Centrelink Age Pension: If you’re keeping an eye on your retirement income or helping a parent navigate Centrelink, the Centrelink Age Pension October 2025 update is one you’ll want to understand inside and out. The Australian Government has made several rate adjustments and cost-of-living updates that directly impact how much you’ll receive in your fortnightly payments starting from 20 September 2025 — carrying into the October 2025 payment cycle. This article breaks it all down in plain English — what’s changing, who’s eligible, how much you’ll get, and when the money hits your account. Whether you’re new to the system or you’ve been receiving payments for years, here’s everything you need to know — clear, factual, and grounded in official sources.

Table of Contents

Centrelink Age Pension

By October 2025, eligible Australians will see new, higher Centrelink Age Pension rates — $1,178.70 for singles and $888.50 each for couples. Payments continue fortnightly (2 Oct, 16 Oct, 30 Oct 2025). The system remains means-tested, ensuring fairness, but with supplements, concessions, and tax offsets, most retirees can enjoy a stable and predictable income. Stay informed, apply early, and keep your details up to date. Whether you’re planning your own retirement or helping someone else, understanding these rules today means financial peace tomorrow.

| Topic | What You Should Know |

|---|---|

| New Pension Rates (from 20 Sept 2025) | Single: approx AUD 1,178.70 per fortnightCouple (each partner): approx AUD 888.50 per fortnight |

| Eligibility Age | 67 years (born on or after 1 Jan 1957) |

| Payment Frequency & Dates | Fortnightly — October 2025 payments likely on 2 Oct, 16 Oct, 30 Oct |

| Income & Assets Tests | Payments are reduced if your income or assets exceed thresholds |

| Extra Benefits | Energy Supplement, Rent Assistance, Pensioner Concession Card |

| Tax Status | Largely tax-free under the Seniors and Pensioners Tax Offset (SAPTO) |

| Official Link | Services Australia |

The Big Picture: What’s Changing in October 2025

Every March and September, the government reviews pension rates to keep them in line with inflation and average wage growth. That means the September 2025 increase will roll into your October 2025 payments. The changes are meant to help older Australians keep up with rent, groceries, and energy prices — all of which have risen steadily in recent years.

The Centrelink Age Pension remains the backbone of Australia’s social security system for retirees. It provides a stable income floor for those who’ve reached pension age, helping millions cover basic living costs after leaving the workforce. The new rates for October 2025 reflect one of the largest single-year boosts in recent times — about $29.70 extra per fortnight for singles and $44.80 (combined) for couples.

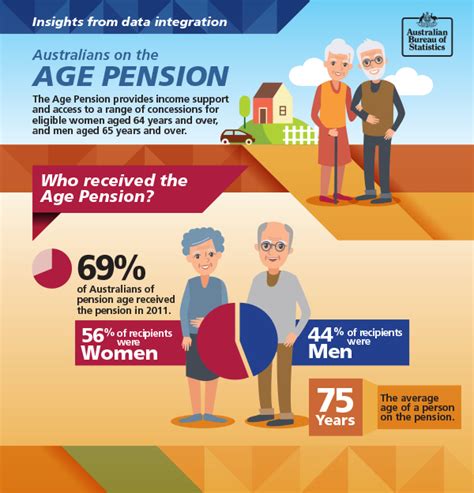

Historical Context: How the Age Pension Evolved

The Age Pension first appeared in Australia in 1909, long before modern superannuation. Back then, it was just £26 a year! Over time, it’s been adjusted, modernized, and integrated into the broader welfare system, with the goal of providing fairness and security.

Today, it’s paid to over 2.5 million Australians and is indexed to keep up with inflation and national wage growth. The formula ensures the pension doesn’t fall behind the general standard of living. Twice a year — in March and September — Centrelink reviews the rate, and that’s why the October 2025 payments will reflect the September 2025 increase.

Who’s Eligible for the Centrelink Age Pension?

Eligibility isn’t automatic — you’ve got to meet a few key rules.

1. Age Requirement

You must be 67 years or older. This threshold fully phased in by July 2023. If you were born on or after 1 January 1957, your qualifying age is 67.

2. Residency Rules

You must:

- Be an Australian resident, and

- Have lived in Australia for at least 10 years, with 5 years continuously.

Special rules apply for people who’ve lived or worked overseas, often covered by international social security agreements.

3. Income and Assets Tests

The government looks at your total income (from work, super, investments, etc.) and total assets (savings, property, vehicles, investments, etc.).

Whichever test gives you the lower pension amount is the one Centrelink uses.

