Canada Cost of Living Increase: Living in Canada comes with its perks and challenges — and one challenge that many Canadians face is keeping up with the rising costs of everything from groceries to gas. In October 2025, there’s an important update you need to know: a government-mandated cost of living increase is taking effect to help cushion the impact of inflation. This adjustment affects key benefits like Old Age Security (OAS) and the Guaranteed Income Supplement (GIS), giving a boost to thousands of Canadians’ monthly income. So, what exactly is this cost of living increase? Simply put, it’s a government adjustment to certain benefits designed to keep pace with inflation — the general rise in prices that makes everyday things cost more than they did last year. Inflation slowed down a bit this year compared to recent spikes, leading to a measured but still meaningful increase of 0.7% in October 2025. If you’re receiving social benefits, this means more money in your pocket starting October 29.

Table of Contents

Canada Cost of Living Increase

| Topic | Details | Reference |

|---|---|---|

| Cost of Living Increase Rate | 0.7% increase on OAS and GIS benefits | Canada.ca |

| One-time Relief Payment | $2,200 one-time payment for seniors, low-income families, and disabled individuals | |

| Who’s Eligible | OAS recipients age 65+, CPP Disability recipients, low-income families | Government of Canada |

| Payment Date | October 29, 2025 | |

| Inflation Measurement | Based on Consumer Price Index (CPI) adjustment |

Why Does Canada Cost of Living Increase Matter?

Inflation is a sneaky opponent. When prices go up, your dollar doesn’t stretch as far as it used to. For seniors and others living on fixed incomes, this can be a real problem. Every extra penny counts when you’re paying for essentials like utilities, transportation, or medicine. The government’s 0.7% increase aims to help bridge that gap, ensuring that benefit recipients maintain their purchasing power despite rising costs.

How Inflation Impacts Your Wallet?

Think about a loaf of bread or a gallon of milk — a few years ago, it might have cost you less than it does today. When prices like these climb consistently, it means your living expenses rise too. Inflation affects:

- Food prices

- Housing costs, including rent and property taxes

- Gasoline and transportation fares

- Medical and prescription expenses

- Utilities such as electricity and heating

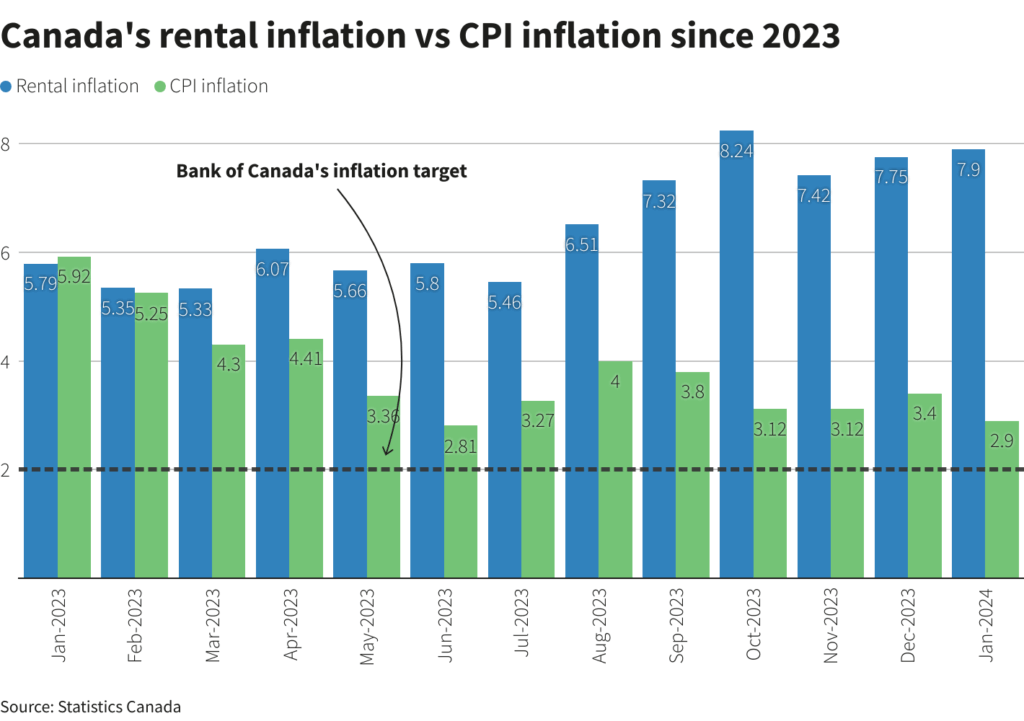

Canada’s statistical watchdog, Statistics Canada, tracks these changes carefully to help the government decide on benefit adjustments. The Consumer Price Index (CPI) is the main tool here. For the upcoming increase, this CPI data from July to September 2025 showed steady but moderate inflation, triggering the 0.7% bump.

