Canada Retirement Age Change: In a significant change to Canada’s social safety net, the government has announced that the eligibility age for Old Age Security (OAS) benefits will be gradually increased from 65 to 67. This move, aimed at ensuring the long-term sustainability of Canada’s public pension system, will affect individuals born on or after October 1, 2025.

The decision has sparked a broad discussion about the implications for Canadians approaching retirement and the future of the OAS program. Below, we break down what this shift means for future retirees.

Table of Contents

Canada Retirement Age Change

| Key Fact | Detail/Statistic |

|---|---|

| Eligibility Age Shift | OAS eligibility moves from 65 to 67 |

| First Impacted Group | Individuals born on or after October 1, 2025 |

| Full OAS Payment (65-74) | $740.09 per month |

| OAS for 75+ | $814.10 per month |

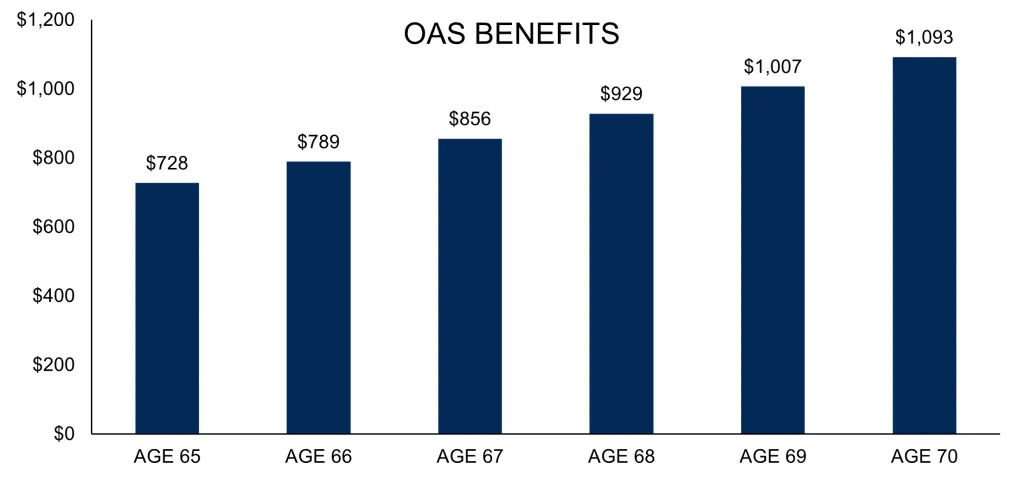

| Payment Deferral | Delaying OAS to age 70 can increase payments by 36% |

| Official Website | Canada.ca |

Why Is the OAS Eligibility Age Changing?

The shift in the eligibility age from 65 to 67 comes as part of a broader effort to address Canada’s aging population. Over the past few decades, life expectancy has increased, while birth rates have decreased. As a result, the proportion of Canadians who are aged 65 or older is rising rapidly, putting pressure on the OAS system and other public pension programs.

“The increase in the retirement age ensures that the system remains financially sustainable while continuing to provide crucial support to seniors,” said Dr. Elaine Williams, an economist at the University of Toronto. “This adjustment reflects changing demographic realities and is necessary to ensure that future generations will be able to rely on these benefits.”

The aging population is one of the primary drivers of these changes. According to Statistics Canada, the number of seniors aged 65 and older is projected to increase from 6.9 million in 2021 to 10.7 million by 2041, making up nearly 25% of the total population. This demographic shift is expected to strain public finances, which is why adjustments to pension systems like OAS are becoming essential.

Impact on Current and Future OAS Recipients

For those already receiving OAS or nearing the current eligibility age of 65, this change will not apply. However, anyone born after October 1, 2025, will have to wait until age 67 to receive full OAS payments.

The move will likely affect Canadians in their 50s and early 60s, who are planning their retirement around the current eligibility age of 65. These individuals will need to adjust their retirement strategies, whether that means saving more in private pensions or delaying their retirement plans.

Additionally, Canadians who choose to delay receiving OAS payments until age 70 will see their monthly benefits increase. Those who delay will receive up to 36% more per month than those who begin payments at age 65. This deferral option has led many financial advisors to recommend delaying OAS if possible, as the increased payments can provide significant benefits in the long term.

What Will the Financial Impact Be?

The financial impact of this change will depend on several factors, including an individual’s ability to save privately and their plans for retirement. The government’s decision is expected to save the Canadian public pension system billions of dollars over the coming decades, ensuring its viability as the population continues to age.

However, experts caution that the increase in the OAS eligibility age may not be enough on its own to address the financial challenges posed by an aging population. Some have called for more comprehensive reforms to Canada’s pension system, including changes to the Canada Pension Plan (CPP).

The Canadian Centre for Policy Alternatives (CCPA), a progressive think tank, has raised concerns that raising the eligibility age may disproportionately impact low-income Canadians, who often have shorter life expectancies and may struggle to work longer. A study by CCPA found that those with lower incomes tend to have lower life expectancy, and for them, the delay in OAS benefits could mean less time to benefit from the program.

What Can Future Retirees Do Now?

For Canadians affected by the change, there are several steps to take to prepare for the shift. Retirement planning experts recommend reviewing your current savings strategy, including whether to delay the start of OAS or contribute more to private pension funds like RRSPs (Registered Retirement Savings Plans) or TFSAs (Tax-Free Savings Accounts). These additional savings options can help offset the delay in OAS eligibility.

