Canada $400 Increase:If you’ve seen posts online or heard from someone that there’s a “Canada $400 increase in CPP and OAS benefits in October 2025,” you’re not alone. It’s been spreading fast — but what’s the real deal? The truth is: There is no official $400 flat increase coming in October 2025 for all recipients of CPP or OAS. What is happening, though, is a standard quarterly cost-of-living adjustment (COLA) to Old Age Security (OAS) benefits in line with inflation. This increase is small — approximately 0.7% — and is not the same as a one-time $400 top-up. Let’s break it all down: what’s actually happening, who qualifies, when payments go out, and how much money you could realistically expect.

Table of Contents

Canada $400 Increase

While the rumors of a “$400 increase in CPP/OAS in October 2025” may have gotten folks excited, the reality is much more measured. The OAS benefit will see a small 0.7% increase based on inflation, and CPP adjustments already occurred in January 2025. There’s no one-time top-up or bonus payment confirmed by any official government source. That said, even small increases matter — and being informed helps you plan smarter. If you’re nearing retirement or already drawing benefits, check your eligibility, stay updated, and consider talking to a certified retirement planner to maximize your benefits.

| Detail | Info | Source |

|---|---|---|

| Confirmed October 2025 OAS Increase | 0.7% inflation-based bump | Canada.ca |

| Flat $400 Benefit Boost? | No official confirmation of any $400 increase | |

| OAS Payment Date (Oct 2025) | October 29, 2025 | |

| CPP Payment Date (Oct 2025) | October 29, 2025 | |

| CPP Inflation Adjustment | Took place in January 2025 (~2.6%) | |

| Clawback Threshold (OAS, 2025) | $90,997 (age 65–74) |

What is OAS and CPP? A Quick Refresher

Before we get into the numbers, here’s a quick breakdown:

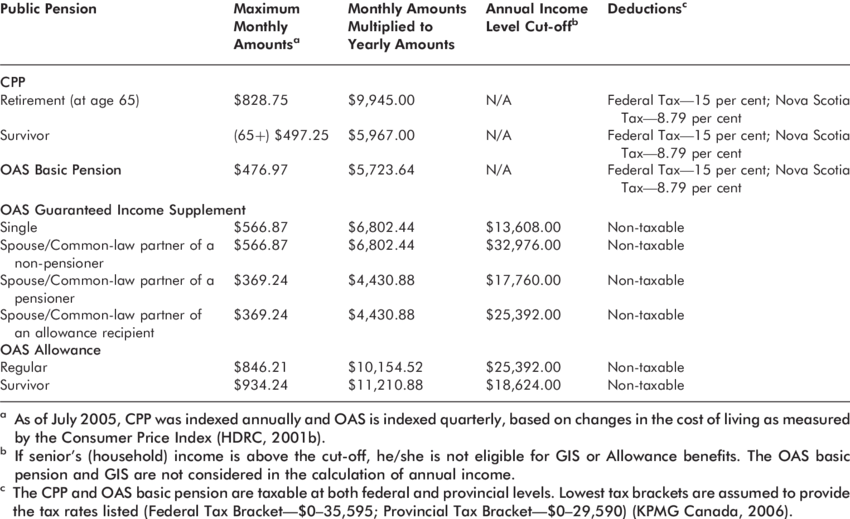

Old Age Security (OAS)

- Funded by general government revenue — not based on employment.

- Available to most Canadians 65 or older, based on legal residency.

- Adjusted quarterly for inflation (CPI-based).

- Subject to income-based clawback starting at ~$91,000 in 2025.

