Alaska Revised $1000 Permanent Fund Dividend: If you’ve been keeping an eye on Alaska’s annual Permanent Fund Dividend (PFD), you already know 2025 is shaping up to be another big year. The Alaska Revised $1,000 Permanent Fund Dividend has officially been approved, and Alaskans are eager to find out how to qualify, when to expect their money, and what changes might affect them this time around. The PFD is more than just a check in the mail — it’s part of what makes Alaska, well, Alaska. It represents the state’s commitment to sharing the benefits of its natural resources with its residents. Whether you use it to catch up on bills, plan a trip, or tuck it away for savings, the dividend has become a cornerstone of life in the Last Frontier.

Alaska Revised $1000 Permanent Fund Dividend

The Alaska Revised $1,000 Permanent Fund Dividend for 2025 is more than a payment — it’s a tradition that reflects the state’s spirit of shared prosperity. From its oil-rich origins to today’s digital application process, the PFD continues to serve as a bridge between Alaska’s resources and its residents. So, whether you’re planning to spend your dividend on heating oil, winter gear, or a bit of holiday cheer, make sure your paperwork is spotless, your information’s up to date, and your eyes are on October 2, 2025 — the first payday of the season.

| Detail | Information |

|---|---|

| Official Amount (2025) | $1,000 (Revised and Approved) |

| First Payment Date | October 2, 2025 |

| Second Payment Wave | October 23, 2025 |

| Final Payment Wave | November 20, 2025 |

| Application Deadline | March 31, 2025 |

| Residency Requirement | Must be an Alaska resident for all of 2024 |

| Official Source | Alaska Department of Revenue – PFD Division |

| Legislative Confirmation | Alaska Beacon – 2025 PFD Update |

| Total Applicants (Est.) | Around 625,000 residents |

| Typical Payment Method | Direct Deposit via MyPFD Portal |

What Is the Alaska Permanent Fund Dividend (PFD)?

