OAS Increase in October 2025: The Old Age Security (OAS) increase in October 2025 is something every senior, retiree, and financial advisor is talking about right now. If you’re receiving OAS benefits, you’ve probably wondered — Will the payment amount actually rise? How much will it increase? And when will I see the money in my account? In this detailed guide, we’ll break it all down — in clear, friendly language. You’ll learn exactly what’s changing in October 2025, how it’s calculated, how to check your payment, and what it means for your retirement plan.

Table of Contents

OAS Increase in October 2025

The OAS increase in October 2025 is confirmed — payments are going up 0.7 % to help seniors manage rising living costs. The new maximum monthly rates will be approximately $740.08 for ages 65–74 and $814.09 for those aged 75 and older, with the first payment arriving October 29, 2025. It’s not a major raise, but it’s part of Canada’s ongoing effort to ensure that retirees maintain their standard of living. Staying informed, monitoring your My Service Canada Account, and planning around your income thresholds are the best ways to make the most of your OAS benefits. Remember, OAS is just one pillar of retirement income. Combining it wisely with CPP, private pensions, and savings can ensure long-term stability and peace of mind.

| Topic | Details | Source |

|---|---|---|

| Increase for Oct–Dec 2025 | 0.7 % | Canada.ca |

| Annual OAS Increase (Oct 2024–Oct 2025) | ~1.7 % cumulative | |

| New OAS for Ages 65–74 | ~$740.08/month | |

| New OAS for Age 75+ | ~$814.09/month | |

| Payment Date (October 2025) | October 29, 2025 | Government of Canada Calendar |

| Clawback Thresholds | $93,454–$151,668 (ages 65–74) / ~$157,490 (75+) |

What Is OAS and Why It Matters?

The Old Age Security (OAS) program is one of Canada’s most important retirement income sources. Unlike the Canada Pension Plan (CPP), you don’t pay into OAS while working. Instead, it’s funded through general tax revenues and paid to eligible seniors who have lived in Canada for a specific period.

To qualify for full OAS, you generally need to have lived in Canada for 40 years after turning 18. If you’ve lived here between 10 and 39 years, you can still receive a partial OAS pension.