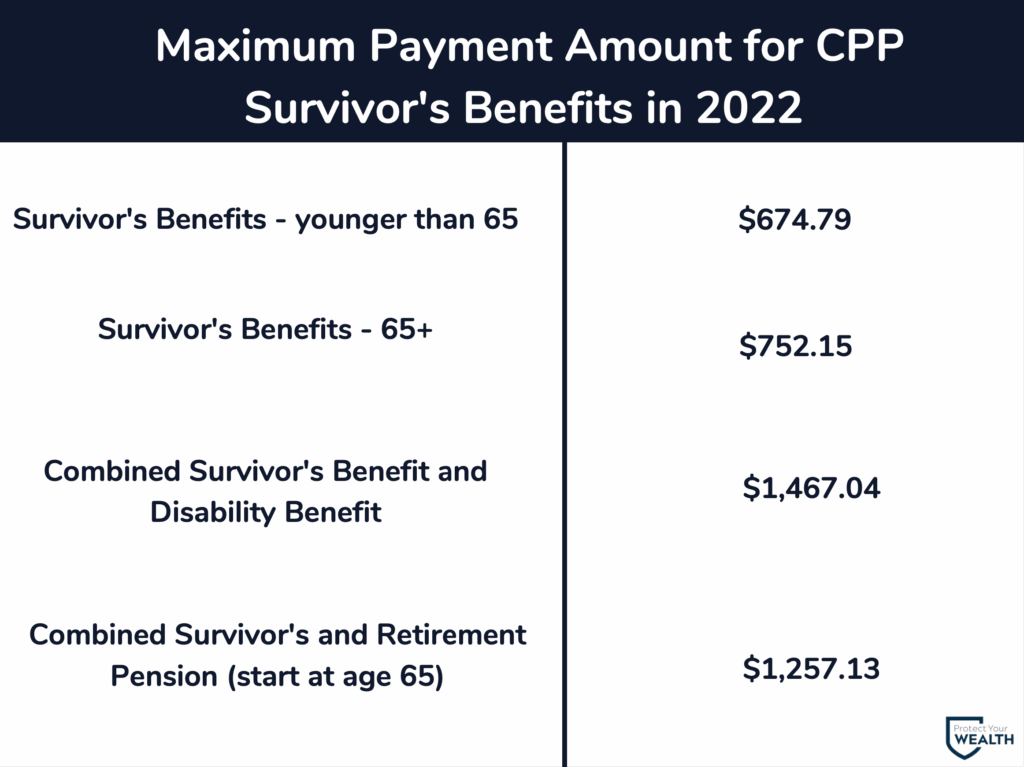

Canada Pension Plan (CPP)

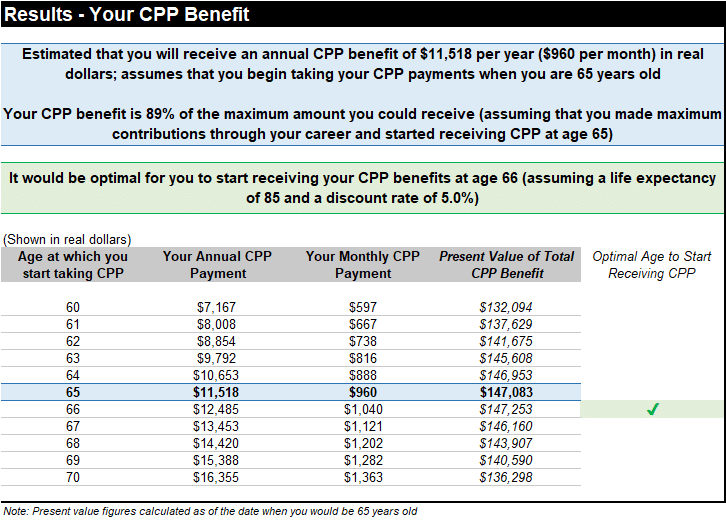

- Contributory system: both you and your employer pay into it.

- Monthly benefits depend on how much and how long you’ve contributed.

- Adjusted yearly for inflation (every January).

- Enhancement rules began in 2019, gradually boosting future benefits.

Where Did the “Canada $400 Increase” Rumor Come From?

There’s no government record of a one-time $400 payment or permanent increase set for October 2025. So where did the rumor start?

Possible reasons:

- Confusion with Multiple Programs – Some seniors receive OAS + CPP + GIS (Guaranteed Income Supplement). Combining slight increases in each may look like a bigger lump sum.

- Viral Misinformation – Social media often simplifies or distorts complex policy changes.

- US Comparisons – In the U.S., there are occasional stimulus or relief payments which some confuse with Canadian programs.

- Misreading Proposals – Advocacy groups often propose large increases to help low-income seniors, but proposals ≠ policy.

