A $2,000 federal direct deposit in October 2025 is circulating on social media and news outlets, but official sources have not confirmed such a payment. As rumors spread, it’s essential to understand the facts and the eligibility for any financial relief offered by the U.S. government in the coming months.

Table of Contents

$2,000 Federal Direct Deposit

| Key Fact | Detail/Statistic |

|---|---|

| Federal Direct Deposit Rumor | Claims of a $2,000 payment circulating in October 2025. |

| Official Confirmation | No government confirmation of a new $2,000 payment. |

| State-based Assistance | Some states offer rebates or financial relief programs. |

| Recent Federal Payments | The last federal payment was in 2021. |

| Official Website | IRS |

As rumors swirl around the possibility of a $2,000 federal direct deposit, the need for verified information is more critical than ever. Taxpayers are urged to verify any claims through official sources to avoid falling victim to fraud or misinformation.

The Reality of a $2,000 Federal Direct Deposit in October 2025

Rumors of a $2,000 federal direct deposit scheduled for October 2025 have caused confusion, with many individuals seeking clarification on the truth of these claims. However, there is no confirmation from official sources, including the U.S. Department of the Treasury or the Internal Revenue Service (IRS), regarding any such payments.

While many are hoping for another round of stimulus checks similar to those distributed during the pandemic, it’s important to assess the current state of federal financial relief programs and the circumstances under which they might be implemented again.

Official Sources Deny the $2,000 Payment

The IRS has consistently stated that no new federal direct deposit payments are planned for 2025. These direct deposit rumors appear to be unsubstantiated. The last round of significant federal relief payments occurred in 2021 as part of COVID-19 recovery efforts, which included direct payments of $1,400 to eligible individuals.

According to IRS spokesperson Frank McCallister, “At present, no new federal direct deposit payments are authorized by the government, and any communication claiming otherwise should be treated with skepticism.”

While there is no federal payment confirmed for October 2025, certain state-level programs may offer financial relief to qualifying individuals.

State-Backed Financial Assistance

Though the federal government has not confirmed any direct deposit payments, several states have implemented or announced financial assistance programs designed to help residents in need.

For example, Pennsylvania has rolled out a rebate program offering residents between $380 and $1,000, depending on income levels and eligibility. Similarly, Virginia residents can receive a fall rebate of up to $400 as part of the state’s budget allocation for financial relief. In Colorado, residents may be eligible for a state refund of up to $1,130, while Tennessee has introduced assistance ranging from $174 to $750 for residents eligible for the Low-Income Home Energy Assistance Program (LIHEAP).

These state-specific programs are often designed to target local economic needs, so eligibility requirements will vary. For example, Tennessee’s LIHEAP offers assistance for households with heating costs, while Pennsylvania’s rebate program targets low- to moderate-income residents.

How State Relief Programs Work

While the federal government has taken a step back from issuing widespread stimulus checks, individual states are stepping in with their own relief packages. These programs can be crucial for households still struggling with the economic effects of the pandemic, particularly as inflation and living costs remain high.

Pennsylvania’s Property Tax/Rent Rebate Program, for instance, provides rebates on property taxes or rent paid in the previous year. This initiative is aimed at helping seniors and people with disabilities, though it is open to all qualifying residents.

Colorado’s Taxpayer Bill of Rights (TABOR) refunds offer a unique model, where surplus revenue from the state budget is returned to residents. Colorado taxpayers who filed a return for the previous year are automatically eligible for these refunds.

For many, these state programs can be the difference between financial stability and uncertainty, providing immediate relief that can alleviate some of the burdens of inflation and high costs of living.

The Risk of Scams Amidst Financial Relief Confusion

The lack of official confirmation about the $2,000 payment has led to an increase in fraudulent schemes, with scammers targeting those who are hoping for financial relief. The IRS has issued warnings about scams involving fake direct deposit payments. Scammers often use email, text messages, and social media to lure individuals into providing personal information or sending money in exchange for supposed government assistance.

“We urge taxpayers to remain cautious of phishing attempts,” said IRS Commissioner Charles Rettig. “Any unsolicited message claiming a direct deposit for a stimulus payment should be reported immediately.”

It’s critical to only trust official communication from trusted sources such as the IRS website or government agencies. If you receive any unsolicited messages about a federal payment, it is advisable to report them and delete the communication immediately.

How Scammers Operate and How to Protect Yourself

Scammers have become increasingly sophisticated, using fake websites and phone numbers that appear to be official. Some may even impersonate IRS agents, requesting bank account details in exchange for “expedited” payments. The best way to protect yourself is to always verify the legitimacy of any claims through the IRS or state government website.

The IRS recommends that taxpayers should never respond to unsolicited emails or text messages and should only use official government portals to access payment information. Also, never send money or share personal banking details with anyone claiming to represent the IRS or a state agency.

Why This $2,000 Direct Deposit Rumor Persisted

The persistence of this rumor could be attributed to a combination of factors, including the public’s continued hope for additional financial assistance. After the economic hardships caused by the COVID-19 pandemic, many individuals are still struggling with inflation and rising costs, prompting renewed interest in government relief programs.

