How Much Should You Save to Retire Comfortably in the U.S.? If you’re asking, “How much should you save to retire comfortably in the U.S.?”, you’re already doing better than most people. Planning for retirement isn’t about chasing a magic number—it’s about creating freedom, peace of mind, and options. Whether you’re 25 or 55, knowing your target gives you a real plan instead of a vague hope. As someone who’s worked with professionals, families, and retirees for years, I can tell you: the number one difference between those who retire comfortably and those who don’t isn’t income—it’s clarity and consistency. Let’s break it all down in plain English so it’s easy to follow and apply.

Table of Contents

How Much Should You Save to Retire Comfortably in the U.S.?

There’s no universal “magic number” for retirement, but there is a clear path to financial comfort. Start early, stay consistent, and plan for the unexpected.

Follow these steps:

- Estimate your annual spending.

- Subtract guaranteed income sources.

- Apply the 4% rule (or 3.5% for safety).

- Add a cushion for healthcare and inflation.

- Automate savings and increase contributions over time.

- Revisit your plan annually.

Retirement security doesn’t come from luck—it comes from steady, informed action. You don’t need to be rich to retire well—you just need to be ready.

| Topic | What You Should Know |

|---|---|

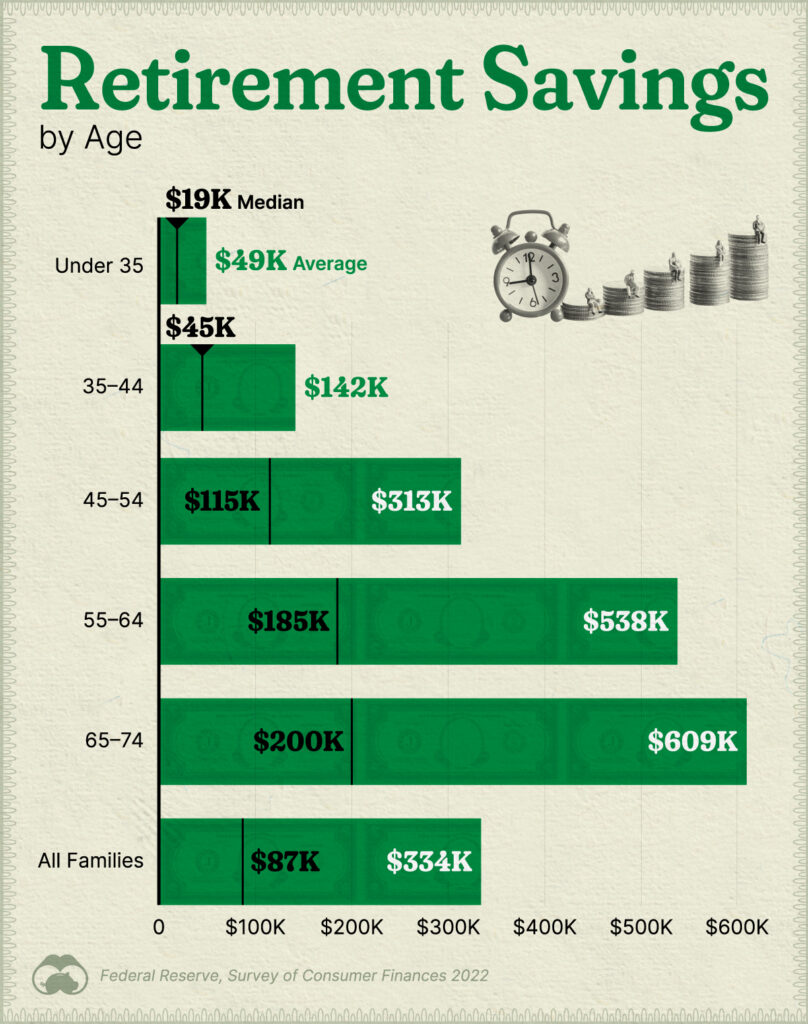

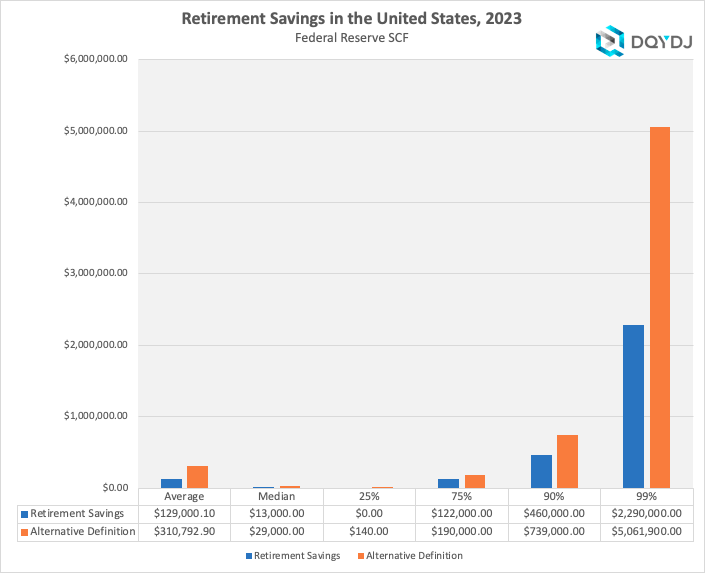

| Median U.S. retirement savings | About $87,000 per household with accounts |

| Average savings goal | $1.26 million (2025 Northwestern Mutual survey) |

| Recommended saving rate | 10–15% of income (including employer match) |

| Rule of 25 / 4% Rule | Multiply annual spending by 25 to find your target |

| Typical income replacement rate | 70–90% of pre-retirement income |

| Government tools | Free calculators and worksheets available |

Why Retirement Planning Matters More Than Ever?

Retirement in America looks very different than it did a generation ago. Gone are the days of guaranteed pensions and lifetime jobs. You are your own pension manager now.

According to the 2025 Northwestern Mutual Planning & Progress Study, the average American believes they’ll need $1.26 million to retire comfortably—down slightly from $1.46 million in 2024.

But here’s the catch: the median retirement savings for U.S. households with retirement accounts is only about $87,000, and many Americans have far less. That’s a huge gap—and closing it takes a clear plan.