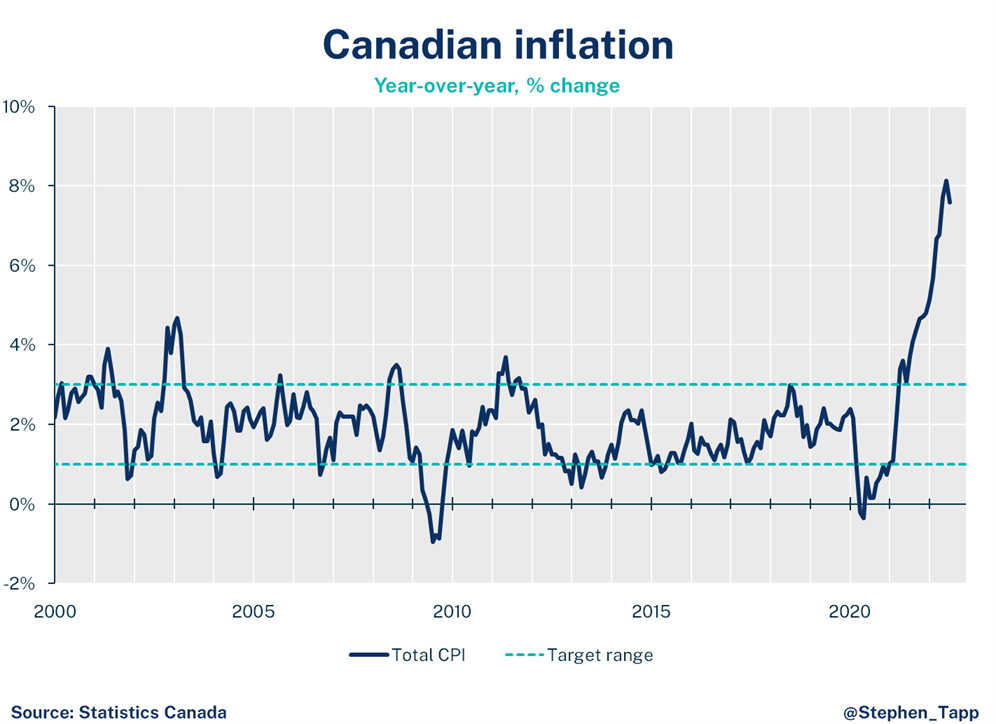

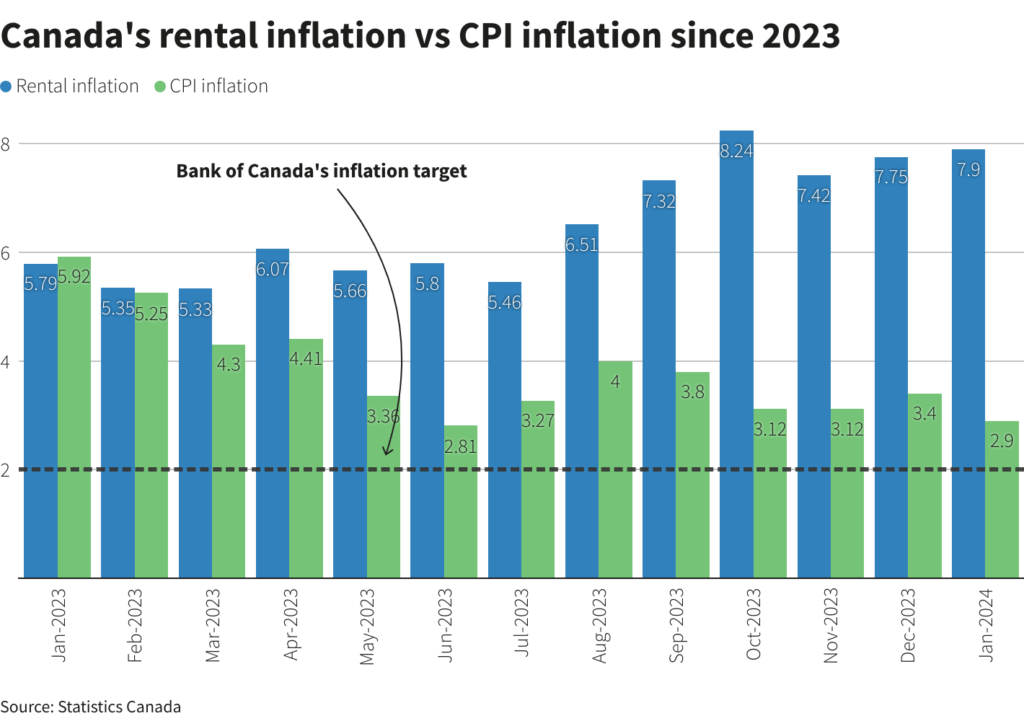

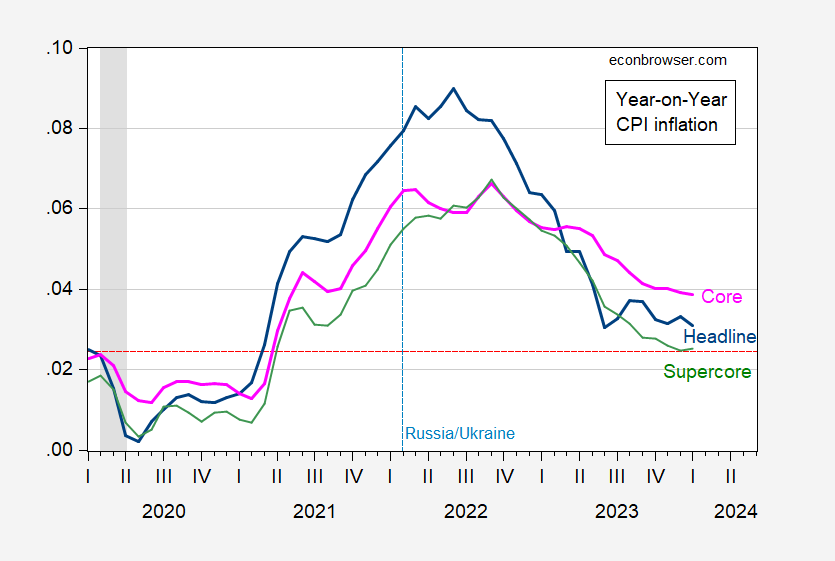

OAS payments are indexed to inflation, which means the federal government reviews them every three months — in January, April, July, and October — and adjusts the amount based on the Consumer Price Index (CPI) published by Statistics Canada. If inflation rises, OAS increases; if inflation falls, OAS stays the same. It never decreases, even in low-inflation periods. That’s a huge safety net for seniors who rely on it for day-to-day expenses like groceries, utilities, and medication.

Will OAS Increase in October 2025?

Yes — the OAS benefit will increase by 0.7 % starting in October 2025. This adjustment will apply for the October to December 2025 quarter.

The increase is tied directly to the Consumer Price Index (CPI) — a key indicator that tracks inflation. The government compares the average CPI from May to July 2025 with that of February to April 2025. If the CPI has gone up, OAS payments rise by the same proportion.

This increase helps protect seniors from inflation-driven price hikes. Even though 0.7% might not sound like much, it maintains the real value of your pension in a time when groceries, gas, and healthcare costs are still on the rise.