Additionally, various online platforms and websites might have contributed to the spread of misinformation, with headlines suggesting that a significant payment was on the way. Without official confirmation, these speculative claims gained traction among individuals who were hoping for a repeat of previous stimulus payments.

The desire for a $2,000 payment may also stem from a perception that the U.S. economy has not fully recovered from the effects of the pandemic. Despite job recovery and growth in some sectors, inflation continues to affect everyday goods, leaving many Americans in a state of financial uncertainty.

The Importance of Federal Financial Relief Programs

Looking back at previous relief programs, the U.S. government’s direct payments during the pandemic were seen as essential for preventing widespread financial hardship. These programs helped many keep up with rent, medical bills, and other essential expenses during uncertain times.

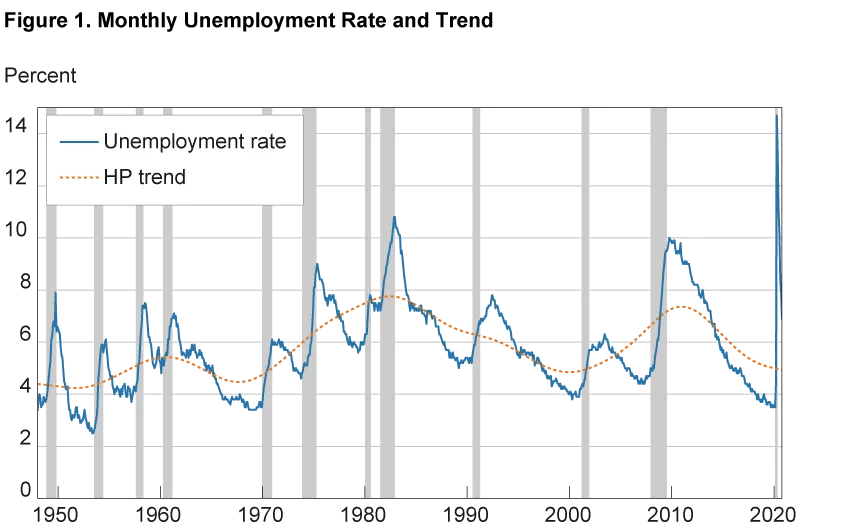

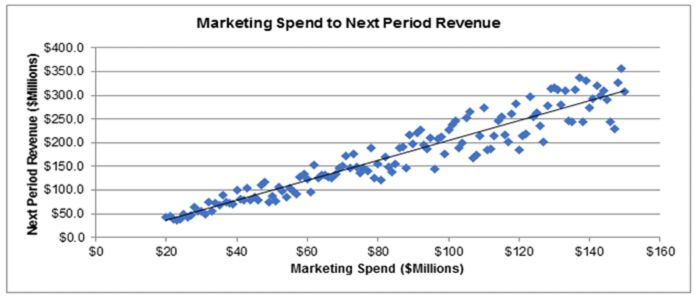

In addition, these payments injected much-needed capital into the economy, bolstering consumer spending, which in turn helped businesses. However, economic experts argue that this type of financial relief should be considered on a case-by-case basis, driven by actual economic indicators such as unemployment rates, GDP growth, and inflation.

How These Payments Affect the Economy

Stimulus payments have a direct effect on the economy, especially in times of recession or inflation. They can help maintain consumer spending levels, which is a key factor in the overall economic health of the country. While critics argue that such payments lead to inflation, proponents argue that the immediate boost to the economy outweighs the longer-term risks.

Moving forward, it remains to be seen whether future economic crises will prompt the government to take similar actions. Experts are divided on whether another round of direct payments would help or hinder the nation’s economic recovery.

Looking Ahead: Federal Financial Relief and Future Possibilities

Although the October 2025 $2,000 federal direct deposit is unverified, the possibility of future federal aid cannot be entirely ruled out. For now, federal relief options are limited to pandemic-era programs and state-level initiatives. As the economic landscape evolves, the U.S. government may consider further action if there is a demonstrated need.

It’s advisable to stay informed through official channels, such as the IRS website, to ensure you’re aware of any legitimate federal payments or relief programs. For now, individuals should remain cautious and avoid responding to unsolicited offers that claim to be linked to government assistance.

$1600 Stimulus Checks October 2025 Date: Will You get this? Check Eligibility & Payment Date

Social Security Payment Changes for Thanksgiving 2025 – Check Payment Amount, Date & Eligibility

$1919 Direct Deposit Checks 2025 Coming Soon: Check Eligibility & Payment Dates

FAQs:

1. Are there any confirmed federal payments coming in October 2025?

No, the IRS has not confirmed any federal direct deposit payments for October 2025. These claims are largely unverified rumors.

2. Can I still receive financial assistance from the federal government?

Currently, there are no new federal direct payments announced, but certain states are offering relief through rebates and assistance programs.

3. How do I avoid falling for scams related to federal payments?

Avoid clicking on links or providing personal information in response to unsolicited messages about payments. Always verify payment details through official government websites like the IRS.