The Real October 2025 Changes: OAS Increase by 0.7%

The confirmed update is that OAS benefits will increase by 0.7% starting in October 2025, based on the Consumer Price Index (CPI). This is part of Canada’s regular process to help seniors keep up with inflation.

For example:

- If you currently receive $740.09 per month (maximum OAS at age 65–74), a 0.7% increase adds about $5.18/month, totaling $745.27/month starting October 2025.

- For those 75 and older receiving $814.10/month, the increase would be about $5.70/month, totaling $819.80/month.

These are modest increases, far from the flat $400 that’s been rumored.

CPP: Already Adjusted in January 2025

Unlike OAS, CPP is only adjusted once per year, in January. The January 2025 adjustment raised payments by roughly 2.6% due to inflation. If you’re receiving CPP now, that increase has already been applied.

CPP payments are not changing again in October 2025.

Example: How Much Could You Actually Get?

Here are three sample profiles showing how the October 2025 changes may affect them:

| Name | Age | Income | Benefit Type | Impact in Oct 2025 |

|---|---|---|---|---|

| Diane | 70 | $38,000 | Full OAS + CPP | OAS increases ~$5.50/month |

| Leo | 66 | $95,000 | OAS + private pension | Partial OAS due to clawback |

| Maria | 75 | $23,000 | OAS + GIS | GIS increases slightly; full OAS increase applies |

What If I’m Not Receiving OAS Yet?

If you’re turning 65 in October 2025, your first OAS payment will include the new, slightly higher rate. That’s good news.

If you choose to delay taking OAS, you’ll get even more. For every month you delay past 65, your OAS increases by 0.6% — up to a maximum of 36% more if you wait until age 70.

So if the normal benefit at 65 is $740/month, waiting until 70 gives you about $1,006/month — plus any future inflation adjustments.

How Does the OAS Clawback Work?

The Old Age Security Recovery Tax (commonly called the “clawback”) reduces your benefit if your net world income exceeds a threshold.

For 2025:

- Clawback starts at $90,997.

- For every $1 above that threshold, you repay 15 cents.

- At around $148,000, OAS is fully clawed back.

So, high-income seniors may not benefit from the October increase at all.

When Will the October 2025 Payments Arrive?

The official payment date for both OAS and CPP in October 2025 is:

October 29, 2025

Ensure your banking information is current in your My Service Canada Account to avoid delays.

Provincial Top-Ups and Tax Implications

Some provinces and territories offer additional income supports for low-income seniors, like:

- Alberta Seniors Benefit

- Ontario Guaranteed Annual Income System (GAINS)

- BC Senior’s Supplement

These benefits may also adjust for inflation — but policies vary by province.

Tax Reminder: OAS and CPP are taxable. Even if your monthly benefits go up, you may see a slight increase in taxes if you’re close to a new tax bracket.

How Does This Compare Internationally?

In the United States, seniors receive Social Security, which is adjusted annually via COLA (Cost-of-Living Adjustment). The 2025 U.S. COLA is expected to be between 2.5% and 3% — similar to Canada’s CPP increase but higher than the OAS increase.

What makes Canada’s system unique:

- Quarterly inflation indexing (for OAS)

- Separate systems for work-based and residency-based benefits

- Guaranteed supplements (GIS) for low-income seniors

So, while the rumor of a $400 boost may resemble U.S.-style stimulus headlines, the Canadian system moves more conservatively.

Practical Steps: What You Should Do Now

Here’s your retirement readiness checklist for Fall 2025:

- Check your eligibility for OAS, CPP, and GIS.

- Log in to My Service Canada Account and review your direct deposit info.

- Estimate your upcoming benefit using the OAS Estimator and CPP tools.

- Consult a tax advisor if your income is nearing the clawback threshold.

- Consider deferring OAS if you want to increase your future monthly income.

- Review provincial benefit programs for additional support.

- Mark your calendar for the October 29, 2025 payment.

Canada Carbon Tax Rebate Payment Schedule in 2026: Check Eligibility, Payment Amount & Date

CRA Approved $742 OAS Boost in October 2025: Check Payment Date & Eligibility