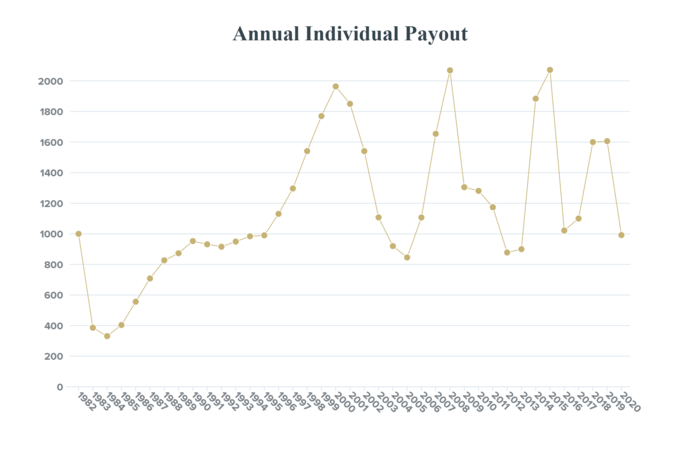

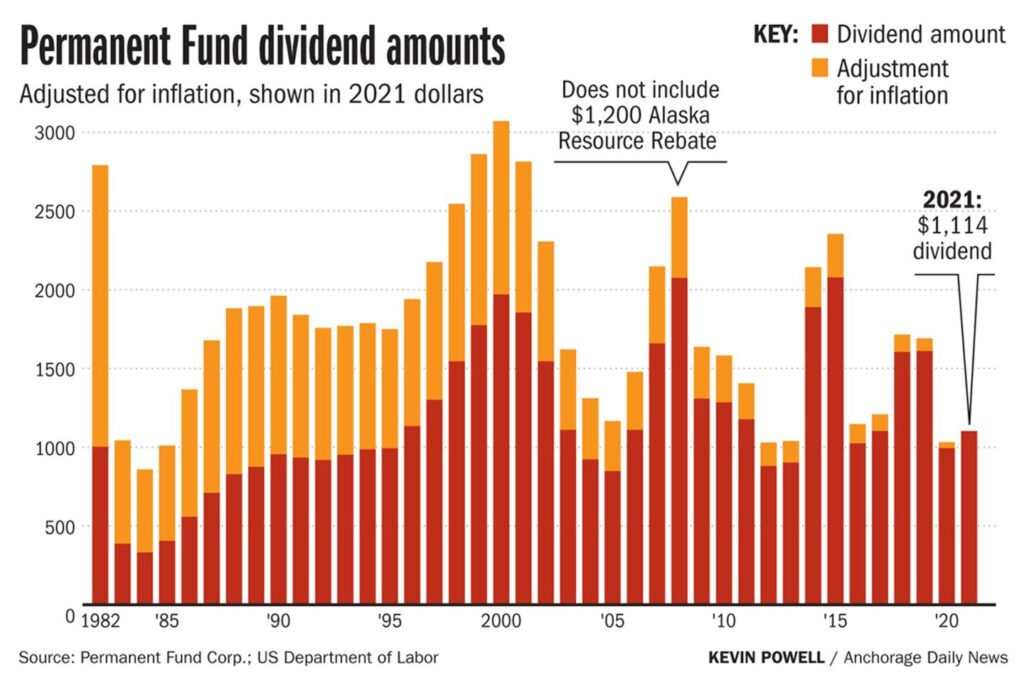

The Permanent Fund Dividend is Alaska’s way of sharing its resource wealth with its people. Established in 1982, it distributes part of the state’s oil revenue earnings to every eligible resident each year.

The Permanent Fund itself was created in 1976 when oil money started flowing into the state treasury. The idea was simple but brilliant — save a portion of that revenue for future generations, invest it wisely, and let the earnings benefit the people.

Every fall, the Alaska Department of Revenue calculates the payout, and residents who meet the eligibility criteria receive their share. The PFD is funded by investment earnings, not taxes, which makes it a unique feature of Alaska’s economy and one of the few programs of its kind in the world.

The Road to the Alaska Revised $1000 Permanent Fund Dividend

The 2025 PFD amount — $1,000 per person — didn’t happen overnight. It followed a long debate in the Alaska Legislature. Some lawmakers pushed for a larger payout, pointing to high living costs and inflation, while others advocated a more conservative figure to help balance the state budget.

In May 2025, the legislature officially approved the $1,000 dividend, marking a compromise between fiscal responsibility and keeping the state’s promise to residents. The decision came amid budget concerns tied to fluctuating oil prices and the state’s dependence on petroleum-based revenue.

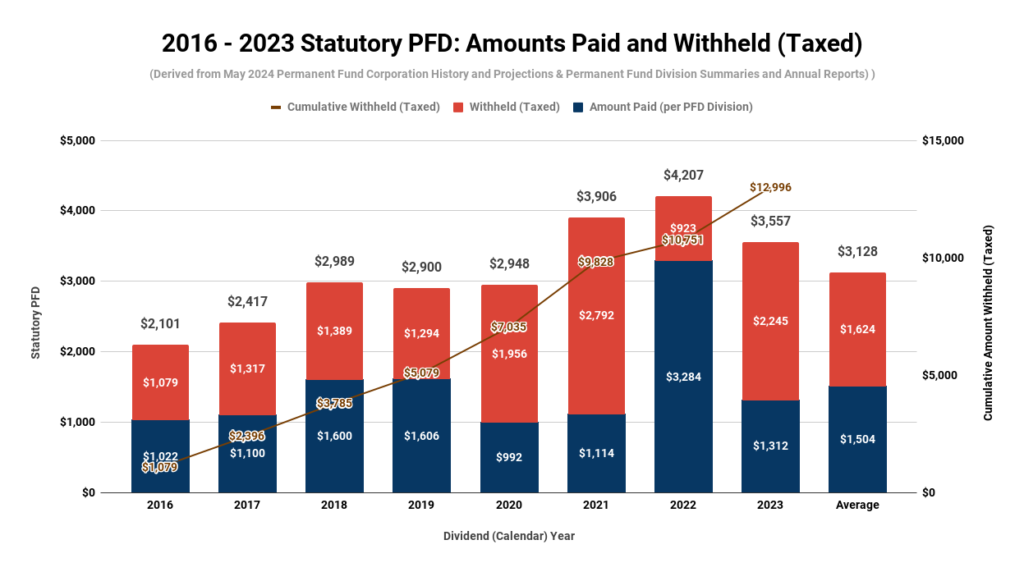

This year’s PFD is smaller than the record-breaking $3,284 in 2022, but it still represents a meaningful boost for Alaskans — particularly those living in remote areas where the cost of fuel and food is sky-high.

A Brief History of the Alaska PFD

The first PFD checks were issued in 1982, and each qualified Alaskan received $1,000 — coincidentally the same as in 2025. The amount has varied widely over the decades, reflecting market changes and political priorities.

- 1984: $331

- 1999: $1,769

- 2008: $2,069 + $1,200 Energy Rebate

- 2015: $2,072

- 2022: $3,284 (largest in history)

- 2023: $1,312

- 2025: $1,000 (Revised and Approved)

While these fluctuations might seem random, they’re tied to how the fund’s earnings are calculated and how much of those earnings the legislature chooses to distribute each year.

