In October 2025, rumors of a $300 federal payment circulating online have left many Canadians curious about its legitimacy. However, these claims are largely inaccurate. Official government sources have confirmed no such universal payment, though several other targeted benefits are due to be distributed to eligible Canadians during the same period.

Table of Contents

$300 Canada Federal Payment

| Key Fact | Detail/Statistic |

|---|---|

| Payment Amount | No $300 universal federal payment in October 2025 |

| Other Payments in October | Canada Child Benefit (CCB), Goods and Services Tax Credit (GST/HST) |

| Eligibility Criteria | Varies by program (e.g., income level, family size, disability) |

| Official Website | Canada Revenue Agency |

While Canadians will indeed receive significant benefit payments in October 2025, the widely circulated claim of a universal $300 federal payment is not based on fact. Instead, eligible families, individuals, and workers can expect to see the continuation of the Canada Child Benefit (CCB), the GST/HST Credit, and the Canada Workers Benefit (CWB). For those seeking clarity, it’s crucial to consult official sources and avoid misleading claims circulating online.

October $300 Canada Federal Payment 2025 Myth

The most recent wave of misinformation regarding the October 2025 $300 federal payment is not based on official announcements. Despite its popularity across social media platforms, there is no confirmation from the Canada Revenue Agency (CRA) or other governmental bodies supporting such claims.

The rumor likely stems from general confusion surrounding multiple government benefit programs, which are scheduled for release in October. However, none of these programs involve a universal $300 payment to all Canadians.

The Actual Payments Set for October 2025

While a one-time $300 payment does not exist, Canadians can expect several critical payments based on specific eligibility criteria.

Canada Child Benefit (CCB)

The Canada Child Benefit (CCB), which provides financial support to families with children under 18, will continue in October 2025. The CCB amount varies based on family income and the number of children. Eligible families can receive up to $666.41 per month for children under the age of six, and $562.33 for children aged six to 17. Payment is scheduled for October 20, 2025.

According to the Department of Finance, families with higher incomes may receive reduced amounts, while those with lower incomes could receive additional provincial top-ups.

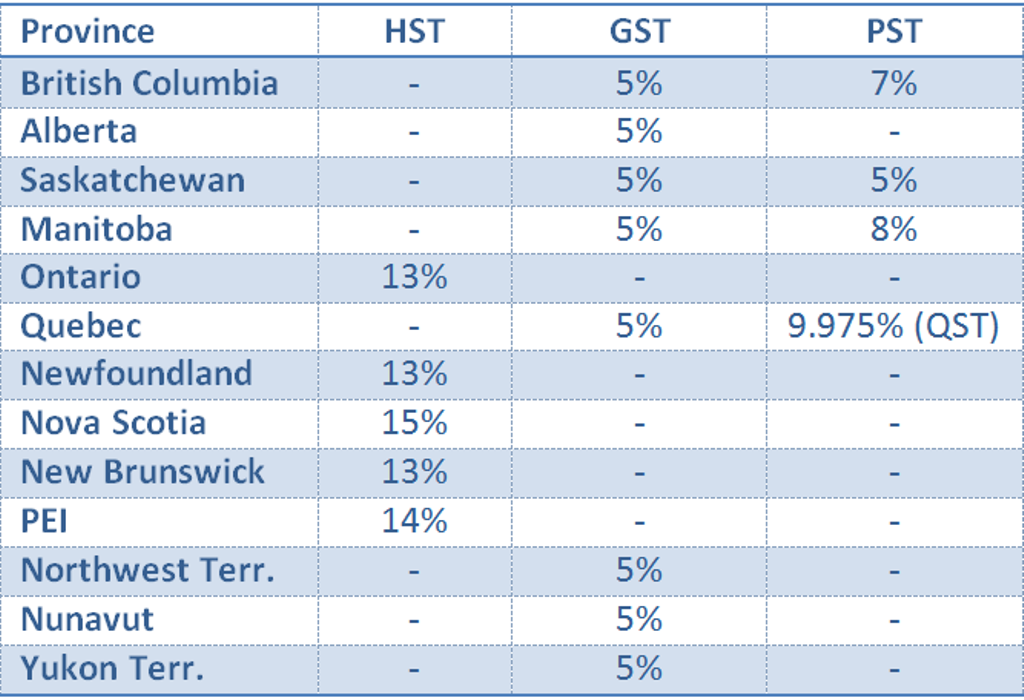

Goods and Services Tax / Harmonized Sales Tax (GST/HST) Credit

For low- to moderate-income Canadians, the Goods and Services Tax / Harmonized Sales Tax (GST/HST) Credit offers crucial relief. This quarterly payment will be issued on October 3, 2025, and will help offset the costs of goods and services. For a single individual, the maximum payment is approximately $533, while a couple can receive up to $698. Children can add an additional $184 to the overall amount.

The GST/HST Credit is an important benefit for those with limited income, and eligibility is determined based on income levels as per the previous year’s tax return.

Canada Workers Benefit (CWB)

The Canada Workers Benefit (CWB), including the Advanced CWB payments, will also be issued in October 2025. The CWB is designed to assist low-income workers and help lift individuals out of poverty by providing additional funds based on income. The Advanced CWB payments are set to arrive on October 10, 2025. The amount varies depending on income, family size, and other factors.