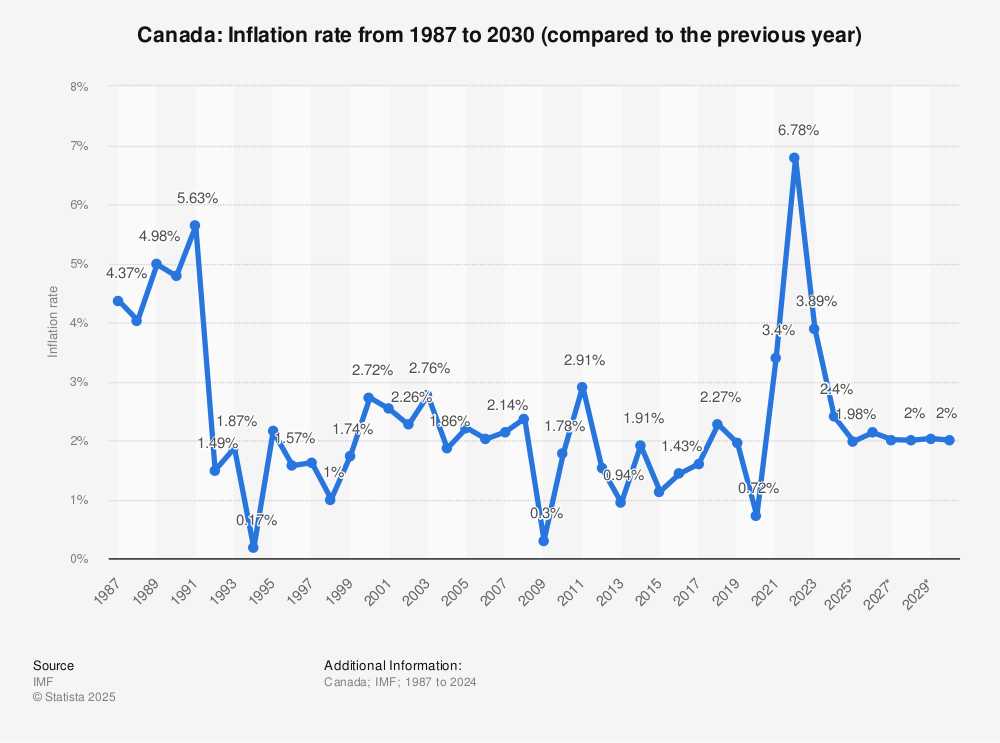

It’s important to note that while inflation can be frustrating, a very low or negative inflation rate—called deflation—can also create problems such as slowed economic growth or job losses. So, a small, stable inflation rate is generally healthier for the economy and manageable for households.

Historical Perspective: Cost of Living Increases in Canada

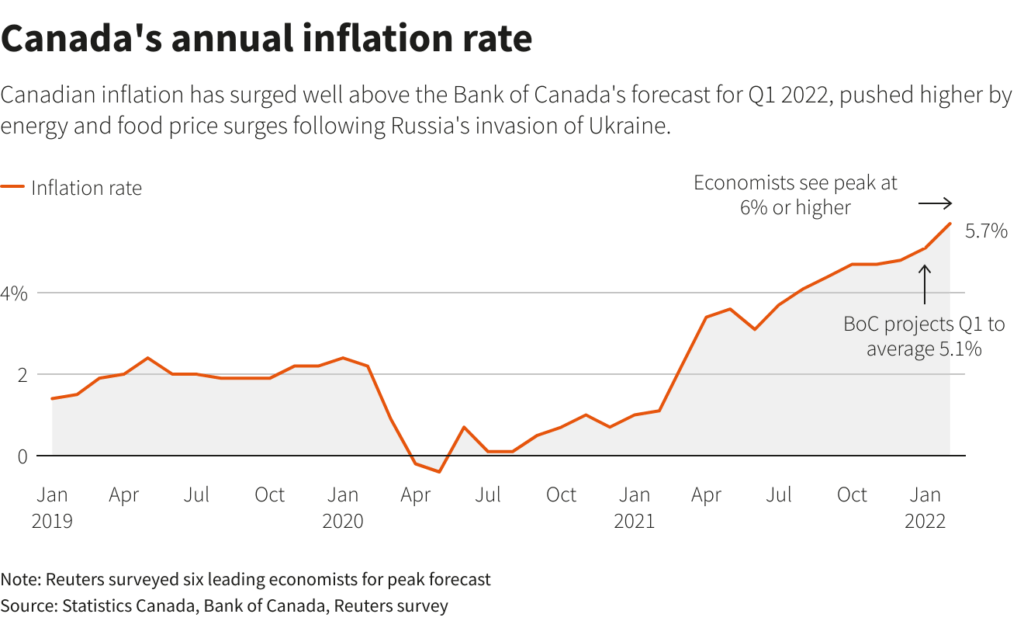

For context, the 0.7% increase is lower compared to recent years when inflation surged following the pandemic and economic disruptions. For example:

- In 2023, the cost of living adjustment for OAS was roughly 4%, reflecting higher inflation in 2022.