Who Qualifies for the Alaska Revised $1000 Permanent Fund Dividend?

Getting the dividend sounds easy — but you’ve got to meet a few clear-cut rules. Here’s the rundown straight from the Alaska Department of Revenue:

1. Residency

You must have lived in Alaska for the entire calendar year of 2024 and intend to remain indefinitely. If you leave the state permanently before the end of the year, you’ll lose eligibility.

2. No Residency Elsewhere

You cannot claim residency or benefits (like tax credits or public assistance) in another state or country during 2024.

3. Legal Status

You must not have been convicted of a felony or incarcerated due to a felony conviction during the qualifying year.

4. Absence Rules

You can’t be gone for more than 180 days in 2024 unless for approved reasons, such as:

- Military service

- Education

- Medical treatment

- Certain employment contracts

5. Application Deadline

The final day to apply is March 31, 2025. Late applications are not accepted — no exceptions.

How to Apply for the Alaska Revised $1000 Permanent Fund Dividend? (Step-by-Step)

Filing for your PFD is free, and it takes about 15 minutes if you do it online. Here’s how:

Step 1: Prepare Your Info

Gather:

- Alaska ID or driver’s license

- Social Security number

- Proof of residency (lease, utility bill, voter registration)

Step 2: File Online

Visit pfd.alaska.gov and select “Apply for 2025 PFD.”

You can also submit by mail, but online is faster and reduces processing delays.

Step 3: Choose Direct Deposit

If you want to be in the first wave of payments, enter your bank’s routing and account number. Direct deposit ensures you get your funds by October 2, 2025.

Step 4: Track Your Application

Log into your MyPFD account regularly. When your status shows “Eligible–Not Paid,” that means your application has been approved and your payment is queued for the next disbursement date.

Step 5: Wait for Payday

If everything’s in order, your money will hit your bank on the announced schedule.

Official 2025 Payment Schedule

The Alaska Department of Revenue has confirmed the 2025 payment dates:

| Application Status Date | Payment Date |

|---|---|

| Eligible–Not Paid by Sept. 18, 2025 | October 2, 2025 |

| Eligible–Not Paid by Oct. 13, 2025 | October 23, 2025 |

| Eligible–Not Paid by Nov. 12, 2025 | November 20, 2025 |

If you filed early and opted for direct deposit, you’ll most likely be in the October 2 wave. Late or paper-filed applications typically get processed later.

How the PFD Impacts Alaska’s Economy?

The dividend isn’t just good news for families — it boosts the entire state’s economy.

In 2024, more than 625,000 Alaskans received a dividend, pumping roughly $625 million into local communities. That’s money spent on heating oil, groceries, school clothes, and even local tourism.

Economists often call the PFD a “mini stimulus.” For rural areas where costs are higher, the dividend can make or break a household’s budget.

Businesses also gear up for what locals affectionately call “PFD Season.” Retailers offer sales, and restaurants see a surge in customers. For many small businesses, October and November become their busiest months of the year.

Tips to Ensure Smooth Payout

Avoid delays by keeping these best practices in mind:

- Apply early: The earlier you file, the faster your application gets processed.

- Double-check your info: Typos in your bank routing or Social Security number can cause weeks of delay.

- Update contact info: If you move or change banks, update it on your MyPFD portal immediately.

- Watch for notices: If the PFD office needs extra documentation, respond quickly.

- Use online services: Mail delays are common, especially in rural regions.

Tax Information

Yes, the PFD is taxable income under federal law.

The Alaska Department of Revenue issues a Form 1099-MISC early the following year. Make sure to include it in your IRS tax return.

State taxes do not apply since Alaska has no state income tax.

If you have kids receiving the dividend, their PFD may be subject to the “Kiddie Tax” if investment income exceeds IRS thresholds.

Controversies and Future Outlook

Every year, the PFD sparks political debate. Some Alaskans argue the dividend should follow the traditional statutory formula, which would’ve produced a higher payout in 2025. Others favor a more balanced approach to protect state savings and avoid deficits.

Governor Mike Dunleavy has supported larger dividends in past years but agreed to the 2025 compromise as part of the state’s broader budget deal. Legislators emphasize that maintaining the fund’s stability is key for future generations.

Looking ahead, experts predict moderate PFDs for the next few years as Alaska continues balancing spending on infrastructure, education, and public safety.

$1,000 PFD Stimulus for these People – Check October 2025 Payment Date; Eligibility

$1,000 PFD Stimulus Coming for Everyone in Oct 2025 – Who will get it? Check Eligibility

$1,702 Stimulus Payments Are Coming in October 2025; Payment Credit Date, Eligibility