$425M Class Action Settlement: If you’ve ever tucked away your savings in a Capital One 360 Savings account, big news is coming your way. A massive $425 million class action settlement could soon mean money back in your hands. The case has stirred up national attention — not just because of the money, but because it highlights something every saver in America should know: sometimes, loyalty to your bank can cost you more than you think. In this guide, we’ll unpack everything you need to know — from eligibility and deadlines to how much you might receive, and what this case means for the future of banking transparency in the U.S.

Table of Contents

$425M Class Action Settlement

The $425 million Capital One settlement is more than a payout — it’s a powerful reminder that financial awareness equals financial empowerment. Whether you get a small refund or a sizable check, the message is clear: keep your bank accountable, and never settle for less interest than your money deserves. Stay informed, verify your eligibility, and take this opportunity to review your savings strategy. It’s not just about getting paid — it’s about taking charge of your financial future.

| Detail | Summary |

|---|---|

| Case Name | Capital One 360 Savings Account Interest Rate Litigation |

| Settlement Amount | $425 million |

| Eligible Customers | Holders of a Capital One 360 Savings account between Sept 18, 2019 – June 16, 2025 |

| Deadline to Object / Opt Out | October 2, 2025 |

| Final Court Approval | November 6, 2025 |

| Payment Distribution | Expected early 2026 (≈ 60 days post-approval) |

| No Claim Form Required | Payments automatic for eligible customers |

| Official Website | www.CapitalOne360Settlement.com |

| Estimated Affected Accounts | Roughly 2–3 million |

| Primary Allegation | Capital One failed to inform customers about better-paying newer accounts |

Background: How It All Began

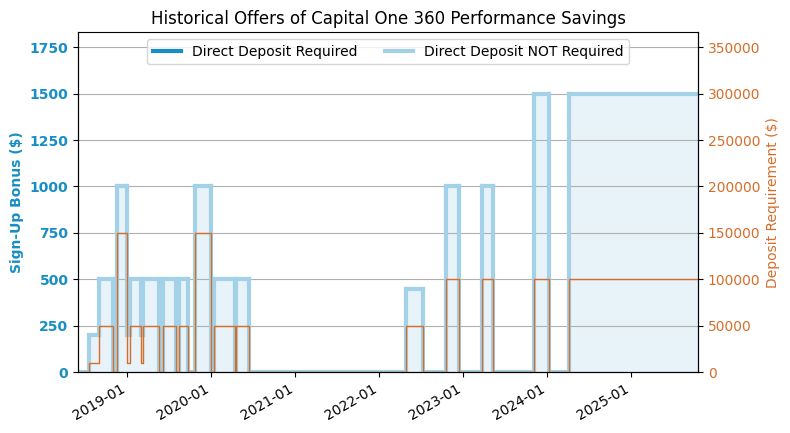

This all started in September 2019, when Capital One introduced a shiny new 360 Performance Savings account offering higher interest rates. The problem? It quietly left millions of 360 Savings customers behind.

While the new product paid rates of 4.35% APY or higher, the older account often stayed stuck around 0.30% — far below the market average. Customers weren’t notified or upgraded automatically.

By 2022, frustrated savers filed a class-action lawsuit claiming Capital One’s actions were deceptive and violated fair banking practices.

The bank denies wrongdoing, but agreed to a $425 million settlement to close the chapter. Legal experts say it’s one of the largest savings-rate settlements in U.S. history — right up there with the Wells Fargo unauthorized accounts scandal.

Why $425M Class Action Settlement Matters?

At first glance, this may look like just another corporate lawsuit, but it’s much bigger than that.

This settlement is a wake-up call for everyday Americans who assume their banks automatically give them the “best available” rate. In reality, many banks roll out newer products and quietly stop updating older ones — meaning long-time customers often earn less for the same service.

In short: loyalty doesn’t always pay in banking.

The Capital One case has now become a national conversation about transparency, fairness, and financial awareness — reminding customers to check rates regularly and not assume their bank has their back.

How the $425 Million Will Be Distributed?

$300 Million in Cash Payouts

The largest chunk of the settlement — $300 million — will go directly to customers as compensation for missed interest.

Your payout depends on:

- The time period your account was open between 2019 and 2025

- Your average balance during that time

- The rate difference between your account and the 360 Performance Savings account

Here’s a rough idea of what that might look like:

| Average Account Balance | Estimated Payment Range |

|---|---|

| $100 – $1,000 | $5 – $15 |

| $1,000 – $5,000 | $25 – $100 |

| $5,000 – $10,000 | $150 – $400 |

| $10,000+ | $400 – $1,000+ |

If your account has since been closed, you could earn up to 15% more because you’ll miss out on future interest increases.

$125 Million for Future Interest Boosts

For current customers, Capital One will temporarily raise 360 Savings interest rates so they’re at least twice the FDIC’s national average rate.

