$1,390 Direct Deposit Relief: Hey there! If you’ve been scoping out the news or scrolling through social media lately, you might have heard whispers about a big relief payment from the IRS—specifically, a $1,390 direct deposit relief coming in 2025. But what’s the real deal? Is this true? And more importantly, how could it affect you or your family? Well, buckle up because we’re about to break it all down in simple, straightforward language — just like talking with your buddy over coffee.

Table of Contents

$1,390 Direct Deposit Relief

While the idea of a $1,390 direct deposit relief in 2025 sounds appealing, it remains unconfirmed by any official government source. Remember to file taxes carefully, maximize your current credits, and keep personal data secure. Staying informed and cautious is the smartest move for your financial well-being.

| Key Point | Details |

|---|---|

| Official IRS Relief Payments for 2025 | No new stimulus checks announced yet |

| Rumors of $1,390 Relief Payment | False, no official confirmation |

| Past IRS Stimulus History | Three COVID-19 payments totaling up to $1,400 per person |

| Current IRS Focus | Tax filing, refunds, and existing credits |

| How to Stay Updated | Follow official IRS updates and beware of scams |

| Critical Reminder | Always verify with trusted sources before acting on info |

| Source | IRS.gov |

Context: The Rumors and the Reality

First off, let’s clear the air. There have been rumors swirling online about the IRS rolling out a $1,390 relief payment in 2025. Folks are asking: “Is it really happening? Who qualifies? How do I get it?” The truth? As of now, there’s no official announcement from the IRS or the federal government about a new round of stimulus checks or direct relief payments in 2025.

These rumors often pop up when people are looking for ways to ease financial stress, especially during tough economic times. Back during the COVID-19 pandemic, the government did issue stimulus checks to help families stay afloat. But since those days, new payments haven’t been announced, and the IRS’s focus has shifted away from direct pandemic aid — instead, they’re handling tax season, refunds, and other official programs. So, if you see headlines promising a $1,390 giveaway, proceed with caution: It’s probably a scam or misinformation.

A Quick Look Back: IRS Relief Payments in History

To understand why these rumors keep popping up, it helps to know the history. During the COVID-19 pandemic, the IRS sent out three rounds of Economic Impact Payments (EIPs), totaling hundreds of billions of dollars nationally. These payments ranged from $600 to $1,400 per individual, helping millions put food on the table and pay bills during uncertain times. These rounds were authorized by bills like the CARES Act and the American Rescue Plan.

However, these programs were temporary and tied specifically to the pandemic emergency. Since those rounds ended, the IRS’s mission has returned to its core task: overseeing taxes and refunds. Any lingering payments now are typically “plus-up” payments or unclaimed credits from those past relief rounds, not new stimulus checks.

Why Do $1,390 Direct Deposit Relief Rumors Keep Coming Up?

People tend to get excited about free money—especially when inflation hits hard and bills pile up. These rumors often arise in the absence of fresh relief measures.

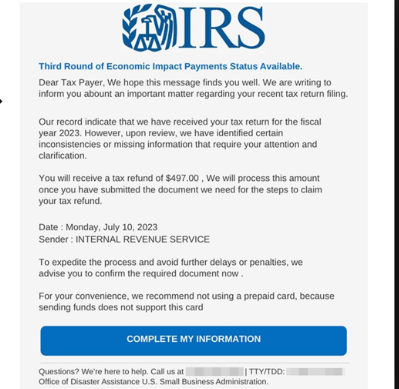

Moreover, scammers exploit these hopeful moments to spread fake news or phishing schemes. They might send texts, emails, or social media messages asking for your bank details or Social Security number, pretending to be from the IRS.

The IRS has clearly warned against these scams, reminding everyone they won’t call, text, or email asking for personal info uninvited.

How the IRS Processes Relief Payments (When They Happen)?

When the government approves relief payments, the IRS plays a key role in distributing the cash, usually based on tax records or benefit eligibility.

Payments are typically direct deposited to bank accounts or sent as physical checks or prepaid debit cards. These programs also have strict eligibility criteria and deadlines, including income limits and citizenship conditions.

Th

Understanding this process helps you spot legitimate communications from the IRS versus scams—official IRS notices always come with clear instructions on how to claim benefits and offer secure online accounts to track payment status.

Economic Factors Behind $1,390 Direct Deposit Relief

Relief payments, like stimulus checks, are often issued in response to major economic issues such as:

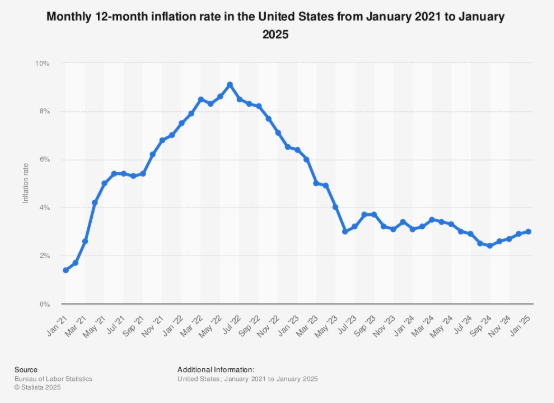

- High inflation: When prices rise sharply, direct payments help people keep up.