- In 2024, CPI data pointed to an increase close to 3%.

This progressive slowing to 0.7% in 2025 signals some price stabilization, which is good news for consumers and policymakers alike. However, even small increases matter, especially for seniors and low-income Canadians who often spend a larger share of their income on essentials.

Who Is Eligible and What Do They Get?

The primary groups benefiting from this increase include:

- Seniors aged 65+ receiving Old Age Security (OAS).

- Low-income seniors also receiving the Guaranteed Income Supplement (GIS).

- Canadians receiving Canada Pension Plan (CPP) Disability benefits.

- Low-income families meeting specific income thresholds.

Payment Details:

- OAS pension: Monthly payments rise from approximately $734.95 to $740.09 for ages 65–74.

- For seniors aged 75+, monthly payments go from $808.45 to $814.10.

- GIS allowance rises from roughly $1,395.73 to $1,405.50 monthly.

- A one-time $2,200 cost-of-living relief payment will be made to eligible groups as extra help for the season.

This relief payment is tax-free and automatic, with no application needed.

When Will You See the Money?

All the payments related to this cost of living adjustment will be made on October 29, 2025. Regular benefit recipients will see their monthly payments reflect the increase automatically. The one-time payment will also be deposited or mailed on this date.

If you receive payments by direct deposit, expect the money to hit your bank account overnight or by the morning of October 29. For those receiving cheques, mailing times may vary, but they should arrive shortly after the payment date.

Beyond Benefits: How Inflation Affects Other Programs and Costs

While OAS and GIS see direct increases, inflation’s influence extends beyond these benefits:

- Provincial social assistance programs often adjust benefits in line with federal changes, but timelines and amounts vary province by province.

- Housing subsidies and rent supplements may see adjustments or renewed funding due to increased landlord costs impacting tenants.

- Tax credits such as the GST/HST credit undergo annual recalculations to keep benefits relevant to changing costs.

- Utility bills including electricity, water, and heating often increase as suppliers face higher operational costs, directly impacting household budgets.

These factors combined make it essential for Canadians to plan carefully, especially as energy markets and food prices face global pressures.

Expert Insight: What Economists Say

Economists see the modest 0.7% bump as a signal of moderation. According to finance expert Lisa Tran, “It’s a sign of cautious optimism. Costs have risen, but this increase signals inflationary pressures may be easing, which is good for long-term financial planning.”

Dr. Mark Camfield, a senior economist at a leading Canadian university, points out that “Despite the increase, inflation remains a global challenge. The 2025 adjustment helps maintain purchasing power but does not eliminate the broader cost pressures impacting Canadians’ daily lives.”

Experts also note that ongoing monitoring of inflation is critical given geopolitical and supply chain uncertainties that could impact prices later in the year.

Tips for Professionals: Negotiating Your Salary or Benefits

Feeling the heat of rising costs but not covered by government benefits? Don’t forget your employer — many companies offer cost of living adjustments (COLAs) as part of salary reviews.

Here’s how to get started:

- Do your research: Know the current inflation rate and average salary increases in your field.

- Build a case: Document your achievements and contributions over the past year.

- Be clear: Request a COLA or raise aligned with inflation figures, showing how your expenses have increased.

- Be prepared to negotiate: Know your minimum acceptable increase and be open to discussing other benefits like flexible work arrangements.

Having this conversation confidently and professionally increases your chance of success.

Practical Budgeting Tips to Stretch Your Dollars

While government and employer adjustments help, managing your money day-to-day is critical:

- Track your spending: Use free budgeting apps like Mint or PocketGuard to see where your money goes monthly.

- Prioritize your bills: Utilities, rent, and groceries come first. Eliminate or reduce less essential expenses like subscriptions you rarely use.

- Shop smarter: Look for sales, buy in bulk when possible, and use coupons or cashback apps to save.

- Plan meals: Meal prepping reduces food waste and lets you buy better in bulk.

- Emergency fund: Build small savings for unexpected costs to avoid going into debt.

These habits help your dollars stretch further, balancing rising costs with stable income.

Canada Carbon Tax Rebate Payment Schedule in 2026: Check Eligibility, Payment Amount & Date

Advanced Canada Workers Benefit in October 2025; Check Payment Amount & Eligibility Criteria

Canada $2560 Annual CPP Pension Boost in 2025: Check Enhancement Process & Payment Date