If you go above the “free area,” your payment gradually decreases rather than stopping immediately.

October 2025 Pension Rates

After the September 2025 adjustment, the new maximum rates will be approximately:

- Single person: AUD 1,178.70 per fortnight (includes Energy Supplement)

- Couple (each partner): AUD 888.50 per fortnight

- Couple combined: AUD 1,777.00 per fortnight

On a yearly basis, that’s around:

- Singles: $30,650 p.a.

- Couples: $46,200 p.a. combined

These numbers may look small next to average wages, but remember, the pension is indexed — it rises automatically as the cost of living increases.

How the Pension Amount Is Calculated?

The formula can seem intimidating, but here’s the gist:

- Start with the maximum rate for your situation (single or couple).

- Apply the income test:

- The first part of your income is exempt (called the “free area”).

- Anything above that reduces your payment by a set rate.

- Apply the assets test:

- Your home is exempt (mostly), but other assets are counted.

- If your assets are above a threshold, your pension drops by a certain taper rate.

- Whichever test produces the lower payment wins.

That’s your pension amount.

Case Study: Bill and Mary

Bill and Mary, both 68, own their home in Brisbane and have about $350,000 in savings. Their small investment income doesn’t push them above the income limit. They qualify for nearly the full couple rate — around $888.50 each per fortnight.

Their friend Tom still works part-time at a hardware store and earns $2,000 per fortnight. His income pushes him above the free area, so his pension is trimmed by about $150 each payment.

Still, he’s eligible for partial pension plus all the extras (like the concession card).

The takeaway? Working is fine — just know how it affects your payments.

Payout Dates in October 2025

Centrelink generally pays pensions fortnightly, every second Thursday.

Expected paydays for October 2025 are:

- Thursday, 2 October 2025

- Thursday, 16 October 2025

- Thursday, 30 October 2025

If a holiday or weekend hits those days, your bank may process it the day before. Always confirm in MyGov > Centrelink > Payments and Claims.

Taxes and the Age Pension

For most pensioners, the Age Pension is effectively tax-free thanks to the Seniors and Pensioners Tax Offset (SAPTO) and the tax-free threshold.

- The current tax-free threshold is $18,200, but seniors can often earn much more before paying tax — sometimes up to $33,000 (single) or $58,000 (couple) depending on eligibility for offsets.

- If you have other income, like rent or investments, you might pay a small amount of tax, but SAPTO usually cancels most of it.