Historical Context: A Tradition of Benefit Payments in Canada

Canada’s approach to social welfare is rooted in a longstanding tradition of support for citizens in need. Programs like the Canada Child Benefit (CCB) and GST/HST Credit have evolved over time, becoming key pillars of the country’s social safety net. For instance, the CCB, introduced in 2016, consolidated various earlier child benefit programs into a more streamlined, tax-free monthly payment system. Similarly, the GST/HST Credit, which dates back to 1990, helps Canadians cope with the cost of living, particularly in the face of rising inflation.

These programs are not new but continue to be integral in alleviating the economic burdens faced by lower- and middle-income Canadians. They also serve as evidence of the Canadian government’s commitment to reducing poverty and promoting income equality.

Economic Impact: How These Payments Help Canadians

The economic impact of these payments is significant, particularly in fostering economic stability and supporting the middle class. According to an analysis from the Institute for Research on Public Policy (IRPP), the Canada Child Benefit has been instrumental in lifting hundreds of thousands of children out of poverty since its inception.

Similarly, the GST/HST Credit helps moderate-income households offset the rising costs of everyday goods and services. By putting money back into the hands of those who are most likely to spend it, these payments serve as both a financial lifeline and a stimulus for the economy. Economists have long argued that such direct payments play an important role in sustaining demand in the economy, especially during periods of slow growth.

Furthermore, the Canada Workers Benefit (CWB) is tailored specifically to support those who earn the least, ensuring that work pays and discouraging people from relying on government assistance without contributing to the economy. This has proven to be an effective tool for reducing income inequality.

Expert Opinions on Canada’s Social Safety Net

Dr. Katherine Lee, a professor of economics at the University of Toronto, highlights that programs like the CCB and GST/HST Credit are essential to ensuring that Canada’s most vulnerable citizens are supported. “These benefits are crucial for families trying to manage the high cost of living, especially in major cities,” Lee explained. “They also provide a safety net in times of economic downturns, which is why they are so vital to the Canadian economy.”

According to Dr. Mikhail A. Dumas, a senior researcher at the Canadian Centre for Policy Alternatives (CCPA), “Canada’s social safety net is one of the most comprehensive in the world, and programs like these are a testament to that. While some individuals may feel the benefits are not enough, they make a big difference in the day-to-day lives of millions of Canadians.”

Comparing Canada’s Programs with Other Countries

Canada’s approach to social benefits is often seen as a model for other countries, though comparisons with other advanced nations reveal some differences in scope and scale. For example, while the United States offers certain federal relief programs like Supplemental Nutrition Assistance Program (SNAP), Canada’s universal benefits such as the CCB provide direct, tax-free payments to families, irrespective of how they spend the funds.

In Scandinavian countries, which are also known for their robust social welfare systems, similar child benefits exist. However, in these countries, tax rates tend to be higher, and the social safety nets are more expansive. Nevertheless, Canada’s approach has been praised for its efficiency and direct impact on those in need without over-bureaucratizing the process.

Personal Stories: Real Canadians and Their Experience with Federal Benefits

To provide a personal perspective on how these payments impact Canadians, we spoke to Mariana Ruiz, a mother of two living in Vancouver. Ruiz, who receives the Canada Child Benefit, shared, “The CCB has been a game-changer for our family. It helps cover daycare costs and buy essentials. Without it, life would be much harder, especially with rising grocery prices.”

Similarly, Brian Fields, a single parent and recipient of the GST/HST Credit, added, “Every few months, when I get my GST cheque, it gives me a chance to catch up on bills and buy things I couldn’t otherwise afford. It’s small, but it makes a difference.”

How to Check Eligibility for October $300 Canada Federal Payment 2025

For Canadians who may be wondering whether they are eligible for these various benefit payments, the government provides clear and accessible guidelines.

- Canada Child Benefit (CCB): To apply for or check eligibility for the CCB, parents can visit the CRA’s official website and log into their My Account portal. Eligibility is based on income and family size.

- GST/HST Credit: Canadians can use the CRA’s online tools to check whether they are eligible for the GST/HST credit. Eligibility is determined by income and household composition.

- Canada Workers Benefit (CWB): The CWB is available to low-income workers, and Canadians can determine their eligibility and the amount they may receive via their My CRA Account.

October $300 Canada Federal Payment 2025 – Is this true? Check Fact, Amount & Eligibility

Canada’s $1,306 Cost of Living Payment in October 2025 – Will you get it? Check Payment Date

FAQ on October $300 Canada Federal Payment 2025

1. Will I receive a $300 payment in October 2025?

No. The $300 federal payment circulating on social media is not an official government program. Instead, Canadians will receive various targeted benefit payments, such as the Canada Child Benefit and the GST/HST Credit.

2. How do I check if I qualify for the Canada Child Benefit (CCB)?

To check eligibility for the CCB, log into your CRA My Account or visit the official CRA website for detailed information and applications.

3. When will I receive my GST/HST Credit?

The GST/HST Credit will be paid on October 3, 2025. The amount depends on your income and family size. You can check eligibility through your CRA account.

4. What is the Canada Workers Benefit (CWB)?

The CWB is a federal program designed to help low-income workers by providing them with additional financial support. The program includes an advance payment in October 2025, which will be delivered on October 10.

5. How can I avoid falling for misinformation about government payments?

Always verify claims about government payments through official sources, such as the Canada Revenue Agency (CRA) website or official government announcements. Avoid relying on unverified social media posts or third-party websites.