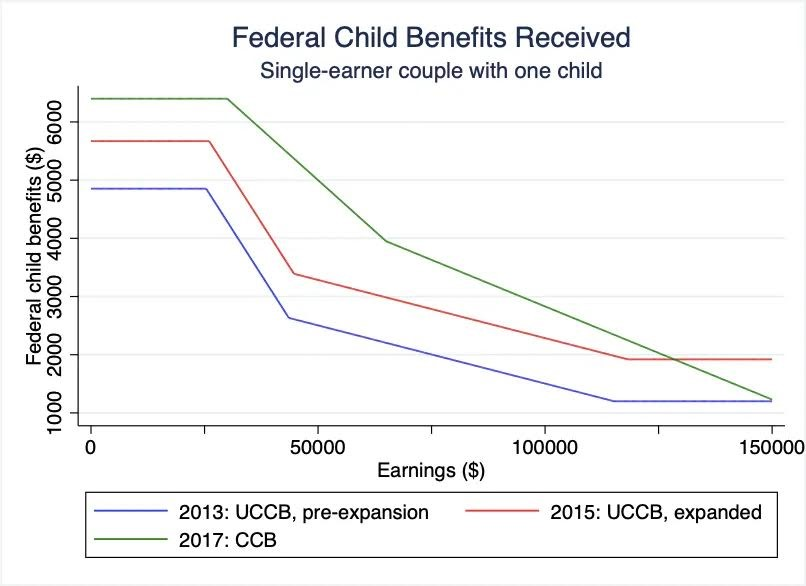

Introduced in 2016, the Canada Child Benefit (CCB) has become a central part of Canada’s efforts to reduce child poverty and support middle-class families. The CCB is a tax-free monthly payment to eligible families with children under the age of 18. For many Canadian households, these payments provide essential financial relief.

For the 2025 period, payments are set to rise, with eligible families receiving up to $666.41 per child under six and $562.33 per child aged six to 17. Payments are means-tested, with the amount gradually decreasing as family income increases. However, even families with higher incomes benefit from the program, which is designed to ensure that no child is left behind due to economic hardship.

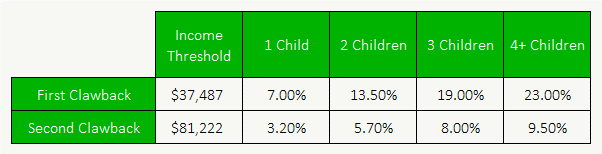

Detailed Breakdown of CCB Reductions Based on Income

The CCB payment is based on the family’s adjusted family net income (AFNI), which includes the combined income of both parents (if applicable). The payment decreases as AFNI increases. Families with an AFNI below $37,487 will receive the full benefit. For every $1,000 above this threshold, families lose approximately 7% of the CCB.

For example:

- Family A: A family with an AFNI of $30,000 will receive the full CCB benefit for their children.

- Family B: A family with an AFNI of $60,000 will see a reduced payment. They may receive only 50-60% of the maximum benefit, depending on the exact amount of their income.

This means families with moderate incomes can still receive substantial assistance, while those with very high incomes may see significantly reduced payments. This approach ensures that the CCB is targeted toward families who need it most, without penalizing those who earn a moderate income.

Comparing the CCB to Similar Programs in Other Countries

Canada’s child benefit program is often compared to similar programs in other developed nations, such as the United States, the United Kingdom, and Australia. While most countries offer child benefits, Canada’s model stands out for its means-tested approach and its progressive payment system, which adjusts based on income.

For example:

- In the United States, the child tax credit is a direct cash benefit similar to the CCB, but it’s not as generous for lower-income families as Canada’s system.

- The United Kingdom offers child benefits as well, but they are capped at a certain amount, with the benefits being gradually phased out as income increases.

The key advantage of the CCB is that it is tax-free, meaning that recipients do not need to repay it. Additionally, the CCB does not count as taxable income, which makes it particularly valuable to low- and moderate-income families who may be in higher tax brackets.

Long-Term Economic Impact of the CCB

Beyond providing immediate financial relief, the CCB has long-term economic benefits. According to a report by the Canadian Centre for Policy Alternatives, the CCB has significantly reduced child poverty since its introduction, helping to lift hundreds of thousands of children out of poverty each year.

The impact is also seen in the form of better health outcomes and increased educational opportunities for children in low-income households. By ensuring that families have more disposable income, the CCB helps improve quality of life, allowing parents to invest in their children’s futures, including education, healthcare, and extracurricular activities.

The CCB’s Role in Reducing Child Poverty

The introduction of the CCB has been a key factor in Canada’s efforts to reduce child poverty. In 2019, the Canadian government announced that the number of children living in poverty had dropped by more than 300,000 since the CCB was implemented. This decline in child poverty is a testament to the program’s success.

As part of the government’s broader poverty reduction strategy, the CCB ensures that families, particularly those with lower incomes, have the financial resources to support their children. This is particularly important in the context of rising housing costs and inflation, which have put a strain on many Canadian households.

What Happens If You Miss a CCB Payment or Fail to Apply?

If you miss a CCB payment or fail to apply for the benefit, it is crucial to take action immediately. The CRA allows families to apply for retroactive payments if they missed a deadline, as long as they can provide the required information and documentation.

However, if a family fails to file taxes on time or misses the deadline to update their information with the CRA, payments can be delayed. In extreme cases, families may be temporarily ineligible for future payments.

For families who are unsure of their eligibility or need assistance with the application, contacting the CRA directly is the best course of action. They offer resources and support to ensure that every eligible family receives their full entitlement.

What Shared Custody Parents Need to Know

Parents who share custody of their children may be eligible for a split CCB payment. In these cases, the payment is typically divided based on the percentage of time each parent has custody. For example, if a child spends more time with one parent, that parent may receive a larger portion of the CCB payment.

Shared custody parents should ensure that their custody arrangements are updated with the CRA and that the proper documentation is in place to avoid delays or errors in payment.

$1,647.34 Canada Survivor Allowance Payment in October 2025: Are You Eligible to Get it? Check Date

Advanced Canada Workers Benefit in October 2025; Check Payment Amount & Eligibility Criteria

Canada Child Benefit (CCB) Coming in October 2025; Check Payment Amount & Date

FAQ

Q: How can I check the status of my CCB application?

A: You can check the status of your CCB application by logging into your CRA “My Account” or by contacting the CRA directly.

Q: If my income increases during the year, will it affect my CCB payments?

A: Yes, your income level determines the amount you will receive, so an increase in your income may result in reduced CCB payments. It is important to update your income information with the CRA promptly.