This bonus fund — roughly $125 million — ensures better rates for loyal customers until the fund runs out, likely lasting several quarters post-approval.

Who’s Eligible for $425M Class Action Settlement?

You’re part of the settlement “class” if:

- You held a Capital One 360 Savings account between Sept 18, 2019 and June 16, 2025.

- You were the primary or joint account holder.

- You still hold, or previously closed, the account.

You’re not eligible if you only had a 360 Performance Savings, checking, or credit account.

Important Deadlines

| Action | Deadline | What to Do |

|---|---|---|

| Update address / payment preference | Oct 2, 2025 | Visit official site to ensure you receive payment |

| File objection / opt out | Oct 2, 2025 | Submit written request |

| Final court hearing | Nov 6, 2025 | Court decides whether to approve the settlement |

| Payment distribution | Early 2026 | Roughly 60 days after approval |

No claim form is required. If you’re eligible, you’ll automatically be included and receive payment via check or direct deposit.

Step-by-Step: How to Check and Prepare for $425M Class Action Settlement?

- Visit the official site — www.CapitalOne360Settlement.com

- Confirm your eligibility using your name, claim ID, or email.

- Choose your payment method — direct deposit or mailed check.

- Update your contact info if you’ve moved or changed banks.

- Check your inbox (and spam folder) for Capital One notices.

If you get no notice, you can still verify eligibility online or contact the settlement administrator directly.

What If You Do Nothing?

If you do nothing, you’ll automatically receive your payout — provided your information is current. However, if you move or change banks and fail to update your contact info, your check could be delayed or lost.

If you want to opt out (say, to sue independently), you must file your exclusion by October 2, 2025.

Impact on Capital One’s Reputation

Capital One’s brand has weathered many storms — from data breaches to now interest-rate lawsuits — but analysts say this settlement is unlikely to dent its long-term stability.

The bank’s quick willingness to settle, without admitting wrongdoing, signals a strategic move to restore consumer trust. According to Morningstar analysts, Capital One remains one of the more customer-friendly major banks, ranking 6th nationally in online banking satisfaction.

Still, critics argue the settlement highlights an industry-wide issue: “set-and-forget” customers get the short end of the stick. The case may influence how other banks handle product transitions in the future.

Expert & Industry Insights

Greg McBride, CFA, chief financial analyst at Bankrate, says the case “highlights why consumers should review rates every six months.”

“Banks rely on inertia — if customers don’t move, banks profit,” McBride explains. “This case sends a message: consumers are watching.”

The Consumer Financial Protection Bureau (CFPB) may also tighten its oversight on product disclosures, ensuring customers aren’t left in the dark when banks roll out new products.

Meanwhile, financial advisors encourage customers to explore alternatives. Online banks like Ally, SoFi, and Discover consistently offer higher yields and clear communication when rates change.

Tax and Legal Implications

- Taxes: Payments from this settlement count as interest income and may be reported on IRS Form 1099-INT if over $10.

- Credit Scores: The case and payments have no effect on your credit report.

- Legal Rights: If you stay in the class, you waive the right to sue Capital One separately for similar claims. If you opt out, you keep that right.

Public Reaction

Customer reactions have been mixed. Some are happy to receive compensation; others feel the bank should’ve automatically upgraded their accounts years ago.

One Twitter user wrote, “Capital One finally paying back the loyalty tax — about time!”

On Reddit’s r/personalfinance, a popular post summarized the sentiment perfectly:

“It’s not about the check — it’s about being treated fairly.”

This kind of feedback shows how class-action settlements don’t just deliver payments; they shift industry norms and customer expectations.

Lessons Learned: How to Protect Your Savings

1. Compare Rates Every Few Months

Banks count on customers staying put. Check the FDIC’s published averages or compare high-yield options.

2. Read Bank Notices

Financial institutions must notify customers of changes — but those emails often land in spam. Always read account updates.

3. Set Rate Alerts

Use apps like Mint, Empower, or Personal Capital to track your APY and get notified of rate drops.

4. Diversify Savings

Don’t keep all your money in one institution. Many online banks and credit unions offer competitive yields with FDIC or NCUA insurance.

5. Ask Questions

Call your bank directly. If there’s a “new” product similar to yours, ask if your rate will match it. It never hurts to negotiate.

$5.695M CRA Class Action Settlement 2025, Check Payment Date, Latest News

AT&T $177M Data Breach Settlement – Apply to get $7,500 Payment, Check Eligibility

Retirement at 69? The Controversial Plan That Could Slash Benefits for Millions of Americans

The Bigger Picture: A Win for Financial Awareness

The Capital One case underscores a major point — you must be your own financial advocate. Don’t assume your bank will automatically move you to the best-rate account.

By checking rates, reading terms, and staying proactive, you’ll not only avoid being underpaid — you’ll maximize your earnings in the long run.

This settlement may also push other big banks to be more transparent, helping millions of Americans earn what they deserve on their hard-earned savings.