The new maximum monthly OAS amounts are expected to be approximately:

- $740.08 for ages 65 to 74

- $814.09 for ages 75 and older (includes the 10% post-75 bonus)

These amounts represent full eligibility. If you have partial residency, your OAS will be prorated accordingly.

When Will You Get the OAS Increase in October 2025?

The official OAS payment date for October 2025 is October 29, 2025. Payments are typically issued on the third-last business day of each month. If that date falls on a weekend or a holiday, the payment is usually made on the preceding business day. You’ll receive your new amount automatically, provided you’re already enrolled and have your direct deposit information set up correctly.

Understanding How OAS Is Calculated

OAS increases follow a clear formula based on inflation data:

- The government calculates the average CPI for two three-month periods.

- It compares the most recent average to the previous one.

- The difference between them determines the OAS adjustment percentage.

This method ensures that benefits rise with the cost of living — and stay that way. If inflation spikes, seniors won’t lose buying power; if inflation cools, their payments hold steady.

How OAS Compares with Other Benefits?

OAS is part of Canada’s three-pillar retirement system, alongside CPP and private or workplace savings.

- OAS (Old Age Security): Based on how long you’ve lived in Canada; no contributions required.

- CPP (Canada Pension Plan): Based on what you and your employer paid into it during your working years.

- GIS (Guaranteed Income Supplement): A non-taxable benefit added on top of OAS for lower-income seniors.

So if you’ve worked and contributed to CPP, you’ll receive both OAS and CPP payments — and possibly GIS if your income qualifies.

Example: How the October 2025 Increase Affects You

Let’s put the numbers in real terms.

If you’re 68 years old and currently receiving $735 per month (for July–September 2025), a 0.7% increase means:

$735 × 1.007 = $740.15

That’s about $5.15 more each month, or $61.80 per year.

For someone aged 76 receiving $808.00, the new amount would be:

$808 × 1.007 = $813.66 — about $68 more per year.

It’s not life-changing, but it helps offset everyday expenses like utilities, groceries, and prescription costs — which can add up quickly for retirees on fixed incomes.

How to Check Your OAS Increase Online?

To make sure you’re receiving the right amount, here’s how to verify your OAS payment online:

- Visit My Service Canada Account (MSCA).

- Log in using GCKey or Sign-In Partner (through your online bank).

- Once inside, go to the “Benefits and Payments” section.

- Select Old Age Security (OAS).

- You’ll see:

- Your current monthly payment

- The upcoming payment date

- Past payment history

- Your tax slips and clawback details

If you notice any discrepancies — like not receiving the October increase — contact Service Canada right away.

OAS Clawback (OAS Recovery Tax) Explained

The OAS Recovery Tax, commonly called the “clawback,” applies to higher-income seniors.

If your net world income exceeds $93,454 (for ages 65–74 in 2025), your OAS is gradually reduced. Once your income reaches around $151,668, your benefit is fully clawed back. For seniors aged 75+, the upper threshold is approximately $157,490.

This reduction happens automatically during tax filing, so it’s important to plan ahead.

To avoid losing benefits unnecessarily, consider income-splitting with a spouse, withdrawing from your TFSA instead of RRSP, or delaying CPP.

Tips to Maximize Your OAS Benefits

These strategies can help you get the most from your OAS payments:

- Delay OAS to Age 70

You can defer OAS for up to five years after turning 65. Each month of delay adds 0.6 % to your payment — that’s a 36 % increase if you wait until 70. - Minimize Taxable Income

Keeping your income below the clawback threshold ensures you retain full OAS benefits. TFSA withdrawals don’t count as income, so they’re a smart way to supplement cash flow. - Apply for GIS if Eligible

If your income is low, you might qualify for the Guaranteed Income Supplement (GIS) — a tax-free addition to OAS. - Keep Records Updated

Log into your MSCA regularly to confirm your direct deposit and contact information are accurate. - Combine Planning with CPP and Private Savings

OAS alone is not designed to cover all retirement expenses. Combine it with CPP and private savings for a stable financial foundation.

Broader Context: Inflation and OAS Indexation

OAS indexing reflects the cost of living — but it also mirrors Canada’s economic health. Over the past few years, inflation has fluctuated sharply due to energy costs, supply chain challenges, and global price pressures.

Between 2020 and 2025, Canada’s CPI rose at an average annual rate of about 3%, though that pace has slowed in 2025. That’s why the October 2025 adjustment is modest at 0.7%.

It shows inflation is cooling, but the government remains committed to protecting seniors’ purchasing power. The next OAS adjustment is expected in January 2026, based on inflation data from fall 2025.

Canada $2988 OAS Per Month for these Seniors: Check Eligibility and Payment Date

CPP & OAS Benefit Payment Coming In October 2025 – Check Revised Amount & Eligibility

Canada $400 Increase In CPP /OAS Benefits in October 2025: Who will get this? Check Payment Dates