- Rising unemployment: Payments aim to provide support if jobs are lost.

- Economic recessions: To stimulate spending and keep the economy moving.

Right now, economic data presents a mixed picture. Although inflation has cooled from its peak, prices remain elevated for many essentials. Congress and the administration are debating new ways to support working families amid ongoing financial pressures, but no laws authorizing fresh federal stimulus payments have been passed for 2025.

What to Do If You Think You Should Get a Payment but Haven’t?

Sometimes there’s confusion around stimulus or relief payments:

- Make sure your tax returns are filed and up to date.

- Check the IRS’s official “Where’s My Refund?” tool for payment updates.

- If you think you’re eligible for existing credits, ensure your information with the IRS is current.

If you’re missing a payment due to an error or you failed to claim a Recovery Rebate Credit for past stimulus payments, you can claim it on your tax return. For missed credits from the 2020 or 2021 stimulus payments, taxpayers must file accurate returns to claim benefits.

How to Report Suspicious Calls or Scams?

If you receive unexpected calls or messages asking for personal details claiming to be from the IRS:

- Do not share your information.

- Visit the official IRS Scam Reporting page to report the incident.

- Forward scam emails to [email protected].

- Inform the FTC via ReportFraud.ftc.gov.

Staying vigilant protects you and your community from fraud.

Other Resources for Financial Assistance

If you need financial help beyond IRS relief, consider:

- State and local assistance programs for utilities, housing, and food.

- Nonprofit organizations offering financial counseling and emergency support.

- Federal programs like SNAP, Medicaid, and unemployment benefits.

Practical Advice for Tax Time in 2025

Here’s how to keep your finances in check this year:

1. Keep Your Personal Info Secure

Never share sensitive data with unverified sources. Use official IRS websites and licensed tax professionals.

2. File Taxes Early

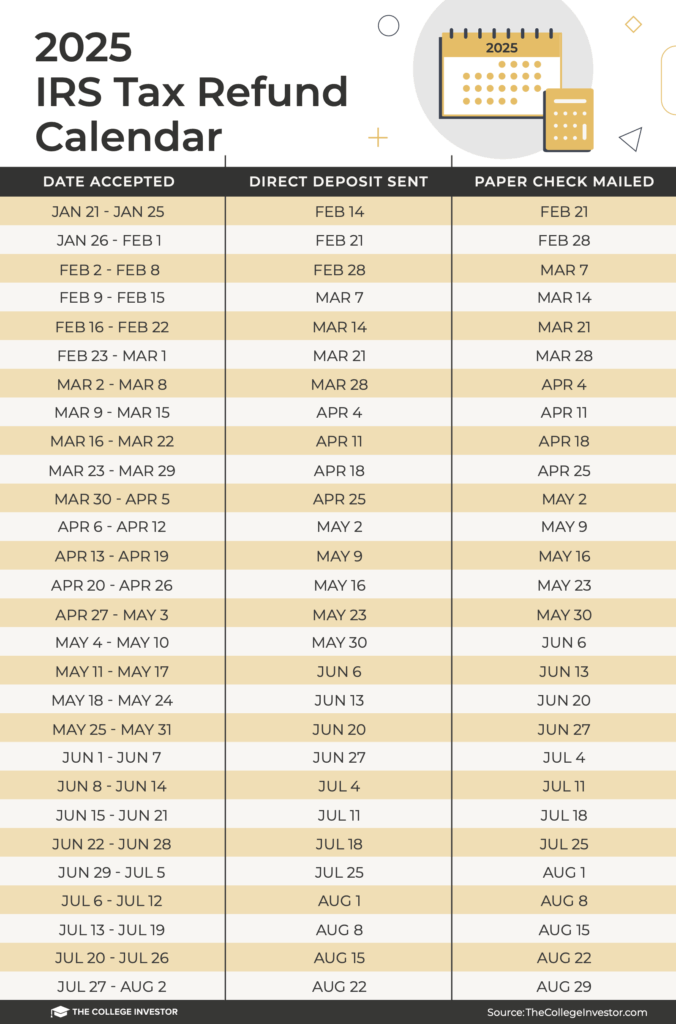

The sooner you file, the quicker you get refunds and catch any issues.

3. Use Trusted Tax Preparation Tools

Certified software and professionals help avoid errors and fraud.

4. Track Your Refund Online

Use the IRS’s Where’s My Refund? tool to stay updated.

5. Stay Informed Regularly

Bookmark the IRS newsroom and subscribe to alerts for official updates.

IRS Child Tax Credit Refund in October 2025: Check Payment Amount & Eligibility Update

$1,702 Stimulus Checks in October 2025; Check Full Payment Schedule & Eligibility Rules

$485-$1650 Bonus Stimulus Checks: Is It Really Coming? Check Eligibility Criteria!