“By planning ahead, Canadians can ensure that they maintain financial security even with the increased retirement age,” said Mary Green, a financial planner with Toronto-based Wealth Solutions.

It’s also essential to stay informed about the potential for further reforms to both OAS and CPP in the future. The government has indicated that it will continue to monitor the situation and could implement additional measures as the population continues to age.

For those nearing the retirement age, it is critical to reassess financial strategies and make the necessary adjustments, especially if they were counting on receiving OAS at 65.

Context and Global Comparisons

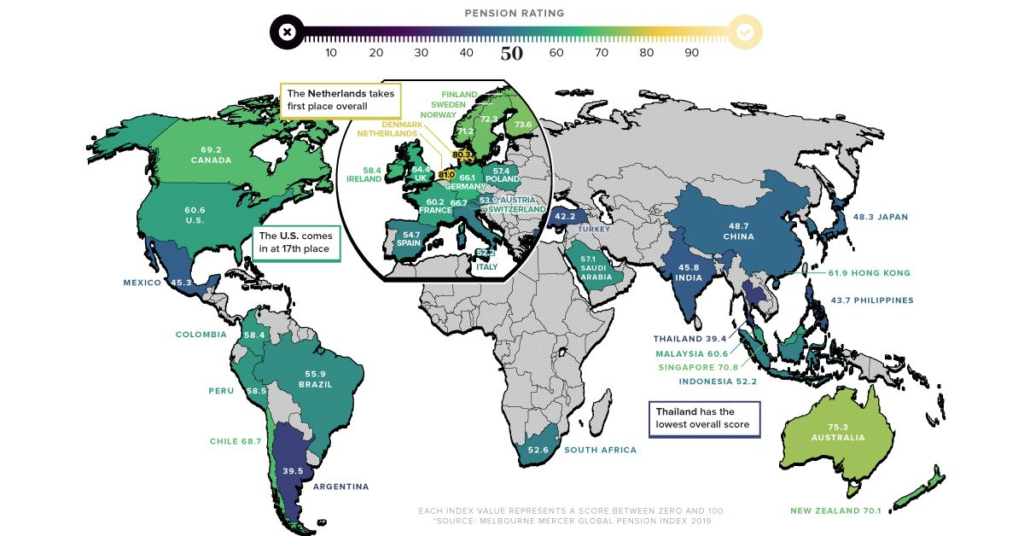

Canada is not alone in raising the eligibility age for public pensions. Several countries, including the United Kingdom, Australia, and Germany, have similarly raised the retirement age in response to demographic shifts. In the UK, for example, the state pension age is set to rise to 67 by 2028, while in Australia, the eligibility age for the Age Pension is gradually increasing to 67 by 2023.

The decision to increase the OAS eligibility age aligns with trends in other developed nations, as governments adjust to longer life expectancies and fewer workers supporting an older population. A global report by the Organisation for Economic Co-operation and Development (OECD) noted that retirement ages are rising in most OECD countries, with many governments shifting their pension eligibility policies to ensure long-term sustainability.

In fact, in countries like Japan and Italy, the eligibility age for public pensions is being raised even further, with some countries discussing plans to increase it to 70. This trend reflects broader global efforts to tackle the economic challenges posed by an aging population.

How Does the OAS Change Fit into Broader Pension Reforms?

The OAS changes are part of a broader effort to reform Canada’s pension system, which also includes the Canada Pension Plan (CPP). Unlike OAS, which is a universal pension paid to seniors based on age, the CPP is a contributory pension plan based on earnings throughout a person’s working life.

There have been calls to expand the CPP to provide higher monthly benefits for future retirees. In 2016, a historic deal was struck to gradually increase CPP benefits, starting in 2019, to ensure greater financial security for Canadians in retirement. This deal will gradually raise CPP contribution rates and increase the amount of benefits received by future retirees.

While OAS serves as a baseline income for seniors, the CPP and other private savings options like RRSPs play a critical role in ensuring Canadians can maintain their standard of living in retirement. It is crucial for the government to continue to balance the needs of today’s seniors with the demands of future generations.

Looking Ahead: The Future of Canada’s Public Pension System

The government’s shift in OAS eligibility age is a proactive response to Canada’s demographic shifts, but it’s unlikely to be the last change to the country’s pension systems. The financial challenges posed by an aging population are complex, and policymakers will need to continue to adapt Canada’s social programs to ensure the long-term sustainability of these systems.

As Canadians adjust to the increase in the OAS eligibility age, it’s clear that careful planning will be key to ensuring a financially secure retirement. While the OAS change is significant, it is only one part of the broader conversation about how Canada’s public pension systems will evolve in the future.

Canada Grocery Rebate Amount for October 2025 – Check Eligibility & Payment Details

Canada CRA $2,600 Direct Deposit in October 2025, Eligibility & Payment Schedule

FAQ

Q: Will the OAS eligibility age change affect me if I’m currently 60 years old?

A: Yes, if you are 60 or older, you will be impacted by this change when you reach the new eligibility age of 67.

Q: What if I can’t afford to wait until 67 to start receiving my OAS?

A: It’s advisable to consult with a financial advisor to discuss how to adjust your retirement planning to ensure that you have enough savings if you need to delay OAS.

Q: Will the increase in OAS eligibility age also apply to the Canada Pension Plan (CPP)?

A: No, the CPP eligibility age remains at 65. However, the government has indicated that future reforms to the CPP may be considered to address similar concerns.