Retirement isn’t just about quitting work. It’s about having control—over your time, lifestyle, and peace of mind.

What “Retire Comfortably” Actually Means?

“Comfortable” doesn’t look the same for everyone. For some, it’s golfing three days a week and traveling to Europe. For others, it’s owning a cozy home, being near family, and not worrying about bills.

To figure out your number, you first have to define your lifestyle goals. Ask yourself:

- Do I plan to travel frequently or stay close to home?

- Will I still have a mortgage or car payments?

- How much will I spend on healthcare, especially before Medicare?

- Am I supporting kids, parents, or other dependents?

A comfortable retirement generally replaces 70–90% of your working income, but that’s just a rule of thumb. Your actual number depends on spending, location, health, and how long you’ll live.

Remember: the goal isn’t perfection—it’s preparation.

The Rules of Thumb: Where to Start

There’s no single answer, but experts use three major approaches to help estimate your retirement goal.

1. The Multiplier Method

According to Fidelity Investments, you should aim to have:

- 1× your salary saved by age 30

- 3× by 40

- 6× by 50

- 8× by 60

- 10× by 67

So if you make $80,000 at retirement, your goal should be about $800,000. It’s simple, easy to track, and gives you checkpoints along the way.

2. The 4% Rule (Rule of 25)

This classic rule suggests you can safely withdraw 4% of your savings each year in retirement without running out of money over 30 years.

To use it:

- Estimate your annual spending (say $60,000 per year).

- Multiply it by 25 → $1.5 million.

That’s roughly how much you’d need saved.

It’s not perfect—the 4% rule assumes steady markets—but it’s a solid baseline. More cautious planners use 3.5% instead.

3. The Savings Rate Approach

Rather than obsessing over the end goal, focus on saving 10–15% of your income yearly. That includes any employer 401(k) match.

Even starting late can work—boosting contributions or delaying retirement by a few years can close big gaps.

Step-by-Step Guide to Find How Much Should You Save to Retire Comfortably in the U.S.

Here’s how to calculate your personalized retirement target.

Step 1: Estimate Annual Spending

Start with your current spending. Subtract expenses that will disappear (like commuting), add new ones (travel, healthcare).

Example: You estimate you’ll spend $70,000 annually in retirement.