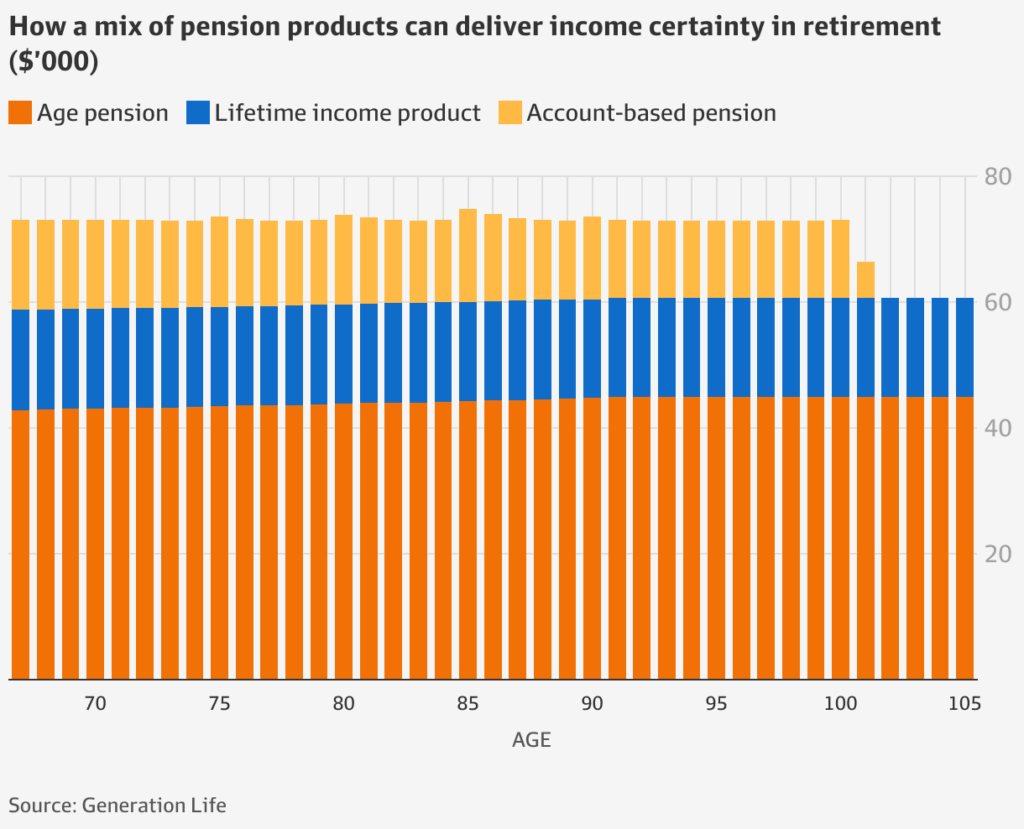

Interaction with Superannuation

Your super balance doesn’t automatically stop you from getting the Age Pension.

Instead, the government looks at how much income it produces or what the balance counts for under the assets test.

For many retirees, part of the plan is combining super income streams (like an account-based pension) with Centrelink payments.

Financial planners often recommend drawing from super gradually so that you stay under the test limits and maximize both super and Centrelink income.

Additional Supplements and Perks

Once approved for the Age Pension, you may also qualify for:

- Rent Assistance – extra money if you rent privately and pay above a certain amount.

- Energy Supplement – included automatically to offset power bills.

- Pensioner Concession Card – major discounts on medical prescriptions, utilities, and travel.

- Advance Payments – you can request part of your pension early (like a mini-loan) and repay through future deductions.

Every little bit helps — and these add-ons can make hundreds of dollars of difference over the year.

Smart Money Tips for Pensioners

1. Budget the easy way:

Use the bucket system — one account for bills, one for spending, one for savings. It makes sure you never spend the rent money on a fishing trip.

2. Report changes quickly:

If your income or assets go up, tell Centrelink. Late updates can mean overpayments and debt notices.

3. Protect yourself from scams:

Centrelink never asks for personal information over text or social media. Always log in through the official MyGov portal.

4. Use pension discounts:

Seniors get big savings on public transport, vehicle registration, and utilities. Check your state government’s concession page for details.

5. Seek professional help if needed:

If your finances are complex, talk to a Financial Information Service (FIS) officer — it’s free, confidential, and offered by Services Australia.

Cost-of-Living Adjustments (COLA) Explained

Every six months, the pension is adjusted by whichever is higher:

- The Consumer Price Index (CPI)

- The Pensioner and Beneficiary Living Cost Index (PBLCI)

- Or a benchmark linked to average male total weekly earnings (MTAWE)

That’s how the government keeps payments fair and relevant. If prices or wages spike, pensioners don’t get left behind.

Common Mistakes to Avoid

- Forgetting to report changes in savings or income.

- Assuming your pension won’t change — it can!

- Waiting until you’re 67 to apply — you can apply 13 weeks early.

- Ignoring official letters or reviews from Centrelink.

- Believing myths like “you lose your pension if you work.”

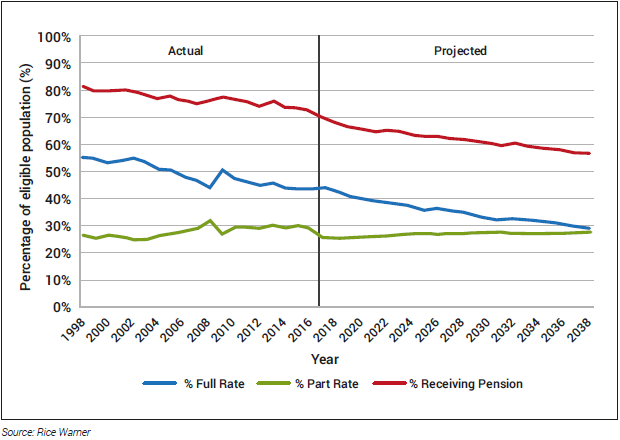

Future Outlook for 2026 and Beyond

Policy experts predict several reforms could be on the horizon:

- Simpler rules for part-time workers and self-funded retirees.

- Raising asset thresholds to reflect home-price inflation.

- Integration with superannuation drawdowns, making reporting easier.

- Potential digital payment tracking through updated MyGov dashboards.

Nothing is confirmed yet, but based on government trends, further support adjustments are likely in March 2026.

Centrelink Payment of $1831 Confirmed for October 2025 – Check Eligibility Criteria

$250-$1300 Centrelink Payments Approved for October 2025 – Check Eligibility & Eligible People List

Centrelink $750 October Bonus 2025: Check Eligibility Criteria and Payment Dates