Step 2: Subtract Fixed Income

Add up guaranteed income like Social Security, pensions, or rental income.

Say Social Security pays $25,000 per year and a small pension adds $10,000.

That leaves $35,000 to come from savings.

Step 3: Apply the 4% Rule

$35,000 ÷ 0.04 = $875,000 needed in savings.

If you want a cushion, aim for $1 million.

Step 4: Adjust for Inflation and Longevity

Inflation erodes buying power. A 3% annual rate halves your money’s value in 24 years.

So build in an inflation buffer by aiming 10–20% above your target.

Step 5: Plan Your Contributions

Work backward. How much should you save monthly to hit your goal?

For example:

- 30 years old with $50,000 saved

- Target: $1.25 million at 67

- Invest $700/month at 7% average return

That’s doable if you start early and stay consistent.

Real-Life Scenarios

Case 1: Sarah, age 35, salary $80,000

She wants to retire at 65.

- 10× her salary → target $800,000.

- Plans to spend $60,000/year, after Social Security needs $40,000/year.

- 25× $40,000 = $1 million target.

If she saves 15% ($12,000/year) and earns 7%, she’ll likely exceed that.

Case 2: John, age 55, salary $120,000

He has $400,000 saved and plans to retire at 67.

He needs $1.5 million for comfort.

If he saves $25,000/year and earns 6%, he could reach roughly $1.2 million—close enough with modest spending.

These examples show there’s no single “right” number—it depends on your lifestyle, savings rate, and time horizon.

Beyond the Math: Mindset and Habits

Money habits matter as much as money math.

1. Automate Everything – Set contributions to auto-draft from your paycheck. You can’t miss what you never see.

2. Avoid Lifestyle Creep – When you get raises, increase savings, not spending.

3. Don’t Panic in Down Markets – Retirement investing is a marathon. Reacting emotionally hurts more than bear markets themselves.

4. Pay Off Debt Before Retirement – Carrying high-interest debt into your 60s kills flexibility.

5. Protect Against Risks – Use health, disability, and long-term-care insurance to prevent financial shocks.

Building wealth is 80% behavior and 20% strategy.

Government and Policy Changes That Affect You

The SECURE 2.0 Act (passed in 2022 and expanding through 2025) introduced major updates:

- RMD age (Required Minimum Distribution) increased to 75.

- Catch-up contributions for workers 50+ increased and indexed to inflation.

- Auto-enrollment in new 401(k) plans to encourage saving.

- Student loan match: Employers can match payments made toward student loans as retirement contributions.

These are big deals—they give you more time and tools to save tax-efficiently.

Hidden Costs People Forget

Many people underestimate certain costs that can derail even a solid retirement plan:

- Healthcare: Fidelity’s 2025 Retiree Health Care Cost Estimate says the average retired couple will spend about $360,000 on medical expenses throughout retirement.

- Long-term care: Assisted living can run $60,000–$100,000/year.

- Taxes: Withdrawals from 401(k) and traditional IRAs are taxable. Roth IRAs, though, grow tax-free.

- Inflation: Even at 3%, prices double every 24 years.

Factor these in when estimating spending.

Advanced Tips for Professionals

If you’re already a strong saver or high earner:

- Diversify across tax buckets: Mix pre-tax (401k), Roth, and taxable investments for flexibility.

- Max out HSA contributions: Health Savings Accounts are triple tax-advantaged.

- Invest beyond retirement accounts: Use brokerage accounts for long-term growth.

- Work with a fiduciary financial planner: They’re legally required to act in your best interest.

You don’t have to be rich to retire well—but you do need a plan.

Common Mistakes to Avoid

- Waiting too long to start – Time is your biggest asset.

- Relying only on Social Security – It replaces just 30–40% of average income.

- Not updating plans – Life changes, so must your plan.

- Ignoring inflation and taxes – These silent costs can shrink your nest egg.

- Taking early withdrawals – Early 401(k) or IRA withdrawals incur taxes and penalties.

Avoid these, and you’ll already be ahead of half the population.

Social Security Just Changed at 69 – Here’s How It Could Drastically Impact Your Retirement

Senate Democrats Demand Answers as Social Security Chief Sparks Retirement Age Confusion

Retirement at 69? The Controversial Plan That Could Slash Benefits for Millions of Americans